Trading 212 Review Of 2025

Trading 212 is well known for its investing app but very few traders are aware they also offer CFD and forex trading. We focused on this lesser-known offering understanding if their fees and platform are on par with their invest range.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Trader 212 Summary

| 🗺️ Country Regulation | UK (FCA), Europe (CySEC), Bulgaria (FSC) |

| 💱 Trading Fees | No Commission CFD trading, Shares |

| 📊 Trading Platforms | Trading212 App, Trading212 Web Browser |

| 💰 Minimum Deposit | $10 |

| 💰 Funding Fees | $10 |

| 🛍️ CFDs Offered | Forex, Commodities, Shares, ETFs, Indices |

| 💳 Credit Card Deposit | Yes |

Why Choose Trading 212

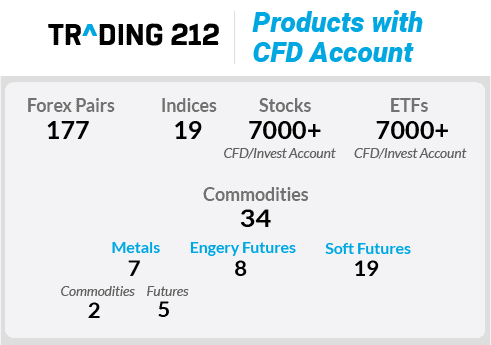

Features we like with Trading 212 include the ability to trade 177 Forex pairs along with 1700 other CFD instruments and the ability to buy and sell real stocks (both whole and fractional) via their Invest Trading Platform. Trading 212 has no commissions and you can even earn interest on funds you have not used.

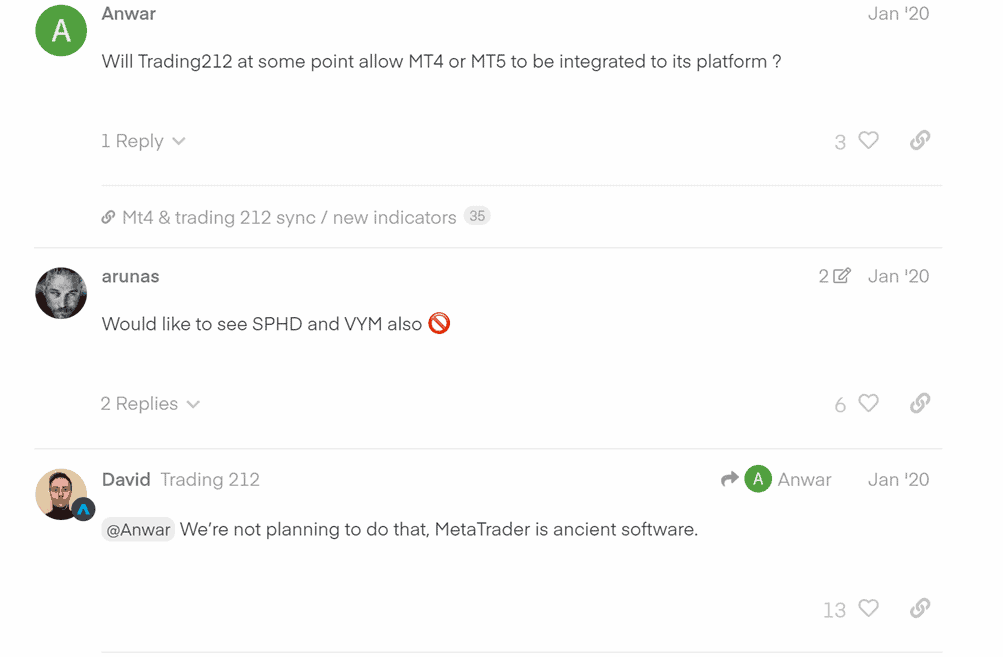

Trading 212 is not without shortcomings; MT4 and MT5 are unavailable, and there is a distinct lack of information about the trading platforms they offer. The broker does not provide advanced trading tools, nor do they offer trading cryptocurrencies. Overall, we think Trading 212 is a better choice for beginners looking to buy shares. We don’t recommend Trading 212 for forex or CFD trading. An alternative broker like Pepperstone would be a better option.

