Axi Pro vs Standard Account Types 2025

Axi’s Standard Account type has no commissions and spreads from 1.1 pips EURUSD while the Pro trading account commissions of $7.00 and spreads from 0.0 pips EURUSD. Axi (AxiTrader) is a MetaTrader 4 trading platform specialist provider with no minimum deposits and a good choice of CFDs.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

How Do Axi Standard Vs Pro Account Compare?

Our comprehensive comparison covers the 10 most crucial trading factors, but let’s focus on the top 5 differences between Axi Trader Pro and Standard Accounts.

- Axi’s Pro Account offers tight spreads as low as 0.0 pips, while Standard Accounts have wider spreads.

- Pro Account holders pay a flat-rate commission fee, unlike the Standard Account where the fee is built into the spread.

- The Pro Account provides an ECN trading experience, ideal for day trading, scalping, and Expert Advisor strategies.

- Both accounts offer leverage starting at 30:1 for major forex pairs, but Pro Account holders gain access to institutional-grade spreads.

- Axi offers 5-digit pricing for greater transparency, a feature available in both Pro and Standard Accounts.

The overall rating is based on review by our experts

1. Lowest Spreads And Fees: Axi Trader Pro

While the forex broker promotes spreads as tight as 0.0 pips for major currency pairs, generally average spreads are between 0.20 pips and 0.45 pips for major fx pairs. Axi has its strengths in the EUR/GBP market, offering lower average spreads than Pepperstone of 0.40 pips. Unfortunately, for those wanting to focus on the most commonly traded currency pair, the EUR/USD average spreads are significantly higher with Axi than other brokers such as FP Markets that offer 0.10 pips.

|

“Commission

|

|||||

|---|---|---|---|---|---|

|

0.44 | 0.42 | 0.40 | 0.30 | 0.83 |

|

n/a | 0.50 | 0.60 | 0.40 | 0.30 |

|

0.10 | 0.20 | 0.20 | 0.71 | 0.40 |

|

0.30 | 0.50 | 0.50 | 0.50 | 0.60 |

|

0.10 | 0.50 | 0.60 | 0.80 | 1.10 |

|

0.20 | 0.40 | 0.50 | 0.70 | 0.70 |

|

0.44 | 1.23 | 1.13 | 1.23 | 1.41 |

|

0.10 | 0.20 | 0.30 | 0.50 | 0.30 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 04/01/2025

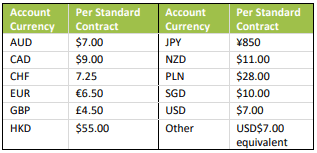

As traders gain access to institutional grade spreads with no markups, Pro Account holders pay flat-rate commission charges as compensation for the forex brokers’ service. Commission charges for Axi Pro account holders will vary by region:

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Trading Conditions

As the forex broker is not a market maker and offers No Dealing Desk Brokers (NDD) interference, Axi Pro Account holders can trade as some of the tightest spreads offered to retail investor accounts. Axi is able to offer institutional grade spreads due to the broker’s pool of top-tier liquidity providers. Multiple pricing sources allow Axi customers to gain access to the best bid-ask prices available in the retail forex market.

With tight spreads as low as 0.0 pips, Axi’s Pro Account provides an ECN trading experience suited to day trading, scalping and Expert Advisor (EA) trading strategies.

Key Features Common To Both Live Accounts

While the commission and the spreads are the main factors that distinguish each account, both accounts have useful features common to both.

Leverage

Leverage in the UK, Europe, Australia and Dubai starts at 30:1 (3.3%) for major forex pairs and 20:1 (5% margin) for minor and exotic fx pairs.

Minimum Deposit

To start trading forex with Axi, no initial minimum deposit is required to open a Standard, Pro or Islamic Account type however to open your position you will need to satisfy margin requirements. Trading accounts can be established in one of the following base currencies:

Trade Size – Trading In Lots

When you trade forex currency pairs, you have a choice of micro-lots (1000 units), mini-lots (10,000 units), and standard-lots (100,000 units). Not all brokers allow trading with mini lots, but Axi does. Smaller lot sizes allow you to control your level of risk without having to sacrifice more of your own capital to meet margin requirements.

5 Digit Pricing

Most forex brokers offer forex pricing to the 4th digit. Axi offer pricing to the 5th digit. Quoting to the 5th digit means greater transparency and better fill when you take your position. When you are trading large volumes of money, taking your quotes to the 5th decimal can make a significant difference.

Demo Accounts

A 30-day demo account is available for both accounts. A demo account is useful for beginner traders who would like to practice their trading skills before committing their own money. Experienced traders may also benefit from a demo account, as they can use them to test trading strategies before using them in the market.

Guaranteed Negative Balance Protections (FCA Regulation Only)

If you are in Europe or the UK, then you would like to be trading with AxiCorp Limited, which is the UK arm of Axi. FCA regulation requirements mean retail traders will get automatically guaranteed Negative Balance Protection. This type of protection ensures your account balance does not go below zero in the event of unexpected losses. As professional traders can trade with higher leverage, professional traders will not have guaranteed protection.

