Best Forex Broker In Canada

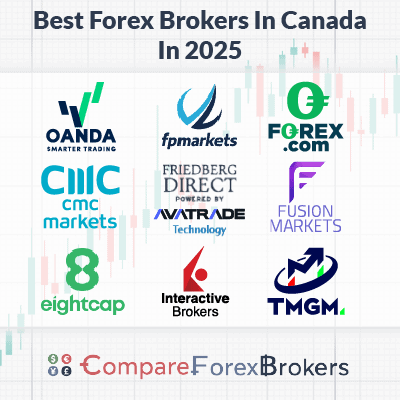

To help choose a broker, I compared the best forex brokers that accept Canadian clients in 2025 and CIRO forex brokers regulated in Canada. Below are my monthly findings.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Our best forex trading platform Canadian list is.

- OANDA - The Best Forex Broker In Canada

- FP Markets - Lowest Trading Fees In Canada

- FOREX.com - Best Range of Trading Products

- CMC Markets - Top Choice For New Traders

- Avatrade - Good Broker For Stable Spreads

- Fusion Markets - Top Broker For Tight Spreads

- Eightcap - Best Broker For Crypto Trading

- Interactive Brokers - Great ECN Broker

- TMGM - Great Choice For High Leverage Trading

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

91 |

FCA, CIRO, ASIC FSC-BVI, NFA, CFTC MAS, JFSA, KNF |

- | - | - | - | 1.4 | 2 | 1.4 |

|

|

|

120ms | $0 | 69+ | - | 50:1 | - |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.2 | 0.29 | 0.21 | $3.00 | 1.2 | 1.4 | 1.3 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

84 | CIRO, FCA, NFA, CFTC, MAS, JFSA, CIMA | - | - | - | $7.00 | 1.2 | 1.5 | 1.4 |

|

|

|

30 ms (May 2023) | $100 | 80+ | - | 33:1 | 33:1 |

|

Read review ›

Read review ›

|

69 |

ASIC, FCA MAS, CIRO |

0.5 | 0.9 | 0.6 | $2.50 | 1.12 | 1.30 | 1.64 |

|

|

|

138ms | $0 | 339+ | - | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

64 |

CIRO, FSCA ADGM, CBI |

- | - | - | - | 0.90 | 1.5 | 1.1 |

|

|

|

160ms | $100 | 37+ | - | 33:1 | 33:1 |

|

Read review ›

Read review ›

|

52 |

CIRO NFA/CFTC,ASIC,FCA,MAS |

- | - | - | 0.08%-0.2% | - |

|

|

|

120ms | $0 | 100+ | - | 30:1 |

|

|||

Read review ›

Read review ›

|

92 | ASIC, VFSA, FSA-S | 0.11 | 0.24 | 0.12 | $2.25 | 0.83 | 1.42 | 1.12 |

|

|

|

79ms | $0 | 84 | 14 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

71 |

FMA, VFSC ASIC |

0.20 | 0.30 | 0.10 | $3.50 | 1.20 | 1.20 | 1.0 |

|

|

|

94ms | $100 | 61 | 12 | 30:1 | 200:1 |

|

Who Are The Best Canadian Forex Brokers?

After comparing 20+ forex brokers that accept Canadian traders, I narrowed the list to 9 brokers based on my extensive testing. My analysis includes independent technical tests for execution speed and trading costs to provide accurate reviews for each broker, while highlighting their top features.

I have included CIRO-regulated brokers if you want to stay local to Canada with maximum regulatory protection. However, I have included a few offshore brokers who accept traders from Canada as they have higher leverage and more competitive trading costs as these brokers may appeal to more experienced traders.

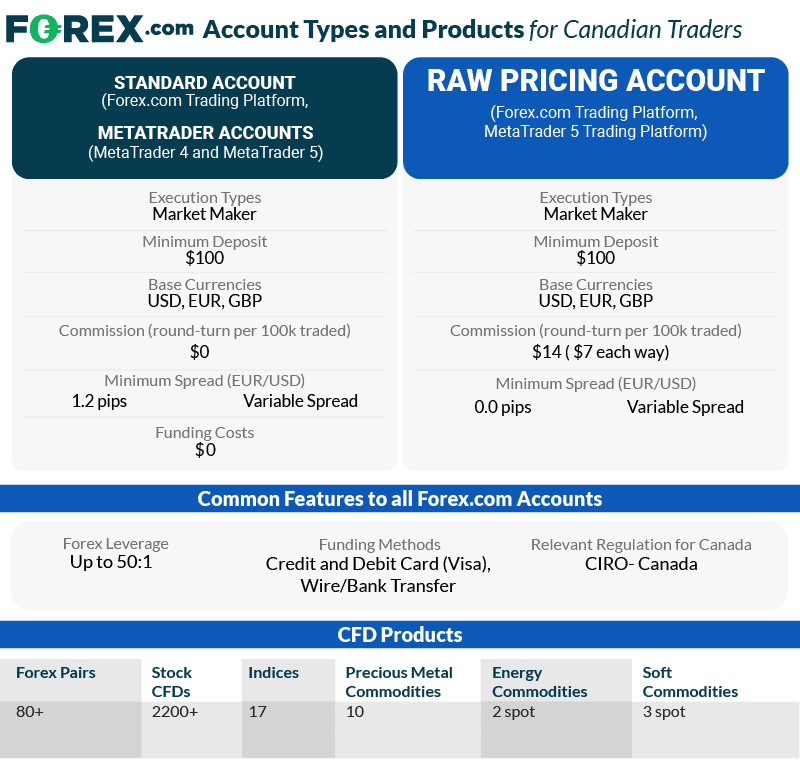

1. OANDA - The Best Forex Broker In Canada

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 0.9

AUD/USD = 0.7

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

I picked OANDA as the best forex broker for Canada after scoring 91/100 in my tests for low trading costs and security (making them the most regulated broker). You don’t pay commission on the Standard account, plus the broker averages 0.92 pips (in my testing), making them an ideal account for beginners.