Trading 212 Pros and Cons

- No commission CFD trading

- Can invest in shares

- Good range of markets

- Shockingly High Fees

- Lack of trading platform options

- Poor customer service for CFDs

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

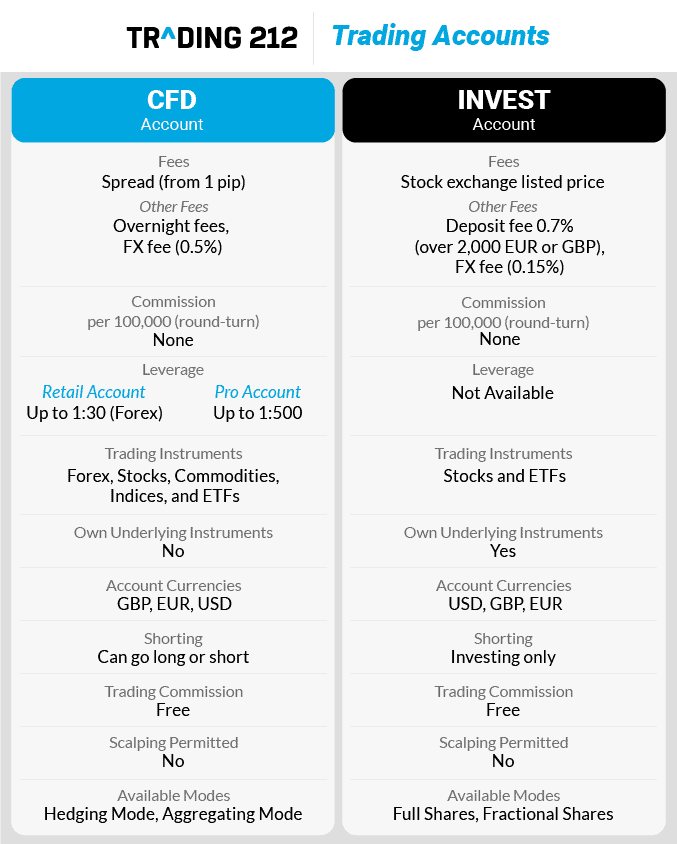

Trading 212 only offers no commission account (known as a ‘standard account) when it comes to Forex CFD products. They also have an investment and ISA account discussed later.

1. Spreads

We compare brokers based on the eight most traded forex pairs traded. Below is Trading 212’s average spread for each pair and a selection of other standard account fees.

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

1.10 | 1.20 | 1.40 | 1.50 | 1.20 |

|

0.60 | 0.70 | 0.80 | 0.90 | 0.70 |

|

0.62 | 0.77 | 1.27 | 1.30 | 0.85 |

|

0.93 | 0.92 | 0.98 | 1.31 | 0.98 |

|

1.00 | 1.20 | 1.00 | 1.20 | 1.00 |

|

0.80 | 1.20 | 1.20 | 1.50 | 1.20 |

|

1.00 | 1.00 | 1.20 | N/A | 1.10 |

|

0.80 | 1.00 | 1.00 | 1.50 | 1.60 |

|

0.90 | 1.20 | 2.10 | 1.10 | 1.30 |

|

0.90 | 1.10 | 1.60 | 1.80 | 1.50 |

|

1.00 | 1.11 | N/A | 1.30 | 1.28 |

|

0.84 | 0.83 | 1.79 | 2.32 | 1.92 |

|

1.10 | 1.10 | 1.10 | 1.20 | 1.20 |

|

1.20 | 1.30 | 1.20 | 1.20 | 1.30 |

|

1.20 | 1.30 | 1.50 | 1.70 | 1.20 |

|

1.10 | 1.20 | 1.30 | 1.40 | 1.40 |

|

1.10 | 1.20 | 1.40 | 2.00 | 1.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 04/01/2025

What we found is that Trading 212 does not have competitive fees. Just comparing each forex pair spread below, you can see that Trading 212 has a rate far higher than the industry average.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| Trading212 Average Spread | 1.6 | 3 | 2.5 | 1.7 | 2.1 | 2.5 | 4.2 | 3.3 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

Overall, Trading 212 has some of the worst standard account spreads we recorded against the other 52 brokers we compared. Your fees will be at a premium if you trade CFDs with the provider.

