Pepperstone Trust And Safety

Being regulated by 8 financial regulators worldwide such as ASIC, FCA, CySEC and DFSA means Pepperstone is a safe broker. Regulation ensures the broker is legit and not a scam and can offer trading services in your country.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

When you start researching different forex brokers and trading platforms, one of the key things to look out for is how safe and well-regulated the provider is. To help inform your research on brokerages, we’re going to explain everything you need to know about the safety and regulation of Pepperstone.

Is Pepperstone a safe broker?

Yes! In case you weren’t already aware, Pepperstone is a brokerage platform with a number of entities in different countries. Each entity operates under the supervision of the local or regional financial regulator for the country the entity is based in. Using a local regulator ensures that each Pepperstone entity complies with requirements set out by the terms of their licence which are designed to protect the clients.

Being regulated by the appropriate financial regulator in your jurisdiction also ensures the broker is legit and is legally able to offer trading services locally and that there is an avenue to verify this by checking the financial regulator’s website. This is important as it means you can be sure the broker is not a scam.

Pepperstone ReviewVisit Pepperstone

Is Pepperstone regulated?

Yes, Pepperstone has a number of subsidiaries across the globe, each being regulated by the appropriate financial body for the country or region in which the subsidiary is based. The regulation that applies to you will depend on which Pepperstone subsidiary you join, which would normally be the most relevant one to the country you join from.

To give you peace of mind, Pepperstone or one of its subsidiaries always keep your funds in a segregated bank account. Other examples of practises regulators may require as terms of their licence include:

- A product disclosure statement – this is the fine print covering details of the broker’s offering.

- A documented complaints resolution process using an impartial 3rd party

- Obligations to keep your personal data secure and private

- Honest and transparent operational practices including checks from 3rd party bodies and/or regulators

- Privacy policies – a good regulator will ensure the broker has acceptable practices in place to ensure your personal data is safe and secure.

- Security practices against fraud such as using anti-money laundering (AML).

The country you’re located in can also dictate the level of leverage you can access as a retail forex trader. There may also be other regulatory controls used, for example, in the UK, the FCA (Financial Conduct Authority) does not allow CFD cryptocurrency trading for retail investors, but it does permit professional traders to do so. Pepperstone Fees are consistent across all regions.

Who regulates Pepperstone?

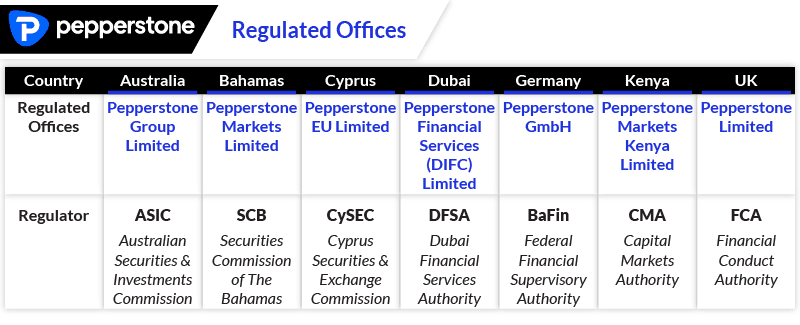

The regulator will depend on the country you’re living in. Here’s a quick overview of the regulatory organisations that supervises Pepperstone across various regions:

- Australia – Australian Securities and Investments Commission (ASIC)

- UK – Financial Conduct Authority (FCA)

- Europe/Cyprus – Cyprus Securities and Exchange Commission (CySEC)

- Germany/Austria – Bundesanstalt für Finanzdienstleistungsaufsicht or Federal Financial Supervisory Authority (BaFin)

- UAE – Dubai Financial Services Authority – DFSA

- Kenya – Capital Markets Authority – CMA

- Bahamas – Securities Commission of the Bahamas – (SCB)

If you are in Africa, then you will join the Pepperstone subsidiary based in Kenya and regulated by the CMA. If you are outside Australia, The UK, European Union, Africa or the UAE then likely join the Pepperstone subsidiary based in the Bahamas and regulated by the SCB.

All regions offer similar trading accounts including the standard (no commission) account and the razor account with trading conditions similar to an Pepperstone ECN trading account.

All regions offer similar trading accounts including the standard (no commission) account and the razor account with trading conditions similar to an Pepperstone ECN trading account.

Are Pepperstone brokerage deposits safe?

Yes, while each regulator has their own requirements, common among all of them is the need to keep your funds in a segregated bank account, meaning the broker can never touch your funds and your funds are held separately from Pepperstone’s own funds. Although there is a theoretical risk the bank one of Pepperstone’s holding banks could go into liquidation, Pepperstone only uses major banks to store your funds and spread this across a number of banks to negate this risk.

Learn more about the broker on our main Pepperstone Review updated monthly.

Is Pepperstone likely to go into liquidation?

Not really, regulators require Pepperstone to hold a minimum reserve in capital at all times under the terms of their licence to meet credit, market and operational risks. The FCA, CySEC and BaFin have a 3 pillars strategy which includes the requirement for the broker to conduct their own reviews to ensure this reserve is adequate to cover their risks. This is subject to regular reviews by the regulator as the second pillar and publicly discloses specific capital and risk concerns, risk processes and remuneration arrangements publicly.

Here are each region’s details:

- Australia: ASIC rules require Pepperstone Australia to have a buffer of AUD1,000,000 / 10% of average revenue

- The UK: FCA rules require Pepperstone to have a base capital requirement of €125,000 as the holder of an Intermediary License to meet

- Europe: ESMA rules (which cover CySEC and BaFin) require Pepperstone Cyprus and Pepperstone Germany to hold a capital reserve of €730,000 / 30% of average revenue

- The UAE: DIFC (DFSA) Base capital requirement for Pepperstone UAE is USD $500,000 as the holder of a Category 3A brokerage licence

- Bahamas: SCB requires brokers dealing as agents and principals to hold USD 300,000 and brokers trading as agents only to hold USD 120,000.

- Kenya: CMA requires dealing fx brokers to have liquid capital of Sh 50,000,000 and Sh30,000,000 for a non-dealing FX licence.

* The European Securities and Markets Authority (ESMA) provides the Forex regulatory frames work all Financial regulators with the European Union must work with. One ESMA directive, the MiFID II directive, allows a broker regulated by one EU-based financial regulator to accept clients from any country within the EU.

What compensation scheme applies in each jurisdiction?

While most regulators focus on preventing brokers from going into liquidation or out of business, some regulators also have a Forex Services Compensation Scheme. Below is the list of compensation schemes for each Pepperstone subsidiary.

-

- Australia – ASIC (Australian Securities and Investments Commission) doesn’t offer compensation within its regulatory framework.

- UK – FCA (Financial Conduct Authority) licence requires Pepperstone to be a member of the FSCS (Financial Services Compensation Scheme), which means you are protected up to the value of £85,000.

- Germany/Austria – BaFin (Federal Financial Supervisory Authority) can compensate up to 90% if you make a claim but with a maximum limit of €20,000. This upper limit refers to the total size of your claim and not €20,000 per account. You can also claim up to 100% of any cash deposits of up to €100,000.

- EU/EEC/Cyprus – CySEC (Cyprus Securities and Exchange Commission) offers an ‘Investor Compensation Fund’ (ICF), which can compensate up to €20,000 for each eligible investor.

- Kenya – CMA (Capital Markets Authority) has no current compensation scheme.

- UAE – DFSA (Dubai Financial Services Authority) doesn’t have a compensation scheme to protect investors and traders.

- Bahamas – SCB (Securities Commission of the Bahamas) doesn’t offer a compensation scheme for added trader protection.

- Kenya – CMA (Capital Markets Authority) has no current compensation scheme.

Is negative balance protection offered?

Yes, all traders with Pepperstone will receive negative balance protection. This means that if your trading account balance goes below zero, the broker will absorb that loss and return your account back to zero.

The broker, however, has several measures in place to prevent your account from going into negative. This includes a margin call when the equity on your account balance dips the minimum margin to maintain your position. For users of MetaTrader, this level is 90% and for users of cTrader, this level is 80-500%. This call warning encourages you to either top up your account fund or close some losing positions.

Should your equity or margin level fall below 50% (i.e. account balance less profit and loss of open trading positions) an automatic stop-out will apply which means the broker will attempt to close losing positions to increase your equity above 50%. This applies to both the razor and standard accounts.

The exception is if you’re using a professional trader account. In this case, you wouldn’t get negative balance protection, but that’s because you get to access higher levels of Pepperstone leverage when trading. Keep in mind there is a 50% margin close-out that applies to all traders.

- Margin level = < 90% (MetaTrader 4/5) or 80% to 500% (cTrader) will result in a margin call warning

- Margin level = < 50% (automatic stop out) for retail clients

Margin level = < 20% (automatic stop out) for professional clients

While a call warning system can help prevent your Pepperstone account from going into negative, it is still essential that you take proper care to make the most of all the risk management tools available with Pepperstone (e.g. the stop loss and take profit controls on the platform).

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.