FxPro Review Of 2025

FxPro is an NDD forex broker regulated by the FCA, FSCA, SCB, and CySEC offering the choice of the MT 4, MT5, or cTrader. We check its range of CFDs with low EUR/USD spreads from 0.5 pips and strong customer support backed by strong FxPro reviews.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

FxPro Summary

| 🗺️ Regulation Country | UK, Cyprus, South Africa, The Bahamas |

| 💰 Trading Fees | Variable Spreads |

| 📊 Trading Platforms | MT4, MT5 Trading Platform, cTrader, FxPro Edge |

| 💰 Minimum Deposit | $100 |

| 💰 Withdrawal Fees | $0 |

| 🛍️ Instruments Offered | Forex, Futures, Indices, Shares, Metals, Crypto, Energies |

| 💳 Credit Card Deposit | Yes |

Why Choose FxPro

Beginners traders looking for a well-known broker with a range of markets may be suitable for FxPro. They have their trading app that is easy to use as well as the usual MT5, MT4 and cTrader (although they don’t offer TradingView). There customer service is also well-suited for those new to trading.

We don’t recommend the broker for intermediate or expert traders as FxPro has some of the highest trading fees. Their standard account has high spreads while their Raw account has competitive spreads but high commission rates. They also don’t offer commission rates in any currency but the USD which isn’t ideal for trades in regions such as Europe, Australia of the UK which have a different base currency.

FxPro Pros and Cons

- Strong regulation

- Multiple platforms available

- No dealing desk

- Complex fee structure

- Limited commission-free options

- High spreads

Open Demo AccountOpen Live Account

*Your capital is at risk ‘73.76% of retail CFD accounts lose money’

The overall rating is based on review by our experts

Trading Fees

This forex broker aggregates the price quotes from multiple liquidity providers (more than +12 LP) and gives forex traders the chance to trade against tier-1 liquidity providers.

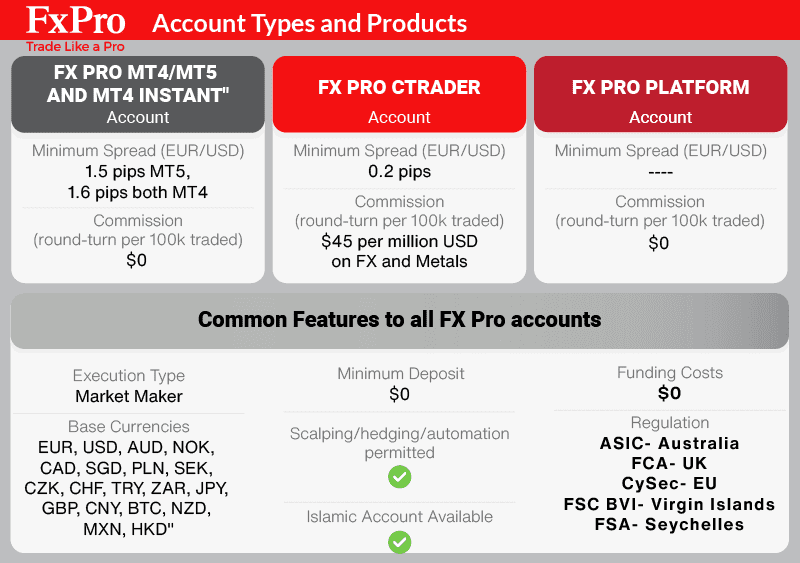

FxPro offers a choice of floating and fixed spreads as follows:

- MT4 and MT5 account types with variable spreads and zero-commission trading

- MT4 fixed spread account has fixed pricing on 7 major Forex pairs

- cTrader account with tight spreads (starting from 0.0 pips) but charges a commission (more on this below)

- FxPro Edge is a fully customisable trading platform that allows clients to trade hundreds of instruments, across six asset classes

1. Raw Account Spreads

FxPro offers a raw spread account on the MT4 platform, providing FX and metals trading. On the cTrader platform, FxPro provides even tighter spreads for FX and metals. In the table below, FxPro’s spreads are lower than the average standard, save for the USD/SGD pair.

| Raw Account Spreads | FxPro | Average Spread |

|---|---|---|

| Overall | 1.08 | 0.72 |

| EUR/USD | 0.2 | 0.28 |

| USD/JPY | 0.31 | 0.44 |

| GBP/USD | 0.21 | 0.54 |

| AUD/USD | 0.31 | 0.45 |

| USD/CAD | 0.5 | 0.61 |

| EUR/GBP | 0.28 | 0.55 |

| EUR/JPY | 0.25 | 0.74 |

| AUD/JPY | 0.5 | 0.93 |

| USD/SGD | 7.19 | 1.97 |

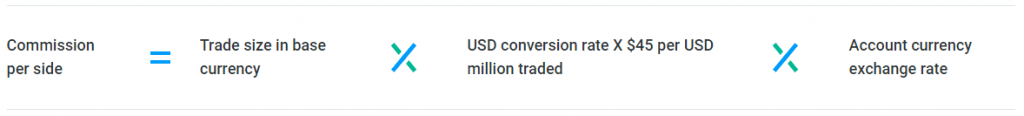

2. Raw Account Commission Rate

FxPro clients are charged a commission only on the FxPro cTrader account.

