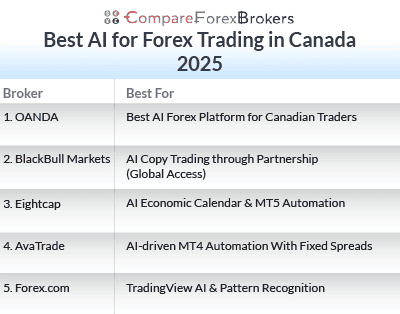

Best AI for Forex Trading in Canada

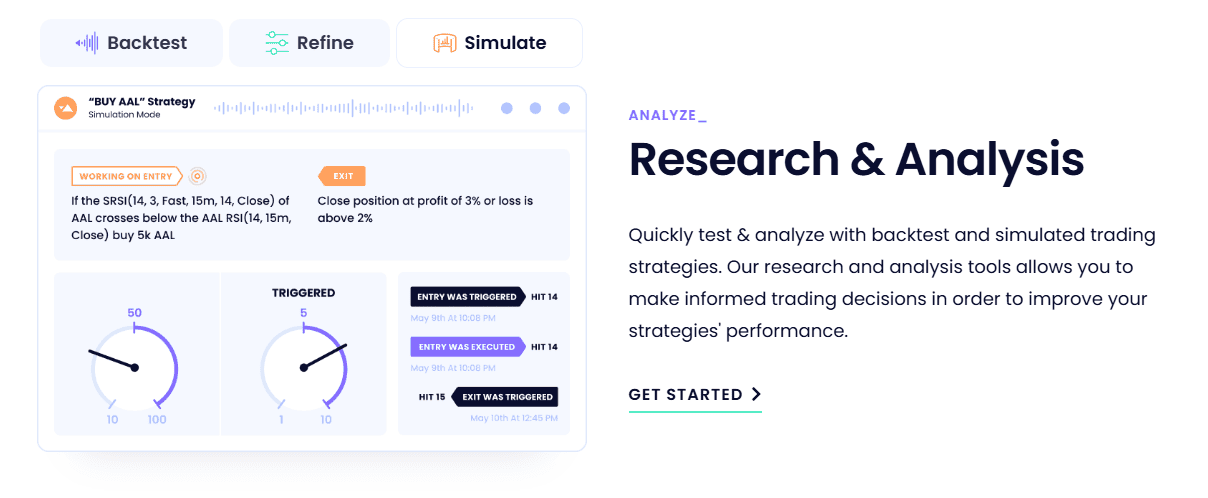

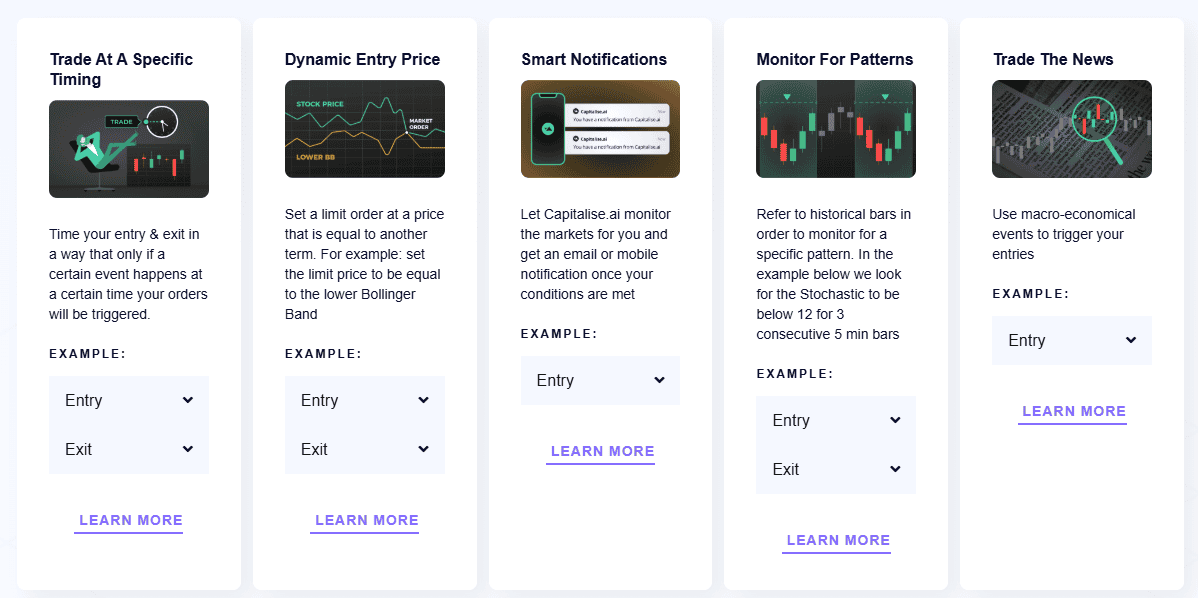

Artificial intelligence (aka AI) can help analyse real-time market data, optimize strategies and even automate trading to help you when Forex trading. I’ll show you the best AI tools you can use for Forex trading and the top brokers offering them.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.