eToro Review Of 2025

eToro offers a unique forex trading platform that incorporates CFDs social trading across markets from cryptocurrencies including bitcoin, and indices to trading ETFs. It suits traders looking for a diverse and interactive trading experience.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

eToro Summary

| 🗺️ Regulation Country | Australia, Europe, UK, Seychelles |

| 💰 Trading Fees | Variable Spread with no commission |

| 📊 Trading Platforms | eToro Trading Platform |

| 💰 Minimum Deposit | $50 |

| 💰 Withdrawal Fees | $25 |

| 🛍️ Instruments Offered | Forex, CFD, Crypto, Commodities |

| 💳 Credit Card Deposit | Yes |

Why Choose eToro

eToro, based in Tel Aviv, Israel, is renowned for its user-friendly platform and social trading features , making it ideal for both beginners and advanced traders. The platform offers a wide range of tradable assets, including forex, stocks, commodities, and a comprehensive selection of cryptocurrencies.

Major benefits include the ability to copy trades from successful traders, a broad market range, and an intuitive interface. However, users should be aware of high withdrawal fees and spreads.

eToro Pros and Cons

- Social trading feature

- User-friendly platform

- Broad market range

- High withdrawal fees

- Poor customer support

- High spreads

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

eToro charges no commissions similar to Plus500. This may seem like a positive, but there are other fees that eToro users might see as higher than low fee forex brokers as shown below.

Standard Account Spreads

eToro’s spreads are generally higher than other ECN Forex Brokers, such as Pepperstone and IC Markets as there are no commissions. This is because eToro uses a trading execution model standard with Market Maker Brokers.

For EUR/USD is 1 pip compared to Pepperstone, which is 1.10 and 0.62 for IC Markets. Another is the EUR/GBP which is 1.50 pips compared to Pepperstone which is 1.40 and for IC Markets is 1.27.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 04/01/2025

1.00

1.00

1.50

2.00

1.50

1.10

1.20

1.40

2.00

1.50

0.62

0.77

1.27

1.30

0.85

0.93

0.92

0.98

1.31

0.98

1.00

1.20

1.00

1.20

1.00

0.80

1.20

1.20

1.50

1.20

1.00

1.00

1.20

N/A

1.10

0.80

1.00

1.00

1.50

1.60

0.90

1.20

2.10

1.10

1.30

0.90

1.10

1.60

1.80

1.50

1.00

1.11

N/A

1.30

1.28

0.84

0.83

1.79

2.32

1.92

1.10

1.10

1.10

1.20

1.20

1.20

1.30

1.20

1.20

1.30

1.20

1.30

1.50

1.70

1.20

Looking more closely at the most trading currency pairs, eToro has lower average spreads for most currency pairs except for the EUR/JPY.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| eToro Average Spread | 1 | 1 | 2 | 1 | 1.5 | 1.5 | 2 | 2 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

Other Fees

Inactive And Overnight Fees

In addition to the $25 withdrawal fee and spreads, eToro’s fees also include an inactivity fee. This is charged when an account is not logged into for a 12-month period with a charge of $10 USD. Fees are also charged when holding a position for a sustained period (overnight) which varies by the investment product and is shown within the site.

eToro Accounts

There are two trading accounts offered by eToro which are regulated by ASIC, CySEC and the FCA in the UK.

The first is the Retail Clients Account (also known as a retail investor account) designed for non-professional traders. This account provides both Copy Trade functionality and manual trading. There are strict margin closeout restrictions for retail investor accounts while negative balance protection ensures losses don’t exceed a trader’s deposit. Leverage is restricted as shown:

- 30:1 for major currency pairs

- 20:1 for exotic currency pairs, gold and major indices

- 10:1 for other commodities

- 5:1 for CFD stocks

- 2:1 for cryptocurrency CFD

The second is the Professional Clients Account, which is designed for those savvy in trading financial markets and requires experienced traders to pass a test. Leverage can be up to 400:1 for professional clients while still having negative balance protection similar to the retail clients’ account.