The commission-based pricing is decent, but there are other good brokers out there offering lower commissions. FxPro charges $3.5 per side for each 1 standard lot traded or a $7 round-turn commission.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| FxPro Commission Rate | $3.50 | N/A | N/A | N/A |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

Note* The commission is only charged on Forex currency pairs and spot metals.

3. Standard Account Fees

FxPro’s variable spread accounts for market execution, meaning if the spread you requested is unavailable, FxPro will execute at the next best available price.

These accounts do not have commission costs so is the same as a standard account other brokers offer. For this reason, you will find spreads are wider than brokers that have ECN pricing and added commission costs.

The below table compares the spreads of FXPro with the average from different brokers that offer a standard account. FxPro spreads to be high when compared side by side with other forex brokers.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| FxPro Average Spread | 1.4 | 1.4 | 1.7 | 1.9 | 1.7 | 1.4 | 1.8 | 2.2 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

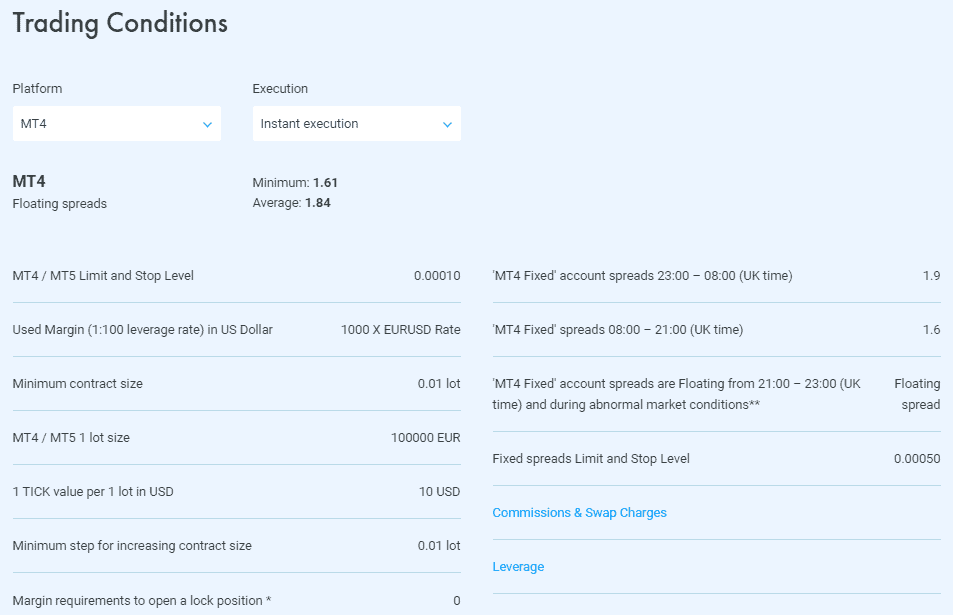

MT4 Platform Instant Execution Spread Review

The FxPro Instant account has a number of features to note:

- Instant execution – requotes when spread does not match the order price

- Fixed Spreads for 7 major currency pairs (EUR/GBP, EUR/JPY, EUR/USD, GBP/JPY, GBP/USD, USD/CAD and USD/JPY

Like with the market execution spreads, we have compared spreads for fixed spreads accounts with brokers that also have fixed spreads.

|

Fixed Spread Accounts

|

|||||

|---|---|---|---|---|---|

|

2.01 | 2.52 | 2.31 | 2.22 | 1.86 |

|

0.90 | 1.10 | 1.50 | 1.50 | 1.00 |

|

0.70 | 1.20 | 1.50 | 1.30 | 1.00 |

|

1.60 | 1.90 | 1.70 | 2.10 | 1.60 |

|

1.50 | 1.80 | 2.00 | 2.00 | 1.80 |

|

3.00 | 3.00 | 3.00 | 3.00 | 3.00 |

|

4.00 | 4.00 | 3.00 | 5.00 | 4.00 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 04/01/2025

One interesting detail to note is that FxPro fixed spreads will vary depending on the time of the day you trade. FxPro has fixed spreads different across two trading sessions.

Trading the EUR/USD currency pair comes with the following fixed spreads:

- Between 11:00 pm – 08:00 am (UK time) – 1.9 pips

- Between 08:00 am – 11:00 pm (UK time) – 1.6 pips

Accounts Offered By FxPro

As you can probably tell, FxPro offers its clients a wide selection of trading accounts. Each trading platform offered by FxPro comes with its own type of trading account and conditions.

Each account is designed for different trading needs.

- FxPro MT4: Offers Instant Execution which means fixed spreads (on selected forex pairs) and the ability to accept or reject any requotes. This account has no commission costs.

- FxPro MT4: Offers market execution with the MetaTrader 4 trading platform. FxPro MT4 allows you to trade all products including shares. This account has no commission costs.

- FxPro MT5: Offers market execution with the MetaTrader 5 trading platform. FxPro MT5 allows you to trade all products except shares. This account has no commission costs.

- cTrader: Offers market execution with the cTrader trading platform. This platform includes a commission when you trade.

