What Is A Drawdown In Forex

Drawdowns in forex are an important metric to help you understand the health of your trading portfolio. It allows you to make trading decisions to prevent your losses from growing. This guide looks at what loss is and how it can be useful for traders.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Drawdowns In Forex Trading And How To Handle It?

One of the key rules to successful Forex trading is controlling your drawdown. Drawdown is managing the reduction in your trading capital incurred before losses cut into profits. Successful Forex trading is more than buying and selling currencies for profit. It also involves protecting your capital by minimising losses or drawdowns.

Managing your drawdown is one factor that separates experienced or successful traders from inexperienced ones. Experienced traders generally place a high value on managing their risks when trading so they diligently monitor the health of their trading positions and portfolio. Drawdowns help you understand the survivability of your trading strategies over the long run. In turn, this allows you to take proactive steps before your drawdown size becomes untenable.

To transition from a losing trader to a successful forex trader you need to understand how to control your drawdown. This trading guide will explore what drawdown is in forex along with other key trading concepts like:

This trading guide will explore what drawdown is in forex along with other key trading concepts like:

- How forex drawdown works

- How to calculate the maximum drawdown

- The single most important reason why you need to keep drawdown under control

- Trading strategy to handle drawdown so that you can win more money than you can lose

What Is Drawdown In Forex?

In forex trading, drawdown (DD) refers to how much money you have lost in your account balance or from a particular trade. It refers to the difference between the peak or high point in your trading account balance and the next trough or low point in the balance of your accounts.

A drawdown can be applied to a single position. In this case, your drawdown will be when the price buy-sell price falls below your entry price. To do this you combine the winning and losing positions to determine at what point your portfolio balance hit its lowest point.

How Does A Forex Drawdown Work?

To understand how drawdown works, let’s consider the following example:

- Trader Joe funds his trading account with USD 10,000

- After five consecutive losing trades, the account balance falls to USD 9,000

- In this particular example, the peak-to-trough decline from USD 10,000 to USD 9,000, represents a 10% drawdown

Note* In this case, the maximum drawdown is also 10% since it’s equal to the maximum peak-to-trough decline.

Most often, the drawdown is expressed as a percentage, but it can also be recorded in dollar terms.

If we consider the same trading example, the drawdown expressed in dollar terms was USD 1,000 because that’s how much the account equity dropped following the losing streak.

How To Measure Drawdown?

Drawdown can be expressed in absolute terms, relative terms, and maximum terms. A top-down approach to analyzing the past performance of a trading strategy involves evaluating the absolute drawdown, relative drawdown, and maximum drawdown together.

The different types of drawdown can help us measure the potential loss of capital incurred if we used that particular trading system.

What Is Relative Drawdown?

A relative drawdown is your unrealized loss. Drawdowns are temporary as long as you hold onto your position and only become realised once your Stop Loss Orders is triggered or you close your position.

For example, the sums of all open positions that are right now losing money constitute the floating drawdown. A floating drawdown is the farthest distance against your position that the price has moved while the forex trade was active.

However, as soon as the losing trades are closed, that drawdown becomes a fixed drawdown. The absolute DD and max DD are fixed drawdowns.

What Is Maximum Drawdown?

The maximum drawdown is the maximum peak-to-trough decline in your account balance.

Where:

- Maximum peak = an all-time account equity high

- Maximum trough = an all-time account equity low

In other words, the maximum drawdown measures the distance between the highest account equity value and the lowest account equity value over the entire trading account lifespan.

What Is Absolute Drawdown?

The absolute drawdown shows how big the loss is relative to the initial deposit.

To understand how absolute drawdown works, let’s consider the following example:

- Trader Joe funds his trading account with USD 10,000

- The account equity grows to USD 15,000 without incurring any drawdown

- After a few bad trades, the account balance falls back to breakeven at the initial amount of USD 10,000

- In this particular example, the absolute drawdown is 0 because the difference between the initial deposit (USD 10,000) and the account equity trough (USD 10,000) is zero

Only when the account value drops below the initial deposit we can talk about the absolute drawdown. We take the difference between the initial deposit and the account equity trough below that level. So, if the account balance drops below the initial deposit of USD 10,000 and it’s now valued at USD 7,000, we’re talking about an absolute drawdown of USD 3,000 (the difference between the initial deposit and the next equity trough).

How To Calculate Forex Drawdown

In forex trading, the drawdown is calculated as a percentage of your account balance.

The maximum drawdown formula is the ratio of the all-time equity high and the difference between the all-time equity high and the all-time equity low.

Let’s walk through a practical example.

With some luck and a good trading plan, trader Joe has managed to bring his account balance to a new peak of USD 20,000. However, before he turned things around, his account balance hit a low point of USD 9,000.

Taking into account the values from the example above the max drawdown incurred by trader Joe is 55%.

