Best Forex Signals Providers

The best forex signals provide trading signals for the right time to buy and sell CFD assets like forex currency pairs, cryptocurrencies, ETFs and shares. Forex signals providers can be specialist signal tools or social trading tools.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

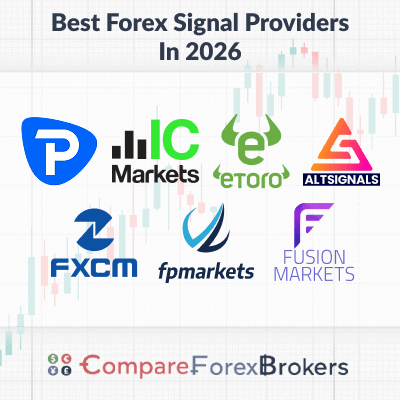

Here are the Forex brokers that offer access to the best signals providers:

- Pepperstone - Best Broker For Trading Signals

- IC Markets - Great Broker With MetaTrader 5

- eToro - Top Broker With Copy Trading

- AltSignals - Best Forex Signals Software

- FXCM - Party Trading Tools

- FP Markets - Top Broker With MyFXBook

- Fusion Markets - Cheapest Broker For Forex Signals

What is the best forex signals provider?

Pepperstone offers the best forex signals provider access, connecting with third-party services like Myfxbook AutoTrade, DupliTrade and MetaTrader Signals with a 77ms execution speed. With RAW spreads from 0.10 pips and $3.50 commissions across 94 currency pairs, Pepperstone delivers fast signal execution with no minimum deposit. We also shortlisted other signal providers based on their track record transparency and signal accuracy.

1. Pepperstone - Best Broker For Trading Signals

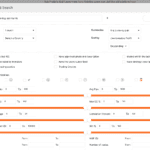

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Pepperstone is our top choice for trading signals, particularly for day trading. They connect third-party signal providers like Myfxbook AutoTrade, DupliTrade and MetaTrader Signals, helping you get insights from professional traders when copy trading.

Pepperstone stands out for fast execution speeds (77 ms), ideal for maximising trading signals. And low spreads with Standard account spreads averaging 1.12 pips on EUR/USD and just 0.1 pips on the Razor account. Achieving tight spreads and fast execution is why we gave Pepperstone 98/100 in our review.

Pros & Cons

- Fast execution speeds

- Low standard and RAW average spreads

- A decent range of signal tools

- Lacks guaranteed stop-loss orders

- Demo account is limited to 30 days

- Educational resources can be updated

Broker Details

From our testing, we found Pepperstone to be the best broker for trading signals thanks to its fast execution speeds, tight spreads, and range of platforms that offer the most opportunities to use signals from third parties.

Although Pepperstone doesn’t provide trading signals, they offer third-party options such as AutoChartist and MetaTrader Signals.

AutoChartist provides professional technical analysis alerts, using price action and harmonic patterns to find high-probability trades that you can verify manually before trading. MetaTrader Signals allows you to find and mirror other traders in real-time, automatically placing your trades when a signal is generated.

We used the MetaTrader 4 to test Pepperstone’s signal services and found that AutoChartist had been built into the platform, allowing us to view and analyse the signals on our charting. Very few brokers provide this, as you’ll typically have to access the AutoChartist web platform to receive the analysis, so this is a huge time saver.

A nice feature we liked was that Autochartist scans multiple markets throughout the day. We could modify the markets for which we’d get alerts so we wouldn’t get spammed with assets like USD/ZAR or CAC40.

In addition, you could open a limit or market order immediately on the MT4 platform for any of the signals we liked, helping reduce discrepancies in signal pricing and giving you more accurate signals.

As most trading signals come at a cost, it is important to have low trading fees, which is why we highly rate Pepperstone. Our analyst tested Pepperstone’s Razor account’s spreads and found that they averaged 0.0 pips on EUR/USD throughout the key trading sessions.

The results were surprising, as few brokers that advertise zero-pip spreads offer them for long periods. So, a 100% uptime on 0.0 pips is a huge positive.