- FxPro (Edge) is only for traders in the UK where spread betting is permitted.

4. Swap-Free Account Fees

FxPro provides swap-free accounts for individuals who require them for religious reasons. Fees may be applied after trades on specific instruments remain open for a certain number of days.

5. Other Fees

While there are no deposit and withdrawal fees at FxPro, there is an inactivity fee. It’s a $15 one-off admin fee, then $5 per month after 6 months of inactivity.

Verdict on FxPro Spreads

FxPro offers higher fees due to its higher commission levels and some uncompetitive spreads.

Trading Platforms

| Trading Plaform | Available With FxPro |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | Yes |

| TradingView | No |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

At FxPro forex traders can pick between a variety of award-winning trading platforms available on desktop, browser, and mobile versions. FxPro offerings include the industry-leading trading platforms, including:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- cTrader

- FxPro Edge

In addition to providing top-graded trading platforms, FxPro has won over 85+ international awards that testify about FxPro’s efforts to offer advanced technological solutions. Some of the most prestigious awards received by FxPro are listed below:

Each trading platform comes with its own set of trading conditions. Depending on the preferred forex trading platform, FxPro clients can get access to a different range of markets, different spreads, different order execution models, and different trading tools. These characteristics allow for a more tailored experience. Below, our team of experts will assess what is the best forex trading platform to suit your trading needs.

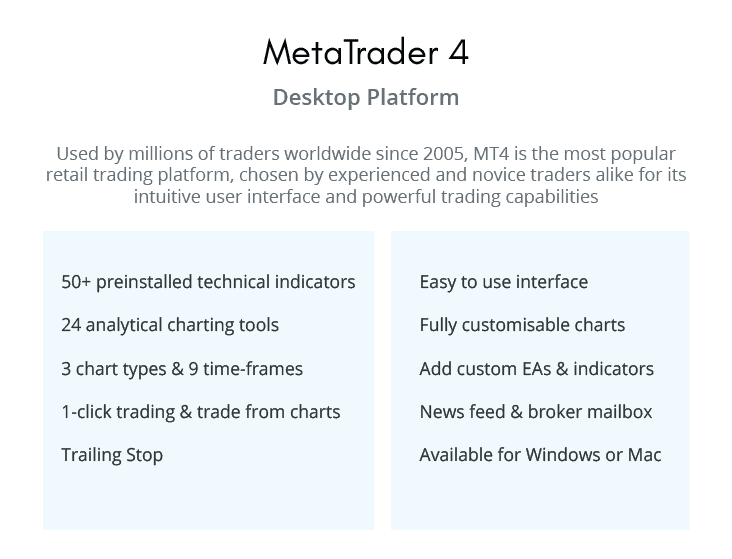

MetaTrader 4

The MetaTrader 4 trading platform is equipped with its native built-in features. Additionally, FxPro combines the MT4 advanced analytical technologies with its price execution model. The key features of the MT4 platform include access to:

- All 6 asset classes

- Both market execution and instant execution

- Intuitive and user-friendly interface

- 3 types of forex charts

- 9 different time-frames

- Micro-lots available

- 50 built-in technical indicators and custom indicators

- Expert Advisors (EAs)

You can download the MT4 trading platform for MAC and Windows. Additionally, FxPro clients can gain exclusive access to powerful trading tools that will enhance your decision-making process. FxPro has also united with Trading Central to offer its customers third-party analytics. Trading Central’s technical analysis package has several key advantages:

- The forex technical analysis is free of charge

- Receive award-winning research on over 8,000 instruments (FX, Equities, Commodities & Indices)

- Around the clock market coverage

- 100s of intraday trading signals with actionable targets and stop-loss levels

- Daily TC Newsletters

- Trading Central uses proprietary algorithms, in-depth mathematical analysis, and artificial intelligence AI. This helps TC detect in real-time support and resistance level, candlestick patterns, and accurate trade signals

Note* The Forex Technical Analysis by Trading Central is available on both MT4 and MT5 trading platforms.