Having three options for trading platforms (OANDA Trade, TradingView, MT4) lets you tailor OANDA’s trading conditions to your style. Of these, I recommend the OANDA Trade platform as it uniquely allows complete control of trade sizes and contains templates for faster order execution across 200+ markets.

Pros & Cons

- Most trusted and regulated broker

- Earn rebates with the Elite Trader Program

- Competitive Standard account spreads

- MT4, TradingView and OANDA Trade Platforms

- Does not offer CFD share markets

- Not an ECN/STP broker

- Not available for traders from Alberta province

Broker Details

Tight Standard Account Spreads

While testing OANDA, I was impressed with its Standard account that provided low spreads from 0.92 pips on EUR/USD and zero commissions. I found you can lower your trading costs further with the Elite Trader Program by earning rebates from your trading volume.

You can receive a rebate from CAD$ 0.5 to 1.70 per lot traded, saving you up to 34% on your trading costs, which is huge if you’re a high-volume trader.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Excellent Trading Platforms

OANDA performed well in my trading platform tests, scoring 7/10 for offering TradingView, MT4, and OANDA Trade, which uses TradingView’s charts, giving you a top platform for technical analysis.

With OANDA Trade, you can set up a default trade template, an excellent tool for scalpers and beginners. The template automatically populates your order ticket with the lot size, stop-loss, and take-profit orders (in pips), meaning your trades include risk management protection.

Most Trusted Forex Broker

During my tests, I scored OANDA 100/100 for its Trust category after I found they are the best regulated forex broker in Canada with licenses from 9 authorities globally. More importantly, I found they are authorized by 6 Tier-1 regulators, who are the following:

As a Canadian trader, OANDA is regulated directly by CIRO giving you full protection under its licence to provide transparent trading services and protect your capital.

All the other regulators don’t matter as far as your trading experience. However, I view them as strong signals that OANDA is trusted as 6 tier-1 regulators have approved them after meeting their strict standards.

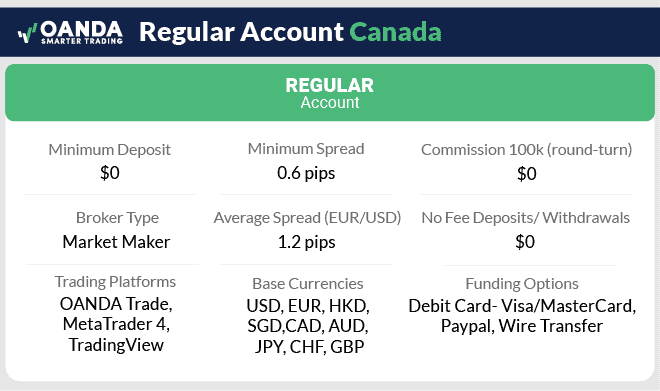

2. FP Markets - Lowest Trading Fees In Canada

Forex Panel Score

Average Spread

EUR/USD = 1.1

GBP/USD = 1.3

AUD/USD = 1.3

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

I awarded FP Markets 86/100 for its low trading fees with commissions from $3.00 and tight spreads from 0 pips on its Raw account. You can also choose from a wide range of trading platforms offering MT4, MT5, and cTrader, providing automation and scalping features, while TradingView has the best technical analysis tools.

The broker’s customer service is solid with knowledgeable human agents, so you’re in good hands should you need the support.

Pros & Cons

- Lowest trading costs

- Access TradingView, MT4, MT5, and cTrader

- Fast execution speeds

- Has withdrawal fees on e-wallets

- Not available for users in Ontario or British Columbia provinces

- Fewer research tools

Broker Details

Lowest Trading Costs In Canada

FP Markets scored an impressive 9/10 for its trading costs, producing solid spreads, but the Raw account stands out for me.

My analyst colleague, Ross Collins, performed a Raw spread test using the IceFX SpreadMonitor indicator for MT4 to gather the average spread values over 24 hours.

Ross’s tests found that FP Markets’ Raw account averaged 0.20 pips on EUR/USD, 0.51 pips on USDCAD, and 0.31 pips on GBP/USD. All of these beat their tested industry average spreads, with GBP/USD being the top performer at a 42% discount to the forex industry.

| Raw Account Spreads | FP Markets | Average Spread |

|---|---|---|

| Overall | 0.38 | 0.72 |

| EUR/USD | 0.10 | 0.28 |

| USD/JPY | 0.56 | 0.44 |

| GBP/USD | 0.29 | 0.54 |

| AUD/USD | 0.21 | 0.45 |

| USD/CAD | 0.16 | 0.61 |

| EUR/GBP | 0.43 | 0.55 |

| EUR/JPY | 0.3 | 0.74 |

| AUD/JPY | 0.5 | 0.93 |

| USD/SGD | 0.8 | 1.97 |

FP Markets offers its commissions in USD at $3.00 per lot traded, while most brokers in Canada have much higher commissions of around $7 per lot traded. So with FP Markets’ Raw account, you can save 57% compared to the rest of the CIRO-regulated brokers, making it the best account if you want Raw spreads.