The Importance Of Measuring Drawdown

It’s important to measure drawdown because it’s a metric that helps forex traders assess the account balance volatility. In other words, it will tell you how much and how far your account equity will drop after a losing streak.

Drawdown is also a good metric to evaluate the performance of a trading system. For example, a trading strategy with a large drawdown indicates a high-risk and high-volatile trading system. By measuring forex drawdown, retail traders can better evaluate if that trading system fits their risk tolerance and investment goals.

As a general rule, the bigger the forex drawdown is, the bigger the up-and-down swings in your account balance are going to be.

Recover From Forex Drawdown

When measuring drawdown, another key characteristic is the time it takes to recover from the drop in your account balance. For example, if your account balance is experiencing a large drawdown of 50% due to a series of consecutive bad trades, to get back to breakeven you’ll need to make 100%.

The main thing is that recovering from a large drawdown requires more effort.

Let’s continue with our initial example and see how much, trader Joe would need to gain in order to just recover the 10% max drawdown. Beginner traders mistakenly believe that if you lost 10% you need to make 10% to be at breakeven (BE). Unfortunately, that’s not how things work in forex trading.

The table below highlights the relationship between drawdowns and how much you need to make back to recover from different levels of drawdowns.

| Drawdown (Loss of Capital) | Gain Needed | Drawdown (Loss of Capital) | Gain Needed |

|---|---|---|---|

| 5% | 5.3% | 50% | 100.0% |

| 10% | 11.1% | 60% | 150.0% |

| 15% | 17.6% | 70% | 233.33% |

| 20% | 25.0% | 80% | 400.0% |

| 30% | 42.9% | 90% | 900.0% |

| 40% | 66.7% | 100% | Broke |

The lesson to learn here is that you need to control the drawdown, because the larger the drawdown is, the harder it will be to recover from it. The amount of money that you need to make to get back to breakeven will always be larger than your DD.

Why You Need To Keep Drawdown Under Control

Drawdowns are an inevitable part of trading as they are more common than you might think. In this regard, it’s normal for our trading accounts to also incur a drawdown. If we can’t run away from a drawdown, then we need to learn how to keep the drawdown under control. This is where proper money management strategies allow forex traders to recover from large drawdowns and continue moving forward.

Coping with drawdown can be mentally challenging. So, before you look at ways to keep a drawdown in forex under control, the first thing you must do is to understand why drawdowns happen.

Why Drawdown Happens

There are several reasons behind the forex drawdown but, the most common causes can be summarized as follow:

- A single bad trade can lead to a large drawdown

- Using an inappropriate level of risk relative to the funds in your trading account

- Times of volatile markets can also lead to large equity drawdowns

- Unpredictable events like a black swan event or flash crashes can lead to large drawdowns

- Not using risk management strategies to control drawdown

- Overtrading, which occurs when you take too many trades and outside of your trading plan

- If you have drawdowns too often, maybe your trading system is not that good

Drawdown Trading Strategy To Control Drawdowns

No matter how long your trading career you can still experience drawdowns. They say you can’t teach an old dog new tricks but in the forex space the learning curve never actually stops. So, no matter if you’re just a novice trader or a more experienced trader, you can still learn new trading tricks on how to bounce back from a losing streak and better control the drawdown.

Obviously, the most important thing is to avoid large drawdowns. Large drawdowns are one of the worst things that can happen to you as they can be difficult to recover from and no one likes losing money.

Without further ado, see below the trader’s guide to dealing with drawdowns (7 drawdown trading strategies):

1. Manage Drawdown by using the 2% Rule

The 2% rule refers to keeping your risk low and only using 2% of your capital on any given forex trade.

