Best CFD Trading Platforms

Australian traders looking for the best CFD broker should compare spreads, range of markets and the CFD trading platform offered by the provider. Our CFD trading platform Australia comparison in April 2025 sorted these criteria to find the best CFD broker.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Our best ASIC regulated CFD broker list for April 2025

- Eightcap - Great CFD Broker

- Pepperstone - Best Broker For MT4

- FP Markets - Best cTrader Broker

- BlackBull - Best TradingView Broker

- IC Markets - Top Broker For MT5

- Plus500 - Good Broker With Trading App

- eToro - Best Broker For Social Trading

- ThinkMarkets - Top Broker For CFD Markets & Shares

- IG Trading - Best Broker For Diverse Trading Products

- City Index - Top Broker For Trading Tools

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 | ASIC, FCA, DFSA | 0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

73 |

FCA, FSCA ASIC, FSA-S, CySEC |

0.11 | 0.23 | 0.24 | $3.50 | 1.1 | 1.3 | 1.1 |

|

|

|

161ms | $0 | 46 | 27 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

66 | ASIC, MAS, FCA | 0.07 | 0.011 | 0.8 | $2.50 | 0.70 | 1.1 | 2.2 |

|

|

|

95ms | $0 | 84 | 5+ | 30:1 | 500:1 |

|

What Are The Best CFD Brokers For Australian Traders?

We have compared the top 25 CFD brokers based on the trading platforms they use, features they offer and fees they charge. This data is designed for Australian CFD traders but could be a useful guide if your located in similar jurisdictions.

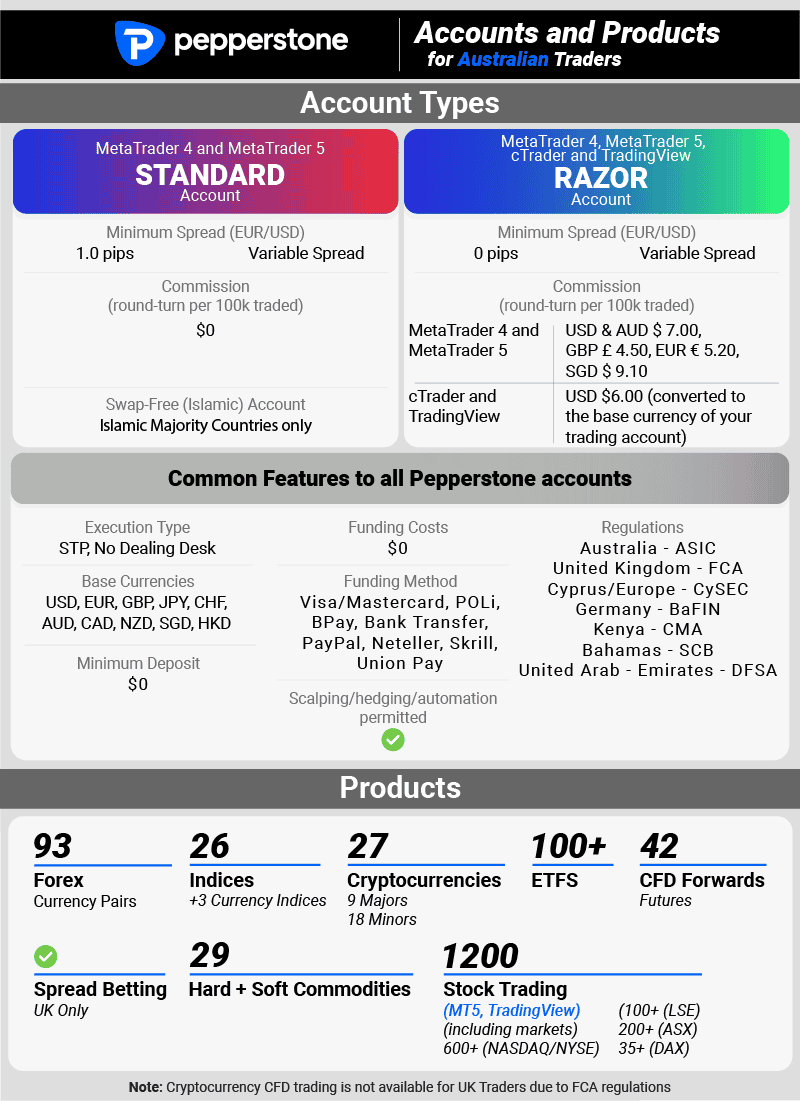

1. Pepperstone - Best Broker For MT4

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We think Pepperstone is one of the best CFD trading platforms out there. This Australian-based broker offers excellent spreads such as an average of 1.12 pips for the EUR/USD plus super-fast execution speeds of 77 ms for limit orders.

Pepperstone is also a world-class provider of MetaTrader 4 and provides extra features to help you make the most of it such as Capitalise.ai for automation along with Smart Trader Tools, Myfxbook and Duplitrade. Trading is also available with MetaTrader 5, TradingView and cTrader.

