IG Group Review Of 2025

IG is the largest retail forex broker with solid reviews, a range of markets including forex, CFD and shares combined with competitive spreads and trading platforms. We liked how CFD trading is available in all markets.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

IG Group Summary

| 🗺️ Tier 1 Regulation | ASIC, FCA, BaFin, FINMA, NFA/CFTC, CySEC, MAS, FMA |

| 🗺️ Tier 2 Regulation | JFSA, DFSA |

| 💰 Trading Fees | Market Maker Spreads, DMA |

| 📊 Trading Platforms | MT4, ProRealTime, IG Platform, L2 Dealer |

| 💰 Minimum Deposit | $0 |

| 🛍️ Instruments Offered | CFDs, Shares, Crypto, Spread betting, Digital 100 |

| 💳 Credit Card Deposit | Yes |

Forex Panel Score

Average Spread

Trading Platforms

Minimum Deposit

Why Choose IG Group

IG is suited for beginner traders as it’s one of the world’s largest and best-known forex brokers. We found their platform was one of the easiest to use and their online training portal and education are one of the best if you are new to trading.

Now with that in mind, we don’t recommend the broker for more experienced traders based on their fees which are at the higher end of the market. We also found their customer support (eg Live Chat) to be relatively weak when it came to more sophisticated questions and interactions and their platform also lacked some advanced features other brokers have as standard. While we do note that the broker offers other platforms such as MT4 and ProRealTime, with their reduced offering on this software and increased fees it’s more logical to choose a broker like Pepperstone or Eightcap if this is your trading preference.

IG Group Pros and Cons

- Vast funding options

- Excellent educational tools

- User-friendly platform

- Limited products

- Slow customer service

- High CFD stock fees

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

A comparison of the leading forex brokers found the spread and commissions using Forex Direct (their ECN broker account) was in the ‘mid-range’ when it came to this trading brokerage.

1. Raw Account Spreads

If clients prefer to trade with No Dealing Desk Brokers, then IG offers direct market access trading execution. This type of trading means full market transparency and therefore tighter spreads.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 04/01/2025

0.17

0.30

N/A

0.54

0.68

0.10

0.20

0.50

0.30

0.50

0.18

0.24

0.67

0.39

0.70

0.06

0.27

0.23

0.49

0.59

0.10

0.20

0.50

0.20

0.71

0.20

0.20

0.50

0.40

N/A

0.30

0.50

0.60

0.50

0.50

0.30

0.40

N/A

0.50

0.50

0.44

0.42

0.50

0.40

0.30

0.20

0.40

0.60

0.50

0.70

0.10

0.50

1.10

0.60

0.80

n/a

0.50

0.70

0.60

0.40

0.44

1.23

1.17

1.13

1.23

The Forex direct account is also termed an ECN forex broker, as traders have direct market access with raw costs. This can help open up opportunities such as trading with FIX API. Overall, the spreads on this account tend to be higher than the standard average but also show decent ones on EUR/USD, USD/JPY, AUD/USD, EUR/GBP, and EUR/JPY.

| Raw Account Spreads | IG Group | Average Spread |

|---|---|---|

| Overall | 0.74 | 0.72 |

| EUR/USD | 0.16 | 0.28 |

| USD/JPY | 0.24 | 0.44 |

| GBP/USD | 0.59 | 0.54 |

| AUD/USD | 0.29 | 0.45 |

| USD/CAD | 0.7 | 0.61 |

| EUR/GBP | 0.54 | 0.55 |

| EUR/JPY | 0.68 | 0.74 |

| AUD/JPY | 1.5 | 0.93 |

| USD/SGD | 2 | 1.97 |

2. Raw Account Commission Rate

This type of trading execution means commission fees are applied in place of a widened spread. IG uses tiered commissions, meaning the more you trade each month, the fewer clients will be charged each time they trade. Unless you trade > 500 million, then commissions are high compared to what we found in the Pepperstone Review and IC Markets Review.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| IG Group Commission Rate | $6.00 | N/A | N/A | N/A |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

3. Standard Account Fees

When trading on the IG core platform, the standard spreads will vary depending on the currency pairing and market conditions.

