Best Crypto CFD Broker Analysis

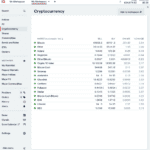

Forex trading brokers offer good trading platforms for trading cryptocurrencies. Cryptocurrency CFD trading platforms allow you to trade digital coins like Bitcoin, Ripple, Dash and EOS along with regular CFDs like forex, indices and shares.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

These are the best trading platforms CFD brokers offer to trade cryptos:

- Eightcap - Best Broker For Cryptos Overall With 95 Tokens

- Pepperstone - Great Crypto Trading Platforms, Including MT4

- IC Markets - Good Crypto Trading With MT5

- XTB - Top Range Of Bitcoin and Ethereum Crosses And Fiats

- eToro - Best For Copy And Social Trading With Cryptos

- IG Trading - Good Weekend Trading With Cryptocurrencies

- Plus500 - Bitcoin Plus 15 Cryptos With This Top CFD Provider

- FP Markets - Good Broker For Scalp Trading With Crypto

- AvaTrade - Great Choice For Day Trading Cryptos

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

51 |

FCA, DFSA, CySEC FSCBZ, CMNV, KNF |

0.9 | 0.14 | 0.13 | - | 0.9 | 1.4 | 1.3 |

|

|

|

160ms | $250 | 49+ | 16+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

91 |

MAS, CIRO, ASIC FCA, NFA/CFTC |

- | 0.2 | 0.2 | - | 0.92 | 0.9 | 1.1 |

|

|

|

- | $0 | 68 | 4 |

|

||

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.2 | 0.29 | 0.21 | $3.00 | 1.2 | 1.4 | 1.3 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

What Are The Best Crypto CFD Trading Platform?

Our 2025 annual review focused on the Best Forex Brokers In Australia but only several offered cryptocurrency CFD trading. With the rise of cryptocurrency trading, we focused on short-listing brokers with a strong crypto CFD platform offering and then find the best broker based on spreads, features and customer service.

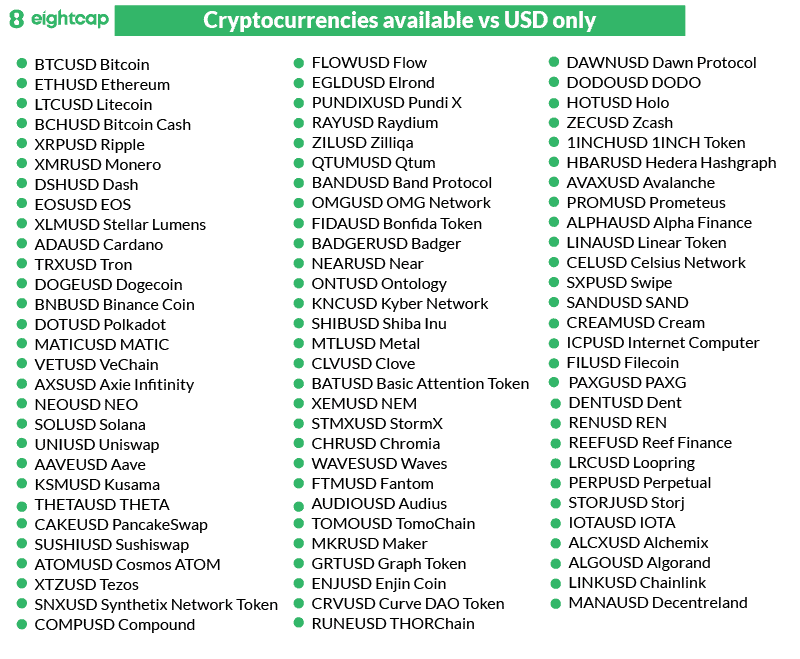

1. Eightcap - Best Broker For Cryptos Overall With 95 Tokens

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.73

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

We recommend Eightcap as the best broker overall if you are interested in trading crypto CFDs based on its extensive selection of 95 crypto tokens to trade, competitive spreads and emphasis on research materials for crypto trading.

This broker also holds licenses from two Tier-1 regulators: the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC).