Pros & Cons

- Low spreads

- Fast STP execution

- A wide range of CFD platforms

- Great CFD product range

- Useful third-party tools

- A demo account only lasts 90 days

- Inactivity fee

- No Islamic account in Australia

- Only CFDs, no spot trading

Broker Details

We chose MetaTrader 4 as Australia’s best CFD trading platform and paired it with Pepperstone, which offers Smart Trading Tools, a free downloadable extension for MetaTrader 4.

These Smart Trader Tools enhance the platform with 28 new Expert Advisors and Indicators that essentially fill in the gaps that the default platform misses, such as automated trade management tools and more advanced indicators like pivot points.

These Smart Trader Tools enhance the platform with 28 new Expert Advisors and Indicators that essentially fill in the gaps that the default platform misses, such as automated trade management tools and more advanced indicators like pivot points.

While testing, we found the indicators easy to install and very useful. Again, using Pivot Points allowed us to see crucial support & resistance levels to find where the market may react, aiding our technical analysis while day trading. Drawing Pivot Points is normally done manually, so it helped speed up our daily analysis.

The broker’s low trading costs and Razor trading account, which offers spreads from 0.0 pips, also helped our decision. Our analyst tested Pepperstone (with 14 others) to see how often the broker provided zero-pip spreads across the major forex pairs during normal market hours. Ross found that the broker offered 0.0 pips 100% of the time across all major pairs, with only City Index able to match Pepperstone.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY | Grand Total |

|---|---|---|---|---|---|---|---|

| Pepperstone | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| TMGM | 97.83% |

| FP Markets | 97.83% |

| Eightcap | 97.83% |

| Admirals | 95.60% |

| Blueberry Markets | 94.20% |

| GO Markets | 87.68% |

| BlackBull Markets | 86.96% |

| GO Markets | 87.68% |

| Axi | 82.61% |

| CMC Markets | 81.88% |

These zero spreads impressed us as they meant your variable trading costs became zero, meaning you’d only pay the fixed commission of $3.50 per lot traded. Standardising your trading costs makes it easier to trade throughout the day without worrying about wider spreads that cost you more in volatile times.

We found that you can trade most of Pepperstone’s markets using MetaTrader 4. These highly liquid markets offer 92 forex, 25 indices, 19 cryptocurrencies and 25 commodities, taking advantage of Pepperstone’s low trading costs.

If you want to trade stocks, we cannot use this on MetaTrader 4 because the platform doesn’t have the infrastructure to stream the pricing of stocks. The good news is Pepperstone also offers MetaTrader 5, so if trading stocks is important to you, you can reap the benefits of MetaTrader 4 while accessing the equity markets.

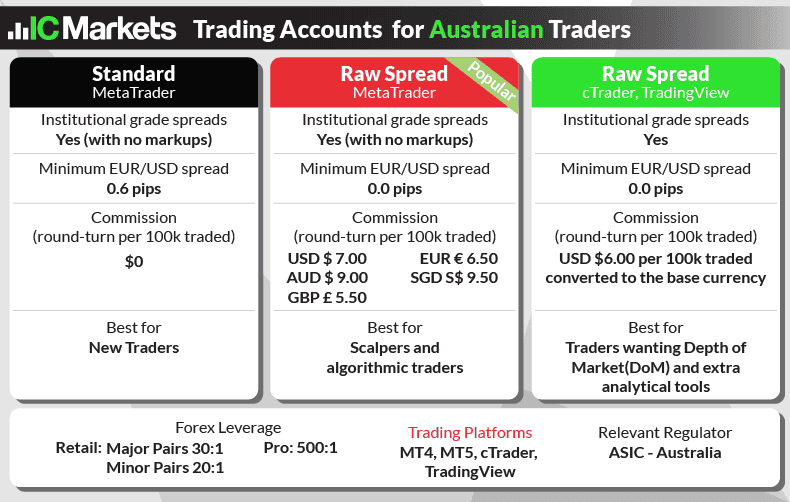

2. IC Markets - Top Broker For MT5

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

IC Markets is a leading CFD broker.

With IC Markets you’ll find a range of CFD products, as well as competitive spreads (0.02 pips for EUR/USD), low trading costs, and reliable trade execution (77 ms for limit orders and 100 ms for market orders).

We like how the broker has a large variety of products you can trade using MetaTrader5 such as 61+ forex pairs, 17 commodities, 1600+ stocks and 25 indices.

Pros & Cons

- Competitive Pricing

- Useful third-party tools

- Social and algorithmic trading

- Tight spreads

- Fast execution speeds

- Educational materials could be better

- High minimum deposit

- Withdrawal fees

- Slow live chat support

BrokerDetails

MetaTrader 5 is an all-in-one solution for traders, allowing you to copy trade, algo trade, and manually trade. Because of its impressive versatility, we like to pair it with IC Markets, which offers low trading costs, a solid choice of markets, and a VPS service if you wish to automate your trades 24/5.

We found that the MT5 platform also improved technical indicators, expanding its collection to 38+ with indicators like Envelopes and Stochastics. It also extends its selection of trading timeframes to 21, allowing you to define a timeframe that suits your trading style.