Verdict on eToro Fees

While no commissions may seem like eToro has low brokerage , the high spreads and other charges mean fees will be higher for most trading activity. While eToro may suit your trading strategies, you will need to take into account the higher brokerage charged by the online broker. We recommend Pepperstone if spreads, commissions and trading experience are important for your trading requirements. Check out our full Pepperstone vs eToro comparison for more information.

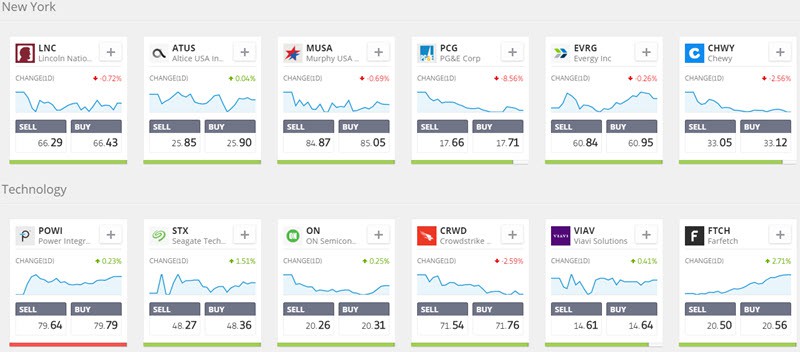

Trading Platforms

| Trading Plaform | Available With eToro |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| TradingView | Yes |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

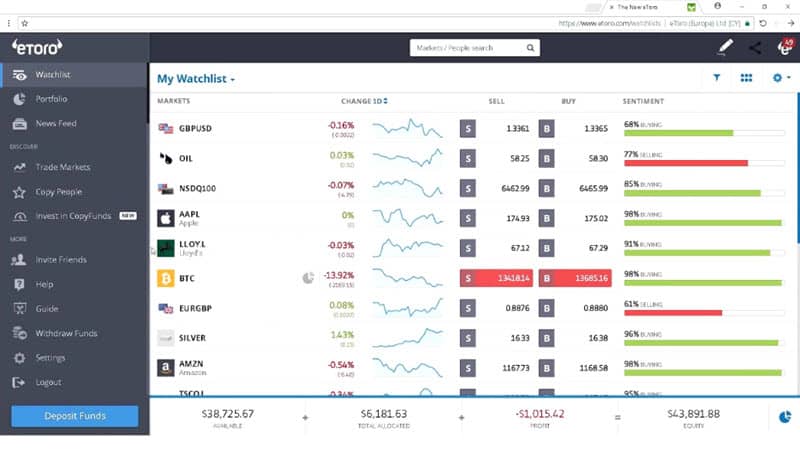

There is the choice of a Webtrader or desktop trading platform available across all major languages. These are exclusive to the eToro platform with a unique clean design, easy user interface, and advanced functionality. That said, only the watchlist is customisable with all other panels fixed. Both indicative prices and current market prices are displayed on the platform. There is advanced search functionality with predictive text and a range of placing orders:

- Market Limit

- Stop Loss

Leverage can also be set for any position that is opened. You can also view a Fee report to see the total fees you have paid overtime or on a particular trade. Finally, you can set alerts on your desktops such as an icon update for market-sensitive events or movements.

There is the option of a demo account or you can trade with real money on a live account through the eToro platform.

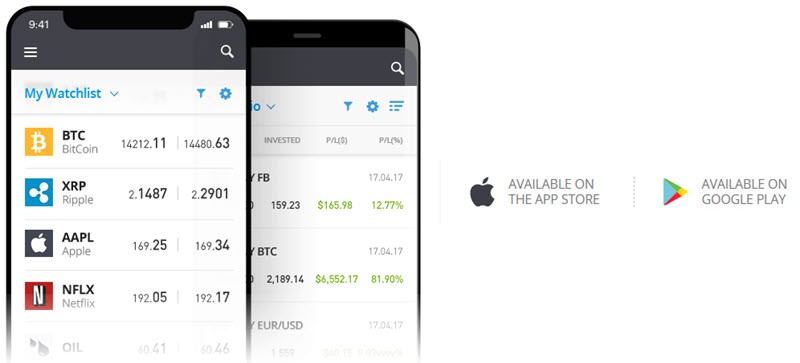

Mobile Trading Platform

The eToro mobile app is available on Apple’s IOS and Android devices for those looking to trade on the go. The mobile trading app allows trading CFD stocks, indices, EFTs, forex (currencies) as well as commodities. Social trading such as the ability to copy leading investors is also available using the mobile app. A bit advantage of the mobile trading platform is that you can get notifications of movements across relevant markets.