Wide Range of Trading Platforms

Considering the low costs, FP Markets offers an extensive range of forex trading platforms so you can choose which platform is best for your needs.

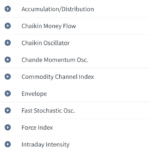

I like that TradingView is available. It’s my favorite platform for technical analysis, thanks to its 110+ indicators, including automated tools for Fibonacci and Trend Lines, making technical analysis easier.

For automated trading tools, FP Markets has MT4, MT5, and cTrader, offering support for algorithmic traders. Alternatively, for scalpers, MT5 and cTrader are best due to their one-click trade features and access to Depth of Markets tools for advanced order flow and volume-based analysis.

With access to so many platforms, you can use my trading platform finder tool to find the one that matches your trading needs.

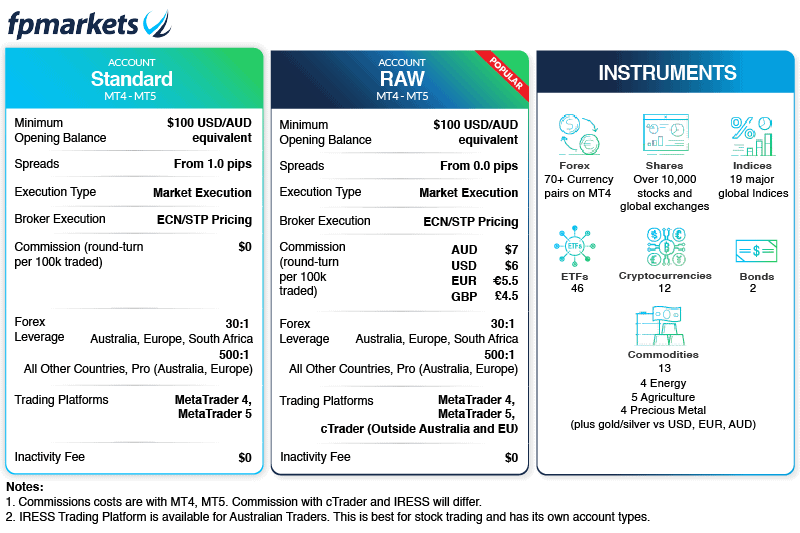

3. FOREX.com - Most Currency Pairs To Trade

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.6

AUD/USD = 1.4

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

FOREX.com scored a solid 84/100 in my tests with access to a solid range of 350+ markets, including 91 currency pairs, the largest in Canada. These spreads on the Standard account are competitive, averaging 1.20 pips on EUR/USD with zero commissions, simplifying your trading costs.

You get access to top trading platforms for technical analysis and automated trading with TradingView, MT4, and MT5, while its own Web Trading Platform has advanced features for performance management.

Pros & Cons

- 91 currency pairs to trade

- Decent native trading platform

- Good educational resources

- Large commissions on Raw account

- $100 minimum deposit

- Restricts advanced trading tools like Trading Central in Canada

Broker Details

91 Forex Pairs To Trade

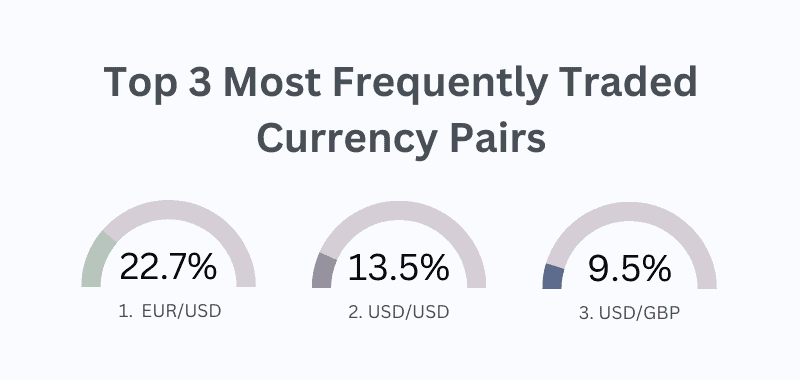

Forex.com proved to have the best range of trading products for a CIRO-regulated broker in my tests, especially for its forex range with 91 currency pairs available.

| Broker | Number of Currency Pairs |

|---|---|

| Forex.com | 91 |

| Fusion Markets | 84 |

| OANDA | 68 |

| FP Markets | 63 |

| TMGM | 61 |

| Eightcap | 55 |

| AvaTrade | 55 |

In my tests, I found the range of currency pairs includes six major pairs, 15 minors, and 57 exotic pairs, giving you a decent opportunity to trade more volatile products. Impressively, I found the exotic pair spreads on the Standard account to be cheap, with USD/THB averaging spreads of 3.2 pips and CAD/NOK averaging 32 pips.

Offers Standard and Raw Trading Accounts

For its major pairs costs, I found them competitive too on both its Standard non-commission account and Raw account with tighter spreads and commissions. The Standard account averaged 1.20 pips on EUR/USD during the New York trading session, which is what I’d expect from Canadian forex brokers based on my experience.

The Raw account offers the EUR/USD spread 83% less, averaging 0.20 pips, which is a considerable saving. However, you do pay USD $7.00 for each lot traded ($14.00 round trade), which is a large commission in my opinion and erodes the discount saved on the spreads. I’d stick with the Standard account with Forex.com or use FP Markets for a significant saving.