Verdict: When it comes to the lowest spreads and fees, Axi Trader’s Pro Account takes the lead with spreads as low as 0.0 pips and a transparent commission structure.

2. Better Trading Platform: Axi Trader Pro

With their motto ‘One Platform’, Axi facilitates the use of trading on any device. Axi’s primary trading platform offering for retail traders is MetaTrader 4 (MT4) and WebTrader. MetaTrader 4 can be downloaded for use on Windows and Mac desktops and added as an app on iOS and Android for tablet and mobile trading. WebTrader is a MetaQuotes solution for using MetaTrader 4 via a web browser.

MetaTrader 4 is the most widely used forex trading platform for both traders and forex brokers worldwide. Developed by MetaQuotes in 2005, MT4 was one of the first readily available trading platforms for retail traders on the market. Unlike most trading platforms at the time, which were the proprietary property of a broker, MT4 was licenced out to all brokers and as a result free for use by traders.

Part of MT4’s appeal comes from the fact it is the first mainstream platform to include an inbuilt language for scripting. MQL4 which is based on the C#/C++ language allowed traders to make use of features not previously available such as Expert Advisors for trading automation and ability the ability to write their own, buy and even sell scripts with custom signals via the large MetaTrader 4 community marketplace.

The ability to create custom indicators and signals allows users to expand on the already impressive range of features MetaTrader 4 comes with. Key among these features include charts that can support multiple timeframes, 31 technical indicators and 30 analytical objects, which means MetaTrader 4 offers a great set of tools to help you make the best trading decisions. Features of MT4 include:

| Interface | Simple to use / customisable |

|---|---|

| Instruments | Forex, Indices, Communities, |

| Timeframes | 9 |

| Pending Order Types | 4 (Buy Stop, Buy Limit, Sell Limit, Sell Stop |

| Programming Language | MQL4 |

| Built-in-indicators | 30 |

| Free custom indicators | 2000+ |

| Paid Indicators | 700+ |

| WebTrader | Chrome, Firefox, Safari, Internet Explorer, Opera Edge |

| PC | Windows, MAC, iPhone, iPad, Android |

| Order execution types | 3 |

| Order Fill Policy | Fill or Kill |

| Graphical .Analytical Objects | 31 |

| Hedging | Yes |

| Strategy Tester | Single threaded |

Extra Platform Features

Users of the MetaTrader platform will get access to MT4 NexGen which includes a range of ‘extra’ trading account tools. MT4 NexGen includes features and functionalities that give you more advanced trading tools such as economic calendars and correlation tools so you can get a richer trading experience.

To complement MetaTrader 4, Axi offers a specialist A.I.-powered analytics software tool called Psyquation so you can make the best possible trading decisions. This tool is free for Axi clients.

Verdict: For a better trading platform, Axi Trader’s Pro Account stands out with its advanced features, compatibility with MetaTrader 4, and customisation options.

3. Superior Accounts And Features: Axi Trader Pro

When you’re looking for an account that offers more than just the basics, Axi Trader’s Pro Account is where you should be setting your sights. It’s not just about the lower spreads; it’s about the entire trading environment.

- ECN trading environment for more transparent pricing.

- Institutional-grade spreads for better trading conditions.

- Advanced trading features like one-click trading and custom indicators.

- Access to a wider range of trading instruments.

The Standard Account is decent, but it’s more of a ‘one-size-fits-all’ solution. It lacks the specialised features that can give you an edge in the market. So, if you’re serious about your trading, the Pro Account is the way to go.

Verdict: In terms of superior accounts and features, Axi Trader’s Pro Account is the undisputed winner. It offers an ECN environment, lower spreads, and features tailored for serious traders.

4. Best Trading Experience And Ease: Axi Trader Pro

In my experience, trading with Axi offers a blend of speed and ease, especially with their Pro Account. The tight spreads and ECN environment make it a go-to choice for day traders and scalpers.

- Pro Account offers institutional-grade spreads.

- ECN trading environment is available in Pro Account.

- Both accounts offer leverage starting at 30:1.

- 5-digit pricing for better fills and transparency.

The Standard Account isn’t far behind, though. It offers a more straightforward fee structure, which can be a boon for beginners. Both accounts also offer a 30-day demo, which is a great way to test the waters.

Verdict: For the best trading experience and ease, Axi Trader’s Pro Account is the standout choice. Its ECN environment, institutional-grade spreads, and user-friendly interface make it ideal for both novice and experienced traders.

5. Stronger Trust And Regulation: Axi Trader Pro

Axi Trader is regulated by both ASIC and FCA, which is like the gold standard in the forex world.

- ASIC regulation ensures compliance with financial laws in Australia.

- FCA regulation adds an extra layer of security and trust.

- Axi Trader also has a strong reputation in the industry.

- They’ve been around for a while, which speaks volumes about their credibility.

Standard accounts may not offer the same level of regulation, so always check before you dive in.

Verdict: Based on our testing and the regulations in place, Axi Trader stands out as the more trustworthy option for traders concerned about security and regulation.