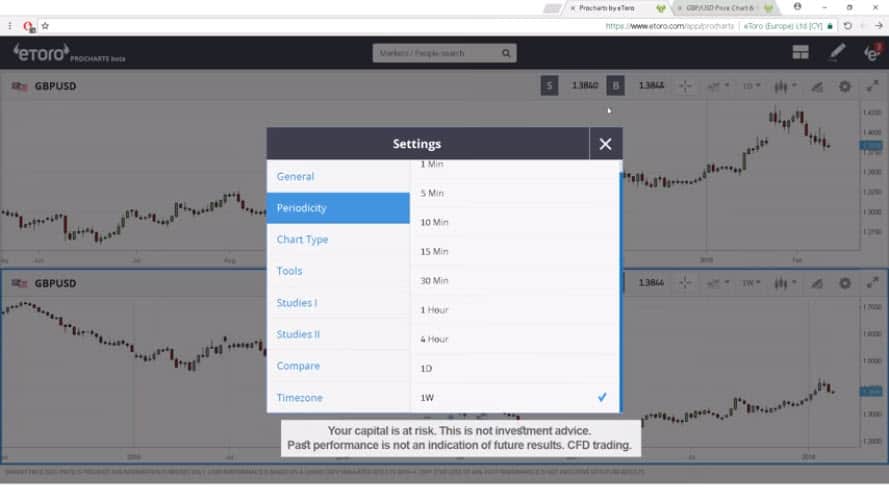

eToro Platform Charts

There is the choice of standard charts or ProCharts. The below screenshot shows an eToro ProChart giving insights into their functionality, including changeable:

- Time-frames from 1 minute to 1-week intervals

- Time zones based on your Australian location

- Layouts from 2×2 to 3×3

- Multi-asset platform comparison such as forex pairings

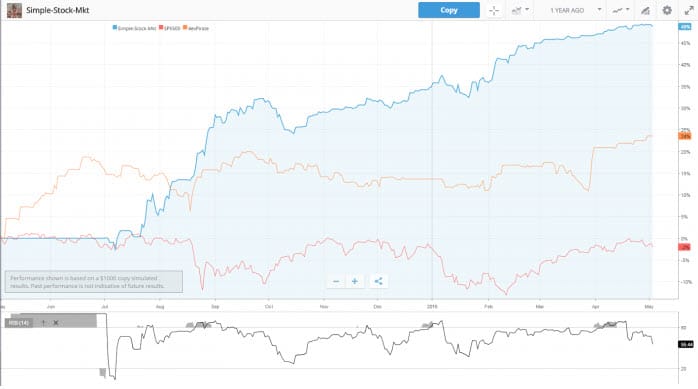

This eToro review focused more on trading tools like the Trader Chart feature, which like social trading is unique to the trading platform. Traders can visualise the performance of individual traders and understand profit-loss amounts over set periods. For example, you can calculate “what profit or loss will be made if I copied trader XYZ 2 months ago with a starting capital of $5,000?”. This trader’s track record can then be compared to other indices or traders or even individual share performances. Below compares three traders’ performances over a set period.