2. Invest account

The Invest account is for traders who wish to purchase stocks and ETFs through the spot market. Unlike with the CFD account, using the invest account means you will own the underlying asset and can even purchase using fractional shares. You can visit our CFDs vs Investing in Stocks page.

Prices are based on the prices listed on the stock exchange however there are a few other fees such as deposit and fx conversion fees to be aware of. A 0.15% is also applied when you execute your trades.

It’s important to note that if you’re trading in the United Kingdom, you will incur a 0.5% stamp duty fee when buying UK shares. When selling US shares, a FINRA fee of $0.000145 per share is charged in addition to an SEC fee of 0.00229%. There are also other jurisdiction-specific fees like a 0.3% French Financial Transactions Tax, so it’s important to be aware of these.

3. ISA account

As mentioned, the ISA account is limited to traders and investors in the United Kingdom. It offers you the ability to shield your investments and trades from income tax, tax on dividends and capital gains. While a government deposit limit of up to £20,000 exists, the Trading 212 account offers you a good way to trade and invest into shares and ETFs without being taxed.

4. Other Fees

While there are no withdrawal fees, there is a charge of 0.7% with card payments once you have deposited $2000. They do not have inactivity fees. If you only intend to trade on an occasional basis, Trading 212 can be a better choice than some brokers who have monthly fees.

Verdict on Trading 212 Fees

When comparing standard account spreads which are the main fees for a standard account Trading 212 has higher fees than most other brokers. We recommend shopping around with other brokers before choosing the broker for CFDs and forex trading.

Trading Platforms

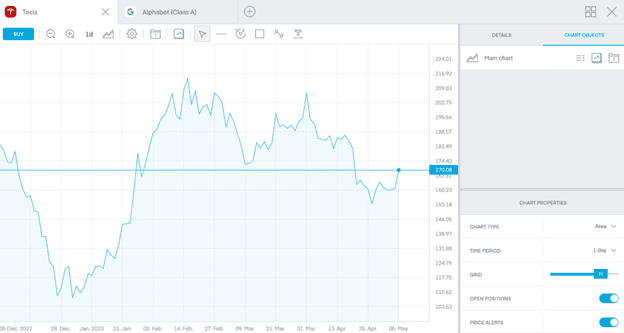

Trading 212 provides its own trading platform for mobile trading and web trading. You will use the same platform for Trading 212 Invest and Trading 212 CFD trading accounts. To compare this platform with others, see our best CFD trading platforms list.

| Trading Platform | Available With Trading 212 |

|---|---|

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

Strangely, Trading 212 makes it hard to find information about their trading platform on their website. The brokers make some mention about how to use their trading platform in their help section but for the most part, it was not easy to find out information.

App for Android and iOS Mobile

The Trading 212 mobile app is hugely popular. As we mentioned at the outset, it has over 10 million downloads and it’s not hard to see why traders like it due to its simple interface. We think it’s especially well-suited if you are a beginner trader but we fear that as an experienced trader, you might find the functionality limited.

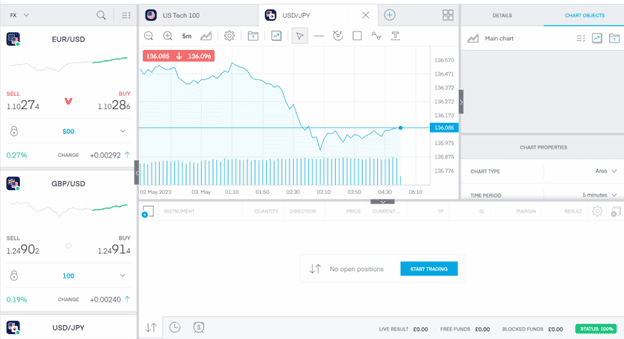

Web Browser

If you prefer to trade via the web browser, then you will get access to more features than with the mobile app. Choosing the web version means you can trade on any operating system – Windows, Mac and even Linux.