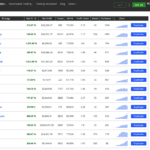

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| TMGM | 97.83% |

| FP Markets | 97.83% |

| Eightcap | 97.83% |

What also stood out while testing Pepperstone was its execution speed, which averaged 77ms for its limit orders. This execution speed protects you from slippage on your stop-loss and take-profit orders. A fast execution speed maximises your trading signals, ensuring the trades are promptly executed.

| Broker | Limit Order Speed | Limit Order Rank |

|---|---|---|

| BlackBull Markets | 72 | 1 |

| Pepperstone | 77 | 2 |

| Fusion Markets | 79 | 3 |

| Axi | 90 | 4 |

| TMGM | 94 | 5 |

| City Index | 95 | 6 |

| HugosWay | 104 | 7 |

| FXCM | 108 | 8 |

| Admiral Markets | 132 | 9 |

| IC Markets | 134 | 10 |

| CMC Markets | 138 | 11 |

| Eightcap | 143 | 12 |

2. IC Markets - Great Broker With MetaTrader 5

Forex Panel Score

Average Spread

EUR/USD = 0.01 GBP/USD = 0.04 AUD/USD = 0.02

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

IC Markets is one of our top-rated brokers with MetaTrader 5, which has its own MQL5 forex signal service (available on MT4 too). However, with MT5, the infrastructure has been rebuilt to be faster vs MT4, allowing for more reliable executions.

The MQL5 forex signals can vary between assets, so having a broker that provides low spreads across the majors is essential. In our review, IC Markets achieved an average of 0.16 pips for the top five major pairs – among the best we tested.

Pros & Cons

- Plenty of signal providers via MQL5

- Low average spreads

- No fees for depositing/withdrawing

- Has a minimum deposit

- Lacks TradingView platform

- Limited range of trading products

Broker Details

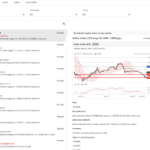

With IC Markets, you can choose trading platforms, but the MetaTrader 5 platform offers a solid trading signal experience, including automating your trades with MT5.

To access the MT5 signals, you can use the ‘Signals’ tab to find providers on the platform. You can also use the MQL5 Marketplace (website) to search for and find signal providers. We chose this method because it was easier to navigate than the desktop platform.

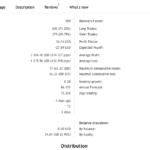

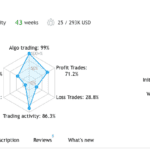

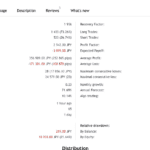

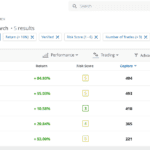

While trying the MQL5 Marketplace, we used its search feature to help narrow down the 3,000+ signal providers based on their profitability and number of subscribers.

After finding potential signals to use, we were impressed with the stats provided on each profile. These stats covered performance to risk and let you dive deeper into the traders’ performance.

One feature that stood out to us was the ability to read customer reviews, which can help you learn from their experiences whether the signal provider is a good choice.

You can also see which broker the signal provider trades with, which is excellent information. You can use this information to choose a provider that uses the same broker as you, meaning your execution times will mirror theirs, providing an optimal signal trading experience.

To take advantage of the MT5 signals, you’ll need low spreads to improve your trading costs. Our analyst, Ross Collins, ran an independent test to determine which brokers had the lowest Raw account spreads. Of the 20 brokers tested, IC Markets had one of the lowest EUR/USD average spreads of 0.19 pips, placing it fourth overall. This makes the broker a solid pick if you want low signal trading costs.

| EURUSD | Average Spread |

|---|---|

| Fusion Markets | 0.16 |

| IC Markets | 0.19 |

| Pepperstone | 0.19 |

| FP Markets | 0.2 |

| EightCap | 0.2 |

| Admiral Markets | 0.21 |

| CityIndex | 0.22 |

| ThinkMarkets | 0.22 |

| Blueberry Markets | 0.27 |

| Go Markets | 0.38 |

| Axi | 0.43 |

| CMC Markets | 0.44 |

| Tested Industry Average | 0.27 |

3. eToro - Top Broker With Copy Trading

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

Copy trading is a solid alternative to trading signals, so we included eToro in this list of the best forex signal providers. Its CopyTrader platform is incredibly user-friendly and lets you quickly find and copy the trades of experienced traders. We liked Smart Portfolios which are indices of the best-performing signal providers.

eToro offers low average spreads, starting from just one pip on EUR/USD. This low-cost entry benefits you because it means less money spent on fees and more on trading.

