CMC Markets Review Of 2025

Our review of CMC Markets found that it was the top forex broker for intermediate forex traders. This is because of the high leverage offered, a strong trading platform, and guaranteed stop-loss orders.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

CMC Markets Summary

| 🗺️ Tier-1 Regulation | ASIC, FCA, FMA, MAS, BaFin, CIRO |

| 💰 Trading Fees | Standard (spread-only), STP (commission) |

| 📊 Trading Platforms | MT4, Next Generation |

| 💰 Minimum Deposit | $0 |

| 💰 Withdrawal Fees | $0 |

| 🛍️ Instruments Offered | CFDs, Shares, Crypto, Indices, Forex, Commodities |

| 💳 Credit Card Deposit | Yes |

Why Choose CMC Markets

We recommend CMC Markets for their low fees with their commissions-free Standard Account and FX Active account, which has low commissions and discounts on spreads . There is no minimum deposit to get started and minimum slippage when trading. You can choose between CMC Next Gen Trading Platform which includes a guaranteed stop loss and MT4 which has automation features. CMC Markets is recommended for its high reputation for trust being regulated in more regions than most Forex brokers.

There are not too many downsides with CMC Markets, while you can trade an impressive 12,000 instruments, it is best not trade CFD stocks as their have high fees, the broker also does not offer 3rd party social trading and automation tools.

CMC Markets Pros and Cons

- Satisfactory trading platforms

- Extensive educational materials

- Low forex fees

- 24/5 support

- High fees on stock CFDs

- Limited products

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

CMC Markets offers a commissions-free Standard Account and FX Active account, enabling you to trade forex with spreads starting from 0.7 pips.

1. Raw Account Spreads

CMC Markets’ raw spreads are not competitive compared to the industry average. In the table below, you will see that they have a better spread only with USD/SGD.

| Raw Account Spreads | CMC Markets | Average Spread |

|---|---|---|

| Overall | 0.93 | 0.72 |

| EUR/USD | 0.5 | 0.28 |

| USD/JPY | 0.8 | 0.44 |

| GBP/USD | 0.9 | 0.54 |

| AUD/USD | 0.6 | 0.45 |

| USD/CAD | 1.3 | 0.61 |

| EUR/GBP | 0.7 | 0.55 |

| EUR/JPY | 1.2 | 0.74 |

| AUD/JPY | 1.2 | 0.93 |

| USD/SGD | 1.2 | 1.97 |

2. Raw Account Commission Rate

CMC Markets’s Raw Account charges a commission of $2.50/£2.50 per side (per 100k traded) consistently for all currency accounts.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| CMC Markets Commission Rate | $2.50 | $2.50 | £2.50 | €2.50 |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

3. Standard Account Fees

To gauge how CMC Markets’ pricing stacks up against the industry, we conducted a comparison of their average spreads with those of their competitors. The comparison, detailed in the table below, reveals that CMC Markets consistently offers lower no-commission spreads.

For instance, their spreads average 1.30 pips for pairs like EUR/GBP and GBP/USD, which may be higher than the average but is significantly lower than competitors’ spreads that can reach up to 2.50 pips. This disparity represents potential savings of up to 48% for traders choosing CMC Markets.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| CMC Markets Average Spread | 1.3 | 1.3 | 1.5 | 1.5 | 1.5 | 1.5 | 1.7 | 1.9 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

4. Other Fees

In addition to forex trading, CMC Markets offers competitive spreads and commissions across a variety of CFD trading instruments. These costs vary depending on the type of asset being traded.

Here’s a breakdown of the typical spreads and commission fees for different CFD categories:

- Index Spreads: Starting from 1.0 pips.

- Cryptocurrency Spreads: For Bitcoin, spreads begin at 40.

- Commodity Spreads: As low as 0.3 for Gold.

- Treasury Spreads: Starting from 2.0.

- Share CFDs: Commission fees start at 0.04%, with specific rates of 0.08% in the UK and 2 cents per unit in the US.

In addition to the spread and commission costs, CMC Markets imposes several other trading fees that traders should be aware of:

- Overnight Holding Costs: At the end of each trading day (5pm New York time), open positions in your account may incur a ‘holding cost’, which can be either positive or negative based on your trade direction and the applicable holding rate.

- Market Data Fees: If you wish to trade or view price data for certain instruments, you need to activate the relevant market data subscription. Monthly subscription charges may apply, depending on your market data classification and account type.

- Guaranteed Stop-Loss Order Charges: For a premium, CMC Markets offers guaranteed stop-loss orders (GSLOs) that ensure your trade closes at the specified price, regardless of market volatility or gapping. If the GSLO is not triggered, the premium is fully refunded.

- Inactivity Fee: CMC Markets charges a dormancy fee if there has been no trading activity for a continuous period of 12 months. The fee is based on your account currency, with a monthly inactivity fee of USD 15.