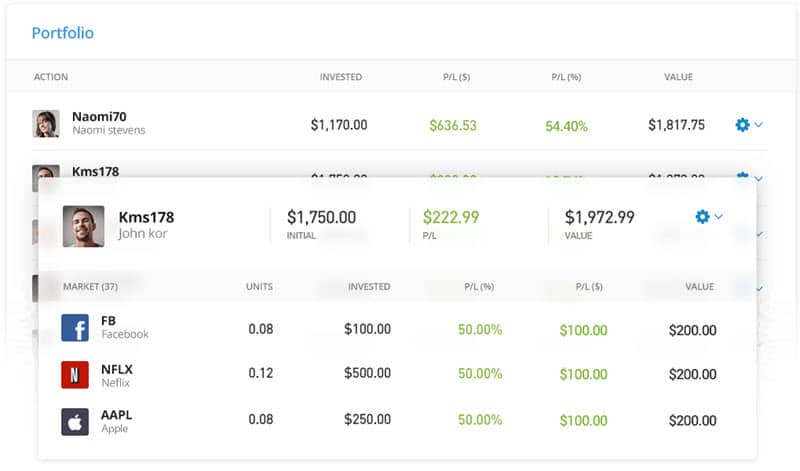

eToro Exclusively Offers Social Trading

What makes eToro unique when trading CFDs is the ability to find and copy trading. With more than 140 countries having access to the social trading platform and millions of users, there are a plethora of options. These can be filtered to find the most popular investors using the ‘editor’s choice’ or by filtering via the search tool. Filters include location, risk score, and other factors shown in the image below. CopyTrader and CopyPortfolio allow the selected trader’s strategies to be reproduced. Just note that past performance is not an indication of future results when choosing a trader to copy.

To incentives, the top traders to share their data eToro provides payouts on how many copiers an individual has. This means that experienced traders can make money based on their trades and additional profits as high as 2% of assets under management as rewards for having copiers of the strategy.

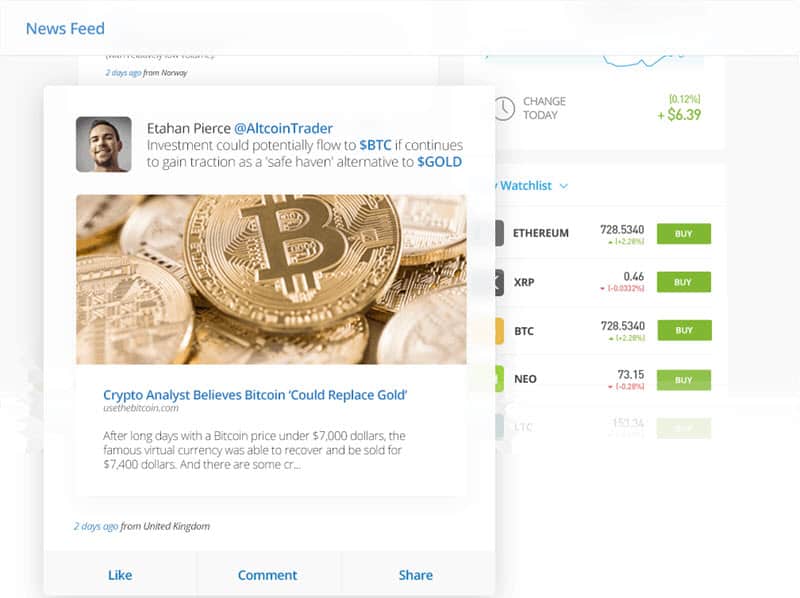

Social News Feeds

A further enhancement is the eToro social trading feeds. These news feeds help traders interact with the brokers’ community to share information and discussions and can also assist in following financial instruments. The social trading platform also allows traders to post updates, share posts, and comment on others’ posts to build a community online. The feed can be tailored towards the interests of the trader filtering out unnecessary noise.

The social trading platform notifies the trader when important updates occur or increased volatility across the CFD assets watched. Notifications can also be given when a user a trader has copied creates a new post. The notifications can be pushed to a mobile device or a desktop trading platform.

Social Media Sharing

eToro allows traders to share their actions across platforms such as Twitter and actions. Charts are also created through the social trading platform, which can then be shared on visual social platforms such as Instagram. The main social media platform eToro connects to is Facebook where traders can view recent news, product and community information. There are also live broadcasts through Facebook periodically. Twitter also offers news and Twittersphere conversations with real-time updates on the main feature. Instagram allows for graphs to be shared, which as mentioned above are created through the eToro social trading platform. Finally, YouTube and Telegram have informative videos, interviews and tutorials.

There is no doubt that social trading is unique to eToro. While Copy trading only exists in the form of automated trading by other brokers, eToro offers some of the best social trading platforms.