Solid Range of Markets

Outside of forex pairs, Forex.com offers a decent range of 350+ markets, letting you trade multiple markets with one trading account. These include:

- 220 stock CFDs

- 8 cryptocurrencies

- 10 commodities

- 17 indices

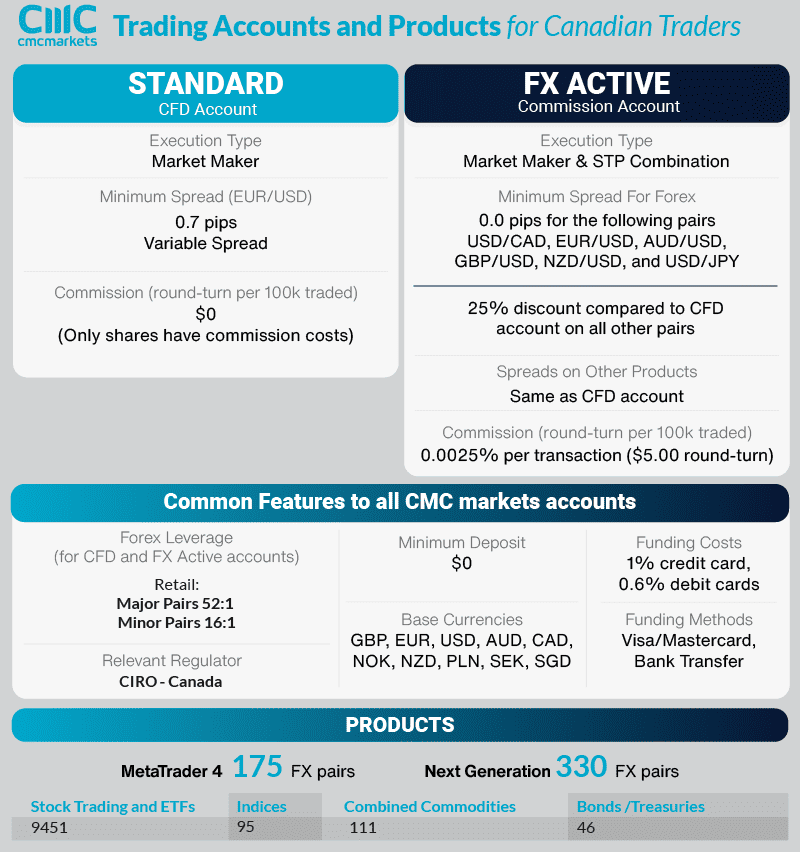

4. CMC Markets - Top Choice For New Traders

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.3

AUD/USD = 1.64

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

I picked CMC Markets as the best broker for beginners because its trading platform offers excellent features like automated pattern recognition tools and guaranteed stop-loss orders. CMC Markets also supplies a decent range of educational resources with over 90+ lessons, webinars, and the Artful Trader podcast, which hosts industry professionals you can learn from.

From our testing, you can learn to trade across its 330+ forex pairs, or 12,000+ financial instruments, with low Standard account spreads (0.80 pips EUR/USD). For me, the low spreads and Next Generation platform make CMC Markets an excellent pick if you’re a beginner trader.

Pros & Cons

- NGEN platform with beginner-friendly features

- Decent selection of educational resources

- Tight spreads on Standard account

- Lacks social trading tools

- No customer service via Live Chat

- No TradingView or MT5 platforms

Broker Details

NGEN Platform Is Best For Beginners

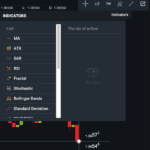

I’ve tested over 30+ trading platforms and found CMC Markets’ Next Generation (NGEN) platform to be one of the best for beginners in my opinion. It’s web-based, so there is no need to download anything and it works on every device while still offering 80+ technical indicators from MACD to Pivot Points.

The standout feature for me was its automated pattern recognition tool that you can use to receive technical analysis alerts based on upcoming chart patterns. If you’re new, it provides an overlay of the technical analysis on your chart so you can see the price patterns in real-time.

Decent Educational Resources

I found CMC Markets to provide a solid library of educational resources consisting of weekly webinars, podcasts, eBooks, and online articles. While testing, I discovered that CMC Markets provides 92 educational articles covering forex trading basics to trading strategies.

Despite the extensive content range with comprehensive and detailed videos, the education suite lacked videos.

Low Standard Account Spreads In Our Testing

I also chose CMC Markets for low spreads on its Standard account with no commissions after my analyst colleague confirmed that CMC Markets was a top performer. Ross tested 15 forex brokers with his MT4 platform using the IceFX SpreadMonitor indicator to record the average spreads for the six major forex pairs.

Ross’ tests returned highlighting that CMC Markets delivered low spreads across the board, with EUR/USD averaging 0.80 pips – 27% cheaper than the industry average (1.11 pips).

