Fusion Markets Review Of 2025

One of the new forex brokers, Fusion Markets has shaken the industry by focusing solely on a no-frills, fastest execution speed, and lowest costs. We visited, tested, and reviewed the broker to see if the broker really stands up to their claims.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Fusion Markets Summary

| 🗺️ Country Regulation | Australia (ASIC), Vanuatu (VFSC) |

| 💰 Trading Fees | ECN Type Zero Account & Classic Account |

| 📊 Trading Platforms | MetaTrader 4, MetaTrader 5, ctrader, TradingView |

| 💰 Minimum Deposit | $0 |

| 💰 Withdrawal Fees | $0 |

| 🛍️ Instruments Offered | Forex, CFD, Crypto, Indices, Metals, Energies, Stocks |

| 💳 Deposit Methods | Visa, MasterCard, Skrill, Neteller |

Why Choose Fusion Markets

From the start, Fusion Markets’s vision is not just to be a low-cost provider but to give traders access to markets at a much lower cost than the standard. With over 250+ available instruments for trading, this Australian forex broker offers a state-of-the-art technological solution for all its clients .

True to their word of delivering low-cost forex trading, their commissions are 36% lower than their competitors. Their features are geared toward traders worldwide, with waived deposit fees, no minimum deposit requirement, copy trading, and free US Share CFD trading. On the negative side, Fusion Markets lacks research tools, and CFDs on stocks are not available.

Fusion Markets Pros and Cons

- Tight spreads

- Fast account opening

- Good customer service

- Limited products offered

- Lacks advanced educational tools

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

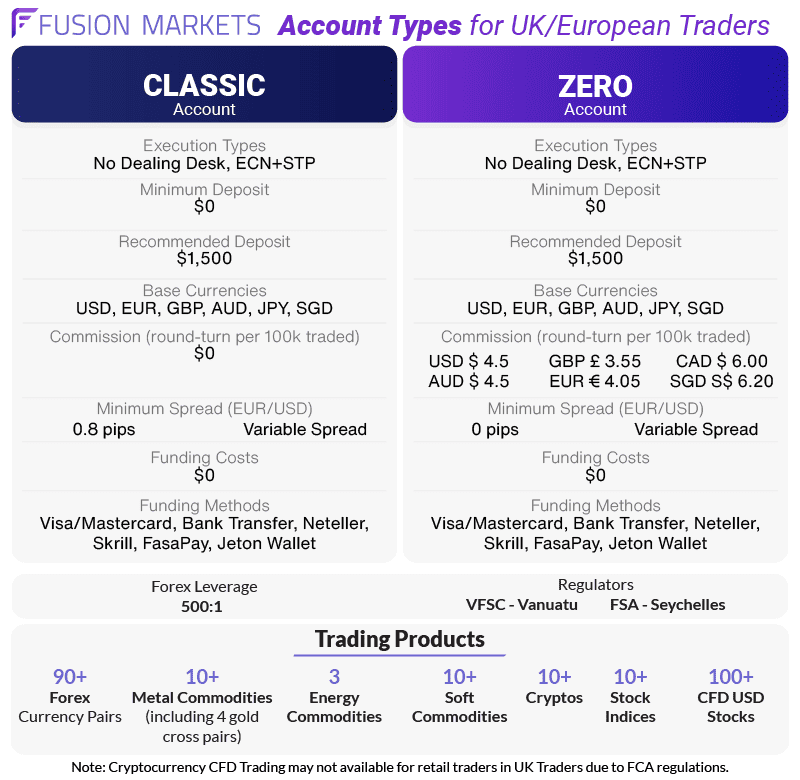

Fusion Markets offers two pricing structures: a ZERO Account with spreads as low as 0 pips plus commission and a Classic Account with no commission spreads from 0.9 pips.

- Classic Account is well-suited to beginner traders wanting a simple pricing structure with no commission fees.