Pros & Cons

- Excellent platform for Copy Trading

- No commission on trades

- Decent average spreads

- Has a withdrawal fee

- Does not offer RAW spreads

- Limited to using CopyTrader platform

Broker Details

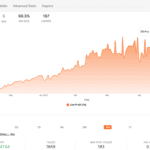

eToro is one of the largest brokers with over 30,000,000 customers, and it has popularised copy trading through its trading platform. Simplifying the process has allowed beginners to profit from experienced traders’ decisions, so we highly rated the broker in our best forex signals provider awards.

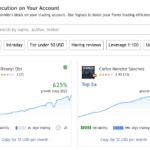

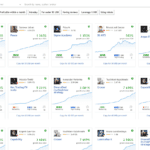

The broker simplifies your choice by only offering its services through its web trading platform or mobile app. While trading on the platform and app, there is nothing too advanced with the platforms, and it lets you easily find potential copy traders through its CopyTrader tool.

If you are new to trading the markets, eToro curates the top copy traders based on different categories, such as most copied and trending, which gives you a sentiment of who other eToro traders are following. We think this is a decent feature, as you can use the crowd’s wisdom to find traders backed by others voting with their dollars, so you can piggyback off this—although there is no guarantee of success.

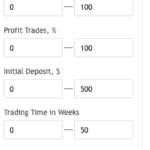

Alternatively, if you know what you want, eToro’s search tool for CopyTrader is an effective way of narrowing down the 2,000,000 options available. We found the tool provided 14 options to specify based on risk, profits, number of subscribers, and assets under management, all of which contribute to finding stable and experienced traders to copy.

eToro has done an excellent job of providing vital trading data to help verify traders’ performance. While vetting our traders, we could dig through their trade history, current portfolio composition, and monthly returns, all updated in real time as the traders use eToro to execute their trades.

Unlike trading signals, which are commonly sent to you to review before executing the trade, copy trading allows you to follow every trade entry and exit, mirroring the same profit and loss the trader experiences.

We think copy trading is better suited if you lack time and experience trading the markets, as you can leverage this through another trader with a track record to back their skills.

You pay no commission on trades, even share CFDs, and the spread on major pairs is surprisingly low, averaging one pip on EUR/USD.

4. AltSignals - Best Forex Signals Software

Forex Panel Score

Average Spread

N/A

Trading Platforms

N/A

Minimum Deposit

N/A

Why We Recommend AltSignals

AltSignals is a top forex signals software with real-time trading signals, technical insights, and a transparent track record. It uses 15 technical indicators and multiple strategies, helping you make informed trading decisions.

What makes AltSignals appealing is its focus on quality over quantity. On average, you receive around 20 trade signals monthly, ensuring that each signal is well thought out.

Pros & Cons

- Affordable pricing plans

- Easy to use

- Regular updates

- Strict risk management is required

- No mobile app

- Customer support can be slow

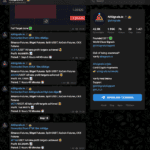

Broker Details

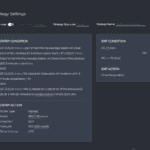

AltSignals is a popular signal provider with over 50,000 subscribers. Its Telegram channel provides a blend of technical and fundamental analysis so you can understand why the signal is generated, which is helpful when copying the idea.

We found the signal provider offers five signal packages focusing on different assets, from forex to crypto markets. Each package costs $100 monthly, an expensive upfront cost, especially if you are just starting with a low trading balance.

As it is a signal service through Telegram, you have to copy the trade instructions from Telegram and place the orders on your platform. We didn’t mind this approach as we could filter which signals and only focus on the ones with a high probability; copy trading and automated trading signal providers don’t have this luxury.

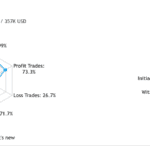

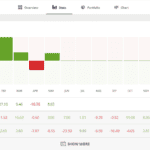

Before signing up for the service, we found that their entire track record is available monthly for each service. The reports included performance figures and trade history, allowing you to verify the signals, which can help promote trust by being transparent. Compared to most signal providers we’ve reviewed, AltSignals has done its best to share its results (even its bad ones).