Unlike MetaTrader 4, MT5 allows you to trade stocks thanks to its improved infrastructure to stream share pricing and its overall software speed, which is improved by running on a 64-bit architecture (a slight boost to trading automation).

Along with its performance boost, we think MT5 is a better platform if you like to scalp trades. You can use the Depth of Markets (DoM) Tool to pinpoint order flow directly from the liquidity provider to find market strength and trade with it.

As IC Markets is an ECN-style broker, you can utilise the DoM tool by streaming the ECN pricing directly to your platform, letting you place your pending orders quickly.

Combining the MT5 with IC Markets also means you get access to some of the industry’s lowest trading costs based on our findings. While testing the trading platform, we found that the spreads for EUR/USD average 0.19 pips on our RAW trading accounts, placing it in joint first with Pepperstone in our rankings.

| EURUSD | Average Spread |

|---|---|

| IC Markets | 0.19 |

| Pepperstone | 0.19 |

| EightCap | 0.2 |

| CityIndex | 0.22 |

| ThinkMarkets | 0.22 |

| CMC Markets | 0.44 |

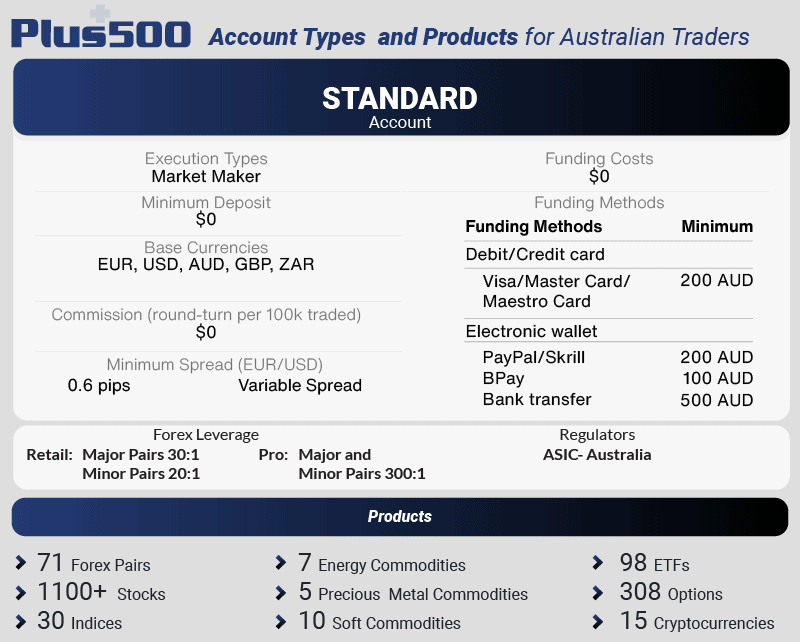

3. Plus500 - Good Broker With Trading App

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why We Recommend Plus500

Plus500 stands out to us due to its risk management features like guaranteed stop orders and negative balance protection. You will have to use the broker’s in-house developed webtrader and app as they don’t offer MetaTrader 4 and MetaTrader 5 but we think this is ok as they are very good platforms in their own right.

When we tested the Plus500 mobile app, we liked how it integrates with the Plus500 WebTrader so you can seamlessly switch between the two. Our tests showed that the mobile app is user-friendly and has 109 indicators and 20 drawing tools to help with technical analysis.

However, we thought spreads with Plus500 to be below-average spreads (AUD/USD = 1.4 pips).

Pros & Cons

- Risk management features

- Large selection of CFD products

- Competitive spreads

- Fast execution speeds

- High minimum deposit

- Inactivity fee

- Slow customer service

- High CFD trading fees

Broker Details

If you like to access the markets on a mobile device or tablet, you’d appreciate it if some apps just provide basic charting with minimal indicators. That’s why we picked out Plus500’s Trading App, which gives you a fully featured platform in the palm of your hands.

The trading app is available through the Apple App Store and Google Play, making it available for all devices. It lets you use the same account details as the Plus500 web platform.

While testing the app, we found the charting set-up similar to the web platform’s, so there is a little learning curve in navigating the trading app. Plus, it includes the same features, such as +insights.

+insights tool is impressive, collecting data on all the open and pending trades from Plus500 traders to provide you with in-house market sentiment. We liked that it categorised it, helping us find a market sentiment that interested us and use it to validate our ideas. These categories were:

- Most Profit-Making Positions

- Most Loss-Making Positions

- Highest Buy Ratio

- Highest Sell Ratio

- Most Traded

- Most Viewed

- Most Followed

A nice quality-of-life feature from the Plus500 app was the added economic calendar showing related economic announcements that would impact the market you are trading. This calendar allows you to get a quick snapshot of upcoming data releases that may impact the price, so you can use it to your advantage or hold off a trade to see how the markets react before placing the trade.

The trading app includes a chart package with 110+ indicators, giving you enough analysis choices. What also stood out for us was that you can use Guaranteed Stop-Loss Orders to protect your losses from market slippage, helping you avoid larger losses.