These additional costs are an essential part of CMC Markets’ pricing structure and contribute to the overall cost of trading with the broker.

Verdict on CMC Markets Fees

CMC Markets offers a competitive CFD Trading Account with low forex spreads starting from 0.7 pips and no commission fees, making it an attractive choice if you are looking for a commission-free account type.

Trading Platforms

CMC Markets offers two main trading platforms for CFD trading being MetaTrader 4 (MT4) and the brokers proprietary Next Generation platform.

Next Generation Platform

The CMC Next Generation platform is the primary software offered for CFD trading and available in standard or advanced versions.

The best feature of the platform is the charting package (chart forum) with 115+ technical indicators, 70 chart patterns, and 12 built-in chart types.

Trading tools offered by the Next Generation trading platform include:

- Client sentiment displays the quantity and position value for the instrument traded.

- Multiple layouts such as a ‘five-minute chart layout’ give unique insights into price movements.

- Pattern recognition scanner identifies and alerts traders when patterns emerge.

The Next Generation trading platform is available as a desktop platform for Windows and Apple computers, Webtrader platforms online, or mobile trading apps for iOS and Android devices.

MetaTrader 4

CMC Markets provides access to MetaTrader 4 (MT4), renowned as the leading forex trading platform. MT4’s appeal lies in its capabilities for automated trading through Expert Advisors (EAs), along with advanced order types, comprehensive technical analysis tools, and a user-friendly interface.

However, it’s important to note that trading on MT4 with CMC Markets does not offer access to their complete range of products.

You can find out more about the Best MT4 Brokers here.

Mobile Trading Apps

CMC Markets provides trading apps for both MT4 and the Next Generation platform, with the brokers mobile trading experience being awarded in our Best Brokers for Beginners for 2025 Review.

The Next Generation app, available for iOS and Android, mirrors the desktop version’s functionality, offering access to CMC Markets’ full range of trading instruments, complex orders, account details, screeners, and charting tools. The app is fully customizable, allowing traders to tailor their mobile experience.

The MT4 mobile app maintains key features like advanced charting and technical indicators, and supports automated trading with Expert Advisors. For added security, MT4 incorporates a One-Time Password (OTP) feature, enhancing safety when accessing trading accounts.

In terms of security for the Next Generation app, the iPhone version includes fingerprint authentication, although this feature is not available on the Android version.

Trade Experience

CMC Markets delivers efficient order execution on both its Next Generation platform and MetaTrader 4 (MT4).

The Next Generation platform ensures fast, 100% automated execution, complemented by a variety of order types for flexible trade placement and enhanced risk management. This high-speed execution is a feature of CMC Markets thats won multiple awards for Best Trade Execution and Best Trading Technology Provider.

CMC Markets’ MT4 platform also offers fast trade execution. This speed is crucial for the platform’s automated trading feature, which uses Expert Advisors (EAs) to execute complex strategies quickly and with minimal manual input.

Verdict on CMC Markets Trading Platforms

CMC Markets provides a choice between its Next Generation platform, offering the full product range and advanced analysis tools, and MT4, ideal for those focused on automated trading with Expert Advisors.

Is CMC Markets Safe?

CMC Markets has a trust score of 91 based on regulation, reputation, and reviews, making it a highly trusted broker.

Regulation

CMC Markets is regulated around the world, including ASIC, the FCA, the Monetary Authority of Singapore, and New Zealand’s Financial Market Authority (FMA).

| CMC Markets Safety | Regulator |

|---|---|

| Tier-1 | ASIC FCA BaFin FMA CIRO MAS |

| Tier-2 | DFSA |

| Tier-3 |

Reputation

CMC Markets was founded in 1989 and has headquarters in London, UK. They have a monthly search volume of 90,500 in Google from traders all around.

Reviews

CMC Markets has a Trust score of 4.0 out of 5.0 on TrustPilot from 1,744 reviews.

Verdict on CMC Markets Trustworthiness

Established in 1989, CMC Markets has earned a high trust score of 91, reflecting its longstanding reputation and robust regulation by top authorities like ASIC and FCA.

Deposit and Withdrawal

CMC Markets offers flexible funding and withdrawal options, with a variety of fee-free funding methods and no minimum deposit requirement, making it easy and accessible for traders.

What is the minimum deposit at CMC Markets?

While the industry norm is around $200, CMC Markets requires no minimum deposit to open a CFD Trading account.