Conclusion Of The eToro Trading Platform

eToro offers-an-easy to use trading platform on mobile and desktop devices. The key issue though is that this platform is unique to eToro, making it hard to switch online brokers and learn a new interface. The other key issue is the lack of functionality of features such as guaranteed stops and customisable charting. Generally, if social trading is your core interest the eToro trading platform will meet your needs. If you’re looking for an online broker with more advanced platforms across CFDs and forex trading, then Pepperstone may be more suitable for you.

Is eToro Safe?

eToro has a trust score of 81, from its regulation, reputation, and reviews.

Regulation

eToro is a supervised trading firm that follows the regulatory framework of the world’s most powerful regulatory bodies, as follows:

- In Australia, eToro is regulated by the Australian Securities and Investments Commission (ASIC) trading under eToro Aus Capital Pty Ltd. The company’s Australian Financial Services Licence (AFSL) number is 491139. The broker was listed as the social platform on the Best Forex Brokers In Australia.

- In European markets, they are regulated by Cyprus Securities Exchange Commission (CySEC) trading as eToro (Europe) Ltd.

- In the United Kingdom, they are regulated by the Financial Conduct Authority (FCA) trading as eToro (UK) Ltd. To avoid scams, it’s important to make sure an online broker is regulated in your local market as seen on the forex broker UK table.

Note* eToro is also available in the USA but, only in a limited number of states.

| eToro Safety | Regulator |

|---|---|

| Tier-1 | ASIC CySEC FCA |

| Tier-2 | MFSA ADGM GFSC (Gilbraltar) |

| Tier-3 | FSA-S |

All forex brokers have trading instruments such as CFDs. These CFDs are included leverage, which means you can trade a multiple of your deposit. Leverage means you are more exposed to the market, which can lead to greater profits from movements but also losses. As stated above, 75% of retail investor accounts lose money with eToro, so it’s important to have safeguards in this high-risk environment. Below goes through some of these.

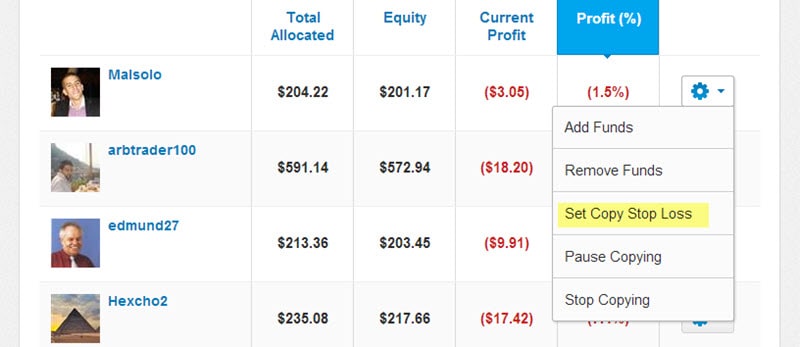

Stop-Loss Orders – Yes

eToro has stop-loss order functionality. This means a trader can set the maximum amount they are willing to lose on a trader and when that price-point is achieved the software exits the trader from the market. The same applies once a profit target is reached. Below shows an example stop-loss order on a copy trader.

Guaranteed Stop-Loss Orders – No

While a stop-loss order is useful to determine the maximum amount a trader wants to lose on a trade, the figure isn’t actually guaranteed. This is due to ‘slippage’ which is when volatility is high and the software program is unable to exit the trader at the price requested. This can lead to losses substantially exceeding the amounts set. The only way to stop this is by placing a guaranteed stop-loss order. This is not available with eToro, and if this feature is important to you, another broker may be more appropriate.

Negative Balance Protection – Yes

Like a stop-loss trigger. eToro has a margin call trigger, which exits a trader when they reach zero balance. This is standard across online, but in extreme situations losses may exceed the online trading deposit. While some brokers will request a repayment of a negative balance, eToro offers negative balance protection. This means that they will pay the difference when losses exceed a traders deposit.

Reputation

eToro was founded in 2007, with headquarters in Tel Aviv, Israel. They have around 1,000,000 monthly hits on Google.

Reviews

eToro has a TrustPilot score of 4.4 out of 5 fr4om 21,585 reviews.