Pros & Cons

- Tight Forex spreads (averaged 0.06 pips in our tests)

- Fast and easy account opening process

- Over 95 cryptocurrency CFDs to trade

- MT4, MT5 and TradingView platforms

- MT4 ‘only’ has 79 crypto compared to MT5

- Minimum deposit required to open an account

- Cryptocurrencies not available in UK, Europe

Broker Details

Eightcap has the most cryptos from the forex brokers we’ve tested this year, offering 95 markets. These markets cover highly liquid coins like Bitcoin and Ethereum and more volatile markets like SHIB, giving you a choice of markets to speculate on. We think this is good because you can jump into trading highly speculative and new crypto markets while being reassured your money is protected through the broker being regulated by ASIC and FCA.

Eightcap has the most cryptos from the forex brokers we’ve tested this year, offering 95 markets. These markets cover highly liquid coins like Bitcoin and Ethereum and more volatile markets like SHIB, giving you a choice of markets to speculate on. We think this is good because you can jump into trading highly speculative and new crypto markets while being reassured your money is protected through the broker being regulated by ASIC and FCA.

Plus, you can access a range of other assets, such as 56 currency pairs, 586 shares, 16 indices, and eight commodities, allowing you to capture trading opportunities across multiple markets with one account.

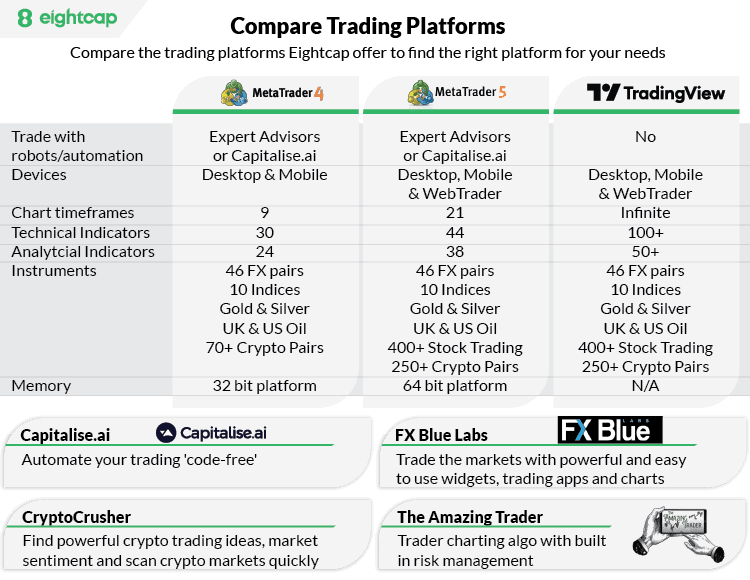

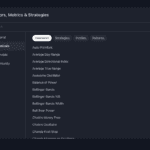

When you open an account, you get access to a range of trading platforms, and these include TradingView, MetaTrader 4, and MetaTrader 5 – all top platforms for technical analysis.

We tried TradingView and think it’s one of the best platforms for using technical analysis to find trading ideas. The platform offers 110+ indicators, 10+ chart types, and custom timeframes.

Plus, you get access to a huge community of active traders who develop custom indicators and strategies you can apply to your charts for free (a bit like MT4’s custom indicators). This exposes you to alternative indicators from other successful traders you can download and apply for your charting.

We used Eightcap’s RAW account to explore the broker’s features, which are the commission-based account and tight spreads. Our analyst, Ross Collins, tested the average spread on this account, averaging 0.2 pips in our tests, which is on par with some of the industry’s best offerings. With the spreads near zero, Eightcap charges a commission of $3.50 per lot traded.

| EUR/USD | Average Spread |

|---|---|

| TMGM | 0.15 |

| Tickmill | 0.15 |

| Fusion Markets | 0.16 |

| IC Markets | 0.19 |

| Pepperstone | 0.19 |

| FP Markets | 0.2 |

| EightCap | 0.2 |

| Admiral Markets | 0.21 |

| CityIndex | 0.22 |

2. Pepperstone - Great Crypto Trading Platforms, Including MT4

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We recommend Pepperstone for devoted MetaTrader 4 users interested in diversifying their portfolios to include cryptocurrency.