Since AltSignals is a signal provider rather than a broker, you must set up a live broker account to trade the alerts. We used our Pepperstone Standard account to test the service on the MT4 platform, which gives us access to forex markets with low spreads and fast execution speeds.

5. FXCM - Best Broker For Third-Party Trading Tools

Forex Panel Score

Average Spread

EUR/USD = 0.3 GBP/USD = 0.9 AUD/USD = 0.4

Trading Platforms

MT4, TradingView, Trading Station

Minimum Deposit

$50

Why We Recommend FXCM

We favour FXCM for its extensive range of third-party trading tools. For signals, FXCM provides ZuluTrade, a leading social trading tool enabling real-time trade copying across various assets.

We think ZuluTrade stands out for its ‘verified track record’ feature, thus instilling confidence in traders’ performance. FXM has an average spread of 1.3 pips on EUR/USD, which aligns with industry standards based on my research.

Pros & Cons

- Good choice of trading tools

- Offers ZuluTrade

- Decent educational resources

- Limited product range

- Has a minimum deposit

- Undisclosed strategies

Broker Details

FXCM offers a range of third-party tools you can sign up for and use for trading signals. The broker offers ZuluTrade, similar to eToro’s CopyTrader, which lets you find experienced traders to mirror. To make finding the right trader easier, we like the fact that ZuluTrade offers a proprietary “ZuluRank” that highlights the top traders based on their risk and performance.

Additionally, Capitalise AI lets you copy the automated strategies developed by other traders on the platform. This method is slightly different from trading signals as you’ll be following the strategy and not the trader so that you can manage the risk and strategy on Capitalise AI. We found this process straightforward by going through Capitalise AI’s available strategies and selecting “copy” trade, allowing us to deploy the automated strategy to our Trading Station platform.

Both of these tools are good if you are a beginner, as they can take the guesswork out of trading and allow you to verify each trader/strategy based on its track record.

For most traders worldwide, you can access FXCM’s Plus trading signals for free with a live account. Only UK traders will miss out due to stricter regulations on trading signals.

We tried the signals on our Trading Station platform and found them to provide a solid stream of daily alerts as they scanned 40 currency markets for new trade ideas. If you like to trade multiple assets, the FXCM Plus signals cover other markets, including crypto, stocks, indices, and commodities, so you can always find new trading ideas, which is helpful if you day trade.

6. FP Markets - Top Broker With MyFXBook

Forex Panel Score

Average Spread

EUR/USD = 0.14 GBP/USD = 0.39 AUD/USD = 0.31

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

We value the ability to verify traders’ past performance, made possible through MyFXBook AutoTrade available with FP Markets. The platform allows users to follow only profitable traders with live accounts, enhancing credibility.

FP Markets, offer competitive RAW average spreads, our testing of the RAW average spread for EUR/USD yielded an impressive 0.41 pips, surpassing the industry average of 0.49 pips.

Pros & Cons

- Decent average RAW spreads

- Offers copy trading tools

- Good variety of trading products

- The mobile trading app is basic

- Demo accounts have limits

- The choice of FX pairs is limited

Broker Details

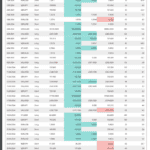

MyFXBook is a top copy trading platform that mirrors verified traders (or systems) using your MT4 account.

While exploring the systems to copy on MyFXBook, we found that most signal providers use custom-built expert advisors, meaning very little human interaction is involved. Using systems can be appealing as there is less room for error, plus you are more likely to emulate the performance as it removes the human emotions involved in trading. Your platform will also place the same trade when the EA executes.

If you want to follow someone who doesn’t use an EA, you can use the web platform’s search feature to narrow your selection by choosing the trading type as “manual”. The search tool also lets you narrow down traders based on brokers, something we haven’t seen before from other platforms.

This search is interesting as you can find signal providers using the same broker, which lets you emulate the alerts accurately by being charged the same spreads and having the same execution speed.

From our experience, using different brokers to the signal provider can generate different results from what the service shows, so MyFXBook can help eliminate this.