| AUDUSD | SPREAD | EURUSD | SPREAD | USDJPY | SPREAD |

|---|---|---|---|---|---|

| CMC Markets | 0.77 | IC Markets | 0.73 | IC Markets | 1.09 |

| IC Markets | 0.82 | Admiral Markets | 0.74 | CMC Markets | 1.17 |

| OANDA | 1 | CMC Markets | 0.8 | TMGM | 1.26 |

| FusionMarkets | 1.02 | FXCM | 0.93 | FusionMarkets | 1.27 |

| TMGM | 1.03 | TMGM | 1 | Admiral Markets | 1.32 |

| City Index | 1.07 | FusionMarkets | 1.01 | FXCM | 1.38 |

| Admiral Markets | 1.1 | OandA | 1.06 | FP Markets | 1.51 |

| Pepperstone | 1.24 | City Index | 1.16 | Go Markets | 1.52 |

| FP Markets | 1.28 | EightCap | 1.16 | EightCap | 1.55 |

| FXCM | 1.31 | FP Markets | 1.19 | OANDA | 1.55 |

| EightCap | 1.34 | Pepperstone | 1.21 | Pepperstone | 1.55 |

| Go Markets | 1.38 | Blackbull Markets | 1.34 | Axi | 1.62 |

| Axi | 1.59 | Go Markets | 1.34 | City Index | 1.74 |

| Blackbull Markets | 1.69 | Axi | 1.45 | FXPro | 1.87 |

| FXPro | 2.49 | FXPro | 1.59 | Blackbull Markets | 2 |

| Tested Industry Average | 1.28 | 1.11 | 1.49 |

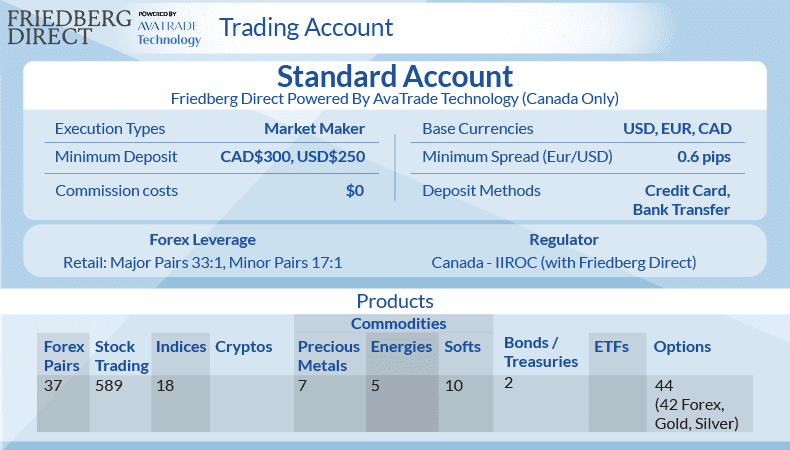

5. Friedberg Direct Powered by AvaTrade - Good Broker For Stable Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.9 GBP/USD = 1.5 AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend Friedberg Direct powered by AvaTrade

AvaTrade is my top recommendation for stable spreads because it offers fixed spreads to Canadian traders. It would be great if you day trade as volatility won’t increase your trading costs. The fixed spreads are low with EUR/USD at 0.90 pips, cheaper than most brokers (who widen their spreads).

Trade with fixed spreads across its 150+ markets ranging from forex to cryptocurrencies, keeping your trading costs stable regardless of the markets. You can trade vanilla options with AvaOptions, giving you a solid alternative to CFD trading that can benefit from market volatility.

Pros & Cons

- Competitive fixed spreads

- AvaOptions for vanilla options trading

- AvaTrade WebTrader offers decent trading features

- High inactivity fees

- No Raw pricing accounts

- Not all markets available on MT4

Broker Details

Fixed Spreads For Stable Pricing

AvaTrade stands out from CIRO-regulated brokers I’ve tested because it offers fixed spreads with no commissions, which are surprisingly competitive. Fixed spreads are a great option if you day trade because your trading costs will remain the same, regardless of whether the market becomes volatile during macroeconomic news announcements like GDP.

On the Standard account I was using, I could get EUR/USD spreads for 0.90 pips, making it almost 20% cheaper than the industry average. Looking deeper across the major pairs, AvaTrade performs well across the board, which is a good sign if you focus on forex markets.

However, USD/CAD is fixed at 2 pips, which is on the expensive side for this pair compared with variable spreads that averaged 1.67 pips in my analyst’s tests.

AvaTrade Has Decent Trading Platforms

Thanks to the integration with Friedberg Direct, you can trade AvaTrade’s 150+ markets covering cryptocurrencies to Canadian stock CFDs. AvaTrade offers its WebTrader platform as the default option to access its markets, providing 90+ indicators and a built-in Trading Central integration for technical insights and chart pattern recognition alerts.

The WebTrader platform also has market sentiment tools to see how many clients are long or short on a market, something I find helpful while day trading. If you prefer traditional trading platforms, you can access fixed spreads through MetaTrader 4 and MetaTrader 5.

AvaOption Offers American Style Options

Unique to AvaTrade, I found the broker offers vanilla-style options trading through its AvaOptions platform. Options trading provides flexibility, better risk management features, and potentially higher returns thanks to volatility compared to CFDs, making it an attractive option for trading highly volatile events or markets.

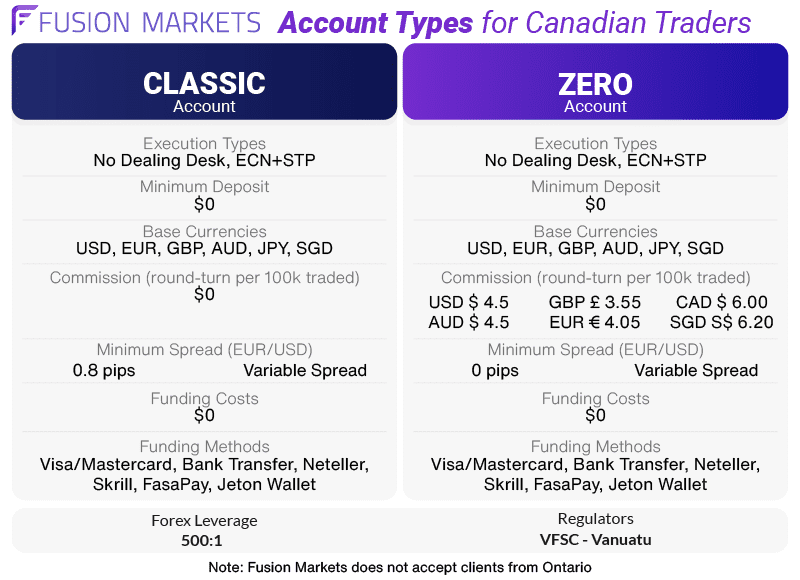

6. Fusion Markets - Top Broker For Tight Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.93

GBP/USD = 1.08

AUD/USD = 0.92

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why We Recommend Fusion Markets