In our testing, we used the Plus500 Standard account (no commission) as this is the only account offered. To our surprise, the spreads were more expensive than the 1.24 pips industry average based on our findings, with EUR/USD averaging 1.70 pips.

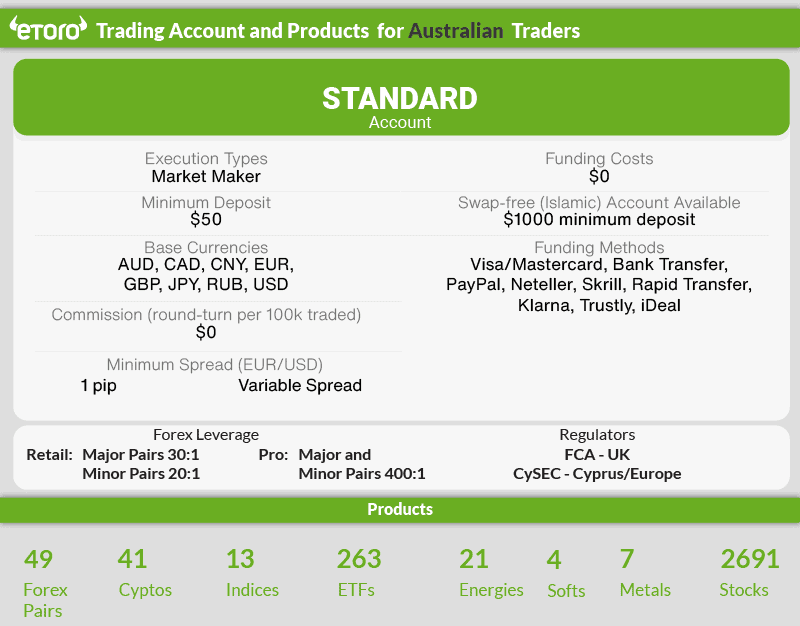

4. eToro - Best Broker For Social Trading

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

eToro is a specialist in social trading and we appreciated this point of difference from other brokers on our list. If you’re new to CFD trading, eToro can be a good place to start as the platform allows you to learn from, follow and copy from the best traders in the eToro community or 30 million+ registered users.

We tested Smart Portfolios which can be an index of the top-performing traders in the eToro community or theme such as Utility, AI revolution stocks or Gold stocks.

Pros & Cons

- Social media integration

- Educational resources

- Tight spreads

- Beginner-friendly

- Multiple assets

- Withdrawal fees

- Inactivity fee

- Cryptocurrency fees

- Not very suitable for experienced traders

Broker Details

We don’t think you’ll find a better social and copy trading platform than eToro’s CopyTrader platform. The broker has managed to simplify trading leveraged products like forex by providing services that mirror more experienced traders’ orders so that anyone interested in benefiting from these higher-risk markets can do so.

In our testing, we found the platform easy to use – just like an online store where we could use an advanced search tool to narrow down our traders based on our requirements. The search tool had 14 metrics we could narrow down eToro’s 2,000,000+ CopyTrader list, including metrics like:

- Assets under management

- No. of people copying their trades

- Specific markets they specialise in

- Risk category

We like that you can create your portfolio of copy traders and distribute your funds equally among different traders, exposing you to multiple markets through different experienced traders.

You can use this feature to find the best traders of the assets you wish to focus on, such as stocks, indices, and gold markets. Mirroring the best copy traders in these markets may give you a better chance to outperform the markets without risking all of your funds in one trader.

It’s easy to follow and manage your allocated funds as you have a bird’s-eye view of your “portfolio of traders” to manage. We liked that you can add a maximum drawdown threshold for each trader – allowing your funds to get pulled out from trading should your copy trader underperform.

eToro only has a standard account, meaning all transactions are commission-free (including shares), and you just pay the spread. We think this suits eToro as the goal is to simplify trading, and without giving you a choice of accounts, it maintains low trading costs, averaging one pip spread on EUR/USD.

While other social trading platforms may require a monthly subscription or charge wider spreads for using their services, eToro can maintain low costs as they are both the broker and platform.