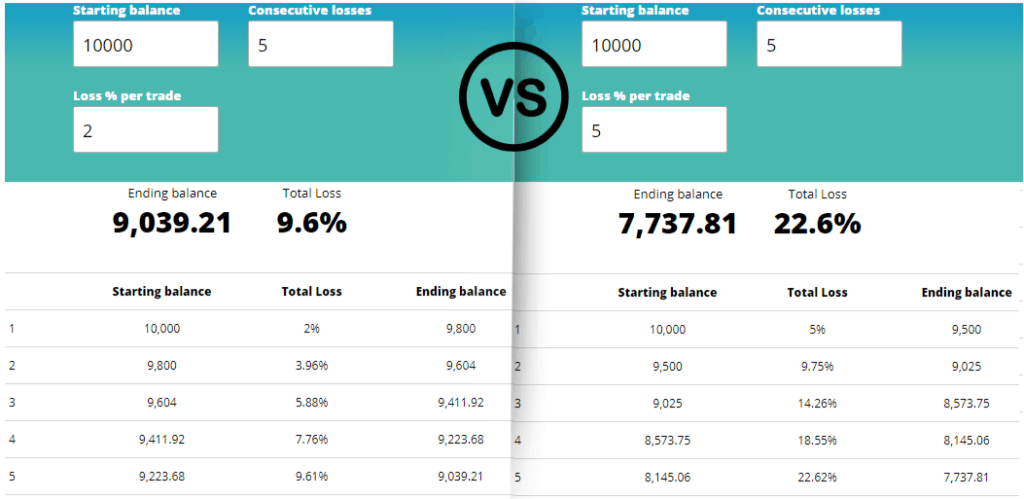

For example, if two traders start with $10,000 in their trading account and both of them suffer a losing streak of 5 bad trades, but one of them only risks 2% per trade and the second trader takes on a higher level of risk (5%). In this case, the first trader suffered a drawdown of 9.6% while the second trader suffered more than double the drawdown (22.6%).

Obviously, the first trader would need a smaller percentage gain (11%) to get back his loss as compared to the second trader who would need approximately 30% gains to break even.

2. Take Emotional Control of DD Ups and Downs

The second rule for a long-term trading career is to learn to deal with the psychological turmoil that comes with drawdown. The first step is to take responsibility for your own trading decisions. Therefore, you need to hold yourself accountable for the forex trades you take and determine a course of action to repair your mistakes

Large drawdowns don’t happen overnight but, they all start with a smaller drop in your account equity curve. Suffering a drawdown can be an emotional rollercoaster for many traders when real money is on the line. This is an added level of stress that usually leads to more trading mistakes and subsequently bigger drawdowns.

Knowing how to control your emotions while you suffer a drawdown can limit the losses you take moving forward. A very powerful technique to be emotionally detached from your losses is to step back for 1-2 weeks; clear your mind and come back later with a fresh mind. While this might seem redundant, taking trading breaks allows us to regain control over our emotions, trading strategy, and trading plan.

According to the Myopic loss aversion theory, the more frequently you see information about the drawdown, the more likely you’ll want to rein in the risk. So, if you don’t check your PnL too frequently, you’re more likely to be emotionally detached from your losses.

3. Take One Trade at a Time

The best way to reduce drawdown in forex is to limit your trading activity to only one trade at a time. If you only take one trade at a time and keep the level of risk at 2% per trade, in the worst-case scenario you’ll only lose 2%. If you know your favourite currency pair (EUR/USD, GBP/USD, etc.) you can stick to trading only that FX pair.

4. Consider Placing a Stop Loss Directly on your Account Balance

Beyond the traditional stop-loss, traders should consider also using an account equity stop-loss. The account equity stop works the same as the standard stop-loss order but once this stop is triggered all open positions will be automatically closed at the market price.

For example, if your account balance is USD 10,000 and you set an equity stop loss at USD 7,000, it means that when the sums of all open positions equal USD -3,000, your forex broker will automatically liquidate the floating PnL. In other words, you have limited the forex drawdown to 30%.

This is a good stop-loss method to be implemented as soon as you fund your trading account. Check out Popular Currency Pairs In The Forex Market. You can trade a wide range of currency pairs in the forex market. The following list summarises the most popular combinations to trade.

1. EUR/USD

The Euro / US Dollar is the most widely traded currency pair as it represents the two strongest major global economies. The EUR/USD is an extremely liquid currency pair and easily tradeable. Information on these two currencies is widely available and transparent. Major economic events such as the non-farm payroll, US Federal Reserve interest rates, and the European Central Bank announcements are some of the most influential events to the forex market.

2. GBP/USD

Another popular currency pair is the Great British Pound / US Dollar combination. This currency pair relies heavily on how well the respective economies are performing, as well as the interest rates set by the corresponding national banks. The GBP is sometimes labeled as the “Pound Sterling’.

3. USD/JPY

The US Dollar / Japanese Yen currency pair is extremely liquid and commonly traded as it combines the biggest global currency with the most traded currency in the Asian market. A major contributing factor to the performance and value of this currency pair is the relationship between the two nations.

4. AUD/USD

The Australian Dollar / US Dollar currency pair is a popular currency pair for forex traders looking to profit from movements in the price resulting from changes in commodity prices. Commodities such as Iron Ore, Gold, and Coal are major influences that affect the performance of the Australian Dollar against the US Dollar and other major global currencies. The AUD is sometimes referred to as the ‘Aussie’ and can be considered a commodity currency due to the heavy reliance on commodities.

5. EUR/GBP

The Euro / Great British Pound is the most commonly traded minor currency pair (as it does not include the US Dollar). The Euro and Great British Pound represent two major global economies. Due to their close proximity and similarities in trade arrangements, it can be a difficult currency pair to trade. If you recall, Brexit (Britain’s exit from the European Union) caused a major spike in volatility of the EUR/GBP currency pair.