With a collection of powerful add-ons and integrations designed to support advanced technical analysis and algorithmic trading, this broker takes the MT4 trading experience up a notch.

Algorithmic traders, in particular, will appreciate the combination of MetaTrader 4, MetaTrader 5, TradingView and cTrader platforms for sophisticated charting and Expert Advisers (EAs).

Pros & Cons

- Powerful trading tools, particularly for MT4

- MT5, TradingView and cTrader platforms

- Fast execution speeds – 77ms for limit orders

- Competitive trading costs

- The demo account expires after 30 days

- 24/5 customer support

- A more limited selection of cryptocurrencies

Broker Details

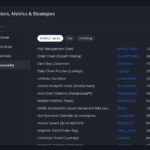

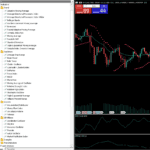

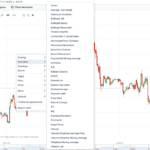

For a choice of trading platforms, Pepperstone offers the widest selection of popular platforms including MetaTrader 4, MT5, cTrader, and TradingView, letting you choose based on your trading style.

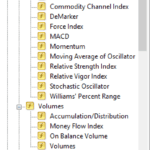

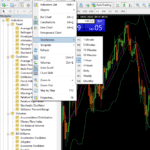

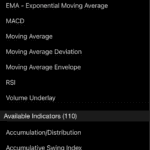

We tried the MetaTrader 4 platform and found that it has 30+ indicators, three chart types, nine timeframes, customisable indicators and automated trading through Expert Advisors. For the indicators, we liked that they offered fundamental indicators like Moving Averages and RSIs but included more advanced indicators such as Fractals and Ichimoku. By offering these, we think it provides a solid foundation for you to perform technical analysis on MetaTrader 4.

Compared to the other platforms, MetaTrader 4 has a strong community that has developed 100,000s of custom indicators and Expert Advisors that you can download and use, helping traders take advantage of the automated trading available.

While reviewing the markets available on Pepperstone, we found the broker offering 19 crypto markets, covering cryptocurrencies from Bitcoin to XRP, all available on the MetaTrader 4 platform, allowing you to take advantage of the platform’s features, including automated crypto trading.

We asked our analyst Ross Collins to test the Razor account spreads to see how frequently the broker offers them at 0.0 pips (as advertised). His results confirmed that Pepperstone offered its spreads 100% of the time on the major pairs, which is impressive as it means you’re essentially paying just the commission (which is a fixed cost)

| BROKER | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY | Grand Total |

|---|---|---|---|---|---|---|---|

| Pepperstone | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

Ross also tested 14 other top brokers to see the industry average and found Pepperstone (and City Index) to be the only broker offering consistent zero-spreads during peak trading times.

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| TMGM | 97.83% |

| FP Markets | 97.83% |

3. IC Markets - Good Crypto Trading With MT5

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

We recommend IC Markets for cost-conscious traders interested in adding cryptocurrency to the mix. This broker offers some of the tightest spreads of any brokers we tested, averaging 0.76 pips for the major currency pairs on a Standard account and 0.16 pips on a RAW account.

Users of the popular MetaQuotes family of trading platforms will appreciate the extensive collection of integrations and add-ons, including Trading Central, Autocharist and cTrader, for advanced technical analysis.

Pros & Cons

- Excellent trading conditions with MetaTrader 5

- Solid selection of financial instruments to trade

- Tight spreads

- Market research tools need improvement

- Licensed by only two Tier-1 regulators: ASIC and CySEC

- cTrader-based mobile app only available for Android

Broker Details

IC Markets is an ECN-style broker, so it instantly processes your trades through the network, matching your order with another buyer (or seller). For us, ECN brokers are a solid pick as they provide faster execution speeds with tighter spreads while providing direct market access, a feature unavailable with market makers.

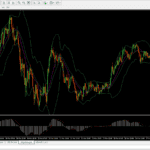

With this in mind, we think that the MT5 platform is an excellent pick for trading crypto, as the platform has a bunch of features that take advantage of how ECN brokers work.