Broker Screenshots

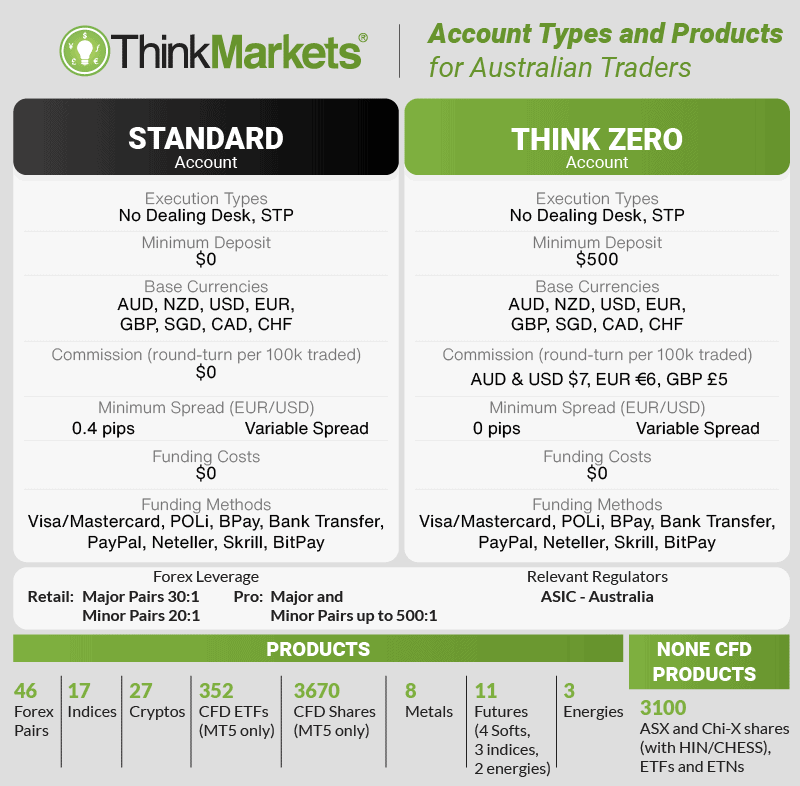

5. ThinkMarkets - Top Broker For CFD Markets & Shares

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.2

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

What we like about ThinkMarkets is that they offer both trading with CFDs and investments on the ASX with Shares and ETFs. This means you can trade CFDs and equities all from one trading account instead of using two different brokers.

ThinkMarkets award-winning ThinkTrader webtrader and app is designed for trading both CFDs and stocks. We like their range of analytical tools which incorporate advanced charts from TradingView for trading the brokers 8000+ CFD and shares products. Other platforms for trade include MT4 and MT5.

Our overall take on ThinkMarkets is that it’s a reputable and reliable broker for CFD trading.

Pros & Cons

- Fast execution speeds

- Tight spreads

- High leverage

- Over 3000 share CFDs to trade

- Superior mobile trading

- Few educational materials

- Can’t access all products with a Standard account

- High minimum withdrawal

- Inactivity fee

Broker Details

ThinkMarkets is a broker that blends access to leveraged CFD products and direct share trading with one trading platform. You can trade over 4,000+ CFD markets and 3,100 ASX and Chi-X shares, allowing you to take advantage of CFDs for shorting the markets and hedging your share portfolio with the same broker.

In our testing, however, we had to have a cash equities account and a separate ThinkZero account if we wanted to trade in both markets. Initially, this may seem like extra effort, but the reason is that with the cash equities account, you will own the shares you purchase with HIN ownership, while with the CFDs, you do not own any shares but the contract instead.

The cost of buying cash equities is fairly low at just $8 per trade if your trade value is less than $200,000 and 0.05% per trade if the trade value is higher. We also liked that there are no other admin fees when using ThinkMarkets, with no minimum monthly trades, which other cash equity brokers require you to do to maintain the account fee-free.

The account setup and options for trading CFDs are much more diverse. The Standard account allows you to trade commission-free, while the ThinkZero account offers tighter spreads with fixed commission. We tested both and found they had decent spreads on EUR/USD, with the Standard account averaging 1.10 pips and 0.10 pips on the ThinkMarkets account, both competing with the industry.

To trade in both markets, you must use ThinkTrader, their proprietary web platform, or MetaTrader 5. They offer MT4, but it doesn’t support share trading. ThinkTrader is our top pick of the available platforms, as it provides a seamless experience when you trade from a web platform to a mobile app, allowing your charting to sync across any device you trade from. As a bonus, ThinkTrader leverages TradingView’s charting to access over 110+ technical indicators, allowing you to perform technical analysis without downloading third-party tools.