We thought the web version was quite intuitive and had decent customisation. There are enough charts and analysis tools to make trading decisions. Features with the web platform include:

- Live price feeds

- Watchlist for instruments you wish to follow

- 10 timeframes covering 1 minute to 1 month

- 5 chart types

- Technical and drawing analysis tools

- Sentiment analysis

- Alerts

- News, research and analysis of the market

- Video tutorials

While automation is not available through the platform itself, you can connect ProQuant to execute automated trading strategies. Learn more about the Best Automated Trading Platforms in our page.

If you are wondering if they have popular mainstream trading platforms such as MetaTrader 4, MetaTrader 5, or cTrader, you are out of luck. It is a similar story for social trading and copy trading.

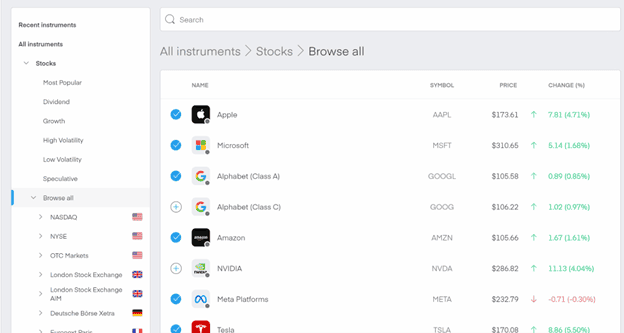

Trading 212 Platform with Invest Account

The Trading 212 comes with some useful features for their invest account. One interesting feature is Pies & AutoInvest, which allows you to automatically reinvest dividends and browse and copy other traders’ investment and trading portfolios.

Their platform also offers some useful categories like ‘speculative’, ‘high volatility’ and ‘dividend’, which we found to be helpful.

After spending a bit of time using the interface, we can confirm it is smooth and very easy to navigate, but it does feel and look a little basic at times.

Demo Account

Given so little information is provided about the trading platform, we think it is a good thing Trading 212 have a demo account to test the platform. This demo account has no expiry date and comes with 100k of virtual funds that can be topped up any time.

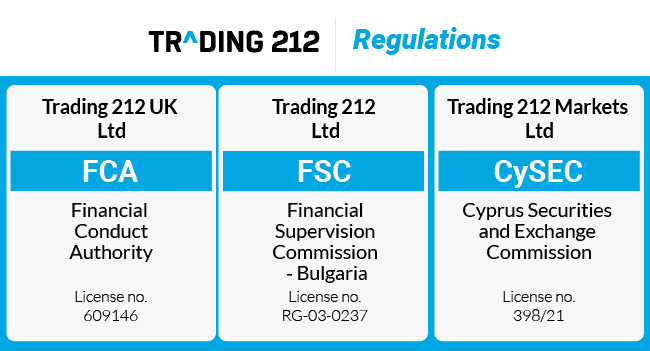

Is Trading 212 Safe?

As a UK trader, you can be confident Trading 212 is fully compliant with requirements set by the financial regulator of the UK – the Financial Conduct Authority (FCA). If you are in the UK, this is a big positive as it means Trading 212 can legally offer its trading services to you. It also means the broker must include negative balance protection as a part of their service.

Similarly, if you are in one of the member countries of the European Economic Community (EEC) then the broker can offer their trading services to you thanks to regulation from Cyprus Securities Exchange Commission (CySEC) and Financial Supervision Commission – Bulgaria. Since both these bodies fall under the jurisdiction of the European Securities And Markets Authority (ESMA), we know Trading 212 can legally offer to trade in this region.

It’s important to note, that Trading 212 isn’t regulated outside of these jurisdictions. If you’re based in Australia, Canada, the United States and certain other countries, then unfortunately you may not be able to sign up with Trading 212. We tried to register and sign in from Australia but weren’t able to do so. We checked with Trading 212 support and at this time they appear to be accepting from the UAE, and other countries in the middle east along with Thailand and a number of countries in Latin America.

While this might be a disappointment for some, we thought it added integrity given many brokers utilise an ‘offshore broker’, typically based in the Bahamas, Seychelles or Mauritius, enabling them to accept clients across most of the globe.

When looking through their website, we did find they have a waitlist you can sign up for if you are outside the UK or EEC, suggesting they have intentions of expanding in the future.

Regulation

Trading 212 is composed of three entities in total including Trading 212 UK Ltd which is the regulated UK entity, Trading 212 Markets Ltd which is the Cypriot-regulated entity, and Trading 212 Ltd which is the Bulgarian entity.

| Trading 212 Safety | Regulator |

|---|---|

| Tier-1 | FCA, CySEC |

| Tier-2 | X |

| Tier-3 | FSC-BG |

If trading from the UK, up to £85,000 of your funds will be safeguarded by the Financial Services Compensation Scheme (FSSC) in the event Trading 212 becomes insolvent. Likewise, if you’re trading from across Europe and are regulated under CySEC, then up to €20,000 of your funds will be safeguarded by the Investors Compensation Fund (ICF) of Cyprus. A Bulgarian Investors Compensation Fund also exists where your funds will be protected up to €20,000.

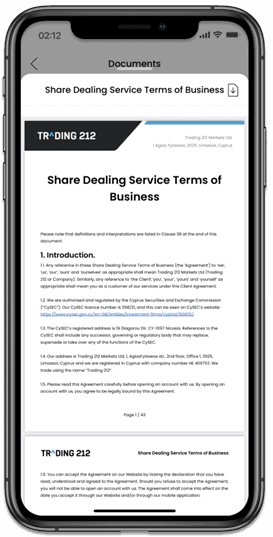

You can check at the top of your service terms contract (in the right corner) when signing up with an account to determine which entity you will be registered under.

Reputation

Trading 212 has been around since 2006 and is regulated by the relevant financial regulators for the UK and Europe. This is good as it appears to be their target market and is part of the reason we consider them to be a moderately safe broker. Not so good is that they are not regulated outside these regions so if you are outside these countries, the broker operates without regulatory protection for you or may not accept you.

Reviews

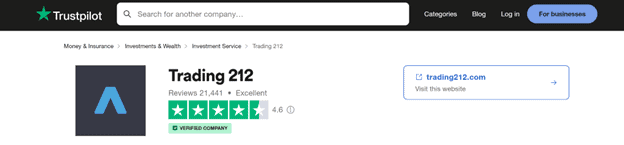

Other key points to mention are that negative balance protection is provided, funds are held in segregated accounts, and when we checked out Trustpilot for third-party validation, we saw that Trading 212 has a 4.6 out of 5 rating with over 21,400 reviews. They’re also highly active on social media with a large following.

Our Verdict On Broker Trust

We gave Trading 212 a score of 7/10 for broker trust and safety. Overall, we think Trading 212 seems pretty solid from a regulatory and safety perspective, and we like that they don’t appear to accept clients (for the most part) outside the regulations they are regulated in.

How Popular Is Trading 212?

There are 246,000 monthly searches for Trading 212 each month on Google, making it the 9th most popular Forex Broker. Similarweb in February 2024 shows a similar story with the broker the 6th most visited, receiving 7,706,000 global visits.

| Country | 2024 Monthly Searches |

|---|---|

| United Kingdom | 135,000 |

| Portugal | 12,100 |

| Germany | 8,100 |

| Netherlands | 8,100 |

| Spain | 6,600 |

| Italy | 5,400 |

| Poland | 5,400 |

| Ireland | 5,400 |

| United States | 4,400 |

| France | 4,400 |

| Greece | 2,400 |

| Australia | 1,900 |

| Austria | 1,600 |

| India | 1,300 |

| Switzerland | 1,300 |

| Canada | 880 |

| United Arab Emirates | 720 |

| Cyprus | 720 |

| Turkey | 590 |

| Philippines | 480 |

| Pakistan | 480 |

| Sweden | 480 |

| Thailand | 390 |

| South Africa | 390 |

| Nigeria | 390 |

| Hong Kong | 390 |

| New Zealand | 390 |

| Brazil | 320 |

| Singapore | 260 |

| Malaysia | 260 |

| Indonesia | 210 |

| Japan | 210 |

| Mexico | 210 |

| Kenya | 210 |

| Ghana | 210 |

| Vietnam | 170 |

| Morocco | 170 |

| Saudi Arabia | 170 |

| Colombia | 170 |

| Egypt | 170 |

| Taiwan | 140 |

| Bangladesh | 110 |

| Algeria | 90 |

| Argentina | 90 |

| Chile | 70 |

| Tanzania | 70 |

| Peru | 70 |

| Cambodia | 70 |

| Sri Lanka | 70 |

| Uzbekistan | 50 |

| Uganda | 50 |

| Jordan | 50 |

| Costa Rica | 50 |

| Ecuador | 40 |

| Mauritius | 40 |

| Venezuela | 30 |

| Dominican Republic | 30 |

| Ethiopia | 30 |

| Botswana | 30 |

| Bolivia | 20 |

| Mongolia | 10 |

| Panama | 10 |

2024 Average Monthly Branded Searches By Country

United Kingdom

United Kingdom

|

135,000

1st

|

Portugal

Portugal

|

12,100

2nd

|

Germany

Germany

|

8,100

3rd

|

Netherlands

Netherlands

|

8,100

4th

|

Spain

Spain

|

6,600

5th

|

Italy

Italy

|

5,400

6th

|

Poland

Poland

|

5,400

7th

|

Ireland

Ireland

|

5,400

8th

|

United States

United States

|

4,400

9th

|

France

France

|

4,400

10th

|

Deposit and Withdrawal

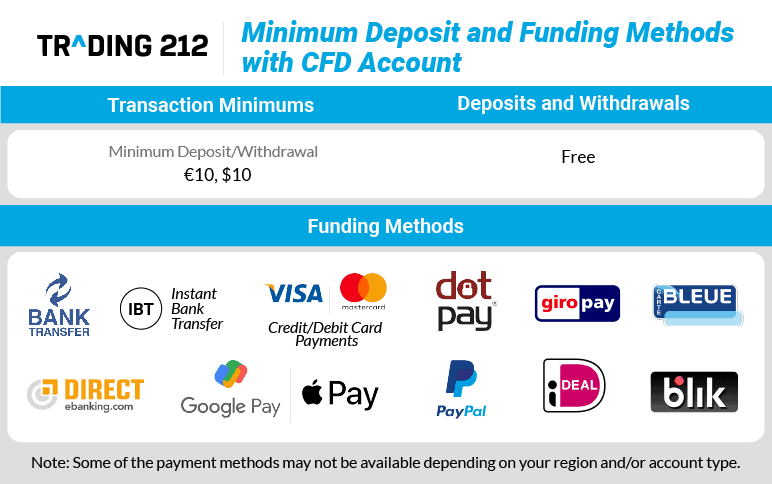

What is the minimum deposit at Trading 212?

Minimum deposits and withdrawals start from $1 / €1 on the Invest account and $10 / €10 on the CFD account.

Account Base Currencies

We like that Trading 212 offers various funding methods which earned it some additional points. Unfortunately though, given there are just three currencies to fund your account with – GBP, EUR or USD, it’s certainly not the most versatile.

Withdrawals and Deposits Options and Fees

We like that there are no custody fees for assets held on either of their account types. Likewise, there are no withdrawal or deposit fees if using a bank transfer. Deposits can be done via debit and credit card, Google Pay, Apple Pay and similar providers are also offered and are free up to your first $2,000 / €2,000, but incur a 0.7% on every deposit once you surpass this threshold.

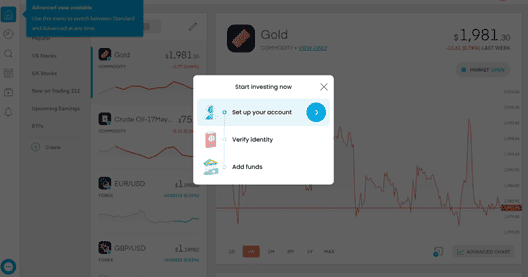

Ease To Open An Account

We tested the sign up process for Account Opening and it was fairly streamlined. All you need to do is follow three simple steps which entail account set up, identity verification, and once approved, adding funds.

Once you’ve added in all the key details including your name, age, place of residence, and where you pay your taxes, you’ll be good to proceed to the next stage where you’ll need to supply either a passport, identity card or drivers license, along with a bank statement or utility bill.

Product Range

Trading 212 offers commission-free trading on 7,000 stocks, 7,000 ETFs, and 177 forex pairs including all Major Forex Pairs, in addition to other asset classes when trading CFDs. If you are using Trading 212 Invest account you can only trade Stock and ETF trading products.

CFDs

We found the fact they have 177 Forex products interesting, very few brokers offer more than 100 although CMC Markets have over 300. We took a look at the Forex pairs available to determine how they have so many and it appears they are offering Forex pairs as futures or options.

Unfortunately, Trading 212 doesn’t offer cryptocurrencies, bonds or options which we found both disappointing and limiting, though we realised the lack of crypto is not the broker’s fault since the FCA does not allow crypto trading for retail traders. Consequently, while Trading 212 earned points for their robust range of stocks and ETFs, they ended up losing them for not offering crypto, bonds or options. The broker also does not have spread betting, which we know is very popular in the UK and prop trading (which isn’t so surprising).

Customer Service

Trading 212 offers 24/7 support with a 29 second average response time. They have a live chat feature with both automated responses and a real person which is a big plus, and their help centre and FAQ section is full of useful material.

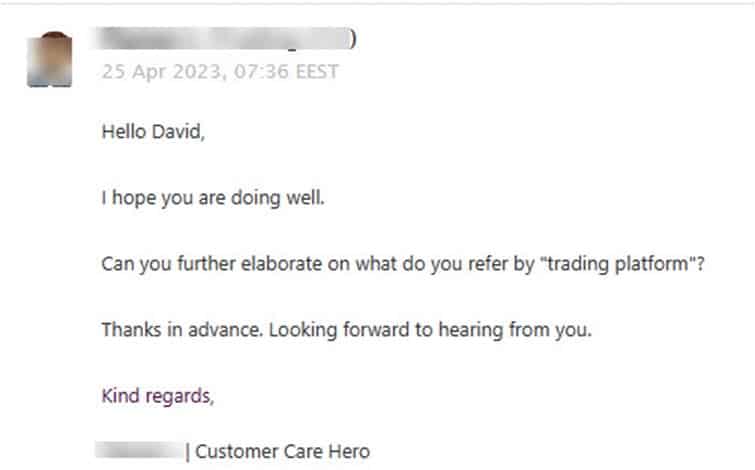

We did briefly speak to a customer support agent, and while they were quick to respond, but at time they didn’t appear to be all that knowledgeable about the features available.

Case in point, we wanted to understand their platform better so we asked for information via email to their customer service team. We were a bit baffled when customer service replied asking us what a trading platform is.

We however did like that there’s also a vibrant community forum which receives a lot of engagement on a range of topics. The Trading 212 team can be seen responding to questions and interacting with the community, which we thought was another big plus for the broker.

Research and Education

Trading 212 has a decent Learn library with a sizable selection of videos, blogs and explainer articles. There are also a lot of tutorials and educational content on its YouTube channel which has over 900,000 subscribers.

Overall, we think the educational content provided is good, but we think Trading 212 would benefit from offering other formats including client webinars, live analysis, and educational courses.

Final Verdict on Trading 212

For a broker with over 2 million funded accounts (or so they claim), we find it surprising how under the reader they seem to be. If you intend to trade CFDs, the broker operates as a market maker with commission-free trading, a decent (but not expansive) range of CFD products plus the ability to trade shares and ETFs with their Invest account.

Account opening is quick and so is getting started with their demo account, which just might be a good thing because it’s surprising how little is mentioned about the trading platform on their website.

Lastly, customer service is timely but their knowledge could be improved, we can’t understand how a customer support team for a Forex broker cannot know what a trading platform is. Overall we gave the broker 50 out of 100.

Trading 212 FAQs

Is Trader 212 regulated?

Trader 212 is regulated by the Financial Conduct Authority (FCA) in the UK and the Financial Supervision Commission (FSC) in Bulgaria.

Does Trader 212 offer a demo account?

Trader 212 provides a free demo account with virtual funds, allowing users to practice trading without risk.

What are the deposit and withdrawal methods?

Trader 212 supports various payment methods, including credit/debit cards, bank transfers, and e-wallets like PayPal and Skrill.

Does Trader 212 charge commission on trades?

Trader 212 offers commission-free trading on stocks and ETFs, while other instruments like CFDs may have associated fees.

Is Trader 212 available on mobile devices?

Trader 212 has a mobile app compatible with both iOS and Android devices, offering full trading functionality.

Compare Trading 212 Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research