Pepperstone Leverage

Pepperstone offers a leverage ratio of 30:1 for major forex currency pairs. Find out the leverage options Pepperstone offer for 150+ other financial products. These CFD products include cryptocurrencies like Bitcoin, indices, and metals like gold.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Before you open up a live account with the Pepperstone brokerage and start trading, it’s worth having a decent understanding of how leverage works across various regions, markets, and products. We’re going to give a detailed breakdown so that you know exactly what rules and restrictions will apply to your trades.

What is leverage?

Leverage is when you’re able to trade with a greater amount than your actual account balance. It basically involves using borrowed capital to make a trade. You can use a smaller amount of upfront funds to gain larger exposure in a particular trade. The benefit is that you can potentially maximise your returns, but the downside is that it can also amplify losses.

When you look at leverage figures, they will be displayed as a ratio. So, 1:1 would mean no access to leverage with a trade. A leverage of 50:1 would mean the broker will lend you $50 for every $1 you place in your trading account. Put another way, to make a trade of $50,000, you need to use at least $1,000 of your own collateral. This means you need an initial margin of 2% in your trading account.

The difference between leverage and margin

It can be confusing when you start learning about using leverage or Margin Trading, but they are closely linked. Put simply, margin is collateral for leverage. You use margin to create leverage and the leverage is then used to trade larger positions than what’s in your trading account.

While margin is expressed as a percentage, leverage is expressed as a ratio. For example, if you wanted to trade 100,000 EUR/USD with a 2% margin, you would only need to deposit $2,000. Thus, the leverage provided for this trade would be 50:1

To calculate leverage, there is a simple formula: Leverage = 1 / Margin Requirement. So, for a margin requirement of 2%, leverage would be 1 / 0.2 which is 50, expressed as 50:1. In this way, leverage has an inverse relationship to margin.

Pepperstone leverage overview

The three key areas that will impact the level of leverage you can access on the Pepperstone trading platform are:

- Where you’re based, and the Pepperstone subsidiary you use (impacting financial regulation).

- The asset or product you want to trade.

- Whether you’re a retail or professional trader.

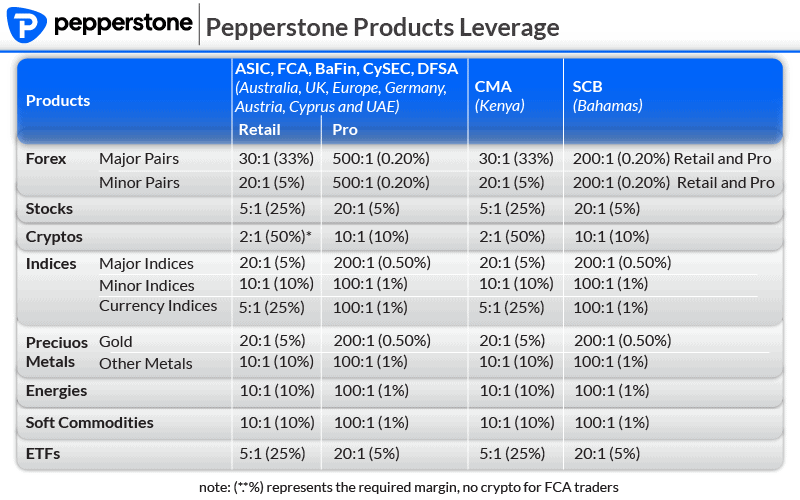

Below is an overview of the leverage limits in place for traders using Pepperstone:

Pepperstone ReviewVisit Pepperstone

The overall rating is based on review by our experts

Why leverage differs in different countries

Each country has its own financial regulator. For Pepperstone (or any forex broker) to offer trading services in the country, a licence from the financial regulator is required. Some regulators set a maximum limit forex brokers can allow for trading. For this reason, leverage can differ depending on which country you are trading from.

Pepperstone offers the maximum allowable leverage that the licence they hold permits. So, whatever the maximum leverage permitted by your relevant jurisdiction is, Pepperstone will allow you to access this leverage figure.

Traders operating from Australia, Europe, the UAE, or the UK fall under what’s referred to as top-tier regulators. Brokers regulated by top-tier regulators offer the highest level of safety or protection to their clients. All Pepperstone customers trading from within these locations will have the same leverage limits (apart from crypto CFDs in the UK) as these regulators largely follow each other for leverage policies. For more details, you can read our assessment of Pepperstone Safety.

