BlackBull Markets vs SwissQuote 2025

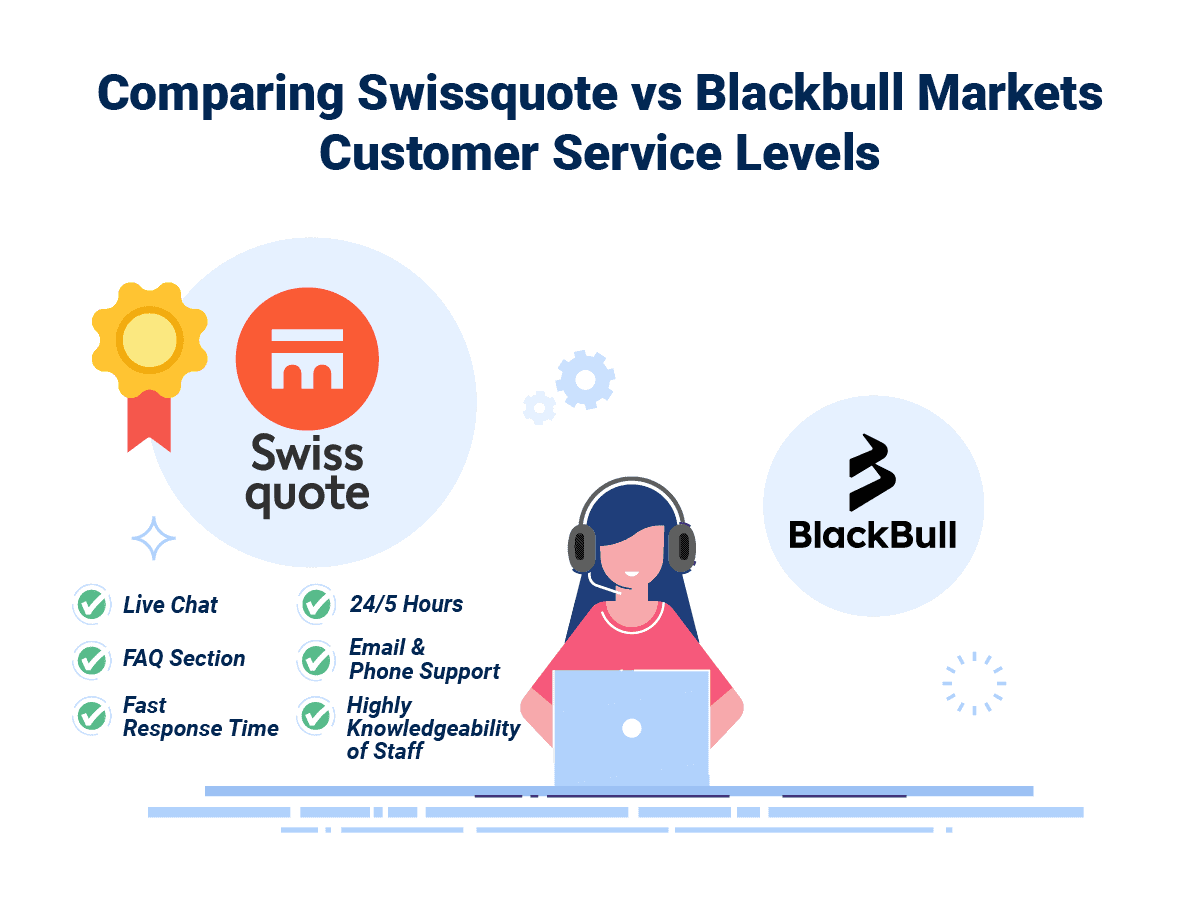

This BlackBull Markets vs SwissQuote forex broker review will give traders a bird’s eye view on the differences in their account types and spreads. While BlackBull Markets utilises their own social trading tools, both brokers are equipped with MT4 and MT5 trading platforms. So which one has a better ease of use. Let’s find out.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Ask an Expert

Does Swissquote have a banking license?

Swissquotes Bank ltd which is the brokers main subsidiary and is based in Switzerland. This entity has a banking licence issued by the Swiss Federal Financial Market Supervisory Authority (FINMA).