Eightcap vs CMC Markets

This review of Eightcap and CMC Markets will provide a comprehensive analysis of how these two brokers operate in the realm of forex trading. We will thoroughly examine the strengths and weaknesses of each broker, delivering valuable insights for traders who are eager to determine which option best suits their preferences. Let’s take a closer look and discover more about these two brokers.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Ask an Expert

What timezone does Eightcap use?

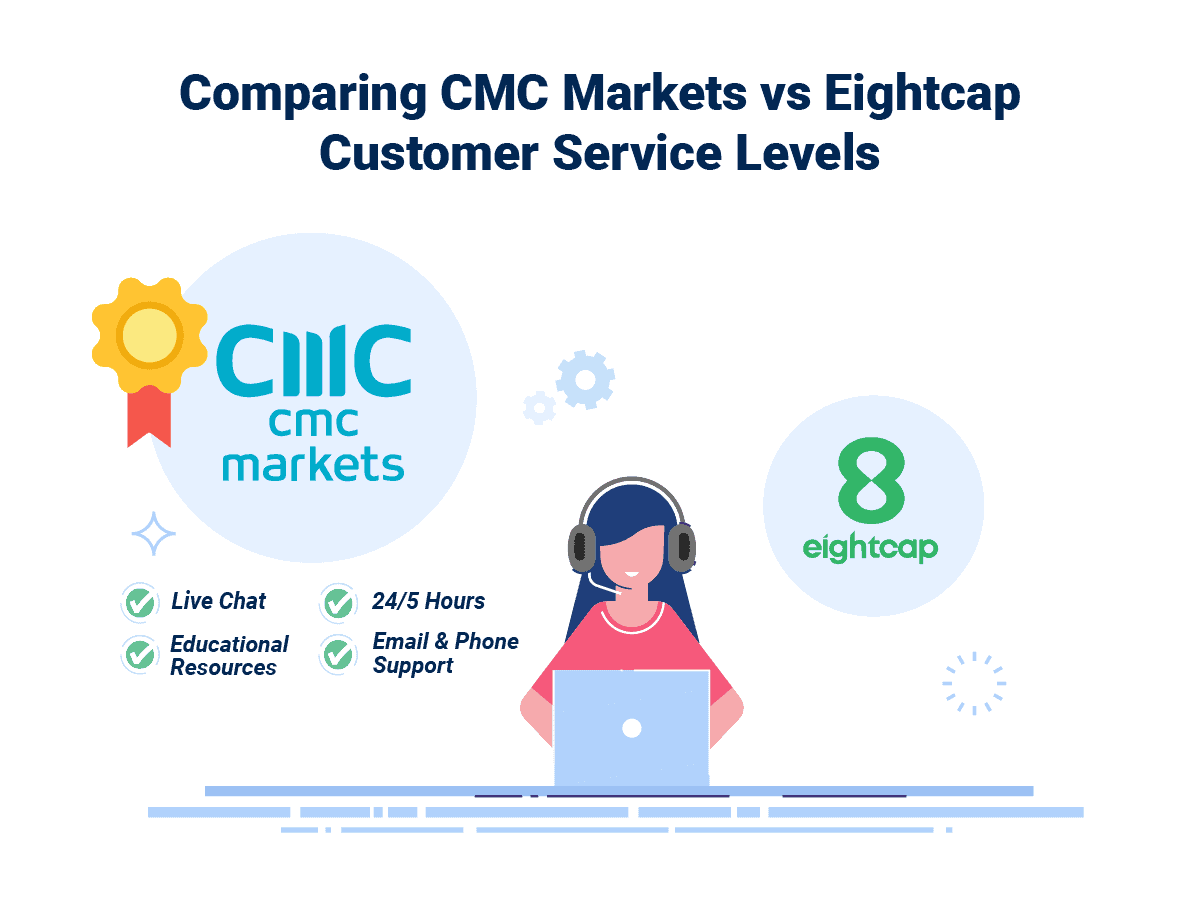

Eightcap has 24/5 support meaning they can assist you any time of day while Forex markets are open.