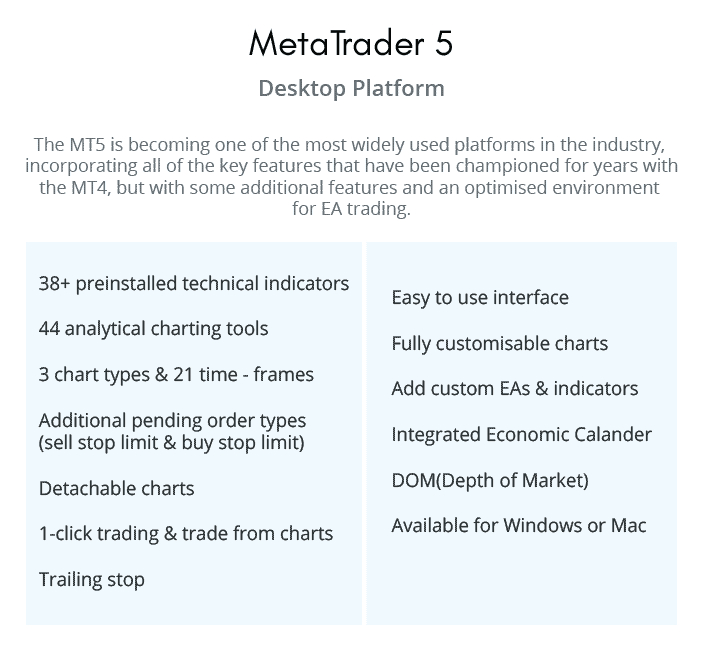

MetaTrader 5

The FxPro MT5 trading platform has been awarded two times in the 2015 and 2016 UK Forex Awards. The range of CFDs available on the MetaTrader 5 platform is more limited compared to the MetaTrader 4 platform. FxPro customers can only trade 5 CFD markets, which excludes support for shares trading. The MT5 platform is the classic go-to solution for more advanced trading features and automated trading solutions.

The key MetaTrader 5 features offered by FxPro include:

- 21 different ETFs

- Lower spreads from 0.6 pips

- Depth of Market (DOM)

- MQL5 programming language

- Market execution model

- Economic calendar inside the MT5 platform

cTrader

The cTrader platform adds an extra layer of advanced market tools. The online trading instruments available on the FxPro cTrader platform include Forex currency pairs, global indices, metals and energies. Trading CFDs on futures and shares are only available on the FxPro MT4 platform. The biggest benefits of FxPro cTrader have been tested by our expert traders. Below you can find our key cTrader platform advantages:

- Big popularity among institutional traders

- Spreads from 0.0 pips on EUR/USD

- Full market execution

- Orders filled in less than 14 milliseconds

You can download FxPro cTrader platform or Windows desktop version, MAC version, or browser-based with the cTrader Web platform.

Mobile Trading Apps

Our team of industry experts also assessed the mobile trading Apps offered by FxPro. Forex traders can choose mobile Apps for both iOS and Android. FxPro brings all the trading tools and features of the desktop version directly to your mobile device. Additionally, this forex broker released its own branded account management tool called FxPro Direct App.

The FxPro Direct App provides the modern trader with a smooth registration process. Having the financial markets readily available at your fingertips can enhance your trading experience. Not many of the online brokers we evaluated can offer their clients multi-functional mobile features like:

- Account management features

- Secure FxPro Wallet for deposits, transfers, and withdrawals

- Built-in Economic calendar

- Advanced trading tools

- Forex push-up alerts

- Secure Trading App (The highest level of encryption)

Note* You can visit Google Play or App Store to download FxPro Direct for free.

Leverage Offered By FxPro By Region

FxPro leverage uses a dynamic margin module that depends upon 3 key factors:

- Local jurisdiction

- Instrument traded

- And trading platform used

The local jurisdiction of FxPro clients is probably the most important factor that will determine the maximum leverage. The maximum level of financial leverage offered by FxPro for forex trading is:

- United Kingdom: FxPro UK Limited (FCA) offer a maximum leverage of 30:1

- Europe and South Africa: FxPro Financial Services Ltd (CySEC and FSCA) offer up to 30:1

- Global: FxPro Global Markets Ltd (SCB) offers higher leverage of 200:1

Note* The above-mentioned leverage levels apply only to forex trading. By comparison, the FxPro leverage offered on CFDs is much lower. The different leverage ratios for different asset classes by each jurisdiction can be studied in the table below.

| Financial Product | FxPro Global (SCB) Maximum Leverage | FxPro Europe (CySEC and FSCA) Maximum Leverage | FxPro UK (FCA) Maximum Leverage |