Conclusion On eToro Safeguards

eToro having Negative Balance Protection is a real positive with the ability of online trading, knowing that losses won’t exceed the deposit. There is also stop-loss functionality to help determine preferred profit/loss levels, but these are not guaranteed and need to be understood. Overall, while not perfect, the safeguards help manage the high-risk environment of CFDs trading. If you are new to leverage, then an eToro demo account is recommended. A broker more suited to beginner traders is Plus500.

Deposit and Withdrawal

The minimum deposit set by eToro is $50. In the USA this is less at USD$10 while in Israel it’s considerably more at USD $10,000. Below is the details minimum deposit requirement by region.

| Trader is a redident in: | Minimum First Deposit (USD) |

| Australia, United Kingdom, Germany, Malaysia, Singapore, Thailand, Ireland, Spain, Sweden | $50 |

| France, Poland, Slovakia, Belgium, Czech Republic | $100 |

| Eligible countries outside of the list | $200 |

| New Zealand | $1,000 |

| Israel | $10,000 |

| Uniited States | $10 |

What is the minimum deposit at eToro?

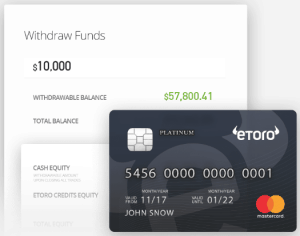

The minimum deposit for Australian residents is $50 with other markets such as China requiring an initial deposit of $500. There is a withdrawal fee of $25 per transaction with conversion fees also applying when non-USD currencies are requested, such as the AUD. The minimum withdrawal amount is $50.

Deposit Options and Fees

Additional fees may be charged by the withdrawal provider with deposit/withdrawal methods including:

- Wire Transfer

- Credit Card

- Debit Cards

- Neteller

- Paypal

- Yandex

- Skrill

- Bank transfer

- Cryptocurrency transfer

- Webmoney

Withdrawals may take a business day, but note that paperwork is required before processing your first withdrawal. It’s recommended to use the same withdrawal method as the deposit method to avoid delays in payment methods. There is a longer wait time for depositing and withdrawing money from your bank account due to the wait times of commercial banks. Cryptocurrency transfers are accepted from outside wallets such as Coinbase straight into your eToro wallet.

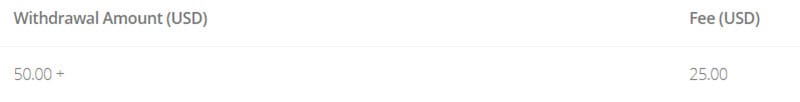

Withdrawal Options and Fees

eToro, unlike most online brokers, charges a flat USD withdrawal fee of $25 USD per transaction. The minimum withdrawal amount is also set at $50USD. While this amount may seem low, most brokers don’t have such a fee, and this fee can add up over time.

Product Range

There are seven key markets that can be traded on eToro with leverage varying by asset class.

CFDs

Currency markets are the most traded in the world, with over $5 trillion USD dollars traded every working day. Markets are open 24 hours, 5 days a week, with small movements regularly occurring. Larger movements can also occur when market-sensitive announcements are made, such as jobs data or interest rate decisions of a reserve bank. eToro offers the major currency pairs from EUR/USD, GBP/JPY through to exotic pairings such as NZD/CHY

Cryptocurrencies

Cryptocurrencies from Bitcoin, Bitcoin Cash, Stellar, Litecoin to Ethereum have increased in trader volume with high volatility on a daily basis. When a trader trades on crypto-assets such as Bitcoin in Australia (under ASIC) they are NOT purchasing an underlying asset. Rather than purchasing crypto, a Contract For Difference (CFDs) is exchanged so no actual cryptocurrency is purchased by eToro on a trader’s behalf.

eToro offers cryptocurrency trading on 41 digital currencies (Bitcoin BTC, Ripple XRP, Dash, Neo, etc.) with low trading fees and 0% commissions.