- ZERO Account was designed for high-volume traders seeking tighter spreads and an ECN-style trading environment.

1. Raw Account Spreads

The broker offers significantly lower raw spreads than the industry norm for the majority of major forex pairs. For example, the EUR/USD spread averages 0.02 pips, which is lower than the rest of the brokers included in our comparative analysis below.

|

ECN Forex Spread Comparison

|

|||||

|---|---|---|---|---|---|

|

0.02 | 0.05 | 0.36 | 0.19 | 0.23 |

|

0.06 | 0.27 | 0.23 | 0.49 | 0.59 |

|

0.10 | 0.20 | 0.50 | 0.30 | 0.50 |

|

0.10 | 0.20 | 0.50 | 0.20 | 0.71 |

|

0.20 | 0.20 | 0.50 | 0.40 | N/A |

|

0.30 | 0.50 | 0.60 | 0.50 | 0.50 |

|

0.30 | 0.40 | N/A | 0.50 | 0.50 |

|

0.44 | 0.42 | 0.50 | 0.40 | 0.30 |

|

0.17 | 0.30 | N/A | 0.54 | 0.68 |

|

0.20 | 0.40 | 0.60 | 0.50 | 0.70 |

|

0.10 | 0.50 | 1.10 | 0.60 | 0.80 |

|

n/a | 0.50 | 0.70 | 0.60 | 0.40 |

|

0.44 | 1.23 | 1.17 | 1.13 | 1.23 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 04/01/2025

Fusion Markets offered better spreads for the nine most traded currency pairs compared to the industry average.

| Raw Account Spreads | Fusion Markets | Average Spread |

|---|---|---|

| Overall | 0.41 | 0.72 |

| EUR/USD | 0.09 | 0.28 |

| USD/JPY | 0.41 | 0.44 |

| GBP/USD | 0.28 | 0.54 |

| AUD/USD | 0.14 | 0.45 |

| USD/CAD | 0.23 | 0.61 |

| EUR/GBP | 0.25 | 0.55 |

| EUR/JPY | 0.63 | 0.74 |

| AUD/JPY | 0.67 | 0.93 |

| USD/SGD | 0.95 | 1.97 |

2. Raw Account Commission Rate

A major perk of Fusion Markets is their remarkably low commission fees, priced at just $2.25 per lot, per 100k traded. This commission fee is significantly below the industry average and approximately 35% lower than the $3.50 charged by competitors such as Pepperstone and IC Markets.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| Fusion Markets Commission Rate | $2.25 | $2.25 | N/A | N/A |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

Use the calculator below to compare Fusion Markets’ trading costs with competitors such as Pepperstone, Eightcap and CMC Markets, adjusting for trade size, currency pair, and base currency.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

3. Standard Account Fees

Fusion stands out by providing competitive pricing in their standard account, featuring tight spreads and low fees, which are comparable to those found in their ECN accounts.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| Fusion Markets Average Spread | 0.89 | 1.2 | 1.11 | 0.95 | 1.05 | 1.06 | 1.43 | 1.49 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

4. Swap-Free Account Fees

Fusion Markets offers a Shariah-compliant account for all countries except the places where regulations limit their services. Traders who adhere to religious principles can no longer have swap-charged accounts since the Islamic account is specifically designed for them.

5. Other Fees

Fusion Markets doesn’t charge fees for deposits, withdrawals, and inactive accounts but you may be charged for international transfers:

- $0 Deposit Fee; International transfers $30

- $0 Withdrawal Fee; International transfers $30

- $0 Inactivity Fee

Verdict on Fusion Markets Spreads

Fusion Markets stands out as the lowest-cost forex broker globally, offering the lowest commission rates and lower-than-average spreads on their raw account. Their no-commission account is competitive but not as good as the former.

Trading Platforms

Fusion Markets offers four trading platform options: MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

| Trading Plaform | Available With Fusion Markets |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | Yes |

| TradingView | Yes |

| Proprietary Platform | No |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

Every platform has its unique strengths for different traders.