|---|---|---|---|

| Forex Majors | 200:1 | 30:1 | 30:1 |

| Forex Exotics | 200:1 | 20:1 | 20:1 |

| Gold | 200:1 | 20:1 | 20:1 |

| Silver | 200:1 | 10:1 | 10:1 |

| Major Indices | 200:1 (cTrader 50:1) | 20:1 | 20:1 |

| Minor Indices | 100:1 (cTrader 50:1) | 10:1 | 10:1 |

| Energy | 100:1 | 10:1 | 10:1 |

| Commodities | 50:1 | 10:1 | 10:1 |

| Share CFDs | 25:1 | 5:1 | 5:1 |

| Cryptocurrency | 20:1 | 2:1 | N/A |

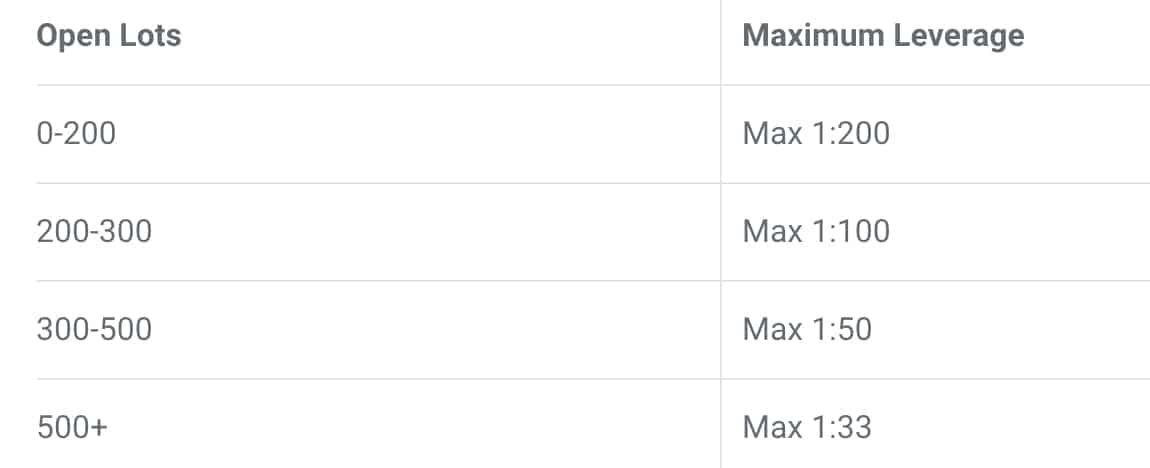

Additionally, the dynamic leverage model offered by FxPro on MT4, MT5 and cTrader trading platforms adjusts to the traders’ positions. The general rule of thumb is that forex traders will get lower leverage ratios as the trading volume per instrument increases. For example, in order to access the FxPro maximum leverage of 200:1, clients need to have less than 200 open lots. The different leverage settings are outlined in the table below.

Open a demo accountVisit FxPro

*Your capital is at risk ‘73.76% of retail CFD accounts lose money’

Is FxPro Safe?

FxPro has a trust score of 60 based on its regulation, reputation, and reviews.

Regulation

We’re regarded as the go-to authority on broker reviews content because among other things we only investigate regulated forex brokers. FxPro operates under the norms and standards imposed by the world’s most trusted forex regulatory bodies. This ensures the highest standard of protection for retail funds. The rules laid down by the forex regulators ensure that all forex traders have fair access to the global markets. FxPro offers a level playing field for all market participants and first-class online trading services.

FxPro is supervised by 4 FX regulatory bodies in the world and has Forex licences in another 28 EEA countries, including:

- Financial Conduct Authority (FCA) in the UK (registration number FRN 509956)

- Cyprus Securities and Exchange Commission (CySEC) in Cyprus (licence number 078/07)

- Financial Sector Conduct Authority (FSCA) in South Africa (authorization number FSP 45052)

- Securities Commission of The Bahamas (SCB) (licence number SIA-F184)

| FxPro Safety | Regulator |

|---|---|

| Tier-1 | FCA CySEC |

| Tier-2 | X |

| Tier-3 | SCB FSC-M FSCA |

Reputation

FxPro Financial Services LTD is an international Forex and an online CFD provider headquartered in London, United Kingdom. The firm was founded in 2006 and accommodates retail and institutional traders worldwide in 170 countries. FxPro Group Limited is the parent corporation of four subsidiaries. Each FxPro branch is regulated by a different financial authority:

FxPro UK Limited – regulated by the Financial Conduct Authority (FCA)

FxPro Financial Services Ltd – the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Conduct Authority (FSCA)

FxPro Global Markets Ltd – The Securities Commission of the Bahamas (SCB)

This UK-based online CFD and (Spread Betting provider in the UK) can serve its large and diverse client base through 4 main worldwide offices spread across three continents (North America, Europe, and Asia):

London (FxPro UK headquarter) 13-14 Basinghall str., City of London, EC2V 5BQ, UK

Monaco – FxPro Administrative Office

Cyprus, Europe

Bahamas

The broker gets around 60,500 monthly search volume on Google.

Reviews

FxPro has a TrustPilot score of 3.9 out of 5.0 from 187 reviews.

How Popular Is FxPro?

There are 60,500 monthly searches for FxPro each month on Google, making it the 25th most popular Forex Broker. Similarweb in February 2024 shows a similar story with the broker the 34th most visited, receiving 412,000 global visits.