Important note: For clients of eToro (UK) Ltd, namely UK retail traders, cryptocurrency trading is not allowed starting from Feb 2022. Due to the regulatory frameworks imposed by the UK’s FCA, regulated brokers are prohibited from offering crypto assets to retail traders. Only institutional UK traders who are able to meet the ESMA requirements can have access to crypto trading. Traders from Europe and the rest of the world can still access cryptocurrencies through other eToro subsidiaries.

Share Trading

CFDs work by not actually purchasing a share but speculating if it will increase or decrease using leverage. With over 1,000 shares to choose from on exchanges worldwide, there are a plethora of opportunities for traders looking to stock trade. eToro also gives you the option of trading in fractional shares if your investment strategy requires a better split of industries. Clients of eToro Australia Capital Ltd (ASIC regulated) can access leverage of between 10:1 to 20:1 amplifying opportunities and risks, which is how CFDs work. Understand that CFDs are complex instruments and it’s recommended to use a trial account if you’re new to leveraged products.

Commodities

Another way to trade with leverage is through commodity trading across valuables from oil, gold to platinum. Traded as CFDs, traders can short a commodity if they predict prices to fall or trade long if prices are predicted to rise. The key commodities traded through eToro are:

- Gold

- Oil

- Natural Gas

- Platinum

- Silver

Exchange-Traded Funds and major Indices can also be traded as CFDs with leverage.

Conclusion Of eToro Tradable Markets

eToro offers all the tradable markets in the form of CFDs from cryptocurrency, shares to forex. The only negative is that eToro doesn’t offer stockbroker services that allow an individual to buy shares (not CFDs shares). Only large retail online brokers like CMC Markets or IG offer these services, but they don’t offer the social trading experience of eToro. Overall, an individual can easily use one broker for a stockbroker and another for tradable markets, in which case eToro has the investment product to suit your needs.

*Your capital is at risk ‘68% of retail CFD accounts lose money’

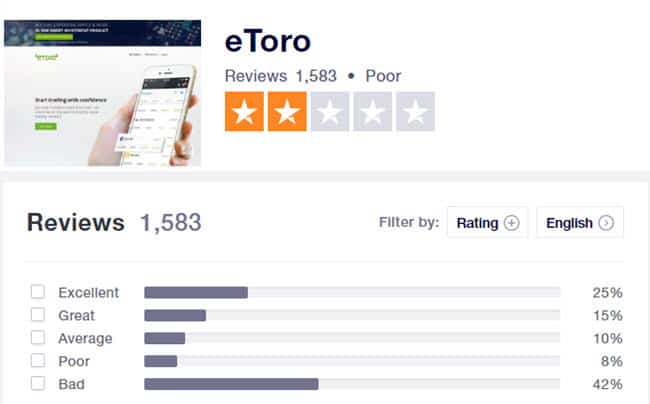

Customer Service

eToro reviews are one of the poorest on Trust Pilot of any online trading broker. Below shows the score of etoro.com is below 4/10 with 42% of traders leading reviews that are ‘poor’.

The poor eToro reviews were based on three core areas:

1) Poor eToro Customer Support

While eToro state that they offer 24-hour customer service, 5 days a week, no contact number is listed. Rather as shown below, users are encouraged to visit the help centre (with FAQs) or to open a ticket. The other details given are the official address: eToro Sydney office, Level 33, Australia Square, 264 George Street, Sydney NSW 2000 and e-mail address, but these are for corporate enquiries.

Some live chat is available within the eToro platform but many reviews stated: “The support is really bad, live chat usually not working”.

2) Losses With the Broker

eToro.com states that 75% of retail investor accounts lose money when trading CFDs with this provider. Many of the negative reviews are based on these customers, with many complaints related to losses attributed toward fees discussed later in this eToro review.

3) Issues With Copy Trading

The final issue that brokers had was with regard to copy trading based on perceived errors and issues with deposits and withdrawals. While it’s hard to verify each review in these areas with each quite different, there are clearly issues in the social trading element for some traders.

Summary Of Why eToro Scored Poorly For Reviews

While it’s logical that most reviews will be from upset customers, the sheer weight of negative eToro reviews is a concern compared to other brokers such as Markets.com. The key issue is customer support, which unlike other online brokers lacks a contact number and a dedicated account manager. If you’re self-sufficient when it comes to navigating the broker features, this won’t be a factor, but if you want the support when you need it, then eToro may not be the right broker for you.