1. MetaTrader 4 (MT4): A standard for Forex trading due to its speed, convenience, and stability

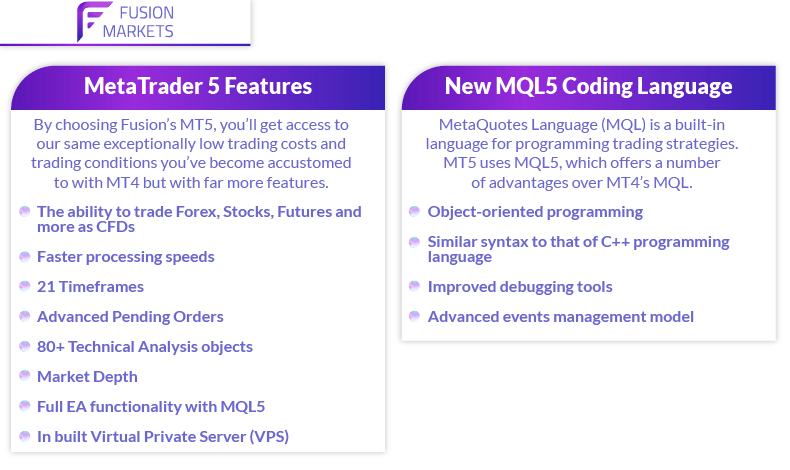

2. MetaTrader 5 (MT5): MT5 offers all the features MT4 has plus more; e.g. while MT4 has 9 timeframes, MT5 has 21

3. cTrader: Advanced automation and charting tools for experienced forex traders

MetaTrader 4

The Fusion Markets MT4 trading platform comes with a suite of features:

- Customisable charts and over 50 indicators and scripts

- Over 250 financial instruments, including Forex, CFDs, and Cryptocurrencies

- Numerous types of orders and one-click trading option

- Automated trading through the use of Expert Advisors

- Virtual Private Server for Forex Trading – clients can use discounted MT4 Forex VPS Hosting Service from third-party providers such as NYC Servers and FXVM. This way, their trades will remain connected 24/7 on a virtual machine

- MyFxBook AutoTrade service that allows clients to follow and copy other traders

- DupliTrade service that allows clients to duplicate the actions of traders with a proven history and track record directly into their Fusion Markets MT4 Account

- Multi-Account Manager (MAM/PAMM) solution for professional traders who manage funds for other clients and seek low costs and reliable technology

MetaTrader 5

If you have not previously used MT4 or you want to trade shares, then you may prefer MT5. MT5 has more timeframes and pending order types than MT4. MT5 offers 21 timeframes and 6 pending order types, while MT4 only has 9 timeframes and 4 pending order types.

cTrader

Fusion Markets now also offers cTrader, known for its intuitive interface and customisation. The platform includes advanced market depth options, over 70 inbuilt indicators, and 26 time frames for comprehensive market analysis.

Its QuickTrade Mode enables one-click trading, while its algorithmic trading solution, cAlgo, allows for the creation and installation of automated strategies and EAs. The platform also features an uncluttered interface with easy access to market sentiment, analysis, and depth.

You can find out more about the Best cTrader Brokers here.

TradingView

TradingView is a charting platform used by over 50M traders worldwide. On TradingView, Fusion clients can execute trades, analyse charts, and run scripts with the help of cTrader integration. You don’t have to download any third-party platform to trade. You can directly trade on TradingView.

Mobile Trading Apps

MT4 mobile apps for iOS- or Android-based smartphones or tablets enable clients of Fusion Markets to manage their accounts, open or close a trade, check live forex prices and use an array of analytical tools on the go.