Deposit Options And Fees

CMC Markets provides various funding methods such as credit/debit cards, bank transfers, PayPal, and electronic wallets, all without any deposit fees. Whether fees apply depends on the CMC Markets branch you are trading with, as shown below.

| Payment Method by Location | New Zealand (FMA Regulated) | Australia (ASIC Regulated) | Europe (BaFin Regulated) | UK (FCA Regulated) | Europe (CySEC Regulated) | Singapore (MAS Regulated) | Canada (CIRO Regulated) | Dubai (DFSA Regulated) |

|---|---|---|---|---|---|---|---|---|

| Visa Debit/Credit Card | 1.5% | No fee | No fee | No fee | No fee | No fee | ☓ | No fee |

| Mastercard Debit/Credit Card | 1.5% | No fee | No fee | No fee | No fee | No fee | ☓ | No fee |

| Bank Transfer | No fee | No fee | No fee | No fee | No fee | No fee | $14 for domestic wires | No fee |

| Online Bill Payment | ☓ | ☓ | ☓ | ☓ | ☓ | No fee | No fee | ☓ |

| PayNow | ☓ | ☓ | ☓ | ☓ | ☓ | No fee | ☓ | ☓ |

| PayPal | No fee | ☓ | ☓ | ☓ | ☓ | ☓ | ☓ | ☓ |

| Neteller | ☓ | ☓ | ☓ | ☓ | ☓ | ☓ | ☓ | ☓ |

| Skrill | ☓ | ☓ | ☓ | ☓ | ☓ | ☓ | ☓ | ☓ |

| Rapid Pay | ☓ | ☓ | ☓ | ☓ | ☓ | ☓ | ☓ | ☓ |

| POLi / bPay | No fee | ☓ | ☓ | ☓ | ☓ | ☓ | ☓ | ☓ |

| Klarna | ☓ | ☓ | ☓ | ☓ | ☓ | ☓ | ☓ | ☓ |

| Cryptocurrency / Digital Wallet | No fee | ☓ | ☓ | ☓ | ☓ | ☓ | ☓ | ☓ |

Withdrawal Options and Fees

CMC Markets also charges no fees on most withdrawal methods. When you withdraw funds, you are required to use the same funding method as you deposited funds.

Ease To Open An Account

Opening an account with CMC Markets proved to be relatively easy with our team, giving them a score of 8 out of 15. One factor that scored down the brokers ease of account opening score was the comprehensive personal information required, which we found excessive when compared to other top brokers.

Verdict on CMC Markets Funding

CMC Markets offers flexible and accessible deposit and withdrawal options, with a range of fee-free methods and no initial minimum deposit required to start trading.

Open a demo accountVisit CMC Markets

*Your capital is at risk ‘69% of retail CFD accounts lose money’

Product Range

CMC Markets is well-known for its diverse range of 12,000+ CFD trading products which includes 338 forex pairs, 8,000 shares, and 15 cryptocurrencies like Bitcoin.

The table below shows the online brokers full range of instruments available.

| Currency Pairs | Stock index CFDs | Stock CFDs | ETF CFDs | Commodity CFDs | Bond CFDs | Cryptocurrencies | |

|---|---|---|---|---|---|---|---|

| CMC Markets | 338 | 92 | 8,000 | 1,000 | 136 | 56 | 15 |

If you are an Australian resident, you can also access CMC Markets stockbroking services.

Meanwhile, in the UK, spread betting is available as a tax-efficient alternative to CFD trading.

Verdict on CMC Markets Trading Products

CMC Markets excels with a diverse range of over 12,000 trading products, including fx pairs, shares, and cryptocurrencies, complemented by stockbroking in Australia and spread betting in the UK.

Customer Service

CMC Markets has global support offered 24 hours a day, 5 days a week via phone support, e-mail support, live chat.

To cater to its global clientele, multilingual customer support is available in 9 languages: English, German, French, Italian, Polish, Swedish, Norwegian, Spanish, and Chinese.

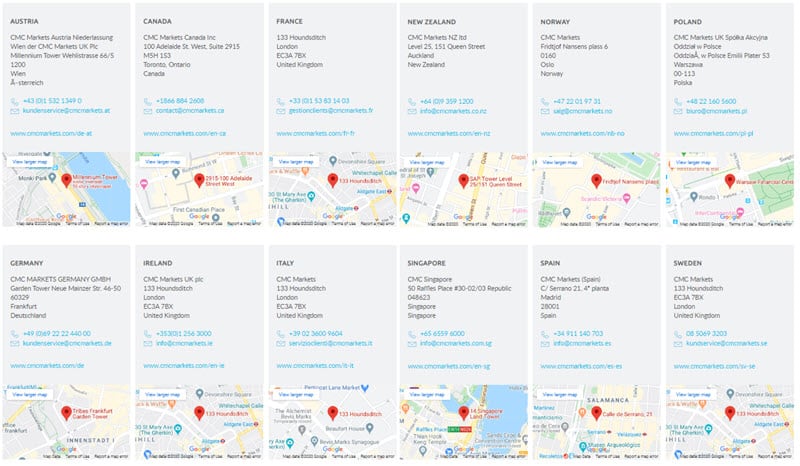

The main office that CMC Markets’ customer service is based out of CMC Markets UK plc, 133 Houndsditch, London. There are also 12 other offices as shown below, each with its own contact number and e-mail address.