You will also find they distinguish between retail traders and ‘professional’ traders. While qualification for a professional trading account varies between regulators, they all recognise professional traders are better equipped to handle the risk involved with trading with high leverage.

In case you’re wondering, the Capital Markets Authority (CMA) of Kenya will be the overarching regulatory body whose jurisdiction you fall under if you’re a trader based in Africa.

For traders living outside of Africa, Australia, Europe, UAE, and the UK – you’d come under the oversight of the Securities Commission of the Bahamas (SCB). This means that the leverage thresholds and limits of the SCB would apply and this differs from the so called tier-1 regulators.

If you come under the regulation of the CMA, there’s no distinction between ‘retail’ and ‘pro’ traders. SCB doesn’t distinguish between ‘retail’ and ‘pro’ for Forex pairs.

Pepperstone leverage trading across markets and products

To give you a more detailed breakdown of the various leverage limits when trading different CDDs and markets using the Pepperstone brokerage, we’re going to explain all the nuances so that you’re fully informed about what you can and can’t trade when using the platform.

With the exception of shares, you can trade all these products with the trading platforms Pepperstone offer – MetaTrader 4 (MT4), MetaTrader 5, cTrader, TradingView. To trade shares, you are not advised to use MT4. Should you wish to automate your trading, you can use MetaTrader Signals or integrate Capitalise.ai with MT4. Social trading is available with Myfxbook (or in the UK with Pelican) and copy trading with DupliTrade.

Forex trading leverage

Forex trading is at the core of what Pepperstone offers customers looking to trade on the platform. In total, there are over 92 currency pairs available to trade (including major, minor, and exotic pairs).

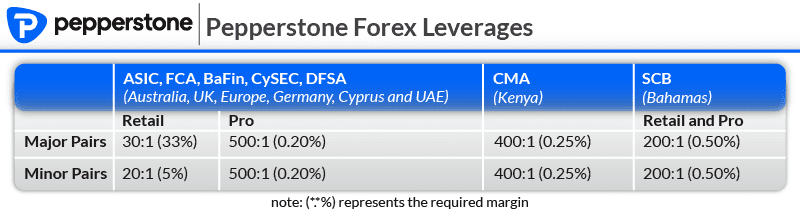

This is what the maximum leverage thresholds look like for different types of forex trading:

- Major currency pairs – this includes the likes of EUR/USD, GBP/USD, USD/JPY, UDF/CHF and some additional currency pairs. For these popular Major Forex Pairs, retail traders based in Australia, Europe, UAE, and the UK can access 30:1 leverage for major pairs and 20:1 for minor pairs.

Pro traders located in these regions can use up to 500:1 leverage. For traders who fall under SCB regulation, the leverage available is 200:1 and for forex traders based in Africa – you can use up to 400:1.

- Minor and exotic currency pairs – these are the less-traded currency pairs and some examples include CAD/CHF, CAD/JPY, CHF/JPY, EUR/CAD. Retail traders located in Australia, Europe, UAE, and the UK can access 20:1 leverage (slightly lower than with the major pairs).

Pro traders have the same ability to use 500:1 leverage as with the major pairs. Forex traders who come under SCB or CMA regulation have the same leverage as with major pairs, 200:1 and 400:1 respectively.

When trading Forex, Pepperstone offers two types of trading accounts. The first is the Standard account which is a spread-only account (aka no commissions) and the Razor account which Pepperstone commission fees are $7 round-turn for each 100,000 lot.

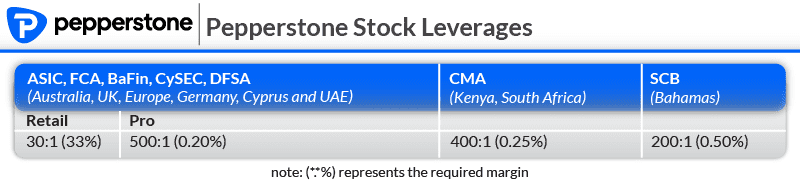

Leverage for stock trading

If you’re planning on trading stock CFDs using Pepperstone, the leverage limits are easy to grasp. Traders on Pepperstone who use the MetaTrader 5 (MT5) platform, cTrader or TradingView forex trading platforms are able to trade over 1,000 different stocks and shares for both long and short positions.

Retail traders from Australia, Europe, UAE, and the UK can use up to 30:1 leverage for trades. Professional traders based in these locations can use up to 500:1 leverage.