Trade Experience

As an ECN Forex broker, Fusion Markets offers cutting-edge technology that allows for lightning-fast execution of trade orders for all asset classes. On the broker’s MT4 platform, clients can take advantage of an execution speed of 0.02ms on every trade.

| Overall Rank | Broker | Market Order Execution Speed (ms) | Limit Order Execution Speed (ms) |

|---|---|---|---|

| 1 | Blackbull Markets | 90 | 72 |

| 2 | Fusion Markets | 77 | 79 |

| 3 | Pepperstone | 100 | 77 |

| 4 | Octa | 91 | 81 |

| 5 | OANDA | 84 | 86 |

Additionally, Fusion Markets offers sponsored forex VPS hosting services for both MT4 and MT5, so your automated trading strategies stay online 24/7. Fusion Markets has partnered with third-party server hosting services for trading in the world’s biggest financial centres.

- NYC Servers (comes with a discount of 25% each month with Fusion Markets VPS service)

- FXVM (comes with a discount of 20% each month on a Fusion Markets FXVM VPS)

Verdict

Traders can enjoy the various features that Fusion Markets’ range of platforms provides, from customisable charts to excellent execution speeds.

Is Fusion Markets Safe?

Yes, Fusion Markets is a safe broker, with a score of 42 out of 100.

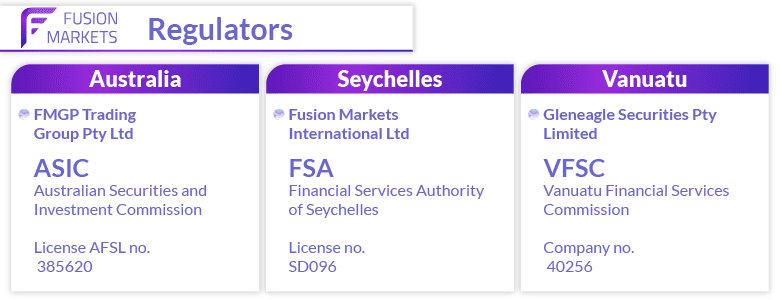

Regulation

Fusion Markets is regulated by the Australian Securities and Investment Commission (ASIC), a leading tier-1 authority. For international activities, the broker is licenced in Vanuatu and Seychelles.

| Fusion Markets Safety | Regulator |

|---|---|

| Tier-1 | ASIC |

| Tier-2 | X |

| Tier-3 | VFSC FSA-S |

Clients who are not based in Australia will have to sign up with a subsidiary of Fusion Markets. This entity is Gleneagle Securities Pty Limited (“Fusion Markets EN”), which is a registered Vanuatu company (Company Number 40256) and is regulated by the VFSC.

Reputation

Fusion Markets was founded in Melbourne, Australia, in 2017, making it a relatively new broker.

Still, the broker gets searched on Google around 12,100 times a month.

Reviews

Fusion Markets has a high TrustPilot score of 4.6/5 from 1,206 reviews, showing that even with its young age, the broker delivers.

Verdict on Fusion Markets’ Trustworthiness

Fusion Markets’ overall trust score is low due to having only one tier-1 regulator, but the broker is still considered safe.

How Popular Is Fusion Markets?

There are 33,100 monthly searches for Fusion Markets each month on Google, making it the 32nd most popular Forex Broker. Similarweb in February 2024 shows a similar story with the broker the 29th most visited, receiving 497,000 global visits.

| Country | 2024 Monthly Searches |

|---|---|

| United States | 2,900 |

| India | 1,900 |

| United Kingdom | 1,900 |

| Canada | 1,900 |

| Australia | 1,900 |

| France | 1,300 |

| Italy | 1,000 |

| Philippines | 1,000 |

| Germany | 880 |

| Sri Lanka | 880 |

| South Africa | 720 |

| Malaysia | 590 |

| Netherlands | 590 |

| Pakistan | 480 |

| Brazil | 480 |

| Spain | 480 |

| Thailand | 480 |

| Poland | 480 |

| Turkey | 390 |

| Nigeria | 390 |

| Singapore | 390 |

| Kenya | 390 |

| Bangladesh | 390 |

| United Arab Emirates | 320 |

| Indonesia | 320 |

| Morocco | 260 |

| Vietnam | 210 |

| Egypt | 170 |

| Japan | 170 |

| Hong Kong | 170 |

| Algeria | 170 |

| Portugal | 170 |

| Saudi Arabia | 140 |

| Sweden | 140 |

| Dominican Republic | 140 |

| Switzerland | 140 |

| Cyprus | 110 |

| Mexico | 110 |

| Colombia | 110 |

| Greece | 110 |

| Austria | 110 |

| Argentina | 90 |

| Tanzania | 90 |

| Uganda | 90 |

| Ghana | 90 |

| Botswana | 90 |

| Ireland | 90 |

| Ethiopia | 90 |

| Cambodia | 70 |

| Venezuela | 70 |

| Ecuador | 50 |

| Taiwan | 50 |

| Jordan | 50 |

| New Zealand | 50 |

| Uzbekistan | 40 |

| Chile | 40 |

| Mauritius | 40 |

| Peru | 30 |

| Costa Rica | 20 |

| Panama | 20 |

| Bolivia | 10 |

| Mongolia | 10 |

2024 Average Monthly Branded Searches By Country

United States

United States

|

2,900

1st

|

India

India

|

1,900

2nd

|

United Kingdom

United Kingdom

|

1,900

3rd

|

Canada

Canada

|

1,900

4th

|

Australia

Australia

|

1,900

5th

|

France

France

|

1,300

6th

|

Italy

Italy

|

1,000

7th

|

Philippines

Philippines

|

1,000

8th

|

Germany

Germany

|

880

9th

|

Sri Lanka

Sri Lanka

|

880

10th

|

Deposit and Withdrawal

Fusion Markets provides various flexible options for funding your account, with no fees or minimum amounts required.

What is the minimum deposit at Fusion Markets?

There is no minimum deposit when trading with Fusion Markets.

Account Base Currencies

These are the base currencies available: USD, AUD, NZD, CAD, HKD, SGD, GBP, EUR, JPY, and CHF. The commission you pay is calculated in your base currency.

Deposit Options and Fees

Fusion Markets does not charge brokerage fees on deposits except if transferring from an international bank to an Australian bank (usually USD $20-$30). This means there are no costs to use Visa, Mastercard, or bank wire from an Australian account to another Australian account.

The following funding options are available:

| Payment Method | Charges | Funding Speed |

|---|---|---|

| Visa Debit/Credit Card | No fee | Instant |

| Mastercard Debit/Credit Card | No fee | Instant |

| Bank Transfer | No fee | 2-3 business days |

| Neteller | No fee | Instant |

| Fasapay | No fee | Instant |

| PayPal | No fee | Instant |

| Skrill | No fee | Instant |

| POLi / bPay | No fee | Instant |

| Cryptocurrency/Digital Wallet | No fee | Instant |

Local bank transfer is also available to the following countries or regions: Singapore, Indonesia, the EEA, the Philippines, the United Kingdom, Malaysia, Vietnam, and Thailand.

Deposits made via Visa or Mastercard will be credited to the client’s accounts immediately. On the other hand, deposits made via a bank transfer internationally to Australia will appear in the client’s trading account within 2 to 3 business days.

Withdrawal Options And Fees

No restrictions and fees are imposed on fund withdrawals as well. Withdrawals via credit or debit cards are processed within 1 to 5 business days, while withdrawals via bank wires are processed within 2 to 5 business days.

Other Fees

The broker has an inactivity fee of $10 per month after an account is not used for a year. It’s important to note that additional fees may apply when trading with a different currency than the base currency selected by the trader. Additionally, overnight fees, also known as swap fees, may be charged by liquidity providers.

Ease To Open An Account

We scored Fusion Markets 14 out of 15 when it comes to account opening. Everything about it is seamless, with the only drawback being a slight delay in the time it took to open an account.