| Country | 2024 Monthly Searches |

|---|---|

| South Africa | 9,900 |

| Vietnam | 3,600 |

| Malaysia | 2,400 |

| India | 1,900 |

| Nigeria | 1,900 |

| United States | 1,900 |

| United Kingdom | 1,900 |

| Turkey | 1,900 |

| Kenya | 1,600 |

| Egypt | 1,600 |

| Thailand | 1,600 |

| Indonesia | 1,600 |

| Argentina | 1,600 |

| Pakistan | 1,300 |

| Brazil | 1,300 |

| United Arab Emirates | 1,000 |

| Germany | 1,000 |

| Italy | 1,000 |

| Cyprus | 1,000 |

| Mexico | 880 |

| France | 880 |

| Colombia | 880 |

| Japan | 880 |

| Spain | 720 |

| Morocco | 590 |

| Tanzania | 590 |

| Netherlands | 480 |

| Peru | 480 |

| Ecuador | 480 |

| Poland | 480 |

| Australia | 390 |

| Uganda | 390 |

| Uzbekistan | 390 |

| Canada | 320 |

| Singapore | 320 |

| Venezuela | 320 |

| Hong Kong | 260 |

| Saudi Arabia | 260 |

| Ghana | 260 |

| Botswana | 260 |

| Algeria | 210 |

| Taiwan | 210 |

| Philippines | 210 |

| Greece | 210 |

| Chile | 210 |

| Bangladesh | 170 |

| Cambodia | 170 |

| Portugal | 170 |

| Sweden | 170 |

| Jordan | 140 |

| Dominican Republic | 140 |

| Switzerland | 140 |

| Mauritius | 140 |

| Austria | 110 |

| Ireland | 110 |

| Costa Rica | 110 |

| Sri Lanka | 90 |

| Panama | 90 |

| Bolivia | 70 |

| New Zealand | 70 |

| Mongolia | 70 |

| Ethiopia | 50 |

2024 Average Monthly Branded Searches By Country

South Africa

South Africa

|

9,900

1st

|

Vietnam

Vietnam

|

3,600

2nd

|

Malaysia

Malaysia

|

2,400

3rd

|

India

India

|

1,900

4th

|

Nigeria

Nigeria

|

1,900

5th

|

United States

United States

|

1,900

6th

|

United Kingdom

United Kingdom

|

1,900

7th

|

Turkey

Turkey

|

1,900

8th

|

Kenya

Kenya

|

1,600

9th

|

Egypt

Egypt

|

1,600

10th

|

Deposit and Withdrawal

What is the minimum deposit at FxPro?

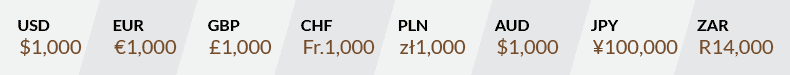

FxPro minimum deposit recommended by their experts is $1000. However, the minimum deposit recommendation is not enforced across the board. FxPro allows deposits as little as $100, which is extremely helpful for forex trading with low capital. There are 9 different base currencies available to fund your FxPro account:

- FxPro UK Limited accepts 7 base currencies including USD, EUR, GBP, AUD, CHF, JPY and PLN

- FxPro Financial Services Limited accepts 9 base currencies including USD, EUR, GBP, AUD, CHF, JPY, PLN, ZAR and RUB

- FxPro Global Markets Limited accepts 9 base currencies including USD, EUR, GBP, CHF, AUD, PLN, ZAR, JPY and RUB

FxPro offers its clients multiple funding options, including

- Bank transfer

- Bank wire transfer

- Debit cards and credit cards (Visa, Visa Electron, Visa Delta, MasterCard, Maestro International and Maestro UK)

- Electronic wallets (PayPal, Skrill, NETELLER and UnionPay)

Deposit Options and Fees

Both FxPro deposits and withdrawals are conducted via an innovative money management tool called FxPro Wallet. This multi-functional account management tool lets FxPro clients transfer funds between their trading accounts in a secure medium. At its core, the FxPro Wallet is synonymous with a bank safe deposit box where you can keep your funds safe and secure.

Withdrawal Options and Fees

FxPro doesn’t charge deposit and withdrawal fees. FxPro Wallet comes with no additional fees, but in some extreme circumstances, FxPro clients can be charged a withdrawal fee depending on the withdrawal method.

Note* In case there is no trading activity, the FxPro withdrawal request will incur additional fees:

- 2.6% for Skrill withdrawals

- 2.0% for NETELLER withdrawals

Negative Balance Protection (NBP)

Negative Balance Protection (NBP)

With the FxPro negative balance protection policy, clients can’t lose more than their initial deposit. FxPro clients are protected from any losses beyond their initial investment. FxPro enforces its negative balance protection policy across all its financial products from forex to CFDs. While the negative balance protection policy is more common to be enforced in Europe due to the ESMA rules, FxPro treats all of its clients the same regardless of their jurisdiction.

Ease To Open An Account

You can open an online trading account by following an easy four-step process:

- Register via FxPro Direct

- Identity and residency verification requirements

- Deposit money into your FxPro Direct Account

- Start trading

Choosing the right trading account depends on your trading style and other important considerations (spreads, leverage, technical tools, trading platforms, execution speed, etc.).

Open a demo accountVisit FxPro

*Your capital is at risk ‘73.76% of retail CFD accounts lose money’

Product Range

FxPro is an online trading provider that offers the following financial services:

- Forex Trading

- CFD Trading

- Spread betting (the UK only)

This forex broker gives retail investors access to 7 major markets:

- Forex (70 major and minor currency pairs)

- Futures (20 popular futures contracts)

- Indices (24 global stock indices)

- Global Shares (2000+ shares from the exchanges of 8 countries including the US, UK, France, and Germany)

- Metals (7 metal pairs including spot gold, silver, and platinum)

- Energies (3 of the most popular spot energies Brent oil, WTI oil, and natural gas)

- Cryptocurrencies (top five crypto pairs including Bitcoin, Bitcoin Cash, Litecoin, Ripple, and Ethereum)

Note: You are not able to trade cryptocurrencies with FxPro’s FCA-regulated branch. The FCA recently changed regulations in the UK, banning retail traders from trading this high-risk product.

Note 2: Stock trading requires the use of MT5 trading platform

Customer Service

FxPro has an award-winning customer support service available around the clock whenever the markets are open. In 2014, FxPro was named the Best Forex Customer Service Brand, Europe, by Global Brands Magazine. FxPro offers its customer service in different languages catering to a global customer base. Our team of experts was able to validate 21 different languages at fxpro.com.

