FXTM Review Of 2025

FXTM is a global forex broker offering access to a wide range of markets through the MT4/MT5 platform. Sometimes referred to as ForexTime, FXTM offers clients low-cost trading, fast execution, and world-class forex education.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

FXTM Summary

| 🗺️ Regulation Country | Australia, Europe, Mauritius |

| 💰 Trading Fees | Variable Spread with no commission |

| 📊 Trading Platforms | MetaTrader 4, MetaTrader 5 |

| 💰 Minimum Deposit | $500 |

| 💰 Withdrawal Fees | $25 |

| 🛍️ Instruments Offered | Forex, CFD, Crypto, Commodities |

| 💳 Credit Card Deposit | Yes |

Why Choose FXTM

After conducting an updated 2025 review of FXTM, we have found them to be the best-rated forex broker for forex education and analysis when trading CFDs. Whether you’re a new trader looking for tutorials and webinars on the basics, or you’re an experienced trader looking for world-class market analysis. It’s worth checking out FXTM.

The only downside to trading CFDs and forex with FXTM is their lack of a cTrader option for those who trade strategies requiring market depth, but their low ECN spreads available on MT4 and MT5 are more than enough for most. The sheer number of CFDs to trade on some of the highest leverage available makes FXTM a clear choice.

FXTM Pros and Cons

- Wide range of account types

- User-friendly mobile trading platform

- Strong customer support availability

- Limited cryptocurrency offerings

- Higher spreads on standard accounts

- Inactivity fee

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

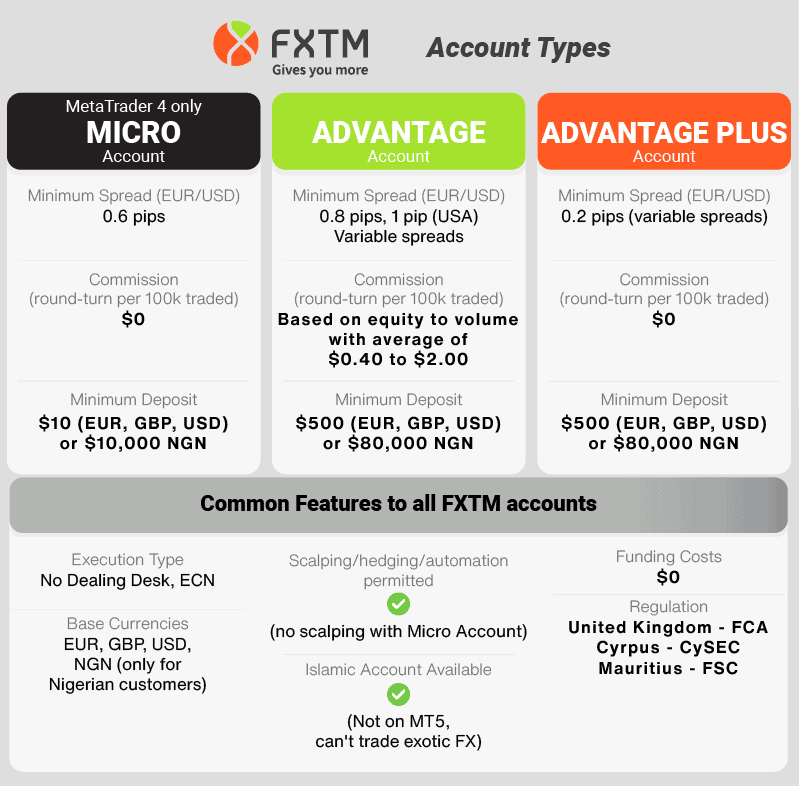

FXTM offers six account types, split into two main categories. Each account type allows clients to focus on different asset classes, as well as offering different spread and commission price models.

1. Raw Account Spreads

These accounts feature much tighter spreads than standard accounts, but a small commission charge is applied to your trades. For this reason, ECN accounts are more suited to experienced traders who may be trading on a larger account.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 04/01/2025

n/a

0.50

0.70

0.60

0.40

0.10

0.20

0.50

0.30

0.50

0.18

0.24

0.67

0.39

0.70

0.06

0.27

0.23

0.49

0.59

0.10

0.20

0.50

0.20

0.71

0.20

0.20

0.50

0.40

N/A

0.30

0.50

0.60

0.50

0.50

0.30

0.40

N/A

0.50

0.50

0.44

0.42

0.50

0.40

0.30

0.17

0.30

N/A

0.54

0.68

0.20

0.40

0.60

0.50

0.70

0.10

0.50

1.10

0.60

0.80

n/a

0.50

0.70

0.60

0.40

0.44

1.23

1.17

1.13

1.23

Overall, FTXM raw spreads tend to be higher than the average, as shown in the table below.

| Raw Account Spreads | FXTM | Average Spread |

|---|---|---|

| Overall | 0.96 | 0.72 |

| EUR/USD | 0.1 | 0.28 |

| USD/JPY | 0.6 | 0.44 |

| GBP/USD | 2 | 0.54 |

| AUD/USD | 0.5 | 0.45 |

| USD/CAD | 0.6 | 0.61 |

| EUR/GBP | 0.6 | 0.55 |

| EUR/JPY | 0.4 | 0.74 |

| AUD/JPY | 0.7 | 0.93 |

| USD/SGD | 3.1 | 1.97 |

ECN Accounts allow your orders to be matched with the best bid and ask prices, offered by a list of top-tier liquidity providers. Short for an Electronic Communication Network, they are an automated connection to liquidity providers that cut out the No Dealing Desk Brokers middle man at your broker.

Trading on an ECN account ensures that you get the absolute best price in the market at any given time. FXTM use tiered commissions which mean commission costs will are lower if you hold more equity in your FXTM trading account and the more volume you trade.

ECN Accounts at a glance:

- MT4 and MT5

- $500 minimum deposit

- Leverage up to 1:2000 (1:30 in Europe/The UK)

- Spreads from 0.0 pips

Use the calculator below to compare FXTM’s trading costs with competitors such as Pepperstone, Eightcap and CMC Markets, adjusting for trade size, currency pair, and base currency.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

ECN Zero Account

An FXTM ECN Zero Account has all the features of the ECN account above but without the commission charges. To compensate for no commissions, you’ll notice that your spreads are slightly wider, but still under the level of Standard Accounts.

ECN Zero Accounts at a glance:

- MT4 and MT5

- $500 minimum deposit

- Leverage up to 1:2000 (1:30 in Europe/The UK)

- Spreads from 1.5 pips

- No Commissions

Another broker that has 1:2000 leverage is HFM, read our HFM Review to find out what we have to say about this broker.

2. Raw Account Commission Rate

Commissions start as low as $2 per lot ($4 round-turn) but as high as $10 per lot ($20 round-turn).

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| FXTM Commission Rate | $4.00 | N/A | N/A | N/A |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

3. Standard Account Fees

There are no commissions on any of the FXTM standard account types. Standard account types are best for new traders who may be trading on smaller accounts.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| FXTM Average Spread | 2.1 | 2.5 | 2.5 | 2.1 | 2.8 | 2.7 | 2.5 | 3.6 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

The FXTM Standard Account is a no-frills option for new traders who want to start trading forex without worrying about extra commissions or fees. The account is not ‘standard’ as such, with the name coming from the fact that traders can trade standard lots.

Standard Accounts at a glance:

- MT4 and MT5

- $500 minimum deposit

- Maximum leverage up to 1:1000 (30:1 in Europe/The UK)

- Spreads from 1.3 pips

- No Commissions

Cent Account

The Cent Account is designed to give new traders a taste of the psychology required to succeed. Used primarily for testing purposes under live conditions, they have an amazingly low minimum deposit level. As the name suggests, your account balance is always displayed in cents. This means that a $10 deposit will be displayed as 1000 cents.

Many traders use Cent Accounts alongside a Standard Account to test new EAs under live trading conditions.

Cent Accounts at a glance:

- MT4 only

- $10 minimum deposit (displayed as 1000 cents)

- Maximum leverage up to 1:1000 (30:1 in Europe/The UK)

- Spreads from 1.5 pips

- No Commissions

Shares Account

For traders looking to expand their trading portfolio, the FXTM Shares Account gives you access to over 180 individual share CFDs. The accounts feature fixed leverage of 1:10 (1:5 in Europe/The UK), no commissions and real-time price data sourced from the NYSE and NASDAQ.

Shares Accounts at a glance:

- MT4 only

- $500 minimum deposit

- Leverage fixed at 1:10 (1:5 in Europe/The UK)

- Spreads from 0.1 pips

- No Commissions

FXTM Pro Account

The FXTM Pro Account is designed for professional traders only. If you trade an institutional account, manage a hedge fund or simply manage your fund of $25,000 or more, this account is for you.

When trading on an FXTM Pro Account, you can be assured that you’ll never be re-quoted or charged a commission. Just direct access to deep pools of liquidity with absolutely minimal interference from FXTM.

FXTM Pro Accounts at a glance:

- MT4 and MT5

- $25,000 minimum deposit

- Leverage 1:200

- Spreads from 0.0 pips

- No Commissions

The Pepperstone vs FXTM review page will help you compare the spreads and features and see FXTM as a leading spread broker.

4. Swap-Free Account Fees

Muslim traders have the option to choose a swap-free account in order to comply with Islamic principles. A swap-free account removes any interest-related charges, in accordance with Sharia law, which prohibits usury.

5. Other Fees

There are no charges on deposits and withdrawals. There is an inactivity fee, however, which is $5 per month after 6 months.

Verdict on FXTM Fees

If your trading account isn’t well-funded or your volumes are low, FXTM can be quite expensive due to its commission costs. For most retail traders, it’s generally easier to choose a broker with standard commission rates and tight spreads.

Trading Platforms

FXTM is known as a specialist MetaTrader broker, focusing its CFD trading platform offering exclusively on the MT4 and MT5 platforms. Unfortunately, this means that if you’re looking to use cTrader, then you are unable to with this broker.

| Trading Plaform | Available With FXTM |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | No |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

The sheer popularity of the MT4 platform has meant that FXTM will never close MT4 accounts and force clients to change to MT5. If you want to stick to MT4 and the massive back-library of custom indicators and EAs that have been developed for it, then you won’t have to worry about being forced to change by FXTM.

Take a look at the two platforms below.

MetaTrader 4

MetaTrader 4 (MT4) is the tried and tested trading platform that has catapulted forex trading into the mainstream. Whether you have a PC, Mac, mobile, tablet, then FXTM has an MT4 option for you.

The biggest reason to choose MT4 is to gain access to the endless library of custom indicators and expert advisors that have been developed specifically for the platform. With an inability to seamlessly transfer indicators from MT4 to MT5, many traders prefer to stick to MT4 to continue trading their proven strategy.

FXTM’s MT4 platform also allows traders to access the multi-terminal feature that is unavailable on MT5.

MetaTrader 5

MetaTrader 5 (MT4) is the next generation trading platform from MetaQuotes. Just like on MT4, you can access the MT5 platform on PC, Mac, mobile trading (IOS and Android), tablet and through any browser thanks to the WebTrader option.

While many features are exclusively available on MT5, the fact that you can’t transfer custom indicators and EAs without having the code re-written remains the platform’s biggest drawback.

You can, however, trade all the major markets offered by FXTM directly from your charts in the MT5 platform and access several exclusive features that we go over below.

Comparing MT4 and MT5

FXTM encourages traders to download both the MT4 and MT5 platforms, then use them in parallel before making their final decision. However, while the broker ensures that they won’t be deactivating MT4 soon, it will happen eventually.

There are many reasons to start using FXTM’s MT5 platform or make the switch from your current MT4 broker.

Key reasons to use MT5:

- Order execution types and conditions – More in MT5

- Partial order filling – MT5 only

- Market depth – MT5 only

- Indicators, objects, and timeframes – More in MT5

- Economic calendar – MT5 only

- Netting – MT5 only

- Hedging – Now available in MT4 and MT5

If you’re a new client to FXTM, it might be worth considering choosing the MetaTrader 5 (MT5) platform from the start.

Is FXTM Safe?

FXTM has a trust score of 60, based on its regulation, reputation, and reviews.

Regulation

FXTM have multiple business entities, regulated by multiple financial authorities.

Your level of regulatory protection depends on your country of residence when you open an account.

- ForexTime Limited (www.forextime.com/eu) – CySEC or Cyprus Securities and Exchange Commission (CIF license number185/12) + Financial Sector Conduct Authority (FSCA) of South Africa (FSP No. 46614) + Financial Conduct Authority of the UK (license number 600475)

- ForexTime UK Limited (www.forextime.com/uk) – Financial Conduct Authority (FCA) in the UK (license number 777911)

- Exinity Limited (www.forextime.com) – Mauritius Financial Services Commission (license number C113012295)

| FXTM Safety | Regulator |

|---|---|

| Tier-1 | CySEC FCA |

| Tier-2 | FSCA |

| Tier-3 | FSC-M CMA |

Reputation

FXTM began in 2011 in Limassol, Cyprus. The broker has around 49,500 searches on Google monthly.