Traders who fall outside of the jurisdiction of the top-tier regulators and come under the oversight of the SCB can use up to 200:1 leverage. Those who are regulated by the CMA can use up to 400:1 leverage for stock CFD trading.

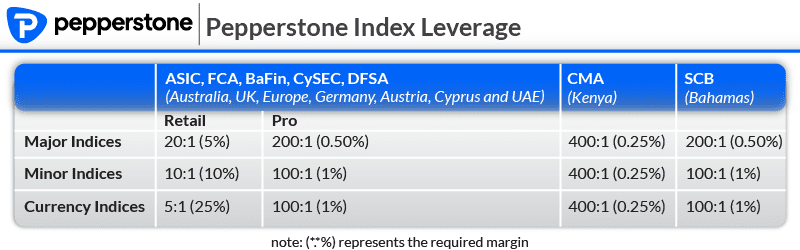

Index leverage limits

Pepperstone allows you to trade 25 major and minor global market indices (such as the US 500, the UK 100, and the AUS 200), along with 3 currency indices, and 3 crypto indices.

When trading the range of index CFDs available on Pepperstone, your leverage limits are described below.

Top-tier regulators (Australia, Europe, UAE, UK)

For retail traders, your maximum leverage for trading indices CFDs are as follows:

- Major indices – 20:1

- Minor indices – 10:1

- Currency indices – 5:1

- Crypto indices – 10:1 (except in the UK)

For pro traders who fall under top-tier regulators, your leverage limits will be:

- Major indices – 200:1

- Minor indices – 100:1

- Currency indices – 100:1

- Crypto indices – 10:1

Traders under SCB supervision (rest of world)

- Major indices – 200:1

- Minor indices – 100:1

- Currency indices – 100:1

- Crypto indices – 10:1

Traders under CMA supervision (Africa)

- Major indices – 400:1

- Minor indices – 400:1

- Currency indices – 400:1

- Crypto indices – 10:1

Commodity leverage limits

Pepperstone allows you to trade different types of commodity CFDs on the platform that can be split into categories:

- Hard commodities – like precious metals and energy.

- Soft commodities – this includes grown agricultural goods and livestock.

The type of commodity you’re looking to trade can impact the leverage that’s available to you. Varying limits apply to traders who want to buy and sell CFDs for metals, energy, or soft commodities.

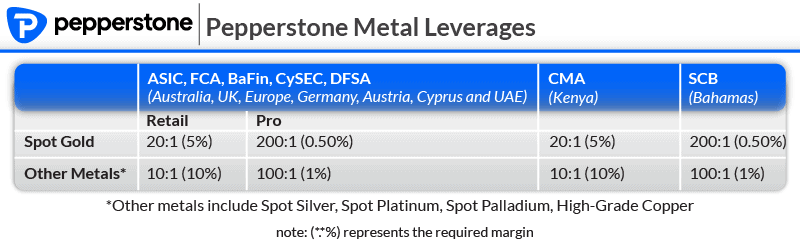

Metal trading leverage

If you’re interested in trading precious metals like gold, or industrial metals like copper, here’s what level of leverage you can access:

- Top-tier regulated retail traders – 20:1 for Best Brokers for Gold CFD Trading and 10:1 for other metals (e.g. silver, platinum, palladium, copper).

- Top-tier regulated pro traders – 200:1 for spot gold and 100:1 for other metals.

- CMA regulated traders in Africa – 20:1 for spot gold and 10:1 for other metals.

- SCB traders in the rest of the world – 200:1 for spot gold and 100:1 for other metals.

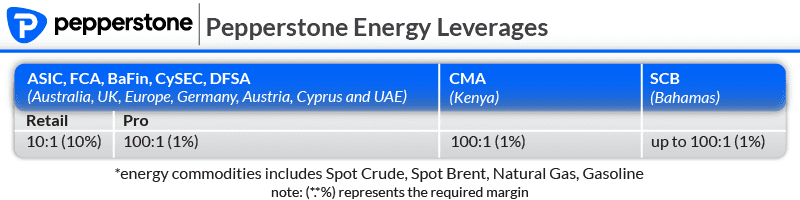

Leverage for energy CFDs

If you’re looking to trade energy CFDs, the Pepperstone brokerage allows you access to the following commodities:

- Crude oil

- Brent oil

- Natural gas

- Gasoline

Retail traders based in Australia, Europe, the UK, or the UAE can use up to 10:1 leverage for trading these energy CFDs. Pro traders from these regions can use up to 100:1.

For traders based in Africa (CMA) or the rest of the world (SCB), the leverage limit is 100:1.