Verdict on CMC Markets Customer Support

CMC Markets provides strong multilingual customer support, available 24/5 through phone, email, and live chat.

Research and Education

CMC Markets offers a wide range of educational resources to its users ranging from webinars to in-house financial analysts.

- Wide range of educational content: eBooks, articles, blogs, webinars, and videos

- A demo account to practice trading with virtual money

- Market research and analysis to help traders make informed decisions

- Market analysts who provide regular insights

Integrated into the Next Generation are multiple news and information sources. This is located within the insights section and includes Morningstar research reports incorporating ‘fair market estimates’, Reuters news, and CMC TV featuring experts discussing market technical analysis. The insights section also has a market calendar and CMC Twitter feed.

Final Verdict on CMC Markets

CMC Markets, established in 1989, is a leading forex broker offering a wide range of over 9,500 CFD products. With competitive EUR/USD spreads starting from 0.7 pips and a diverse selection of trading instruments, including forex pairs, shares, and cryptocurrencies, CMC Markets caters to a global audience. The broker is regulated in key markets like the UK, Australia, Singapore, NZ, and Canada, ensuring a high level of trust and safety with a trust score of 91.

Traders have access to two main trading platforms: MetaTrader 4, known for its automated trading capabilities, and the Next Generation platform, renowned for its advanced charting package and trading tools. While the Next Generation platform offers the full range of CMC Markets’ products, MT4 does not provide access to the complete product range.

The broker also excels in customer service, offering 24/5 support in multiple languages, and a comprehensive suite of educational resources, including webinars and market analysis, to support traders at all levels. With flexible funding and withdrawal options, including fee-free methods and no minimum deposit requirement, CMC Markets is a strong choice for traders seeking a comprehensive and cost-effective trading experience.

Verdict on CMC Markets Research and Education

CMC Markets excels in Research and Education, offering a comprehensive range of resources like eBooks, webinars, and expert market analysis, effectively equipping traders with essential tools and insights for informed decision-making.

Open a demo accountVisit CMC Markets

*Your capital is at risk ‘69% of retail CFD accounts lose money’

CMC Markets FAQs

Does CMC Markets Offer Spread Betting?

CMC Markets offers spread betting exclusively for traders within the United Kingdom. When trading with CMC Markets, you’ll need to use their proprietary trading platform NGEN as MetaTrader (MT4) isn’t available for spread betting with this broker.

What is the minimum deposit at CMC Markets?

$0 minimum deposit is required by CMC Markets to open a trading account.

Although there is no minimum deposit enforced by the broker, clients must deposit funds into their accounts to begin trading.

What Demo Account Does CMC Markets Offer?

CMC Markets provides a free CFD Demo Account, allowing you to practice trading with virtual funds on both the MT4 and Next Generation platforms in a risk-free environment.

Is CMC Markets safe?

Yes, CMC Markets is considered a safe forex broker by all industry standards. CMC Markets is regulated across 4 continents and has over 30 years of experience in the forex space.

Regulators like FCA, ASIC Regulated Brokers, BaFin or CIRO Regulated Brokers ensures the broker complies with strict financial rules. The forex broker has been honoured with numerous awards (+50 industry awards) for the quality of its service.

What Leverage Does CMC Markets Offer?

CMC Markets offers leverage up to 30:1 for branches regulated by ASIC, CySEC, FCA, and BaFIN, while in jurisdictions like New Zealand, regulated by the FMA, leverage can go up to 500:1.

This variation in leverage is due to the different regulatory standards and risk management practices in each region.

About the Review

In reviewing CMC Markets, the team closely followed our comprehensive methodology for assessing forex fees, involving a deep dive into CMC Markets’ published fee information and real-time trading tests. Monthly, we analyze brokers’ fee data, including that of CMC Markets, and test these fees in actual trading environments using advanced monitoring tools. This rigorous process ensures the review is both factual and reflective of real trading conditions, providing traders with an accurate evaluation of CMC Markets’ fee structure.

For a complete understanding of our review methodology, please visit Forex Fees page.

Compare CMC Markets Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Go to CMC Markets Website

Visit Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research

Ask an Expert

Does CMC Markets really have over 300 Forex Pairs?

Yes but many of these 300 are reversed cross pairs for example AUD/USD. USD/AUD

does CMC allow scalping?

Yes, CMC Markets do allow scalping

hello, what is your spread for XAUUSD

Hi Adeyemi, We are not a broker, to find out CMC Markets spreads please visit their website