Broker Screenshots

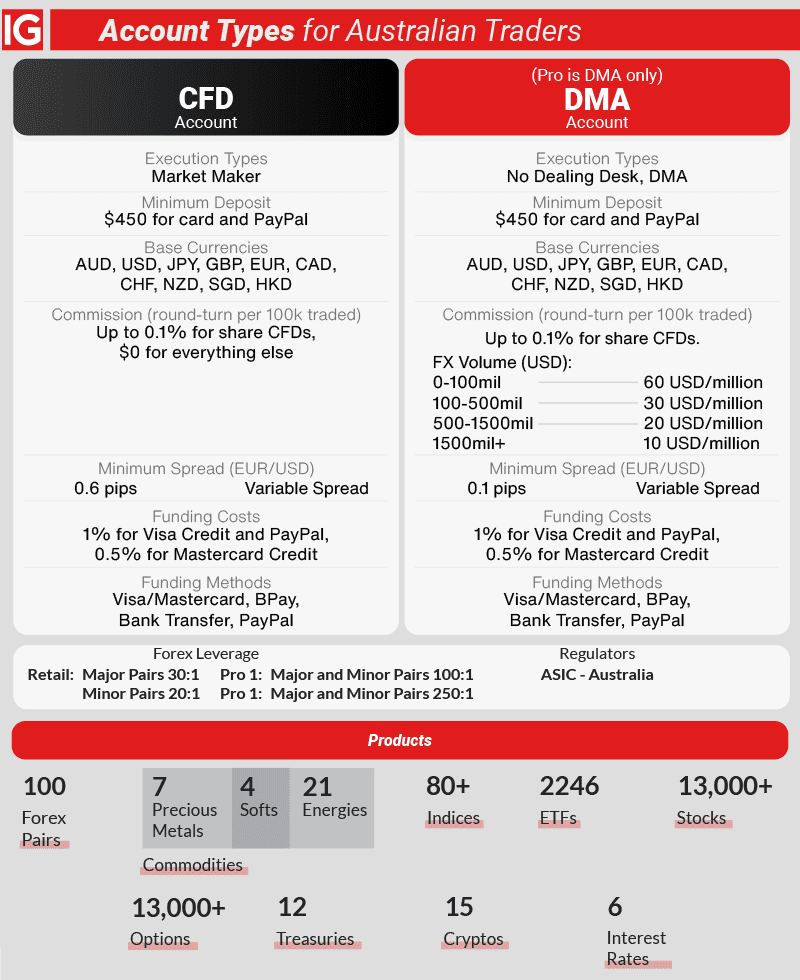

6. IG Trading - Best Broker For Diverse Trading Products

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Trading

IG is one of the oldest and largest brokers in the world. The broker boasts over 17,000 markets to trade on, which we think is by far the largest range of CFD products we’ve seen any broker offer.

Products include over 80+ Forex pairs, 13,000+ stocks, 80+ global indices, 2200+ ETFs, 15+ crypto and even options, futures and sectors.

You can trade Forex with IG trading platform, MT4 and ProRealTime without paying commissions. Spreads for the EUR/USD Forex pair average 1.13 pips and AUD/USD 1.10 pips per lot.

Pros & Cons

- Huge CFD product range

- Top proprietary trading platform

- Tight spreads

- Fast execution speeds

- High stock CFD fees

- Slow customer support

- No fractional share ownership

- High platform fee

Broker Details

IG Trading is one of the largest and oldest brokers on our list; established in 1974, it has been a titan of the forex broker industry. Most notably, we found that the broker offers the largest range of trading products, over 17,000 markets, to analyse and find trade opportunities.

These trading products include 80+ currency pairs, 12,000+ share CFDs, 130 indices, 41 commodities, 7,000+ options, and 15 crypto markets. What stood out for us was the options market, which can be an excellent tool for taking advantage of market volatility and potentially outperforming traditional CFDs.

With such a wide choice of trading products, it makes sense that IG Trading offers multiple platforms to trade the markets your way. The broker offers MetaTrader 4 and ProRealTime, both third-party platforms that offer excellent technical analysis and automated trading.

In-house platforms such as L2 Dealer are excellent for advanced traders who can utilise the Level II pricing feeds and Direct Market Access to find trading opportunities based on order flow. However, the best all-rounder we tested is the IG Trading Platform, which you can access through your web browser and use on any device without downloading an app.

You will get access to all the products, excellent charting tools with 50+ indicators, and the Signal Centre. We found that the Signal Centre combined two providers, Autochartist and PIA First. Both utilise technical analysis to find trading opportunities, but PIA First focuses more on breakout trades, and Autochartist uses chart patterns like wedges to identify trades.

Broker Screenshots

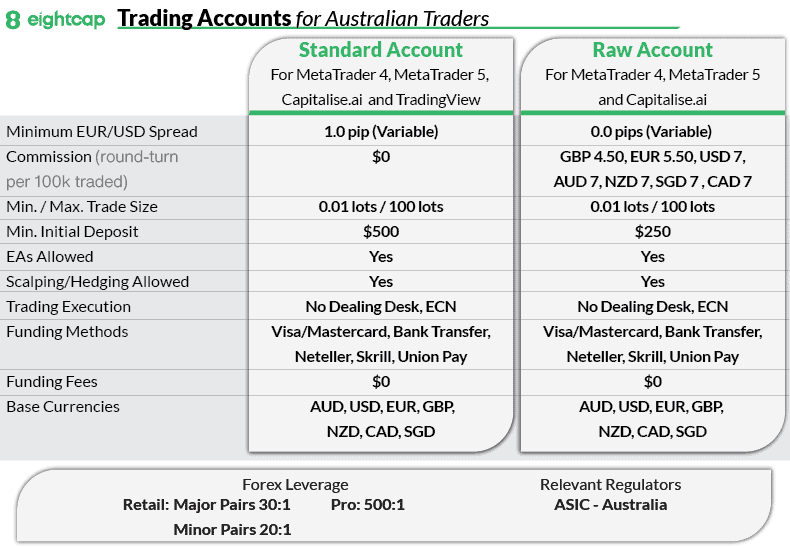

7. Eightcap - Great Crypto Broker

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.73

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

Melbourne-based broker Eightcap has 95 cryptocurrencies waiting for you to trade with the MetaTrader 5 and TradingView platforms (79 with MT4) — it even won an award from ForexBrokers.com because of this.