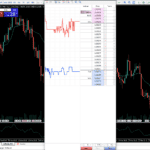

We picked the MT5 platform because you get access to a feature called Depth of Market. This feature shows you the liquidity provider’s orderbook and the prices at which other traders are placing their pending orders. This real-time insight into market depth is invaluable for crypto trading, as it allows you to gauge market sentiment, judging whether there is higher buying or selling pressure.

We also found that you get access to a decent choice of 38+ indicators by default and over 20+ drawing tools, which you’ll find helpful with your technical analysis. Collectively, you’ll have a decent set of tools to perform technical analysis on IC Market’s 18+ cryptocurrencies with MetaTrader 5.

The account we used to test the broker was IC Market’s RAW account, the broker’s commission-based account with tighter spreads and generally considered a cheaper account. Our tests found the spreads low, averaging 0.02 pips on EUR/USD – 91% compared to the rest of the industry based on our research.

The broker also had excellent spreads across the other major pairs, averaging 0.16 pips, the lowest major average spread we tested. These spreads make the broker a solid pick if you want to focus on the crypto and forex markets.

| BROKER | EUR/USD |

|---|---|

| IC Markets | 0.02 |

| Fusion Markets | 0.13 |

| ThinkMarkets | 0.1 |

| FP Markets | 0.1 |

| FXTM | 0 |

| TMGM | 0.1 |

| HYCM | 0.1 |

| XM | 0.1 |

| GO Markets | 0.2 |

| Industry Average | 0.22 |

4. XTB - Top Range Of Bitcoin and Ethereum Crosses And Fiats

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 0.14

AUD/USD = 0.13

Trading Platforms

MT4, xStation 5, xStation Mobile

Minimum Deposit

$0

Why We Recommend XTB

We recommend XTB as the best broker for crypto traders specialised in Bitcoin (BTC) and Ethereum (ETH) based on its extensive selection of crosses, including with fiat currency. This broker also stands out for its excellent user experience.

A same-day, fully digital account opening process has you up and running in less than 24 hours, and XTB doesn’t require a minimum deposit or charge deposit and withdrawal fees.

Pros & Cons

- No minimum deposit

- Interesting selection of digital assets

- Average trading fees

- Limited trading platform selection

- Only one trading account option

Broker Details

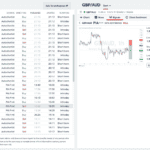

During our testing, we found that XTB offers an impressive selection of cryptocurrency markets, including 9 Bitcoin crosses (DSH/BTC, IOTA/BTC, LTC/BTC) and 3 Ethereum crosses (ETH/BTC, TRX/ETH, and EOS/ETH). These crypto crosses allow you to potentially hedge or exploit a price divergence, offering you more ways to profit in the crypto markets.

However, compared to trading against fiat currencies, your risk will be higher, and the spread will be much wider due to the asset’s enhanced volatility and lower liquidity.

XTB is a multi-asset broker that offers more markets than just crypto. You have a decent selection of 71 forex markets, allowing you to transition between traditional and cryptocurrency trading within a single account. In addition to forex markets, you can take advantage of 1977 share CFDs, 33 indices, and 27 commodities, providing a solid range of markets to explore and trade.

When it comes to the broker’s trading conditions, our testing revealed that the Standard account spreads are highly competitive, where we found the average spread of 0.90 pips on EUR/USD, 0.34 pips lower than the industry average. While the spreads for the other majors were in line with their respective industry averages, XTB’s overall average spread across major pairs stood at 1.36 pips, which is below the industry average of 1.52 pips.

| Top 5 Most Traded Average Spread | |

|---|---|

| BROKER | Major Pair Average Spread |

| XTB | 1.36 |

| OANDA | 0.70 |

| IC Markets | 0.76 |

| Fusion Markets | 0.99 |

| Eightcap | 1.06 |

| Go Markets | 1.08 |

| ThinkMarkets | 1.22 |

| Axi | 1.24 |

| FP Markets | 1.30 |

| IG | 1.38 |

| Pepperstone | 1.40 |

| Blackbull Markets | 1.42 |

| Industry Average | 1.52 |

5. eToro - Best For Copy And Social Trading With Cryptos

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

We recommend eToro not only for the variety of crypto assets available to trade – 41 different tokens – but also for its commitment to social trading and copy trading. Many top brokers treat these trading strategies as ‘bonuses’ or ‘nice to have’, but eToro makes them the centre of its trading experience with innovative features like the CopyPortfolios tool.

