Forex Hedging Strategies

Forex hedging strategies are risk management approaches that minimise volatility when trading. By tactically hedging your forex currency pairs and other CFDs, you can reduce potential losses with assets that move in opposite directions.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Guide To Forex Trading Hedging Strategy

Hedging is all about risk management, whether you trade currency pairs in the Forex market or stocks on an exchange. Risk management ensures that no one trade or series of trades costs you too much money.

This article serves as a guide to help you better understand Forex hedging strategies.

We’ll cover:

- What is a Forex Hedging Strategy

- Forex hedging concepts

- Products available

- 4 types of hedging strategies

- Common mistakes

What Is A Forex Hedging Strategy?

Forex hedging strategies aim to reduce the volatility in trading results and overall risk. To effectively hedge, traders look at how other currency pairs or financial products correlate to the underlying strategy.

For example, the Euro (EUR) and U.S. Dollar (USD) often trade in opposite directions, although not 100% of the time.

That means if you had a long position in the USD, taking one in the EUR should reduce the chances of outsized losses if the dollar falls. However, it tends to reduce potential gains as well.

The idea of hedging is pretty simple. One position is used to offset the risk of one or more other positions.

Consider the following scenario.

Let’s say you found a trade on the British Pound Sterling (GBP) / U.S. Dollar (USD) currency pair.

You believe there is a 90% that if you buy GBP/USD pair right now (long position) and sell tomorrow, you profit $1,000. However, losing will cost you $5,000.

At first, this seems like a great trade. But what if you only had $5,000 in your trading account?

Even though there is only a 10% chance the trade loses, that one loss will wipe out your account.

So how can you reduce your risk? Here’s where hedging comes in.

Let’s look at a potential hedge on our previous example with the GBP/USD

You find out that for every dollar you hedge with U.S. Dollar/Japanese Yen reduces your profits by $1 and your losses by $2 on the original trade.

Now, you take $500 and put it towards the USD/JPY currency pair. This reduces your potential profit to $500 but also limits your potential losses to only $4,000

Forex Hedging Concepts

There are three key concepts to forex hedging: risk, correlation, and diversification.

Risk

Risk is a measure of the total capital you can win or lose at any given point across one or more trades.

Hedging strategies try to reduce your risk while maintaining potential profits. This usually results in short-term protection for a long-term strategy.

Using a hedging strategy can be used in addition to basic risk management tools such as stop-loss orders or limit orders that sell positions at a price target.

Here’s a good example of a hedging strategy.

Before the Brexit vote, a trader might have forex trading strategies built around the GBP. These work under normal conditions. But Brexit is an unusual one-time event that may not work with an automated strategy.

Rather than turning off the strategy, traders could use currency hedging techniques to reduce the specific currency risk around the GBP.

Once the financial markets are normalised, the hedges can be removed.

Correlation

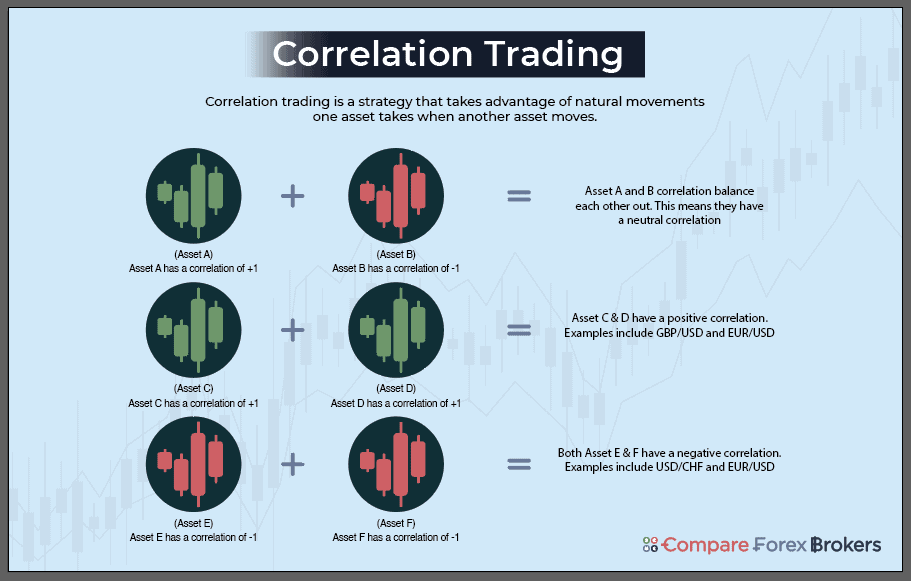

Correlation looks at how two currencies or other financial products move in relation to one another. You measure this on a scale from -1 to +1.