Fusion Markets earned 92/100 in my broker reviews after providing the lowest trading costs for Canadian traders with its Zero account. Tests show that the account averages 0.16 pips and CAD 3.00 in commissions, saving you a fortune compared to other Canadian brokers.

The broker supports the tight spreads with fast execution speeds (sub-80 ms), with multiple top-tier trading platforms like MT4, MT5, cTrader, and TradingView providing solid trading conditions for scalping.

Pros & Cons

- Tight spreads on the Edge account

- Decent choice of trading platforms

- Offers copy trading tools with DupliTrade

- Not CIRO-regulated

- Charges inactivity fee

- Educational resources are limited

Broker Details

Lowest Raw Account Spreads

Although not regulated with CIRO, I found Fusion Markets accepts Canadian traders, which means you can tap into the broker’s excellent Zero account for lower trading costs.

My analyst, Ross Collins, tested the top 15 ECN brokers to get the average raw spreads during a typical trading session.

One of the top performers in his test was Fusion Markets, who achieved an average spread of 0.16 pips on EUR/USD, beating the industry average (0.27 pips). USD/CAD was also 62% lower than its industry average (0.62 pips), recording an average spread of 0.23 pips.

| Average RAW Spread From Test Done By Ross Collins | |||||||

|---|---|---|---|---|---|---|---|

| AUDUSD | Average Spread | EURUSD | Average Spread | GBPUSD | Average Spread | USDCAD | Average Spread |

| Fusion Markets | 0.09 | TMGM | 0.15 | CityIndex | 0.17 | CityIndex | 0.16 |

| TMGM | 0.15 | Tickmill | 0.15 | Fusion Markets | 0.21 | Fusion Markets | 0.23 |

| Pepperstone | 0.19 | Fusion Markets | 0.16 | IC Markets | 0.27 | TMGM | 0.43 |

| CityIndex | 0.23 | IC Markets | 0.19 | FP Markets | 0.31 | IC Markets | 0.45 |

| IC Markets | 0.23 | Pepperstone | 0.19 | TMGM | 0.35 | Go Markets | 0.47 |

| FP Markets | 0.31 | FP Markets | 0.2 | Pepperstone | 0.41 | Blueberry Markets | 0.5 |

| Blueberry Markets | 0.32 | EightCap | 0.2 | EightCap | 0.44 | Tickmill | 0.5 |

| Go Markets | 0.37 | Admiral Markets | 0.21 | Blueberry Markets | 0.44 | FP Markets | 0.51 |

| Tickmill | 0.37 | CityIndex | 0.22 | Go Markets | 0.59 | ThinkMarkets | 0.56 |

| ThinkMarkets | 0.42 | ThinkMarkets | 0.22 | Tickmill | 0.59 | Pepperstone | 0.61 |

| EightCap | 0.48 | Blueberry Markets | 0.27 | ThinkMarkets | 0.62 | EightCap | 0.64 |

Low Commission on the Zero account

With all Raw spread accounts tested, you have to pay a commission, and because I could set my base currency to CAD on my Zero account, you get better commissions. The commissions you pay are CAD 3.00 per lot traded, which is one of the lowest commissions you can receive.

Sub-80ms Execution Speeds

Ross also tested the broker’s execution speeds along with 19 other brokers using his MetaTrader 4 platform and recording the speeds using ExTest_ForExpat and Broker Latency Tester EAs. This gave him the average limit order and market order execution speeds to rank each broker accordingly.

Fusion Markets placed first in Canada (second globally) in his tests with a limit order speed of 79ms and a market order speed of 77ms. I always pick brokers that have fast execution speeds as they help protect you from negative price slippage on your stop-loss orders while ensuring your orders are filled.

| Execution Speed Tested Results | ||

|---|---|---|

| Broker | Limit Order Speed (ms) | Market Order (ms) |

| Fusion Markets | 79 | 77 |

| OANDA | 86 | 84 |

| TMGM | 94 | 129 |

| FOREX.com | 98 | 88 |

| CMC Markets | 138 | 180 |

| Eightcap | 143 | 139 |

| FP Markets | 225 | 96 |

| AvaTrade | 235 | 145 |

| Eightcap | 143 | 139 |

Based on this and the tight spreads, I think Fusion Markets is a great option for scalpers if you don’t mind choosing an offshore broker.

7. Eightcap - Best Broker For Crypto Trading

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 1

AUD/USD = 1.2

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

I chose Eightcap as the best broker for crypto trading in Canada because they offer 95+ markets, covering Bitcoin and altcoins, which is the largest selection in the forex industry. The broker also posted solid spreads on its Standard account, averaging 1.16 pips for EUR/USD and 0 pips on its Raw account for low-cost trading.

Because of the large range of crypto markets and low trading costs, Eightcap is among my best forex brokers, scoring 96/100 on my tests. It has extra tools like Capitalise.ai for code-free automated trading and FlashTrader for improved trade management.

