FP Markets vs XM: Which One Is Best?

Dive into our comprehensive comparison of FP Markets and XM Group. We dissect key areas like trading costs, platforms, regulation, and more to help you choose the right broker for your trading needs.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Ask an Expert

I was wondering about that execution speed comparison. What factors played into it, and what specific aspects led to the conclusion that FP Markets had a slight edge in this category?

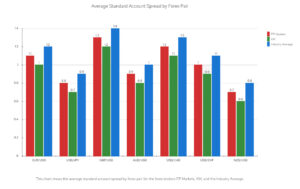

Our execution speed tests done by our colleague Ross Collins found FP Markets has limit order speed of 225 ms and markets order speed of 96 ms while XM has a limit order speed of 148 ms for limit orders and 184 for market orders. When you sum the two FP Markets finished 10th and XM finished 19th of the 20 brokers tested.

What is the execution speed of FP Markets?

In the month of December 2022, FP Markets found their median order execution time from the time the trade is received, processed and closed is 29 milliseconds. Our tests found FP Markets has a limit order speed of 225 ms and market order speed of 96 ms.