Spreads with Eightcap average an impressive 0.06 pips for the EUR/USD pair which makes them one of the best choices with this popular major.

We think it’s safe to say Eightcap is the best CFD broker for crypto. The huge product range, tight spreads, and fast execution speeds will enhance your trading experience significantly.

Pros & Cons

- Algorithmic trading

- Good range of trading platforms

- Low trading fees

- Tight spreads

- Fast execution speeds

- Limited educational resources

- Limited leverage in some areas

- Inactivity fee

- Slow customer service

Broker Details

With the popularity of cryptocurrencies, it was surprising while testing the best CFD trading platforms in Australia that not many brokers offered a variety of crypto markets. Eightcap had the most with 95 markets available, almost double its nearest competitor, eToro, making it an obvious pick for best crypto broker.

| Broker | No. of Crypto Markets |

|---|---|

| Eightcap | 95 |

| eToro | 41 |

| City Index | 25 |

| ThinkMarkets | 21 |

| Pepperstone | 19 |

| IC Markets | 18 |

| IG Trading | 15 |

| Plus500 | 15 |

We think trading crypto through a forex broker is a good idea. They are regulated firms protected by the Australian Securities and Investments Commission (ASIC), so your funds are secure should anything happen.

Even though the choice of crypto markets is impressive, the range of forex and indices markets is lacking compared to other brokers. Eightcap offers the most liquid and popular markets for forex, indices, commodities, and share CFDs, which is enough for most if you stick to major markets.

However, we think it lets down those seeking higher volatility markets like exotic pairs and emerging market indices, which is unusual considering they offer crypto markets.

It’s not just the crypto markets that stood out for us. The broker offers Capitalise.AI, a no-code tool that can automate your crypto trading strategies by typing in your instructions. This tool is much faster and less costly than learning (or purchasing) to code an Expert Advisor on MetaTrader 4.

We tried the platform to develop our Bitcoin strategy. After logging into the platform, we typed in the strategy’s entry and exit conditions. The platform helped us with its prompts and suggestions for completing the conditions.

This process took less than two minutes, and we could test our first strategy without writing a line of code. We liked that you can instantly backtest the strategy and reconfigure the conditions based on the results.

If automating your crypto strategies isn’t your thing, Eightcap offers TradingView, one of our favourite trading platforms. You can use Market Screeners to find crypto markets that match your trading criteria (helping speed up idea generation) and then use TradingView’s excellent charting tools to analyse the cryptocurrency to time your entry.

Broker Screenshots

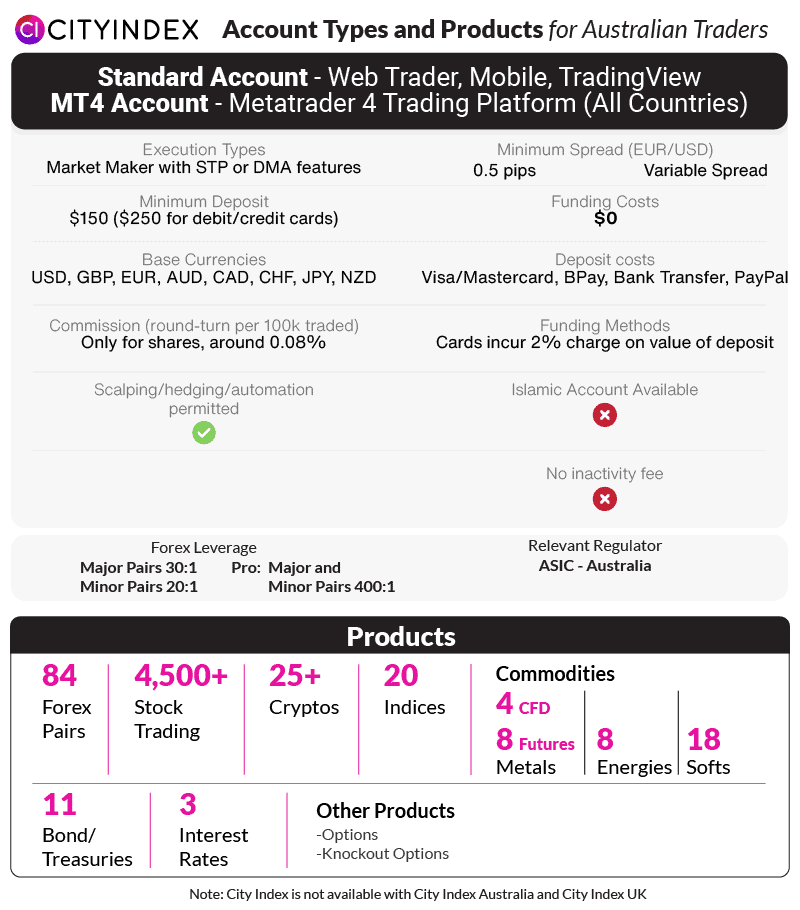

8. City Index - Top Broker For Trading Tools

Forex Panel Score

Average Spread

EUR/USD = 0.07

GBP/USD = 0.011

AUD/USD = 0.8

Trading Platforms

MT4, TradingView, City Index WebTrader

Minimum Deposit

$150

Why We Recommend City Index

City Index is part of the NYSE-listed StoneX group (SNEX) which also owns Forex.com. This broker operates as a market maker but you wouldnt know it because of its low spread average spreads.