6. Top Product Range And CFD Markets: Axi Trader Pro

Axi Trader offers a diverse range of products, from forex pairs to CFDs on indices, commodities, and more.

| Product Type | Axi Trader | Standard Account |

|---|---|---|

| Forex Pairs | ✓ | ✓ |

| Indices | ✓ | ✗ |

| Commodities | ✓ | ✗ |

| Cryptos | ✓ | ✗ |

| Stocks | ✓ | ✗ |

| ETFs | ✓ | ✗ |

| Bonds | ✓ | ✗ |

| Metals | ✓ | ✗ |

| Energies | ✓ | ✗ |

| Agriculturals | ✓ | ✗ |

Verdict: Axi Trader offers a more diverse range of CFDs and Markets.

7. Superior Educational Resources: Axi Trader Pro

Axi Trader provides a wealth of educational resources, perfect for traders looking to up their game.

- Webinars to keep you updated on market trends.

- E-books for in-depth knowledge.

- Video tutorials for visual learners.

- Trading guides to get you started.

- Market analysis for informed decisions.

- A glossary to understand trading jargon.

Verdict: Based on our testing, Axi Trader scores higher in educational resources.

8. Superior Customer Service: Axi Trader Pro

Axi offers 24/5 customer support via live chat, phone and email for their products and includes a dedicated account manager. The customer support system has a wide range of languages, including English, Chinese, Spanish, Thai, Italian, Polish, German, Vietnamese, Japanese, Russian, Romanian, and Arabic.

| Feature | Axi Trader | Standard Account |

|---|---|---|

| 24/5 Support | ✓ | ✗ |

| Live Chat | ✓ | ✗ |

| Email Support | ✓ | ✓ |

| Phone Support | ✓ | ✓ |

| Multilingual | ✓ | ✗ |

| Response Time | Fast | Slow |

Verdict: Axi Trader offers superior customer service based on our testing.

9. Better Funding Options: Axi Trader Pro

Axi Trader offers multiple funding options, making it convenient for traders like us.

| Funding Option | Axi Trader | Standard Account |

|---|---|---|

| Bank Transfer | ✓ | ✓ |

| Credit Card | ✓ | ✓ |

| PayPal | ✓ | ✗ |

| Skrill | ✓ | ✗ |

| Neteller | ✓ | ✗ |

| Bitcoin | ✓ | ✗ |

| Ethereum | ✓ | ✗ |

| Litecoin | ✓ | ✗ |

| Ripple | ✓ | ✗ |

| USD Coin | ✓ | ✗ |

Verdict: Axi Trader offers more diverse funding options.

10. Lower Minimum Deposit: Axi Trader Pro

When it comes to starting your trading journey, the minimum deposit can be a significant factor. Axi Trader requires a minimum deposit of just $200, which is fantastic for those of us who don’t want to commit a large sum right off the bat.

| Broker | Minimum Deposit |

|---|---|

| Axi Trader | $200 |

| Standard Account | $500 |

- It allows you to test the waters without a hefty financial commitment.

- The broker also offers a demo account to practice before going live.

- Standard accounts, on the other hand, usually require a higher minimum deposit, often around $500.

This difference in minimum deposit can be a game-changer, especially for new traders who are cautious about their initial investment.

Verdict: Axi Trader is the better choice for traders looking for lower minimum deposit requirements, making it more accessible for everyone.

Our Final Verdict On Which Broker Is The Best: Axi Trader Standard vs Pro Account

Axi Trader’s Pro Account is the winner because it offers lower spreads, superior trading platforms, and better customer service. The table below summarises the key information leading to this verdict.

| Criteria | Axi Trader Pro Account | Standard Account |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ❌ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ✅ | ❌ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ❌ |

Best For Beginner Traders

Standard Account is better suited for beginner traders due to its lower minimum deposit and straightforward fee structure.

Best For Experienced Traders

For experienced traders, Axi Trader’s Pro Account is the go-to choice for its lower spreads and advanced trading features.

FAQs Comparing Axi Trader Pro vs Standard Account

Does Axi Trader Standard vs Pro Account Have Lower Costs?

Axi Trader’s Pro Account has lower costs. The Pro Account offers spreads as low as 0.0 pips. For more in-depth information, you can check out our Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Axi Trader’s Pro Account is superior for MetaTrader 4 users. It offers advanced features and lower spreads. For more details, visit our Best MT4 Brokers.

Which Broker Offers Social Trading?

Neither Axi Trader’s Pro Account nor Standard Account offer social or copy trading. For those interested in social trading, you might want to explore other options on our best social trading platforms.

Does Either Broker Offer Spread Betting?

No, neither Axi Trader’s Pro Account nor Standard Account offer spread betting. For spread betting options, you can check out our best UK spread betting brokers.

What Broker is Superior For Australian Forex Traders?

In my opinion, Axi Trader’s Pro Account is superior for Australian Forex traders. It’s ASIC-regulated and offers competitive spreads. For more details, check out our Best Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

From my perspective, Axi Trader’s Pro Account is the better choice for UK Forex traders. It’s FCA-regulated and offers a robust trading platform. For more information, visit our Best Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert