Pepperstone vs Swissquote 2025

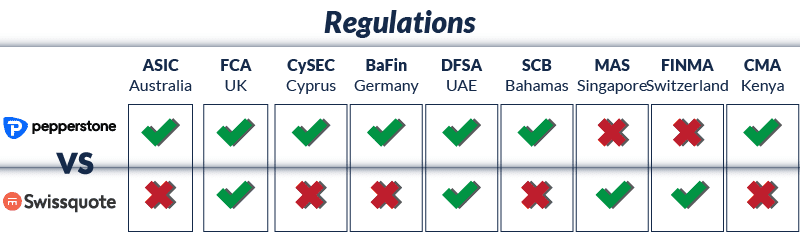

Our comprehensive analysis of Pepperstone and Swissquote presents a fascinating comparison. Swissquote, established in 1996 as a bank, contrasts sharply with Pepperstone, a CFD broker founded in 2010. Join us as we delve deeper into the nuances of these two brokers. Keep reading!

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Ask an Expert

Is my money safe with Swissquote?

Yes, Swissquotes is a regulated broker so you can be sure your funds are kept in a segregated account.