Due to the nature of copy trading, you’ll want a broker with fast market order execution speeds. Based on our testing, we found FP Markets to be a solid pick after our analyst placed them in fourth place for fastest market order speed—achieving 96ms on MT4.

We found that faster execution speeds accurately placed our trades according to the signals generated, preventing lag and market slippage, which can negatively cost us money.

| Broker | Market Order Rank | Market Order Speed |

|---|---|---|

| Fusion Markets | 1 | 77 |

| BlackBull Markets | 2 | 90 |

| HugosWay | 3 | 94 |

| FP Markets | 4 | 96 |

| Pepperstone | 5 | 100 |

| FXCM | 6 | 123 |

| TMGM | 7 | 129 |

| City Index | 8 | 131 |

| FxPro | 9 | 138 |

| Eightcap | 10 | 139 |

7. Fusion Markets - Cheapest Broker For Forex Signals

Forex Panel Score

Average Spread

EUR/USD = 0.14 GBP/USD = 0.1 AUD/USD = 0.13

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why We Recommend Fusion Markets

We think Fusion Markets, offers a highly cost-effective service, notably with the RAW account featuring low $2.25 per lot trading commissions—the lowest we observed. The RAW account showcases the best spreads, averaging 0.22 pips on EUR/USD, nearly 50% cheaper than the industry average.

As a budget-friendly broker, Fusion Markets is optimal for maximising gains from trading signals. You can trade using MyFXBook AutoTrade and Duplitrade; we favour the latter for verified track records and the ability to invest in specific strategies.

Pros & Cons

- Best low commissions

- Tight spreads

- ECN broker with copy trading tools

- Lacks TradingView platform

- The trading product catalogue isn’t the largest

- Has an inactivity fee

Broker Details

From our spread tests, Fusion Markets offered some of the lowest on its Classic account (spread-only) and Zero account (tight spreads with commission). The broker achieved a 1.01 pip average on EUR/USD for its Classic account, lower than the industry average of 1.24 pip.

While scoring better with the Zero account, averaging 0.16 pips, the broker placed second out of 15 brokers tested, falling just behind joint first place at 0.15 pips. The spreads make it cheaper to follow the trading signals, helping you improve your trading margins.

| EURUSD | Average Spread |

|---|---|

| TMGM | 0.15 |

| Tickmill | 0.15 |

| Fusion Markets | 0.16 |

| IC Markets | 0.19 |

| Pepperstone | 0.19 |

| FP Markets | 0.2 |

| EightCap | 0.2 |

| Admiral Markets | 0.21 |

| CityIndex | 0.22 |

| ThinkMarkets | 0.22 |

| Blueberry Markets | 0.27 |

| Go Markets | 0.38 |

| Axi | 0.43 |

| CMC Markets | 0.44 |

| Blackbull Markets | 0.46 |

| Industry Average | 0.27 |

However, what stood out for us (and why they are the cheapest broker overall) is how low the Zero account’s commissions are. We found the account charged just $2.25 per lot traded, the lowest commission in Australia, beating the industry average of AUD $3.29 in our tests.

| Broker | AUD |

|---|---|

| Fusion Markets | $2.25 |

| CMC Markets | $2.50 |

| Fair Markets | $2.50 |

| Go Markets | $3.00 |

| City Index (Web Trader) | $3.00 |

| VT Markets | $3.00 |

| FIBO Group | $3.00 |

| DNA Markets | $3.00 |

| FlowBank | $3.25 |

| City Index (MT4) | $3.50 |

| Pepperstone | $3.50 |

| EightCap | $3.50 |

Ask an Expert

Are forex signals legit?

There are many legit forex signal, plenty of poor quality signals provider as well as a fair share of scam forex signals. Since Forex signals indicate when to buy or sell Forex, one can argue they provide financial advice ad therefore should only come from a certified financial providers.

How can you verify a signal provider’s track record?

You would need to look online and speak with other traders who have used it on forums.

Finding trustworthy signal providers is definitely a challenge I’ve looked into quite a few myself. FX Leaders stood out to me because they publish their actual results and have been consistent since 2012. It’s refreshing to see a service that focuses on transparency rather than just flashy marketing promises.