Reviews

FXTM has a TrustPilot score of 3.6 out of 5.0 from 778 reviews.

How Popular Is FXTM?

There are 40,500 monthly searches for FXTM each month on Google, making it the 31st most popular Forex Broker. Similarweb in February 2024 shows a similar story with the broker the 31st most visited, receiving 473,000 global visits.

| Country | 2024 Monthly Searches |

|---|---|

| India | 5,400 |

| Nigeria | 5,400 |

| United States | 1,600 |

| Vietnam | 1,600 |

| Malaysia | 1,300 |

| Kenya | 1,300 |

| United Kingdom | 1,000 |

| United Arab Emirates | 1,000 |

| South Africa | 1,000 |

| Pakistan | 880 |

| Turkey | 720 |

| Egypt | 720 |

| Thailand | 590 |

| Algeria | 590 |

| Brazil | 480 |

| Indonesia | 480 |

| Spain | 390 |

| Hong Kong | 390 |

| Canada | 320 |

| Germany | 320 |

| Australia | 320 |

| Mexico | 320 |

| Taiwan | 320 |

| Morocco | 320 |

| Bangladesh | 320 |

| France | 260 |

| Colombia | 260 |

| Singapore | 260 |

| Japan | 260 |

| Saudi Arabia | 260 |

| Philippines | 260 |

| Ghana | 260 |

| Italy | 210 |

| Venezuela | 210 |

| Cyprus | 210 |

| Tanzania | 210 |

| Netherlands | 170 |

| Argentina | 170 |

| Peru | 170 |

| Jordan | 170 |

| Uganda | 170 |

| Ecuador | 140 |

| Sri Lanka | 140 |

| Cambodia | 110 |

| Ethiopia | 110 |

| Poland | 70 |

| Greece | 70 |

| Dominican Republic | 70 |

| Botswana | 70 |

| Switzerland | 50 |

| Portugal | 50 |

| Chile | 50 |

| Bolivia | 50 |

| Austria | 50 |

| Sweden | 50 |

| Mauritius | 40 |

| Uzbekistan | 30 |

| Ireland | 30 |

| Costa Rica | 30 |

| New Zealand | 30 |

| Panama | 20 |

| Mongolia | 10 |

2024 Average Monthly Branded Searches By Country

India

India

|

5,400

1st

|

Nigeria

Nigeria

|

5,400

2nd

|

United States

United States

|

1,600

3rd

|

Vietnam

Vietnam

|

1,600

4th

|

Malaysia

Malaysia

|

1,300

5th

|

Kenya

Kenya

|

1,300

6th

|

United Kingdom

United Kingdom

|

1,000

7th

|

United Arab Emirates

United Arab Emirates

|

1,000

8th

|

South Africa

South Africa

|

1,000

9th

|

Pakistan

Pakistan

|

880

10th

|

Deposits and Withdrawal

What is the minimum deposit at FXTM?

The minimum deposit requirement at FXTM is $10.

Account Base Currencies

When setting up your CFD trading account, you will be able to choose from three base currency options being the EUR, USD or GBP. If you are a resident of Nigeria, you also have the option of the NGN.

Deposit/Withdrawal Options and Fees

To deposit and withdraw funds, you can use a variety of payment methods, including:

- Bank transfer

- Bank wire/wire transfer

- Bitcoin Payments

- Neteller

- Perfect Money

- Skrill

- Webmoney

- QIWI

- Credit Cards (Visa and Mastercard)