Verdict on Fusion Markets Funding

The absence of deposit and withdrawal fees was a plus, and opening an account was easy.

Product Range

Fusion Markets offers CFD trading on over 250 financial products, including forex pairs, cryptocurrency, commodities, and more.

CFDs

FX Trading

Fusion Markets offers 90+ Forex major, minor and exotic currency pairs. It is a large range considering most brokers offer about 40-70 pairs.

Indices

You can trade 10+ indices across the globe and you pay $0 in commissions. You will be provided access to a group of shares such as the top 500 largest US companies.

Shares

Fusion Markets charges $0 brokerage when trading US Share CFDs. Over 100 of the world’s leading companies are available to trade for much lower costs.

Commodities

Products such as wheat, coffee, sugar, and cocoa are available to trade with Fusion Markets with no commissions or exchange fees.

- 10+ choice of metals including aluminium, nickel, lead and copper (many brokers only offer Gold, Silver, and Palladium)

- 3 Energies – West Texas Intermediate (Crude) Oil, Brent Oil and Natural Gas)

- Soft commodities include wheat, coffee, cotton, and soybeans, among others

Cryptocurrency

You can trade a number of cryptocurrencies with Fusion Markets, which include Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Stellar, EOS, Polkadot, Chainlink and others.

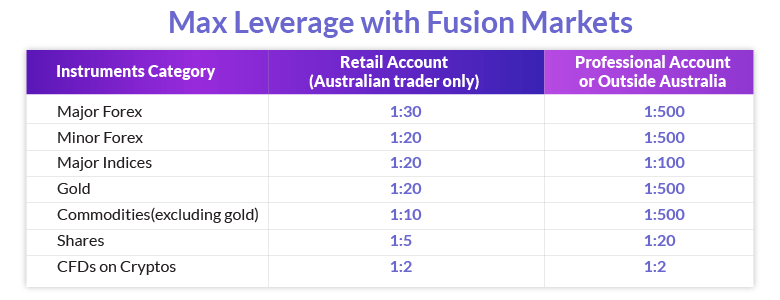

Retail traders in Australia will have restricted leverage because of ASIC regulations. Traders who qualify as professional traders or are outside Australia will have a more generous leverage allowance.

Customer Service

Fusion Markets’ customer service is available 24/7. Traders can contact the brokerage’s customer support team via live chat, phone, email, messenger, Twitter, or the website’s Contact Us section.

Fusion Markets’ customer service is available 24/7. Traders can contact the brokerage’s customer support team via live chat, phone, email, messenger, Twitter, or the website’s Contact Us section.

The live chat button can be found at the lower right corner of the screen, no matter which section of the website you are currently browsing.

Fusion Markets ReviewVisit Fusion Markets

Verdict on Fusion Markets Customer Support

Fusion Markets excels in customer support with its 24/7 availability. Regardless of your location, you can contact them through multiple channels and receive a prompt response.

Research And Education

There is a lack of educational materials concerning a particular market segment (Forex, Equities, Bonds, etc). Some tools can be very helpful for traders. Here are a few that are especially beneficial:

- Video on Demand (VOD) – videos for beginners and advanced traders covering basic Forex trading terms, etc.

- Webinars – how to recognise short-term/long-term trends, price action (candlestick) patterns, long-term chart patterns, etc.

- Tutorials – how to operate the broker’s trading platform and mobile applications,

- EBooks – materials covering different aspects of Forex, Commodity, Stock or Cryptocurrency trading

- Trading Guides (Courses) covering similar topics

While Education features may be lacking, Fusion markets do offer useful research analysis tools. These include:

- Technical Analysis – Such as actionable analyst views such as support and resistance levels

- Technical Insights – Such as technical analysis indicators and interactive charts to help you make the best trading decisions

- Sentiment Indicators – “Market Buzz” is a tool which sifts through thousands of market news to bring you the wisdom of the crowd

- An Economic calendar which Fusion Markets claim to be the best in the market

- Trading Calculator

- Trading Signals

Final Verdict on Fusion Markets

Our team of industry experts at CompareForexBrokers, led by Justin Grossbard, concluded that it’s safe to trade with Fusion Markets with an overall score of 8.5/10.