Beginners and casual traders will also like eToro’s simplified, user-friendly platform and the mandatory stop-loss and take-profit orders the broker uses to protect client funds.

Pros & Cons

- Impressive market analysis tools and content

- Platform built for social trading

- Unique products such as ‘smart portfolios’

- Easy to use portfolio features for casual traders

- Experienced traders may find the proprietary trading platform lacking

- Does not support algorithmic trading strategies

- Higher-than-average trading costs

Broker Details

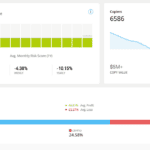

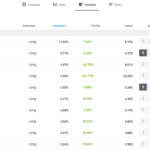

eToro lets you automate your cryptocurrency trading by copying the trades of other experienced traders with a proven track record who run their own strategies.

Kind of like investing with a fund manager, these “copy traders” do all the heavy lifting by performing the analysis, risk management, and timing the trades.

You just mirror the trades and profit from their expertise or lose when they lose, which can be a decent way of getting exposure to high-risk assets like crypto without investing the time to learn how.

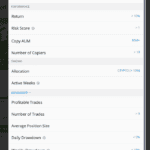

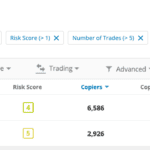

Copy trading is a special way of trading, and we think eToro does an excellent job of simplifying the process with its user-friendly search-based platform, which you can customise with 14 metrics.

These metrics included performance, trade volume, markets traded, number of copy traders, and total assets under management.

The latter two metrics caught our attention, as they offer a transparent view into other traders’ confidence in a copy trader – if people were not impressed, they wouldn’t invest.

When we tried the CopyTrader platform, we focused our search on traders who specialise in cryptocurrency markets. This narrowed our search to just two traders (from 2,000,000 options).

This made validating the traders manageable as we know that they check all of our boxes, we just had to double-check by validating the performances within their accounts.

We liked that you could see simple breakdowns of the performances, which included monthly results, the number of assets invested, current positions, and trade history. This allowed you to fully audit them before choosing to copy trade.

It’s worth noting that eToro offers a solid selection of 41 crypto markets, including Bitcoin, Ethereum, Litecoin, Solana, Dogecoin, and Avalanche. However, you cannot choose which coins you trade through copy trading.

6. IG Trading - Good Weekend Trading With Cryptocurrencies

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Trading

We recommend IG Trading for its stellar reputation as an industry leader in the online trading space, its award-winning trading platform suitable for casual traders, and its comprehensive selection of educational resources to help you develop your trading strategy over time.

If you’re more of a ‘weekend trader’ without the time to devote to intensive market analysis and backtesting, this broker offers a solid foundation for your trading that you can easily scale if you decide to pursue retail investing further.

Pros & Cons

- Licensed in ten jurisdictions

- The largest selection of assets to trade of any broker we reviewed

- Low spreads – 0.32 pips on average for the major currency pairs

- Far fewer tradable assets on MT4 than on the proprietary platform

- Spotty customer support – users report slow response times

- MetaTrader 4 trading experience is lacking, and MetaTrader 5 is not available

Broker Details

As crypto is a 24/7 market, accessing the markets even over the weekend is important, which we found not many forex brokers offer. IG Trading is one of the only brokers that offered weekend markets on Bitcoin, Ethereum, and the Crypto 10 Index (IG’s index of top 10 cryptocurrencies) to trade.

Alongside the weekend markets, we found IG Trading to offer an impressive range of 17,000+ markets, the most we’ve seen from a forex broker. These markets include 80+ currency pairs, 12,000+ share CFDs, 130 indices, 41 commodities, and over 15 cryptocurrencies to trade.