Standard trading execution is a spread-only account, which means no commission costs. If you choose to use guaranteed stops (which ensure you can’t lose more on a trade than the amount set) then spreads will widen slightly. A glance at the table below indicates that spreads on most currency pairs are slightly above average.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| IG Group Average Spread | 1.13 | 1.12 | 1.66 | 1.01 | 1.98 | 1.71 | 2.27 | 2.06 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

4. Swap-Free Account Fees

Available to IG’s Dubai clients, this account is designed for Muslim traders as it has no swap fees or rolling fees.

5. Other Fees

There are fees to look out for when trading with IG:

- Deposits: $0; credit cards have a 0.5-1% charge

- Withdrawals: $0; $30 for international transfers

- Inactivity Fee: none

Verdict on IG Fees

Forex Direct has overall the lowest spreads , but commissions can be high for traders who have low volumes. For such traders, it’s recommended to view the list of the Best Forex Brokers In Australia or the Best Forex Brokers In UK. Otherwise, IG offers good value for high-volume traders.

Trading Platforms

IG offers a wide range of trading platform options that are superior to forex brokers across forex and CFDs including MetaTrade 4, TradingView, IG Trading Platform, and L2 Dealer.

| Trading Plaform | Available With IG Group |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| TradingView | Yes |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

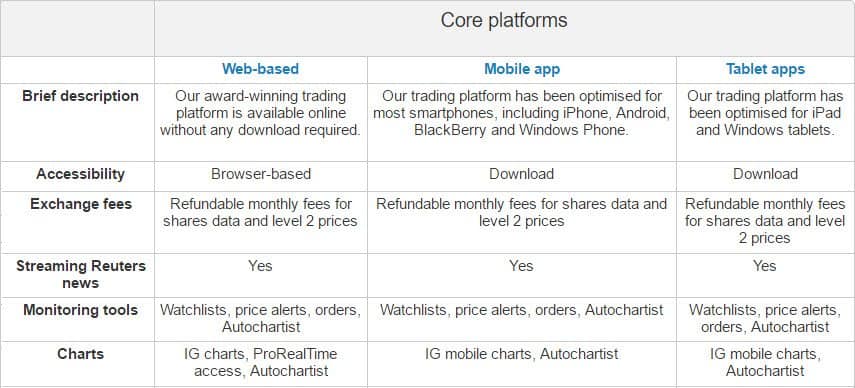

Core Platform

Their most popular platform is their own ‘core platform’ which is browser-based spread betting and CFD web platform designed for on-the-go FX traders as no downloads are required. This is complemented with mobile apps (iOS and Android) for any device, including tablets, which integrate with the web-based platform.

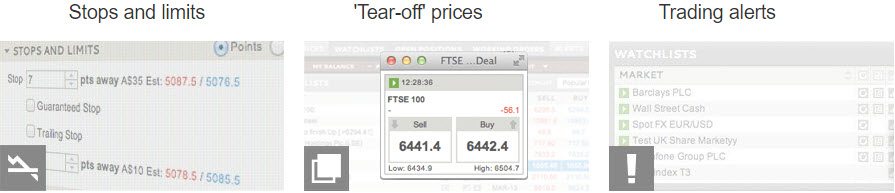

There are several monitoring tools including the ability to set limits and stops to close out positions, the ability to ‘tear-off’ prices when you want to close the core platform and the option to have price alerts in the form of e-mails or an SMS when prices are reached. The platform is also complemented by an excellent suite of research tools and interactive charts equipped with a full range of technical indicators.

Numerous free tools and features are available with the core platform once you become an IG client, including streaming of Reuters news which is fully integrated with no delays. Autochartist is another feature that can monitor CFDs and currency markets, alerting clients as to opportunities based on chart patterns. Trading central is also available as a technical analysis tool, providing charting and daily e-mail updates about the financial markets.

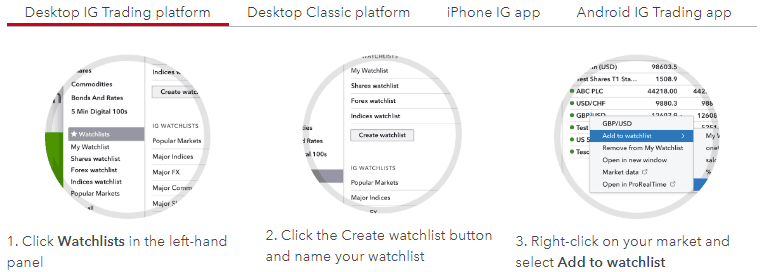

IG Charts can be included for free to provide technical indicators and the ability to trade directly from charts. Another option is ProRealTime, which is an advanced charting tool, with a dedicated suite of features. This charting balance has monthly costs, but these are not charged when traders actively trade on the platform. Additionally, the IG platforms allow FX traders to create a watchlist with their preferred financial instruments to find them at their fingertips.