After compiling multiple factors into our proprietary scoring system, our Fusion Markets review revealed the following:

- Proper Forex regulation and licencing

- Industry-leading commissions on the ECN account

- Low spreads across all major and minor currency pairs

- Industry-leading MetaTrader 4 and 5 trading platform

- No deposit fees and no minimum deposit policy

- Free VPS if you trade over 20 standard lots within a month

Fusion Markets was able to lower costs by 36% compared to other Australian-based forex brokers. Australian FX traders can find excellent trading conditions and top-level customer support experience. Additionally, if you want to open a live trading account with Fusion Markets, it only takes up to 5 minutes.

Visit Fusion Markets

Risk Warning: Trading forex and CFD products carry a high-risk level and it’s not suitable for all investors. Trading leveraged instruments can lead to the complete loss of all your investments. Before investing any of your hard-earned money, make sure you understand how trading on margin works.

Fusion Markets FAQs

What is the minimum deposit at Fusion Markets?

With Fusion Markets, there is no minimum deposit requirement for clients to open a trading account. According to the Australian brokerage, the average deposit made by most retail customers equals $1,500 or more.

What Demo Account Does Fusion Markets Offer?

Fusion Markets’ demo accounts mimic the live accounts and corresponding trading platforms. The account will expire after 30 days and can be extended with account funding.

Is Fusion Markets Safe?

Yes, Fusion Markets is considered a safe broker, with a trust score of 42 out of 100. It is regulated by ASIC, VFSC, and FSA-S.

What Leverage Does Fusion Markets Offer?

The leverage available will depend on your region, the product you are trading, and your client type – Retail or Pro.

The maximum leverage available is as follows: Cryptocurrencies: 10:1, Forex & Metals: 500:1, and Index CFDs: 100:1.

Can I fund with PayPal?

Yes, you can use PayPal to fund your account free of charge. You can use your PayPal wallet or via the debit or credit card option.

Compare Fusion Markets Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Go to Fusion Markets Website

Visit Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research

Ask an Expert

Is Fusion Markets An ECN Broker?

Fusion is an ECN forex broker but due to regulators restricting the use of the term ‘ECN’ it’s self-terms a RAW forex broker. To have market based spreads you need to select their RAW account.

Please is fusion market ecn or market maker and does it offer instant execution on buy stop ,sell stop order?

Fusion Markets is a no dealing desk broker with STP execution. In reality very few brokers have ECN but STP is very similar and you won’t notice much difference in spreads. Execution with Fusion is market execution not instant, this means you won’t get requotes or rarely get rejections.

Does Fusion Markets have an app?

If you mean an in-house developed app then no but you can trade using MT4, MT5 and cTrader apps

Does Fusion Markets support TradingView?

Yes, Fusion Markets offer tradingView

How much does Fusion Markets charge per transaction?

Fusion Markets charges a commission of $2.25 per lot, per side, for every 100k traded. This is 35% lower than the industry average of $3.50 charged by other brokers.

Does Fusion Markets have investor protection?

They do not offer investor protection, but they do provide negative balance protection for clients under ASIC.

How long does Fusion Markets take to verify?

The verification process is usually quick. According to the broker’s website, about 95% of applications being reviewed and processed within an hour.

What is the difference between Fusion Markets Zero and Classic?

Zero is a Raw style account with commission costs in addition to the spread. Classic is a Standard account meaning you only pay spread costs.

What is the maximum leverage in fusion market?

In Australia it is 1:30 for major pairs with a retail account, outside Australia it is 1:500