We found that IG Trading only provides a Standard account, which simplifies your trading costs as the commission is priced into the spread. Our analysis found that this account averaged a respectable 1.13 pips on EUR/USD, making it cheaper than the industry average.

IG Trading offers a range of platforms to execute your trades, including MetaTrader 4 and ProRealTime—both excellent for technical analysis. However, we tried the IG Trading Platform, which is a web platform but has many features that compete with platforms like MT4 and TradingView.

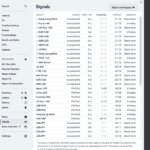

Such features include 40 indicators, which can be applied to the charts and customise settings to tailor them to your strategy, which other web platforms don’t allow. We also found that the platform had advanced charting tools such as the Signal Centre, which generates new trade ideas from Autochartist and PIA First based on price action analysis.

Although the IG Trading Platform is excellent for executing and analysing, it does like the ability to automate trades.

7. Plus500 - Bitcoin Plus 15 Cryptos With This Top CFD Provider

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why We Recommend Plus500

We recommend Plus500 for traders interested in Bitcoin (BTC) and other major tokens like Ethereum (ETH) and Litecoin (LTC) but otherwise care most about a straightforward trading experience.

This broker doesn’t top the list for low spreads, and experienced traders may find the platform lacking, but for intermediate traders who also want to trade forex, indices, commodities and other financial markets, Plus500 gets the job done.

Pros & Cons

- Excellent trading tools

- Solid selection of financial instruments beyond crypto CFDs

- Limited education content and market analysis tools

- Proprietary platform may not meet the needs of active traders

- High trading fees

Broker Details

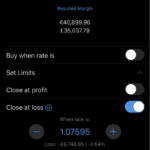

After opening our Plus500 Standard account, we found that the broker offers 16 cryptocurrency markets, including major coins like Bitcoin, XRP, and Ethereum. While not an extensive selection, this range covers some of the most liquid and popular cryptocurrencies, allowing you to capitalise on the opportunities with a well-regulated CFD provider.

We found that Plus500 strips back offering extra tools and trading platform options to deliver a better overall CFD trading experience instead. The broker only offers its Plus500 Trading platform, which lacks features such as custom indicators and automated trading, which will narrow Plus500’s appeal.

However, after testing the platform, we grew fond of it. We tried the trading app on our iPhone, which was easy to download and install from the Apple App Store (it is also available on Android). Once we logged in, we found the app’s charting tools were similar to TradingView’s, which is a big plus in our books. It offered over 100 indicators with 13 chart patterns so we could set up our charts how we wanted.

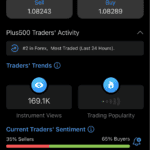

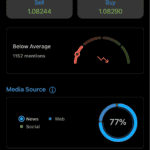

The platform has a service called “+insights,” which is Plus500’s sentiment analysis tool. It aggregates all of its clients’ positions and provides insights on what asset is trending, breaking it down further to show the split between buyers and sellers.

An interesting part of the tool also shows which assets have created the most profits for its clients over the previous day, week, and month. This can help you find potential new markets to trade based on the recent success of other traders.

8. FP Markets - Good Broker For Scalp Trading With Crypto

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

We recommend FP Markets as one of the few brokers to permit scalping as a trading strategy and allow clients to trade crypto CFDs.

Scalping, which refers to opening and closing positions over minutes (and sometimes seconds), relies on a high degree of market volatility and can prove both expensive and risky.

Many brokers prohibit the practice, but FP Markets supports traders seeking to profit from rapid price movements with various tools.

Pros & Cons

- Interesting collection of trading platforms

- Low spreads and commissions

- Excellent collection of cryptocurrencies

- The mobile app has limited features

- Could have better social trading and copy-trading tools

- Average execution speeds

Broker Details

Our analyst Ross Collins found that FP Markets had one of the fastest market execution speeds, recording an impressive 96ms – one of the fastest we tested. We believe this is an important factor if you are scalping, as you need lightning-quick execution, especially when placing instant market orders, to capture quick price movements.

FP Markets can achieve these remarkable speeds because it is an ECN broker, providing direct market access by connecting buyers and sellers. This eliminates dealing desk intervention, giving you tighter spreads and faster execution speeds – a perfect trading environment for scalpers.