6. USD/CAD

The price of oil is a major influence on the US Dollar / Canadian Dollar currency pair. The reason is that Canada relies heavily on oil as their major export and thus, their economy is impacted by the price. The US and Canada also have a close relationship, meaning trade arrangements are common. If you ever hear the term ‘Loonie’, it is referring to the CAD.

7. USD/CHF

The US Dollar / Swiss Franc currency pair is considered a safe haven investment due to the economic strength and reliability of the two currencies. The Swiss Franc in particular is a safe haven asset, as the currency is typically stable during times of economic and political turmoil. For this reason, the USD/CHF currency pair is a frequently traded combination. There is also a vast amount of data and therefore a high level of predictability on this currency pair.

8. NZD/CHF

Another commonly traded minor currency pair, the New Zealand Dollar / Swiss Franc is heavily reliant on the agricultural influence of New Zealand. Therefore, if you are trading the NZD/CHF currency pair, it is recommended to closely monitor the prices of global agricultural products. Trading the NZD/CHF currency pair is slightly safer than the NZD/USD combination due to the stability of the CHF.

9. USD/CNY

The US Dollar / Chinese Renminbi or Yuan is a major currency pair that is heavily influenced by the US-China trade war and ongoing economic and political tension. The corresponding governments often attempt to drive prices of imports and exports higher or lower, and this has a major effect on the value of the USD/CNY. CNY can often be referred to as CNH, depending on whether it is being traded onshore or offshore.

10. USD/HKD

The final major currency pair of this list is the US Dollar / Hong Kong Dollar. This combination features a linked exchange rate that allows the HKD to fluctuate between HK$7.75/HK$7.85 to US$1.00. Once again, the relationship between the two economies is a major contributing factor to the movements in value.

Final Words On Currency Pairs

When trading forex, it is important to remember a few key points before jumping in with any currency pair. To optimise your trading, it is best to

- consider the time of day you are trading,

- long-term investing in assets or short-term scalping on CFDs, and

- knowledge of the currencies and corresponding financial markets you are interested in.

Consider all the factors discussed in this article in developing your trading strategy, as they all contribute to the performance of currencies against each other. As always, it is suggested to test your skills with a top forex broker in Australia with a demo account before you start trading with a live account on your chosen trading platform.

The maximum drawdown that you’re willing to accept is mainly going to be in accordance with your risk tolerance. You wouldn’t want to have a larger drawdown than 30% because you’ll need more than 43% returns to recover from that loss.

5. Rank your Trades based on Profitability

Rank your trade setup based on profitability and keep the level of risk lower on the low-probability trades. If you have fewer favourite Forex Patterns and still believe it’s worth giving it a try you can do 2 things:

- Reduce the stop loss level,

- And, also risk less on these trade setups.

6. Setting a Daily Loss Limit

Setting a maximum daily loss limit is the practice of capping the losses on a single day to a certain level. When the daily loss threshold is reached, you need to stop trading for the rest of the day and only start resuming trading the following day. As a rule of thumb, experienced traders use a 5% – 6% daily loss limit.

If you’re in a situation where your daily loss limit is hit too frequently, that’s not a sign for you to extend your daily loss limit. A more appropriate response would be to either lower your position size per trade or, in extreme cases, you’ll need to go back to a demo account and figure out what’s wrong with your trading strategy.

Even the more experienced forex traders and the big hedge funds go back to the drawing board when they perform poorly.

If you’re actively trading forex and CFDs, you really need to employ a daily loss limit system to protect yourself against bad trades. This practice will reduce the volatility of your account equity.

7. Use Guaranteed Stop Loss

Another way to reduce drawdown is to use what is called a guaranteed stop-loss order (GSLO). The GSL order safeguards your trade by ensuring that your stop loss is executed at the desired price without any slippage.

For example, if you trade EUR/USD and have the stop loss set at 1.1750 no matter the market volatility, your stop loss will always be triggered at 1.1750.

Usually, the guaranteed stop loss is available only with certain forex brokers and only works on a selected few instruments in exchange for a small fee.

| Broker | City Index | Plus500 | IG | Oanda | CMC Markets | easyMarkets |

|---|---|---|---|---|---|---|

| Guaranteed SL | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

See the full list of Guaranteed Stop Loss.

Final Thoughts On Drawdowns

If you want to be a successful forex trader who is going to make money over the long term and doesn’t burn out your account quickly then you need to keep drawdown under control. Drawdowns are part of trading and once in a while, everyone is going to have to deal with them. Try incorporating into your trading plan some of the techniques taught throughout this drawdown trading guide if you really want to better cope with drawdowns.

Risk Disclaimer: Leverage trading can amplify drawdowns exponentially. So, make sure you don’t overlook the importance of risk management strategy in your trading.

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Ask an Expert