The most popular feature of the core platform is that it allows IG shares trading. This allows you to trade shares across stock exchanges in Australia, the USA, Ireland, Germany and the UK. The combined forex and share trading CFD accounts solution means that IG customers can benefit from an all-in-one financial services solution.

Three Specialist Platforms

For those that prefer to use more popular platforms compared to IG’s platform, three of the most popular options are available for forex trading. The absence of trading Apps is the only major disadvantage that comes with IG’s specialist platforms.

L2 Dealer

L2 Dealer

This platform allows an ECN forex broker trader experience with direct access to markets through IG’s Forex Direct, which means the broker doesn’t add any additional spreads on currency pairings. Instead, prices are quoted directly with liquidity and major providers with a flat commission placed on volume by IG. This platform is ideal for those forex traders who also want to trade shares worldwide through a CFD broker. As discussed earlier, L2 Dealer is the advanced choice for those looking to trade CFDs and also share trade.

Note* There are no mobile trading apps supported by the L2 Dealer platform.

ProRealTime

This platform is ideal for forex traders who specialise in automated trading. The platform allows traders to build strategies using their development tools, or you can code from scratch. Other options include functionality to import strategies from other traders or 3rd parties and back-test it across 30 years of data. There is no need to be active on the platform for the tool to trade on your behalf.

MetaTrader 4

MetaTrader 4

This has been a new addition to IG based on the platform’s popularity and the fact most Australian forex brokers offer MT4. This platform’s popularity is due to the simplicity of the platform, the ability to customise it to your needs and its fast execution speeds. With the MetaTrader 4 platform, you have the advantage to trade forex currency pairs or spread betting on additional thousands of markets on the go with IG’s mobile trading applications.

The three advanced platforms and the core platform offer one of the Best Forex Demo Accounts. This allows forex traders to try the platforms risk-free and test out IG’s customer service to make sure it suits their needs before trading with real money.

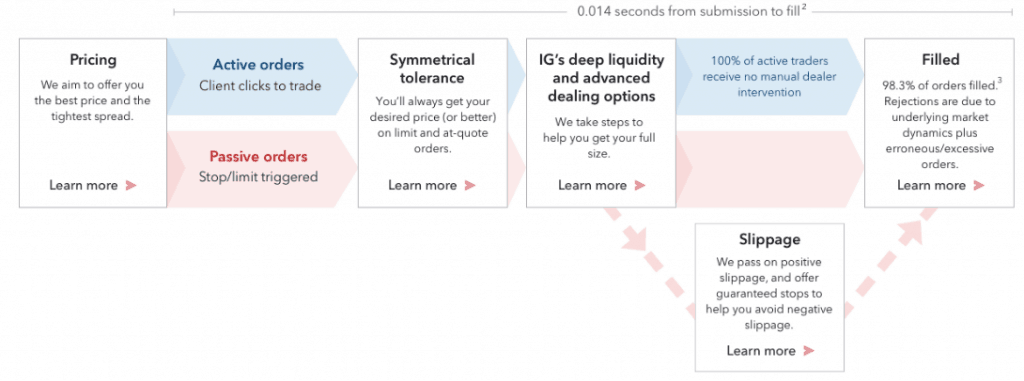

Trading Platform Execution Speed

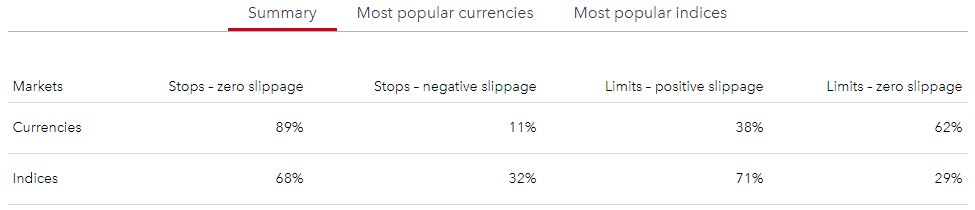

IG’s technology focuses on stability, speed, and achieving improved pricing within the forex trading market. IG’s pricing model is also able to fill 98.3% of their market orders within 0.014 seconds across all trading platforms, including the spread bets. At IG, retail investors can profit from consistent liquidity and advanced dealing options that ensure forex traders will always get the desired exchange rate with zero slippage on 89% of their trades.

The table below gives an in-depth view of IG’s slippage performance (based on data from Nov 2019).

To minimise slippage caused by delays, their systems have been built at scale achieving:

- 25+ million orders

- 40,000 daily users from desktop devices

- 43,000 daily users from mobile devices

IG broker also source their forex market quotes directly from the world’s largest global exchanges and banks. In turbulent markets, their price improvement technology may give you a superior price to that quoted when available. This has resulted in 1.8 million points of positive slippage to clients, which is equivalent to nearly £3.3 million that were passed on to IG traders.

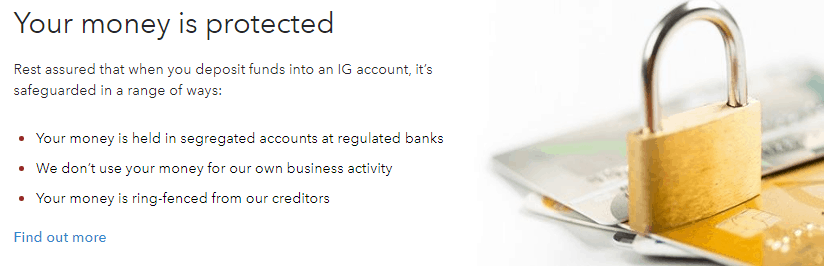

A real positive of IG is that, unlike many other forex online brokers, all their client’s funds are not used for hedging. This means that all funds which include net running, unrealised profits are held for their clients in the major banks which is above and beyond AFSL requirements. This combined with their technology has led them to win several awards, including the Online Personal Wealth Awards in 2015.

Is IG Group Safe?

Regulation

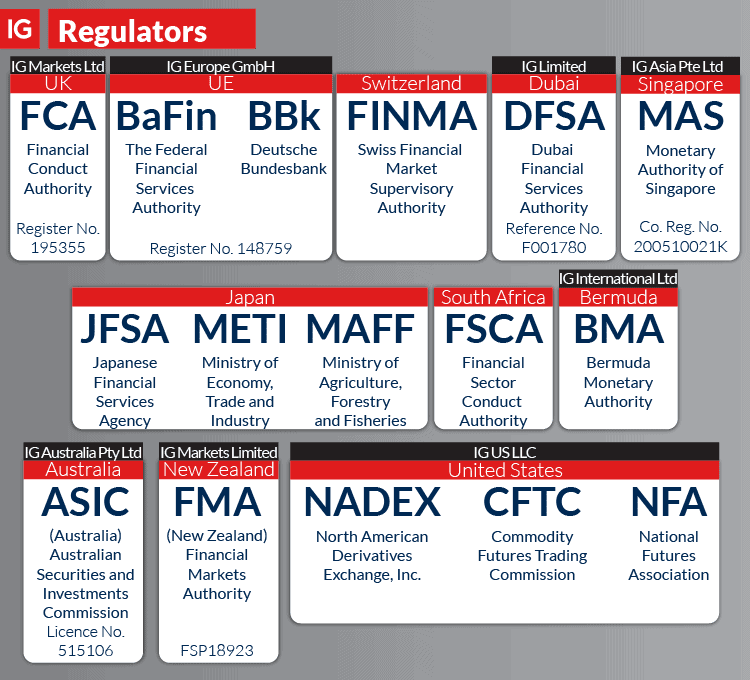

Established in 1974, IG Markets is trusted by over 178,500 worldwide retail investors. IG Group is subject to strict standards and operates under the norms imposed by tire-one regulatory bodies, including:

- Financial Conduct Authority (FCA) in the UK

- Australian Securities and Investments Commission (ASIC) in Australia

- Financial Sector Conduct Authority (FSCA) in South Africa

- Financial Markets Authority (FMA) in New Zealand

- National Futures Association (NFA) in the USA

- Federal Financial Supervisory Authority (BaFin) in Europe (Germany/Austria)

- Swiss Financial Market Supervisory Authority (FINMA) in Switzerland

| IG Safety | Regulator |

|---|---|

| Tier-1 | ASIC FCA BaFin FINMA NFA/CFTC CySEC MAS FMA |

| Tier-2 | JFSA DFSA |

| Tier3 | BMA FSCA |

The table below outlines all the regulatory bodies that supervise IG trading activities.

Additionally, trading CFDs on IG.com come with extra peace of mind as IG broker also abides by the leading principles of the FX Global Code of Conduct. The online brokers that have signed the FX code created by the Bank of International Settlements (BIS) are required to offer a fair trading environment.

There are many locations such as Nigeria which are not covered by the regulator regions above. A trader can choose the entity they trade with (e.g. FSCA in South Africa) which determines factors such as the leverage available when forex trading.

Reputation

IG Group is a pioneer in the trading industry since 1974, with headquarters in London, UK. They are quite popular among traders with a monthly search volume of 2,000,000.

Reviews

On TrustPilot, they have a score of 3.9 out of 5 from 6,401 users.

How Popular Is IG Group?

There are 97,080 monthly searches for IG Group each month on Google, making it the 21st most popular Forex Broker. Similarweb in February 2024 shows a similar story with the broker the 5th most visited, receiving 9,438,000 global visits.

| Country | 2024 Monthly Searches |

|---|---|

| France | 14,800 |

| Italy | 8,100 |

| Australia | 6,600 |

| Germany | 5,400 |

| Hong Kong | 5,400 |

| India | 4,400 |

| Sweden | 3,600 |

| United Kingdom | 2,900 |

| United States | 2,900 |

| South Africa | 2,400 |

| Pakistan | 1,000 |

| Singapore | 1,000 |

| Saudi Arabia | 1,000 |

| Malaysia | 480 |

| Netherlands | 480 |

| Taiwan | 480 |

| Austria | 480 |

| Thailand | 320 |

| Canada | 320 |

| Switzerland | 320 |

| Turkey | 320 |

| Portugal | 320 |

| Vietnam | 260 |

| United Arab Emirates | 260 |

| Morocco | 260 |

| Brazil | 170 |

| New Zealand | 170 |

| Japan | 140 |

| Greece | 140 |

| Spain | 110 |

| Indonesia | 110 |

| Nigeria | 90 |

| Poland | 90 |

| Kenya | 90 |

| Mexico | 90 |

| Philippines | 90 |

| Algeria | 90 |

| Ireland | 90 |

| Colombia | 70 |

| Cyprus | 70 |

| Bangladesh | 50 |

| Peru | 50 |

| Egypt | 50 |

| Argentina | 50 |

| Chile | 50 |

| Sri Lanka | 40 |

| Dominican Republic | 30 |

| Mauritius | 30 |

| Cambodia | 30 |

| Ecuador | 20 |

| Ghana | 20 |

| Jordan | 20 |

| Tanzania | 20 |

| Botswana | 20 |

| Uzbekistan | 10 |

| Mongolia | 10 |

| Ethiopia | 10 |

| Uganda | 10 |

| Venezuela | 10 |

| Costa Rica | 10 |

| Bolivia | 10 |

| Panama | 10 |

2024 Average Monthly Branded Searches By Country

France

France

|

14,800

1st

|

Italy

Italy

|

8,100

2nd

|

Australia

Australia

|

6,600

3rd

|

Germany

Germany

|

5,400

4th

|

Hong Kong

Hong Kong

|

5,400

5th

|

India

India

|

4,400

6th

|

Sweden

Sweden

|

3,600

7th

|

United Kingdom

United Kingdom

|

2,900

8th

|

United States

United States

|

2,900

9th

|

South Africa

South Africa

|

2,400

10th

|

Deposit and Withdrawal

What is the minimum deposit at IG Group?

IG doesn’t have any minimum requirements to open an account however there are minimum deposit requirements to fund your account. Most regions give you a choice of a debit card, credit card, PayPal or Bank Wire for deposits.

| Funding Methods | UK | Europe (outside the UK and Switzerland) | Switzerland, South Africa, New Zealand | Australia | Dubai | USA |

|---|---|---|---|---|---|---|

| Account Opening Minimum | $0 | $0 | $0 | $0 | $0 | $0 |

| Minimum Deposits with Credit/Debit Cards or PayPal | £250 | €250 | South Africa - R4000 Switzerland - CHF 300 New Zealand - $450 | $450 | $300 | $250 |

| Maximum Daily Deposit | £20,000 | €20,000 | South Africa - R20,000 New Zealand - $50,000 | $50,000 | $99,999 | $99,999 |

| Funding Methods | Credit Card, Debit, Card,, PayPal, Bank Wire | Credit Card, Debit, Card, PayPal, Bank Wire | Credit Card, Debit, Card, PayPal, Bank Wire | Credit Card, Debit, Card, PayPal, BPAY, Bank Wire | Credit Card, Debit, Card,Bank wire, | Wire transfer, automated clearing house (ACH), Debit card |

Account Base Currencies

IG offers these account base currency options: USD, SGD, EUR, AUD, HKD, and GBP.

Deposit Options and Fees

IG Group charges no deposit fees for any payment method. A diverse range of funding methods is available, including Visa and Mastercard debit and credit cards, Wise, PayPal, and crypto such as Bitcoin or Ethereum.

Withdrawal Options and Fees

IG also charges no withdrawal fees. The minimum amount to withdraw will depend on your account’s currency denomination. You can withdraw a maximum of $25,000 daily, which will be processed from 2 to 5 days.

Bank wire transfers are usually processed from 1 to 3 days, with no withdrawal limits.

Ease To Open An Account

The process of opening an IG account was smooth and hassle-free. There was no minimum deposit for bank transfers. However, it took around 3 business days for our account to be verified.

Product Range

CFDs

IG is one of the few forex brokers that offer domestic and international share trading in addition to CFD trading. The only other brokers we have covered that do this are CMC Markets, Trading 212, ThinkMarkets (in Australia and South Africa), and BlackBull Markets. What is unique about IG share trading is that a trader can use the same platform for both currency and stockbroking services. Below highlights a few key features of IG share trading.

When trading in shares, IG clients can trade shares the following way

- Shares CFD

- Shares Spread Betting (UK clients only)

- Share Trading (the UK and Australian clients only)

When trading shares CFD and spread betting, clients can profit off the stock’s price movements with a small margin invested. With this type of trading, clients do not take actual ownership of the stocks. Australia and clients in the UK have the option of Share trading, which gives them shareholders rights as they have ownership of the company’s stocks, which they can later sell for profit. Australian’s and UK traders wanting to trade shares will need a Share dealing account.

1) Stock Exchanges Available

1) Stock Exchanges Available

IG share trading gives access to 12,000+ shares from global stock exchanges including the ASX, DOW, NASDAQ and London Stock Exchange. Across these major exchanges, you can start trading not only large companies such as those listed on the S&P 500 can be traded but also many small caps. An IG share trading account has some limitations on stock exchanges such as Germany and Ireland, where only large companies can be traded.

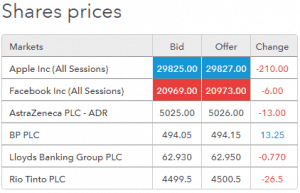

2) Share Trading Fees

Brokerage will depend on if you are trading CFDs or Stocks along with the stock exchange traded as shown in the table below.

Shares CFD fees

CFD trading of stocks requires less upfront capital than Stock trading. CFDs are a leveraged instrument, so only the margin needs to be invested to gain full exposure to the trade. Over 17000 markets are available for trade. Below lists the costs when CFD trading.

| Market Costs | CFD Commissions Per side | CFD Min online Charge | CFD Min phone charge | Margin Requirement (Retail) |

|---|---|---|---|---|

| UK | 0.10% | £10 | £15 | 5.00% |

| US | 2 cents/share | $15 | US$25 | 5.00% |

| Euro | 0.10% | €10 | €25 | 5.00% |

| Australia | 0.08% | $7 | $7 | 5.00% |

| New Zealand | 0.09% | NZ$7 | NZ$7 | 5.00% |

Share Trading

IG’s client’s clients can choose from the following markets

- UK: FTSE 100, FTSE 250 and more

- US: S&P 500, NASDAQ 100 and more

- Australia: ASX, S&P 300

- Germany: DAX, HDAX, MDAX

- Austria: ATX, WBI

- Ireland: ISEQ

- Belgium: BEL 20

- Netherlands: AEX

One unusual feature available to UK traders is the ability to buy US stocks out of hours.

Below lists the costs when trading stocks

| Australia Shares Online | US Shares | UK Shares | |

|---|---|---|---|

| Australia 0-2 trade previous month | $8 / 0.01% | Free | Free |

| Australia 3+ trade previous month | $5 / 0.05% | Free | Free |

| UK 0-2 trade previous month | £3 | £10 | |

| UK 3+ trade previous month | Free | Free |

Note: Fees are higher when trading by phone, and there are also currency conversion fees for overseas share trading. IG will convert the currency at the time of trade based on the best available exchange rate, plus a spread of 0.5% for UK traders and 0.7% for Australian traders.

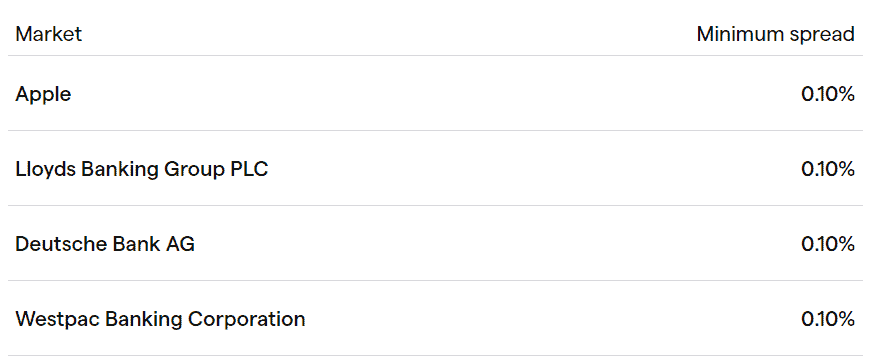

Shares Spread Betting

If you choose to spread bet, then you should expect a minimum spread of 010%. Spread betting has the lowest costs of CFD, Shares, however, is the riskiest method of investment.

Share Trading Accounts

To enable stockbroking, it’s important to pick a suitable platform when selecting the share trading account. This is discussed trading platforms section, but in summary, there are two options:

- Core Platform

- L2 Dealer

Selecting either platform during the share trading account sign-up will allow a combination of stockbroking and CFD trading with IG. There is also a market access DMA account to gain direct market prices while paying an extra commission. Overall, most Australian forex brokers do not offer stockbroking services and rather focus on CFD trading. The IG share trading and CMC Markets are presently the larger retail foreign exchange brokers offering these range-of-markets which has led to their popularity over the past decade.

Customer Service

IG offer locally based customer service 24 hours a day from Monday to Friday. The IG Group also supports customer service if a trader is overseas. IG offers support over the phone, via e-mail, or even through their handle on Twitter. An investment trends report found IG has strong customer support but was awarded the winner in 2015, 2016 and 2017 to Pepperstone. To reach the full Pepperstone report including these awards.

Research and Education

While customer service may not be the best in the industry, they do have a solid training offering. This includes free in-person seminar which is also held live through webinars. They also have a free IG academy app that covers all sorts of topics related to trading such as how to manage trading risks and how to use trading indicators.

Additionally, the IG community offers an open social trading network that allows retail traders to interact with each other and learn from experienced traders.

Final Verdict on IG Group

If you’re in the market for a reliable online broker, IG is an excellent choice for both seasoned traders and those just starting out. Whether you’re trading forex or diversifying into other major asset classes, you’ll appreciate IG’s competitive spreads, extensive range of tradable assets and investment products, and the wealth of in-house research and market updates they offer. The trading platform is feature-rich but remains user-friendly, making it accessible for everyone.

With over 50 years of experience in the financial services industry and a strong reputation as a highly regulated company, IG provides everything you need to access global markets, whether you’re an individual investor or part of a corporate team.

IG Group Broker Review FAQ

Is IG Group a good forex broker?

Founded in 1979, IG Markets is a safe CFD provider regulated by the world’s most trusted financial institutions. IG is authorized and licensed by tier-one regulatory bodies (CFTC, NFA, ASIC and FCA), has round the clock support service, offers over 17,000 financial instruments and is the home to over 239,000 retail traders.

Is IG Group a market maker?

Yes, IG uses a market maker model but has direct market access (DMA) via L2 Dealer when trading forex and shares. Unlike ECN Brokers brokers, market maker brokers ensure that your orders will always get filled without any requotes. However, traders need to keep in mind that IG is the single counterparty to your trades.

How much does IG Group charge per trade?

IG Markets charges on average 0.6 pips spread on EUR/USD trading and 0.1% commission per share dealing. US share trades come with zero-commission trading while the UK shares require GBP 3 commission per trade. Trading major stock indices like the DAX 30 and FTSE 100 comes with a 1 point spread while gold trading has a minimum spread of 0.3 pips.

An in-depth comparison of the Lowest Spread Forex Brokers can help you out better asses IG’s spreads.

IG Group Markets Review Conclusion

IG is the most popular retail foreign exchange forex broker and their all-in-one offering of forex, CFD, spread betting, and share trading is why traders choose the broker. Compare Forex Brokers recommends IG for high-volume traders (who want lower commissions) with a low-risk appetite.

Additional IG Group Information

When opening an account, four core funding options exist for currency traders:

- Credit Cards – Mastercard and Visa can be used to fund IG markets live account with a 0.5% charge applicable and respectively 1.0% fee for Visa credit cards.

- Debit Cards – No charge applies to MasterCard debit card funding and Visa debit cards. This funding option offers an instant deposit feature.

- BPAY – No costs are incurred through BPAY, but funds can take two working days before they are cleared.

- PayPal Account – As an alternative online payment solution, FX traders can fund their live accounts through PayPal.

IG Minimum Deposit

IG minimum deposit is $450 when using a debit card, PayPal, or credit card while those who use a bank transfer or BPAY method have a $0 minimum deposit requirement when opening an IG forex account.

The minimum deposit to start online trading or spread betting with IG Markets is $450 or the equivalent in your local currency. All client funds, as discussed earlier, are segregated into separate bank accounts as per AFSL regulations. Clients of IG Markets can fund their trading accounts in any of the following currencies: USD, GBP, EUR, AUD, and HKD. IG clients must be aware that an inactivity fee of $18 will be levied on all trading accounts that have no trading activity for 24 consecutive months.

About IG Group

IG Group is a worldwide global leader in online multi-asset trading headquartered in the City of London, UK. IG clients and possible customers can reach the UK-based broker at its head office address: Cannon Bridge House 25 Dowgate Hill London EC4R 2YA. The company is also listed on the London Stock Exchange LSE and is included in the FTSE 250 Index.

IG is truly an international forex broker with over 45 years of experience in the financial markets. For our IG Markets Review, we assessed if the brand can serve clients from around the world. Our team of industry experts found that IG has a remarkable global presence through its 16 offices (including UK, USA, Australia, Singapore and Europe) spread all around the globe and across five continents.

Spread Bets vs Trading CFDs

If you’re considering spread betting and having the option to trade at the same time CFDs, IG Markets is among the few online brokers offering both leveraged products. IG clients can open spread bets for CFD trading in both market directions (long and short) across more than 16,000 financial instruments. The most popular markets that can be traded with CFD accounts include currency pairs, shares, cryptocurrencies (Bitcoin and Ethereum), ETFs, and much more.

Compare IG Group Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Go to IG Website

Visit Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research

Ask an Expert

I see IG is a Market Maker, What does this mean?

A market maker is your counter-party to your trades. This means the broker takes the opposite position to your trade. So if you are buying, then the market maker is selling.

This is different from a no dealing desk broker who connects you with liquidity providers and have no involvement in your trade.

Can you explain what DMA trading is and if i should use it?

DMA stands for Direct Market Access. It means you have access to the order books at the exchange centres. While in theory, it means you can choose the cheapest prices available in the book, it takes a very skilled trader to take advantage of this and very few brokers offer DMA to retail traders.

How long do IG withdrawals take?

Depends on your withdrawal method

Where is IG Group based?

London, UK

Is IG trading good for beginners?

Yes, except in the US and Canada, IG have a limited risk account and guaranteed stop order option if you are using the IG trading platforms along with a lot of education material making it a good choice if you are new to trading.

Can you trade futures with IG?

Yes, IG offer one of the largest range of financial derivatives products of all brokers.