While testing FP Markets, we found their range of trading platforms extensive, including popular choices like cTrader, MetaTrader 5, and TradingView. We felt that cTrader was a top choice for scalping, pre-loaded with 67 indicators, ten chart types, and an impressive 130 timeframes that go as low as tick charts.

We think the one-click trading setting is a standout feature on cTrader that pairs well with scalping. By reducing the time to place an order, you can capture your scalps faster and maximise profit margins.

The Depth of Market tool allows you to see where the buying and selling pressure lies in the crypto markets, enabling you to leverage this information to take higher probability scalps.

9. AvaTrade - Great Choice For Day Trading Cryptos

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

We recommend AvaTrade for anyone looking for solid risk management and lots of different ways to trade. From options to CFDs to exchange-traded financial instruments, this broker has a little bit of everything.

Pros & Cons

- Social trading and copy trading with ZuluTrade and Duplitrade

- Extension options trading

- Powerful risk management features, including loss protection

- Higher-than-average trading costs

- Limited collection of financial instruments

- Market analysis resources are lacking

Broker Details

AvaTrade’s fixed spreads can potentially improve your overall crypto trading costs compared to variable spreads, which can widen aggressively during volatile periods, making entering or exiting a position expensive, while fixed spreads remain constant regardless of market conditions.

We think fixed spreads are decent for day trading as you’ll know your trading costs upfront. You also won’t suffer from spreads widening during volatile times, which could reject your initial trade entry (potentially costing you a profitable trade).

It’s worth noting that AvaTrade’s crypto spreads work differently from their other assets, such as forex. For cryptocurrencies, they charge a fixed 0.10% spread, which means the spread can vary but will always be proportionate to the asset’s price. On the other hand, for forex, the broker offers a highly competitive fixed spread of 0.9 pips on the EUR/USD pair, which is on par with industry standards.

| Broker | Avg. EUR/USD Spread (Standard Account) | Fixed/Variable Spreads |

|---|---|---|

| IC Markets | 0.62 | Variable |

| AvaTrade | 0.90 | Fixed |

| XTB | 0.90 | Variable |

| Eightcap | 1.00 | Variable |

| eToro | 1.00 | Variable |

| FP Markets | 1.10 | Variable |

| Pepperstone | 1.12 | Variable |

| IG Trading | 1.13 | Variable |

| Plus500 | 1.70 | Variable |

In particular, we liked the AvaTradeGO mobile app, which features an impressive market sentiment tool that provides a snapshot of where AvaTrade’s clients believe the market will move. We believe tools like this can be particularly helpful for day traders, as they offer a quick and easy way to gauge the sentiment of other market participants.

Ask an Expert

what cryptocurrencies are available for me to trade on MT4 with FP markets?

FP Markets offers 12 different cryptocurrencies for trading when using either MT4 or MT5. This consists of the most popular cryptos such as Cardano, Bitcoin, Bitcoin Cash, Dogecoin, Polkadot, EOS, Ethereum, Chainlink, Litecoin, Ripple and Stellar. For most traders, this range is adequate however you can find brokers with more cryptos. Eightcap for example offers 250 cryptocurrencies.

What is the best cfd crypto broker I can use in the USA?

Unfortunately, US regulations stipulate that you cannot trade CFD products. As a result, you are not allowed to trade crypto CFDs.

You can however trade real crypto using spot prices

What is the best NZ crypto CFD broker?

We consider BlackBull Markets and TMGM to be the best brokers for trading within New Zealand. Both brokers are regulated by the FMA.

What the best platform to select from the broker to trade crypto CFDs?

MetaTrader 5

How long can I hold a CFD?

You can hold CFDs ss long as you wish but you will get overnight charges (also called rolling fees) if you hold you position overnight (5pm New York time). Keep in mind overnight charges are not always a cost, sometimes you can earn interest from them.

Where is CFD trading banned?

CFD trading is banned in the US by the Securities and Exchange Commission (SEC) as part of their Dodd Frank Act. The SEC is responsible for protecting investors and have concerns with risks associated with leverage trading and transparency.