-1 means the two currencies move in exactly the opposite direction.

+1 means they move in the exact same direction.

0 means they move entirely independently of one another.

Say I have a long position in the EUR/USD. I know that EUR forward contracts have a correlation of +0.8 to the EUR/USD. I can sell those forward contracts to reduce my potential risk.

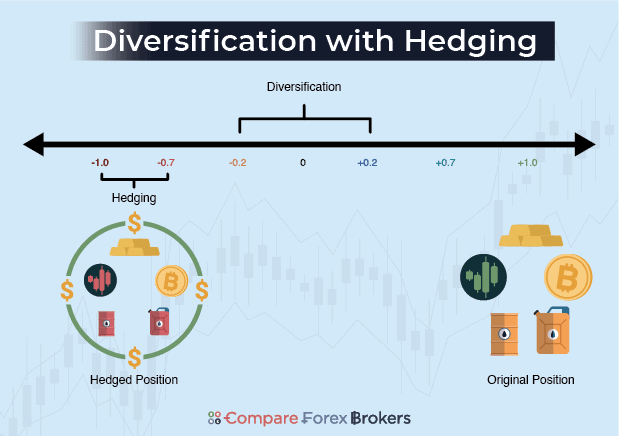

Diversification

Diversification is the idea that spreading your money amongst many trades reduces your risk of ruin.

The risk of ruin is the chance that any particular single trade or position wipes out your account. Using a previous example, if you bet everything in the USD/JPY currency trade, you could wipe out your account.

You can also diversify by spreading your risk across multiple trades that may or may not be correlated.

Here’s an example.

Let’s say you find two other trades with the same probability in addition to the USD/JPY – the CHF/JPY and the AUD/JPY. You then decide to hedge by splitting up your account amongst the three positions.

Now, you would need three losses in a row to wipe out your account. The odds of that happening drop from 10% to 10% x 10% x 10% = 0.1%.

At the same time, your odds of hitting a loss increase to 10% +10% +10% = 30%.

This shows you that diversification cuts the chance that you wipe out your account, but increases the chances you do not make the maximum amount.

Products Available

Let’s quickly cover some common products used for currency hedging.

– Currency pairs: Traders use positively and inversely correlated currency pairs to hedge positions.

– Contract for difference (CFD): Contracts for difference are leveraged derivative products that pay you based on the difference between two underlying instruments. This can be currency pairs, interest rates, or something else.

– Options contracts: Option contracts are leveraged derivatives that you can buy or sell against various assets including currencies. Owners have the right, but not the obligation, to execute the terms.

– Forward contracts (futures): Forward contracts and futures contracts are fairly similar. For our purposes, we’ll discuss them interchangeably. These are leveraged products with an expiration date. Unlike option contracts, the owner has an obligation to execute the contract.

Types Of Hedging Strategy

In the foreign exchange market, there are several strategies traders typically employ.

1. Taking an Opposite Position

This is one of the easiest hedging strategies you can apply.

Taking an opposite position involves using any financial instrument whose value moves opposite to your position. This is known as direct hedging.

What’s important to understand is how you take an opposite or inverse position.

Some financial products like options contracts are dynamic. Their value changes over time and has price changes in a non-linear fashion. This contrasts with other instruments like forwarding contracts which see their value change in a linear fashion.

Forex traders will look at the correlation to determine how a long or short position in another forex pair might move compared to their current holdings.

Before you implement an opposite position hedging strategy you need to ask yourself the following question:

– Is hedging a better idea than reducing my position size?

Many traders forget that it’s easier to reduce their position size. Not only does reducing your position size directly cut risk, but it also increases your buying power. There are also costs associated with opening a new position.

Hedging in currency markets should only be implemented if you are unable to reduce your position, it’s too difficult, or you stand to benefit from the hedge.