The FxPro customer support team is available through several means of communications, including:

- Live chat

- Fax

- By phone

- Through FxPro Help Centre

FxPro Live chat is probably the fastest way to get in touch with one of the FxPro representatives.

Research and Education

The Help Center is equipped with a search feature where potential FxPro customers can type to search for the right information. The most interesting section is the Featured Articles, which tries to answer simple questions like how to open a live trading account and the most asked question. If you have exhausted this option and still couldn’t find a satisfactory answer, you can proceed forward and talk directly with FxPro staff members.

Another feature that makes forex broker FxPro stand out among its competitors is the “Watch and Learn” section. Here, FxPro answers the most frequently asked questions about their financial services.

No Dealing Desk Execution Model

FxPro offers a No Dealing Desk execution model (NDD). As an NDD forex broker, FxPro executes clients’ orders anonymously without any intervention in the exchange rates. NDD forex brokers guarantee that there are no requotes of prices and spreads are kept low. Additionally, besides having direct market access to the interbank market, there is no conflict of interest between the forex broker and the FX trader.

Note* FxPro is not a true ECN forex broker, but due to its NDD execution model, it can’t be categorised as a market maker either.

FxPro trading servers are co-located inside the world’s largest data centre and co-location provider Equinix. FxPro currently operates its proprietary aggregator Quotix via cross fibre cables from two locations:

- Equinix LD5 Slough Data Centre in London, UK

- Equinix Datacenter AM4 in Amsterdam, Netherlands

After evaluating all aspects of FxPro’s No Dealing Desk execution model, we have found the following advantages:

- Fast order execution speed (client orders are executed in less than 14 milliseconds)

- Up to 7,000 orders are processed per second

- Award-winning execution model (BEST EXECUTION BROKER GLOBAL, 2017 by Global Brands Magazine)

- Deep liquidity that can be accessed through a network of 10 tier-one liquidity providers (Morgan Stanley, Barclays, JP Morgan, UBS, Deutsche Bank, BNP Paribas, Bank of America, Nomura, Citibank, RBS)

- Most client order flow is matched internally and only partial exposure is hedged with its liquidity providers

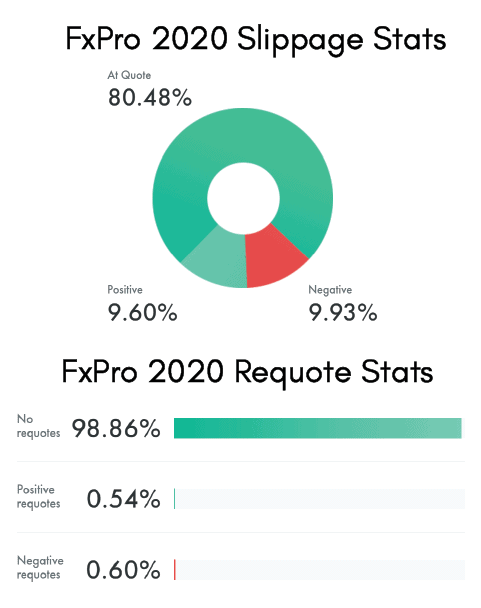

- According to the 2020 slippage statistics, 80.48% of market orders were executed at the desired price

- 9.60% of FxPro’s client order received positive slippage, and 9.93% received negative slippage

- 98.86% of FxPro orders are executed with no requotes

Open a demo accountVisit FxPro

*Your capital is at risk ‘73.76% of retail CFD accounts lose money’

FxPro for clients in the United Kingdom

Clients in the UK should be aware of a few differences between the FxPro product compared to products offered by FxPro in other regions. This is mostly to meet the requirements of the FxPro regulator.

FxPro Business and Regulation

- FxPro UK Limited is a subsidiary of FxPro Group Limited with business registration 06925128. FxPro is regulated by FCA registration 509956.

FxPro is registered at the following address: FxPro UK Ltd: 13/14 Basinghall Street, City of London, EC2V 5BQ, UK. and can be reached at the contact +44 (0) 203 151 5550

FCA needs to follow compliance guidelines set by ESMA MiFID II which are higher than other regulators outside Europe. This explains why FxPro leverage for clients in the UK (and Europe) is lower than FxPro offers other clients outside Europe. Clients wishing higher leverage can apply for a professional account however will need to meet qualification criteria. With a Pro account, leverage is 1:500.

Leverage with Retail vs Professional Account

| Max Retail Leverage | Professional Leverage | |

|---|---|---|

| Forex Majors | 1:30 | 1:500 |

| Forex Minors | 1:20 | 1:500 |

| Gold | 1:20 | 1:200 |

| Silver | 1:10 | 1:200 |

| Platinum | 1:10 | 1:50 |

| Major Indices | 1:20 | 1:500 (cTrader 1:50) |

| Minor Indices | 1:10 | 1:200 |

| Major Futures | 1:20 | 1:50 |

| Minor Futures | 1:10 | 1:50 |

| Spot Energies | 1:10 | 1:100 |

| Future Energies | 1:10 | 1:100 |

| Futures Commodities | 1:10 | 1:25 |

| Shares CFD | 1:5 | 1:25 |

| Cryptocurrencies | 1:2 | 1:5 |

To qualify for the professional account, 2 of the following is needed:

- You have made an average of at least 10 significant trades per quarter over the past year

- You manage a financial portfolio that exceeds 500,000

- You work or have worked relevant positions of at least one year in the financial sector

If you qualify for a professional account, you will also get the following benefits Negative Balance Protection, which is significant because most other brokers don’t offer this with professional accounts. This can be useful given you are trading with High Leverage Forex Brokers. Professional traders will, however, lose access to the Financial Services Compensation Scheme.