Pros & Cons

- Largest cryptocurrency market range

- Provides Capitalise.ai for beginner-friendly automation

- Offers Standard and Raw pricing accounts

- Offers fewer products than other brokers

- Customer support is not 24/7

- Has a minimum deposit

Broker Details

95+ Cryptocurrencies for Canadian Traders

As CIRO restricts crypto trading in Canada for retail traders, I found Eightcap the best regulated broker for crypto trading as it has 95+ crypto markets to trade. The reason Eightcap can offer Canadian traders crypto is because CIRO does not regulate them, instead, they are regulated by the Securities Commission of the Bahamas (SCB).

The advantage of trading with Eightcap is that you are trading with a regulated broker, meaning the conditions are transparent and your money is protected unlike cryptocurrency exchanges.

Using TradingView, I checked out what crypto markets are available on Eightcap and found you can trade Bitcoin, Solana, and Ripple as well as altcoins like PEPE and SHIB. If you want to take on higher-risk markets like crypto, Eightcap is the top choice in my opinion as they offer almost 10 times more than the other Canadian brokers:

| Broker | Crypto Markets Available |

|---|---|

| Eightcap | 95+ |

| Fusion Markets | 14 |

| TMGM | 12 |

| FP Markets | 11 |

| Interactive Brokers | 4 |

Tight Spreads For Crypto and Forex on the Standard Account

While trading Bitcoin, I found that Eightcap’s spreads were decent, averaging 17 pips during the New York session, which is cheap based on my experience. If you trade forex, EUR/USD averages 1.16 pips on my tests, which is also competitive.

Automate Crypto and Forex Strategies Without Coding Knowledge

An interesting trading tool Eightcap offers is Capitalise.ai, a no-code automation tool that allows you to automate your strategies without coding experience. The tool is straightforward to use by simply instructing the AI with my trading rules, and then it processed the instructions and automated my strategy.

Not only did it take minutes to create my automated trading strategy, but Capitalise.ai can deploy your strategy to a live MT4/MT5 account in one click.

8. Interactive Brokers - Great ECN Broker

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

Interactive Brokers is a decent ECN broker with some of the lowest commissions in Canada at $2.00 per lot traded and tight spreads from 0.1 pips. The catch is that if you trade less than 1 lot, it becomes an expensive broker. So, if you frequently trade 1 lot or more, I think Interactive Brokers will be a solid fit, especially as the commission gets cheaper the more you trade.

The broker scored 58/100 in my tests because I felt they favoured experienced traders with advanced trading platforms and over 65,000 markets to trade from.

Pros & Cons

- Lowest commissions from $1 (high trading volume required)

- Professional-grade trading platforms

- Largest selection of financial products in Canada

- Trading platforms are not beginner-friendly

- High trading costs for micro and mini lot trade sizes

- No MT4 or MT5 platform

Broker Details

My preferred style of forex brokers are ECN brokers, which provide the best trading conditions and fees compared to market makers. Interactive Brokers is able to offer low spreads because it receives multiple offers through the ECN; therefore, the best price is taken, which is typically the cheapest.

Lowest Trading Commissions in Canada

During my time with Interactive Brokers, I found they averaged spreads as low as 0.1 pips, which is about standard for ECN accounts. However, they charge a tiered commission, which gets better the more volume you trade.

These commissions start at $2.00 per lot, which already places Interactive Brokers as one of Canada’s lowest commissions. However, I found this is their minimum charge regardless of whether you trade a micro or mini lot, making the broker expensive if you trade smaller lot sizes.

If you are a high-volume trader, you can get commissions as low as $1 per lot, the cheapest I’ve seen a broker offer.

Solid Trading Tools for Experienced Traders

I felt that Interactive Brokers provided a better trading environment for professional traders as the IBKR platform has advanced charting and Level II pricing for Direct Market Access. If you’re a new trader, you may get overwhelmed by the platform as it’s not very user-friendly due to the modulated approach of the platform.

Largest Selection of Financial Markets

Interactive Brokers is one of the largest CIRO-regulated forex brokers with access to 65,000 markets from 117 forex pairs to over 17,000 share CFDs, the largest in Canada.