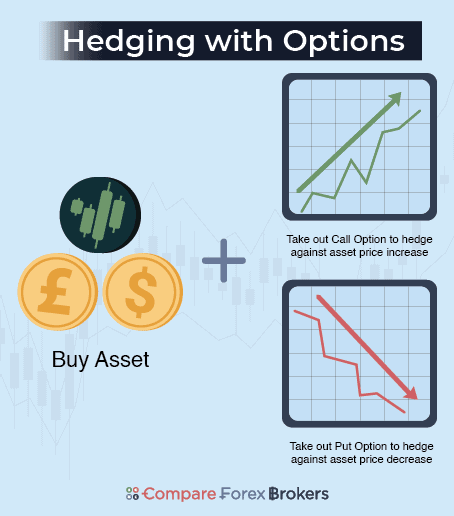

2. Trading with Forex Options

Options contracts are derivatives of financial products. These enable the holder the right to buy or sell the underlying product at a given strike price up to or at a specific date.

European-style options can only be exercised (executed) at the expiration date. American-style options can be exercised at any time up to and including the expiration date.

Options come in two flavours – call options and put options.

Call options give the owner the right to buy shares or currency at a given price. These are bets that pay off when the underlying instrument moves higher.

Put options give the owner the right to sell shares or currency at a given price. These are bets that pay off when the underlying instrument moves lower.

Options contracts can be in or out of the money.

In-the-money option contracts have a strike price below the current price for call options and above the current price for put options.

The premium (the price of an option contract) is made up of intrinsic and extrinsic value. Intrinsic value is the difference between the strike price and the current price for an in-the-money option contract. Extrinsic value is anything left over.

Options that are out-of-the-money have no intrinsic value and only extrinsic value.

The price of an option contract is made up of three components: time until expiration, the distance between the current price and the strike price, and implied volatility. What you need to know is that the extrinsic value of an option declines over time at an increasing rate.

Traders use the options to bet for or against the currency pair they own or another. They can create simple or complex strategies with different payoffs.

A basic strategy might be to buy a put option to offset the long position you have in a particular currency pair.

3. Hedging with Correlating Currency Pairs

Another common option for hedging is to use a correlated currency pair. There is a good article done by Tim Thomas discussing swing trading strategy.

As we noted earlier, correlations range from -1 to +1. You can take long or short positions in correlated pairs to offset some of the risks in your current open positions.

Let’s say you invested in a USD position that’s grown over time. Now, it’s a huge part of your portfolio.

You decide that you have too much USD exposure. But you believe it can still go higher.

To offset your risk you find a currency pair that has a high correlation to the USD, say the JPY. You can then take a short position in the JPY to reduce potential losses if the USD falls.

4. Hedging your portfolio

While some traders stick with one foreign currency, many hold positions in several at once. Each of these can have a different correlation to another in the portfolio.

In this case, traders can weigh each position’s correlation to a main currency or currency pair. Then, they can take short or long positions in the main pair to offset the portfolio risk.

A common way to do this is using the USD, GBP, EUR, JPY, or AUD as your main currency. These are all highly liquid currency pairs.

Some trading platforms can weigh your entire portfolio against one of these currencies. Otherwise, you may need to do it by hand.

From there, you can then hedge with that currency or currency pair to offset the risk of your entire portfolio.

A quick disclaimer – correlations aren’t static. They are based on historical fluctuations in the exchange rates between currencies. They can and do change over time. That’s why it’s important to evaluate your portfolio’s performance against expectations on a regular schedule.

Common Hedging Mistakes

Here are a few pitfalls that snag traders who implement hedging strategies.

Too complex – Hedging doesn’t need to be in place for every position. As the portfolio method shows, you can create simple hedges that cover multiple positions.

No defined parameters – Traders need clear reasons for their hedges. That way they know when to add or remove them. Otherwise, you can find yourself with hedges that no longer serve a purpose.

Misunderstanding correlation – Just because two currency pairs have a +0.70 correlation doesn’t mean they will trade in the same direction every day. It means they will over time. You need to understand the difference between normal differences and true correlation breakdowns.

Capital management – Most Forex trading products involve leverage. Some take up more buying power than others. Make sure you account for this when you take a position if you might need a hedge. You don’t want to be in a situation where you planned to hedge and don’t have the money to do it.

Final Thoughts

The idea of hedging is simple enough. But as you can see, the execution can be difficult. Quite often, it involves a good deal of math.

Before implementing any of these or other hedging strategies, do your homework. Make sure that the strategy fits your goals and trading style. You might also find it helpful to use some Project Management tools to track your trading if you are using multiple Best Forex Brokers In Australia platforms.

Remember, you can always test out ideas in a demo account for free before using it.

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Ask an Expert