Research and Education

Training

eToro has live webinars that include investment advice, eCourses, and trading videos to help those new to Forex trading. The demo account can also be used for educational purposes and for virtual trading before using real money. It’s these online training facilities that can introduce and refine trading strategies across markets.

Final Verdict on eToro

eToro is unique thanks to its unique trading platform, social trading functionality and range of markets including crypto. Traders will need to balance these trading features with the high brokerage, poor customer service and lack of risk management tools which partially lead to 66% of traders losing their money with eToro. If you’re looking for alternatives, then view the awards for different Countries. Otherwise, you can open a demo account and try the unique features and markets eToro offers.

Open a demo accountVisit eToro

*Your capital is at risk ‘68% of retail CFD accounts lose money’

eToro Review FAQs

Is eToro trustworthy?

eToro the world’s largest social trading platform is a legitimate brokerage trading firm regulated by tier-one financial bodies (ASIC, CySEC and FCA). Due to its global presence, millions of registered retail traders, segregated accounts, free insurance of up to USD 1 million we regard eToro as a safe broker.

Check out a comparison between eToro and Plus500, eToro’s biggest competitor: eToro vs Plus500.

Is eToro good for beginners?

Yes. eToro’s copy trading features make it suitable for inexperienced traders. Beginner traders can follow and copy trades from more experienced traders, learn and connect with traders from all over the world. At eToro, beginner traders can copy up to 100 trades simultaneously with a minimum amount of USD 200 to invest in a trader.

See a full comparison of the Forex Social Trading that the brokers have to offer.

Is eToro really free?

Partially Yes. eToro offers commission-free trades for stocks and ETFs. Additionally, there is no management fee when you copy other traders and no rollover fees. However, the cost of trading CFDs comes in the form of the spread and overnight fees. The spreads on the most popular currency pairs start from 1 pip, 2 pips on commodities, 100 pips on stock indices, and 0.75% on cryptocurrencies.

What Leverage Does eToro Offer?

Leveraged Trading – Retail vs Professional

In line with FCA requirements that follow ESMA MiFID directives, has two types of classification for its clients. These are retail and professional. Retail clients are all clients except those who successfully apply for a professional qualification. To qualify as a professional client, 2 of the following conditions need to be met:

- Have made at least 40 trades of significant size over the previous 12-month period (avg 10 per quarter)

- Manage a portfolio of 500,000+

- Worked in a relevant position in the finance industry for a period of at least one year

Professional traders will be able to access higher leverage than retail traders. Below compares the leverage differences for retail and professional traders.

Retails Traders Leverage

- 30:1 for major currency pairs

- 20:1 for minor and exotic currency pairs, gold and major indices

- 10:1 for commodities (excluding gold) and minor stock indices

- 5:1 for shares CFD

- 2:1 for cryptocurrency CFD

Professional Traders Leverage

- Up to 400:1 for Forex

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Go to eToro Website

Visit Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research

Ask an Expert

What is the difference between social trading and copy trading?

Social trading and copy trading allow you to copy the trades of others. However, social trading is distinct from copy trading because of the added element of social interactions.

Social trading is for traders that want to learn from and make trading decisions based on interactions with other successful traders.

As copy trading lacks the social elements, you are simply replicating the trades of others. Here decisions are made purely on data and filters.

Is social trading better than manual trading?

Social trading can be a good option for beginner trader since you can leverage the skills of other successful traders and save you time doing your own research.

However you will only be as good as the traders you copy or follow and not all traders are reliable.

Can you trade options on eToro?

No, eToro does not support options trading.

If I copy trade on eToro, can I use leverage?

Yes you can. Just keep in mind leverage will vary depending on which country you sign up with eToro from.

Do i need alot of money to start trading with a broker?

Do I actually own stocks on eToro?

No, eToro offers CFD, the exception to this is if you buy shares with eToro in the US.

Can eToro limit trading on assets?

I’m not sure i follow the question. eToro have trading with CFDs so technically you don’t own the asset.