- Debit Cards

- China Union Pay

- Western Union

- WorldPay

- Yandex Money

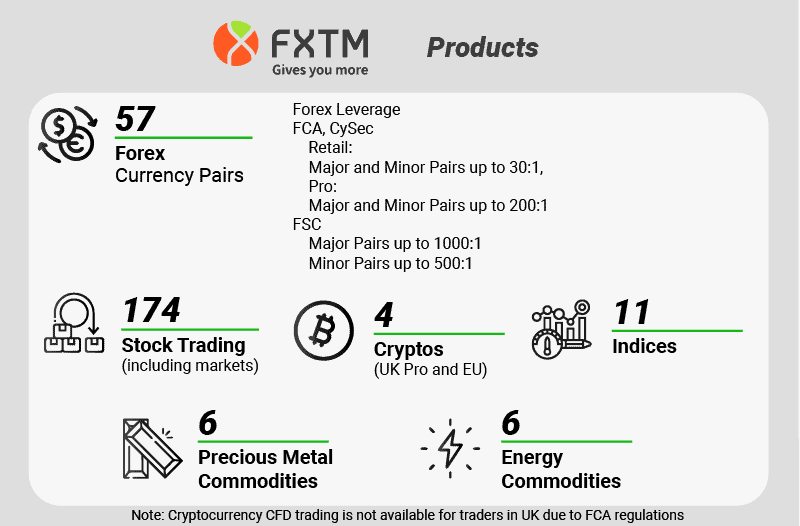

Product Range

FXTM offers clients the opportunity to trade over 250 financial instruments, all from MT4/MT5.

CFDs

One of the most exciting aspects of FXTM’s range of CFDs to trade is the fact that traders no longer have to change platforms to trade stocks CFDs. Simply trade all asset classes under a single account on the one trading platform.

The range of CFDs that you’re able to trade with FXTM is outlined below.

Forex

FXTM allows you to trade the most popular major, minor and exotic forex currency pairs, on MT4 and MT5. The $5 trillion a day forex market is moving 24 hours a day, 5 days a week, and FXTM is your gateway to all the major currency pairs such as EUR/USD and GBP/USD.

Commodities

Whether you trade spot metals, energy, or soft commodities, FXTM has a CFD market for you. Whether it’s the main part of your trading strategy or simply used for diversification, take advantage of the volatility in commodities markets with FXTM.

Indices

If you’re looking to take advantage of movements in an entire country’s stock market, you’re still able to trade index CFDs on MT4 with FXTM. FXTM’s Indices markets have some of the lowest spreads, making them a popular choice.

Cryptocurrencies CFDs

FXTM allows clients to trade all the major cryptocurrencies, in the form of CFDs. All cryptocurrency CFDs are traded in currency pairs just like forex markets, against the US Dollar. So, for example, if you want to trade a Bitcoin CFD, then you’d trade a BTC/USD CFD.

It is important to note that to access crypto financial instruments, you will need to sign up for an FXTM subsidiary outside of the UK. The UK’s financial authority, the FCA, recently changed regulation banning retail traders from trading cryptocurrencies. Professional traders still have access to crypto markets.

Share Trading

As highlighted above, the ability to trade individual share CFDs on MT4 is one of the most exciting aspects of opening an account with FXTM. With real-time prices sourced directly from the NYSE and the NASDAQ, trade price movements of some of the largest global companies.

Copy Trading

While we’ve rated FXTM as the best broker for education and analysis, if you have concluded that learning to trade just isn’t for you and you’re simply after trading signals, then FXTM’s copy trading solution may be the answer.

FXTM Invest is a copy trading service similar to the setup at eToro. You follow the FXTM traders, known as strategy managers in this case, with the risk management principles and system that align with your expectations.

If you’re a risk-tolerant trader, then choose a high-risk system. If you want short term results, then choose a scalping system. The choice is entirely up to you.

Steps toward copy trading with FXTM Invest:

-

- Choose a Strategy Manager

- Make a deposit

- Automatically copy the strategy

- Cash in when they profit

- Share a percentage with the Strategy Manager.

Customer Service

As you can see by the multiple business divisions, FXTM is a truly global forex broker. As a result, their customer support is diverse and wide-reaching to match each client’s needs depending on the region.

This means that they have a massive customer support team that is ready to answer your questions, in whatever language you ask them in. Their client focus ensures that they are there to make your trading experience as seamless as possible.

FXTM support methods:

- Web. The support section of the FXTM website featuring frequently asked questions is your ideal place to start.

- Live Chat. If you’re looking for instant answers to all of your questions, whether you’re a client or not, this is your best bet.

- Email. For those in-depth questions that require a solid record of communication, the FXTM support email address is also available to all.

- Phone. Call any of the regional office phone numbers and speak to someone in your language.

Research and Education

Rated as the broker offering the best forex education opportunities for CFD trading, the learning material available to FXTM account holders is second to none.

New traders or those simply looking to learn new methodologies are well catered for, with a multitude of tutorials and articles throughout the website. Experienced traders, on the other hand, have access to some of the brightest economic minds in the game.