Spreads for the City Index Standard account average 0.7 pips for EUR/USD and 0.07 pips with the RAW Spread Account. Commissions with RAW spread account is $3.50.

If using City Index WebTrader, you will get access to advanced tools such as guaranteed stop loss, Performance Analytics, Smart Signals, Advanced charts and Trading Central. All useful tools to help you make better trading decisions.

In our opinion, City Index is a highly versatile platform because it has a large range of share CFDs and provides multiple trading platforms.

Pros & Cons

- Educational resources

- Tight spreads

- Fast execution speeds

- No withdrawal fees

- High stock CFD fees

- High minimum deposit

- No MetaTrader5

- Inactivity fee

Broker Details

City Index offers a range of complimentary trading tools to help you find more trading opportunities or improve your trading performance. These tools are very useful for any aspiring trader.

You can access these tools with City Index Web Trader, the broker’s proprietary web platform. This platform also uses TradingView’s charts, giving you access to 80+ indicators and 20+ drawing tools to help you analyse the markets.

To help you find more trading ideas throughout the day, the SMART Signals powered by Trading Central will automatically scan the markets for chart patterns. Each signal generated gives you a breakdown of the trade, what price to enter, and when to exit, giving you the information to vet the trade yourself or copy the trade directly.

While trading, we tested the Performance Analytics tool by Chasing Returns to see our stats on our recent trades. This tool analyses your trades in real-time and gives you feedback highlighting your strengths and weaknesses in trading performance.

We liked that it broke down our best trading assets. This highlighted which markets we responded well to, allowing us to focus more on the currency pairs we have success with while ditching the ones we aren’t finding success with.

The trading tools are only available on the City Index web trading platform, as we could not access them through the brokers’ other platforms, such as MetaTrader 4 and TradingView.

We tested the Standard account average spreads of City Index and compared them across the other top Australian forex brokers to gauge how cost-effective they are. Our testing found that the broker’s spreads were lower than most other brokers, averaging 0.70 pips on EUR/USD, with only IC Markets having lower at 0.62 pips.

| BROKER | EUR/USD | USD/JPY | GBP/USD |

|---|---|---|---|

| IC Markets | 0.62 | 0.74 | 0.83 |

| City Index | 0.7 | 0.6 | 1.1 |

| Eightcap | 1 | 1.1 | 1 |

| eToro | 1 | 1 | 2 |

| Pepperstone | 1.12 | 1.47 | 1.69 |

| IG | 1.13 | 1.12 | 1.66 |

| Plus500 | 1.7 | 1.9 | 2.3 |

| Industry Average | 1.24 | 1.44 | 1.57 |

Alternatively, City Index offers a Raw FX account with tighter spreads. We are impressed with the commission, which is just $2.50 per lot traded, one of the lowest available for a Raw account.

Your capital is at risk ‘70% of retail CFD accounts lose money with City Index’

Broker Screenshots

Ask an Expert

This article forgot to include Capital.com, which has a much larger range of CFD instruments than most listed here. Also Pepperstone and IC Markets (correct me if I’m wrong) use the cTrader backend? It would be good to include just how many CFD codes can actually be traded per platform in stocks, currencies, commodities, crypto, etc.

Hi J.S. There are many quality (and some not so good) brokers one can choose from. We recommend the brokers we feel worthy of making this list. In time, its possible we will add Capital.com. Pepperstone and IC Markets use MetaTrader backends for MT4 and MT5. Pepperstone also uses MetaTrader backend for Capitalise.ai. Both brokers use cTrader backend for cTrader while Pepperstone also use cTrader backend for TrdingView

Is forex easy money?

No, 60% to 80% of retail traders lose money. Only trade what you can afford to lose.

Is forex trading legal in the UK?

Yes it is. You will need to declare any capital gains taxes as income but you can also claim any losses too.

Is it a good idea to become a full time trader or is it a side hustle job?

That depends on your skills and ability to make money when forex trading and how much income you have saved up and can afford to lose. Everyone is different.

What is more beginner friendly MT4 or 5?

Depends what you call beginner friendly…are you looking for platofrm with risk management tools? then EasyMarkets is a good option, IG, OANDA, City Index custom platform include a guaranteed stop loos. Or maybe you need a broker with good education tools?

What is a pip exactly? And is it the same as spread ?

A pip is the smallest amount a currency can move. When you see the AUD/USD quoted as 0.6410, a pip is a movement of 0.0001 up or down.

The spread is simply the difference between the bid (what you can sell a currency at) and the ask (what you can buy a currency at) that you see on your trading platform.

Is forex better than stocks?

THat really depends on your personal preference, knowledge and skills as a trader