Tradersway vs IC Markets 2025

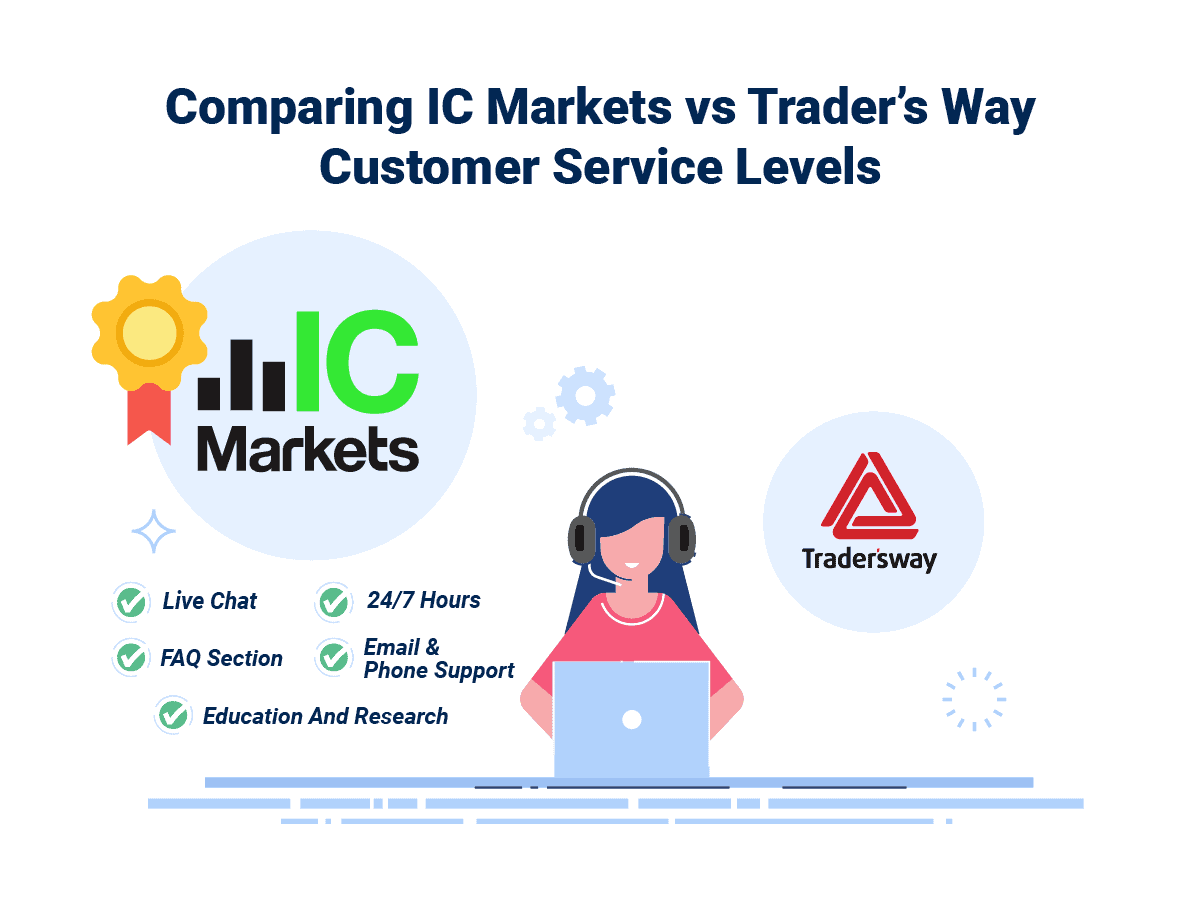

IC Markets and Traders WAy offer strong trading platforms, with IC Markets excelling low spreads and deep liquidity, while Traders Way provides high leverage options. However, in this review, IC Markets comes on top as the superior choice.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Ask an Expert