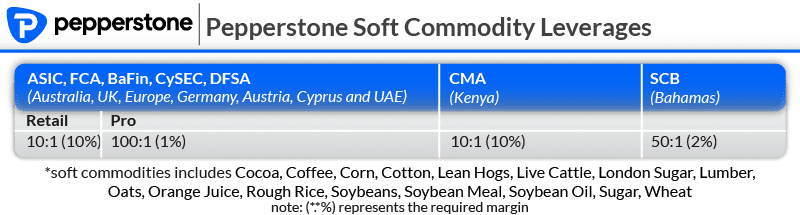

Soft commodity leverage

Trading soft commodity CFDs in top-tier regulated countries is the same as with energy CFDs. So, retail trade can use up to 10:1 and pro traders can use up to 100:1.

For traders who fall under the supervision of the CMA, your leverage limit for soft commodities will be 10:1. And, for traders operating within the SCB regulated Pepperstone subsidiary, your leverage limit will be 50:1 if you’re looking to trade items such as Cocoa, Coffee, Live Cattle, or Lumber (for example).

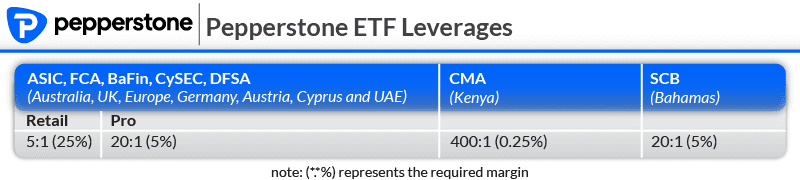

ETF leverage

Pepperstone also offers clients the ability to trade ETF (exchange-traded fund) CFDs. ETFs operate in a similar way to an index fund, except that these investment products are openly traded on stock exchanges.

An ETF contains a basket of different investments, allowing you to gain exposure to a whole bunch of assets with a single trade. The key difference between trading standard ETFs and ETF CFDs is that with the CFDs, you’re able to use leverage to potentially boost your profits.

Pepperstone gives traders access to around 100 ETFs and the leverage capability looks like this:

- 5:1 – retail traders in top-tier regulated regions.

- 20:1 – pro traders in top-tier regulated regions.

- 20:1 – traders in the rest of the world that are under SCB supervision.

- 400:1 – traders based in Africa that are regulated by the CMA.

Cryptocurrency leverage limits

Pepperstone allows traders to buy and sell 19 different cryptocurrencies, along with 3 crypto baskets (mentioned under the indices trading leverage section). This is a solid range of cryptos to trade, matching or bettering the range with many Forex brokers but well shy of Eightcap who has 250 crypo products to trade.

Crypto is the one area that is slightly more complex for traders. It’s the only area where there’s a difference among retail traders under the supervision of top-tier regulators. The FCA (Financial Conduct Authority) in the UK does not permit any retail traders to use leverage with cryptocurrency CFDs.

Also, with cryptocurrency the amount of leverage you’re able to use will also depend on the digital asset you’re looking to trade.

- For retail traders in top-tier regulated areas (apart from the UK) – you can use a maximum of 2:1 leverage.

- For pro traders in top-tier regulated areas (including the UK) – you can use up to 10:1 leverage.

- For traders under CMA or SCB regulation – you can use up to 10:1 leverage with crypto CFDs.

Note: Crypto needs to be fixed – its 2:1 leverage for retail traders and 10:1 for Pro traders and CMA, and SCB

Spread betting leverage limits

CFD trading isn’t the only way to use leverage. If you are in the UK then Pepperstone offers spread betting and bettors can bet on the same products and use the same leverage as CFD traders. Spread betting is not available outside the UK.

Are the leverage limits the same across all Pepperstone account types?

Yes. It doesn’t matter whether you’re using a Standard Account, Razor Account, or an Islamic (swap-free) Account. What impacts your leverage is where you’re based, what you’re trading, and whether you’re a retail or pro trader.

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Ask an Expert

I live in the USA can I trade on your platform?

Hi Chris, sorry we are not a platform. We are a comparison website but if you are in the US, OANDA and Forex.com are two good brokers to consider. Just note that you are trading spot not CFDs since CFDs are not permitted in the US.

Which leverage is good for beginners?

It’s important for beginners to start with low leverage to help limit losses and manage risk better. As for Pepperstone or any other broker, a leverage ratio of 1:10 is often recommended as a safe starting point.