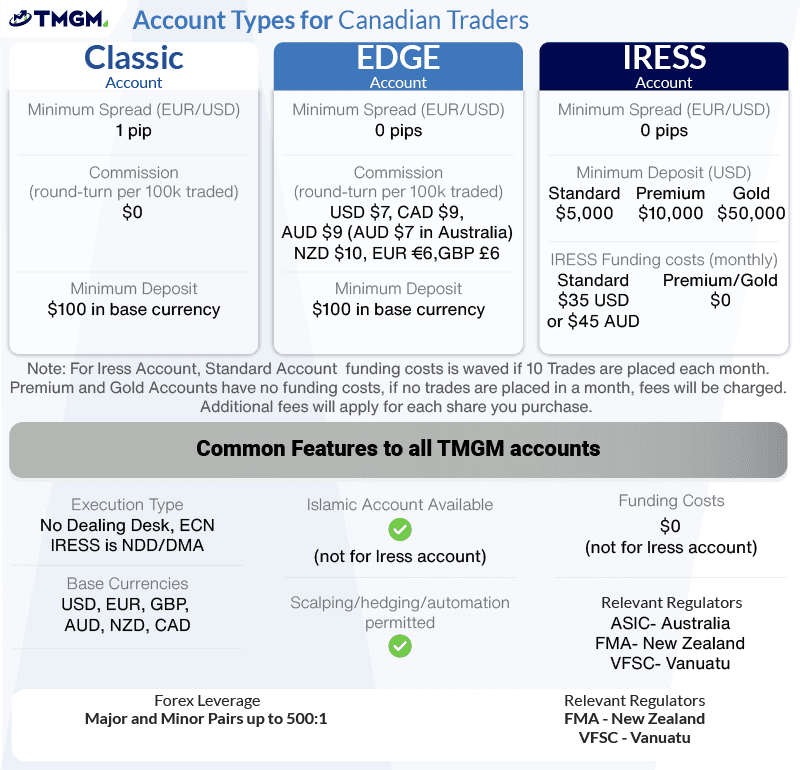

9. TMGM - Great Choice For High Leverage Trading

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 1.32

AUD/USD = 1.11

Trading Platforms

MT4, MT5, TMGM App

Minimum Deposit

$100

Why We Recommend TMGM

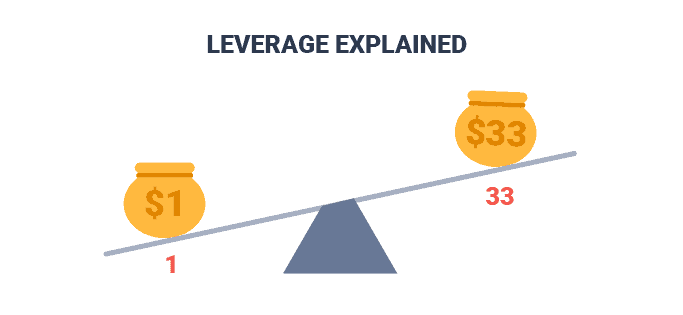

TMGM is my top choice if you want access to higher leverage, giving you access to 1:500 leverage on its forex markets – allowing you to trade with small margins.

In my tests, I gave TMGM 71/100 for providing 1,200+ CFD markets and tight spreads averaging 0.15 pips on EUR/USD with its Edge account. As an offshore broker, the broker offers CAD as a base currency, keeping your costs simple and without currency conversion fees.

Pros & Cons

- Access 1:500 leverage

- Low trading fees with the Edge account

- Large collection of markets

- $100 minimum deposit

- Charges an inactivity fee

- Lacks educational materials

Broker Details

TMGM Has 1:500 Leverage Available

If you are looking to acquire higher leverage than what CIRO offers (1:50), then TMGM is a good choice as it provides 1:500 leverage for retail traders. TMGM can do this as they are not regulated by CIRO but by the Vanuatu Financial Services Commission (VFSC), which allows TMGM to accept Canadian traders.

With access to 1:500 leverage, I think it allows experienced traders to scale their profitable strategy without making a large deposit. However, you need sound risk management as the leverage can also magnify your losses.

1,200+ Markets With Higher Leverage

You can benefit from the broker’s high leverage with a large selection of 1,200+ financial instruments from 61 forex pairs to share CFDs including NVIDIA, Tesla, and Apple.

Edge Account Has Low Trading Fees For Canadian Traders

When I opened my Edge account, I liked that it offers the option to change your base currency to CAD to simplify my trading costs and eliminate currency exchange fees. The Edge account is TMGM’s ECN account, which gives tight spreads averaging 0.15 pips on EUR/USD based on the test my analyst did.

As my base currency was CAD, my commission was only $4.50 per lot traded ($9.00 round turn), making it competitive but not as cheap as FP Markets. Alternatively, the Classic account is available with no commissions but wider spreads, which average 1 pip on EUR/USD from my analyst’s tests.

Ask an Expert

Can i trade cryptocurrency in Canada?

We are not actualy sure what policy IIROC have when it comes to Crypto CFDs, What we can tell you is that no CFD brokers offer Crypto trading with CFDs.

I noticed on some sites that there are Canadian regulated brokers vs traders that accept Canadian traders. What’s the difference?

To legally offer trading services to Canadian residents, the broker needs to be regulated by the Investment Industry Regulatory Organization of Canada (IIROC) and in some cases by the financial regulator of the province the broker is offering services to. One example is Autorite des Marches Financiers (AMF) in Quebec, all brokers offering trading services to residents of Quebec need to be regulated by both IIROC and AMF. Fortunately, most Canadian provinces and territories will accept brokers with only IIROC regulation. Using IIROC guarantees the broker complied with the requirements to operate in Canada and is part of the Canadian Investor Protection Fund (CIPF).

Brokers that accept Canadian traders are not regulated by IIROC, these brokers don’t even operate in Canada but will accept clients from Canada. These brokers will usually be using an offshore regulator such as the Seychelles Financial Services Authority (FSA), British Virgin Islands Financial Services Commission (BVI FSA), Vanuatu Financial Services Commission (VFSA), Financial Services Commission (IFSC) in Belize and The Securities Commission of The Bahamas (SCB). Brokers using these regulators do offer a level of protection to their clients but it won’t be of the standard set by IIROC. There is no CIPF (though some brokers do have their own insurance plans) and avenues to settle disputes might not exist. These brokers will usually have higher leverage available – up to 500:1 and also offer Cryptocurrencies for trading.

Note: when choosing an offshore broker, it is wise to check the broker is using an offshore broker as some brokers might not be regulated at all.

Can I trade forex with $100 CAD

Most trading accounts regulated in Canada don’t have a minimum deposit. For example, OANDA doesn’t have a minimum to open a live account.

what’s the maximum leverage you can get with etoro?

It is up to 100:1 Gold and other commodities, and major indices. x50 for non-major currency pairs.