Forex Education

FXTM allows traders to expand their forex trading knowledge thanks to a plethora of educational content. The market analysis and education sections of their website are some of the most in-depth that we’ve come across.

Ways to learn forex with FXTM:

- Forex eBooks

- Webinars on both education and analysis

- Forex trading guides

- How to trade new trading strategies

- Education and news videos

Whether you’re the type of trader that learns through visual or text-based mediums, FXTM has an option that caters to you.

New traders are often overwhelmed with the sheer amount of information required to succeed in the markets. But FXTM’s forex education breaks down the fundamental concepts in an easy to consume manner.

Forex Webinars

If you’re someone who learns by visual means, then free forex webinars for FXTM traders will be of interest to you.

Headed by FXTM’s head of education, Andreas Thalassinos, the broker’s webinars cover a wide range of education and analysis topics to help traders make money in the markets.

Topics FXTM forex webinars cover:

- Economic data releases such as US Non-Farm Payrolls

- Weekly market previews

- Learn new trading strategies

- Question and answer sessions with pros

Market Analysis

If you’re a more experienced trader who’s looking to take their trading to the next level, then FXTM’s market analysis is worth checking out.

The market analyst team at FXTM consists of:

- Jameel Ahmad – Global Head of Currency Strategy and Market Research

- Hussein Sayed – Chief Market Strategist (Gulf & MENA)

- Lukman Otunuga – Research Analyst

- Han Tan – Market Analyst

- Andreas Thalassinos (BSc, MSc, MSTA, CFTe, MFTA) – Head of Education at FXTM

Final Verdict on FXTM

Our 2025 FXTM review has rated them the best forex education broker. The resources that FXTM has put into both education and analysis exceeds anyone else in the entire industry.

If you’re a new trader who’s looking to learn how to trade, FXTM is worth a look. Why pay for expensive supplementary trading courses from a third party you don’t even know if you can trust, when FXTM’s articles, courses, and webinars are all accessible for free.

FXTM FAQs

What trading platforms does FXTM offer?

FXTM provides access to the popular MetaTrader platforms, including MT4 and MT5. These platforms are available on various devices such as PC, Mac, mobile, and web-based options. MT4 remains the go-to choice for many due to its extensive library of custom indicators, while MT5 offers additional features like market depth and more order types.

What types of accounts can I open with FXTM?

FXTM offers a range of account types to suit different trading styles. These include Standard Accounts, which are ideal for new traders, and ECN Accounts, which provide tighter spreads but come with commission fees. Additionally, FXTM provides a Cent Account, ideal for beginners who want to trade with smaller amounts.

What are the fees associated with trading on FXTM?

FXTM features competitive spreads, starting from 0.0 pips on ECN accounts. However, ECN accounts charge a commission based on trade volume. For traders who prefer not to pay commissions, FXTM offers standard accounts with wider spreads starting from 1.3 pips.

Does FXTM offer educational resources?

Yes, FXTM excels in providing educational content. It offers a variety of learning tools such as eBooks, webinars, and video tutorials. These resources are particularly useful for new traders looking to expand their forex knowledge.

What is the maximum leverage available at FXTM?

FXTM offers different leverage limits depending on the trader’s location and account type. In Europe and the UK, the maximum leverage for retail traders is capped at 30:1. However, for clients outside of these regions, FXTM offers higher leverage ratios, up to 1:2000 for certain accounts.

Compare FXTM Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Go to FXTM Website

Visit Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research

Ask an Expert

is it any deposit bonus anytime founding account?

Hi Amos, FXTM does not currently offer a bonus program with your deposit when founding your account.

Does FXTM have inactivity fee?

FXTM an inactivity fee of $5 per month after 6 months of dormancy.

What is the difference between FXCM and FXTM?

FXTM stand for Forex Time, FXCM stands for Forex Capital Management. While the acronyms, may be similar, they are separate companies. Exinity Limited owns FXTM and is regulated by CMA, CySEC, FCA, FSC Mauritius, FSCA, FXCM is owned by the FXCM brand and is regulated by ASIC, CySEC, FCA, FSCA.

Does FXTM pay dividends?

FXTM does not directly pay dividends but if you hold positions in stock CFDs that go ex-dividend, the broker makes a dividend adjustment to your account. This means if you have a long position, your account is credited with the dividend amount, while a short position results in a debit from your account to reflect the dividend payout.

Does FXTM allow copy trading?

Yes, and they have an app just for this called FXTM invest.