FxPro Edge Trading Platform For UK Spread Betting

Since 2017, FxPro launched its own proprietary spread betting platform called FxPro Edge. It is worth mentioning that spread betting is only available through FxPro UK Ltd. FxPro allows financial spread betting to take place on a wide range of markets including forex currency pairs, shares, spot indices, spot metals, and spot energies. Our industry experts at Compare Forex Brokers will try to outline below what are the benefits of spread betting with FxPro:

Since 2017, FxPro launched its own proprietary spread betting platform called FxPro Edge. It is worth mentioning that spread betting is only available through FxPro UK Ltd. FxPro allows financial spread betting to take place on a wide range of markets including forex currency pairs, shares, spot indices, spot metals, and spot energies. Our industry experts at Compare Forex Brokers will try to outline below what are the benefits of spread betting with FxPro:

- In total, spread betters have access to over 430+ financial instruments

- Commission-free trading

- Tighter spreads

- A tax-free way to speculate on the price movement of several global markets

View our full FxPro spread betting review on our sister website spread-bet.

Final Verdict on FxPro

FxPro has one of the highest numbers of retail clients with over 1,866,000 million trading accounts. FxPro’s primary source of revenue comes from its large customer base. With such a large number of retail clients opting for a FxPro trading account, it’s important to examine if FxPro is a trusted broker.

FxPro FAQs

What is the minimum deposit required for FxPro?

FxPro recommends a minimum deposit of $1,000 for optimal trading, although clients can deposit as little as $100. This flexibility allows both low-capital traders and professionals to start trading.

What platforms does FxPro offer?

FxPro provides access to multiple trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader. Each platform comes with unique features suited to different trading needs and styles.

How are FxPro’s spreads and fees structured?

FxPro offers both variable and fixed spreads depending on the account type. For example, cTrader accounts feature tight spreads from 0.0 pips but include commissions, while MT4/MT5 accounts have zero-commission trading with variable spreads.

Does FxPro offer leverage?

Yes, FxPro offers dynamic leverage based on the local jurisdiction and instrument. For forex trading, leverage can go up to 200:1 for global clients, while European and UK clients are limited to 30:1.

What customer support does FxPro provide?

FxPro offers 24/5 customer support via live chat, email, phone, and fax. Support is available in over 20 languages, ensuring traders worldwide can get assistance quickly and efficiently.

About the Review

The FxPro review was crafted by our devoted team of investment and business professionals at Compare Forex Brokers. We’re regarded as the go-to authority on broker review content. We have spent considerable effort assessing all FxPro features, starting from broker’s platforms, account types, regulation, type of products offered, the quality of FxPro service, the total costs and fees, the mobile experience and the FxPro NDD execution model.

We used a standardised process to collect all the information needed to assess FxPro’s performance. And, based on our proprietary scoring system, we concluded that it’s safe to trade with FxPro.

Risk Warning: Forex and CFD Trading are considered to be high-risk investment vehicles. Due to the high degree of leverage involved in FX trading, traders can experience a complete loss of their money.

Compare FxPro Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research

Ask an Expert

The fact that slippages occur rarely gives additional confidence in trading, especially during high volatility. It allows for better planning of trading operations.

Not sure if this is a question but FxPro does have the option of Fixed spreads with MT4 for 10 currency pairs which can ensure you don’t experience slippage. You can also choose instant execution with MT4 which allows you to reject requotes.

Is Fxpro a good Investment?

You don’t invest in a broker, you invest in products on the market. That said, FxPro is a decent broker but you can find other brokers with better spreads.

Is FxPro good for scalping?

Yes, it you use MT4 Fixed, then 9 currency pairs are available as a fixed spread. Fixed spreads are popular with scalpers as their trading plans often relies of predictable price moments.

I’m greatly appreciative of the trading platform’s dependability and rapid customer service. The real-time market information is crucial for my short-term trading approaches. The clear transparency and promptness foster trust for sustained success.

The mobile app of this platform has a high rating in app stores, indicating its effectiveness and convenience. What can you say about their mobile app?

FxPro trading platform is called FxPro Direct. The app comes with a wealth of indicators and analysis tools thanks to its use of TradingView Charts, you can also use the app in 19 languages. Overall,

What documents are required for FxPro?

To sign up for a trading account with FX Pro you will need to provide an international passport, and national ID Card or drivers licence. You might also need to provide proof of residence for the last 6 months.

There’s also Fxpro Edge for spread betting. They do have a huge array of platforms tbh.

One of the best for scalping too, I found. Even your table says that, except for USD/SGD (who trades that??).