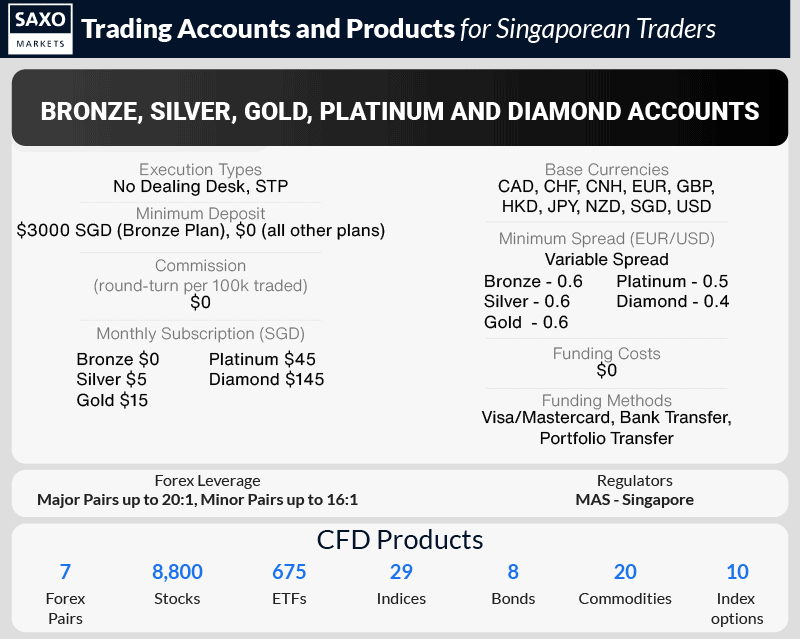

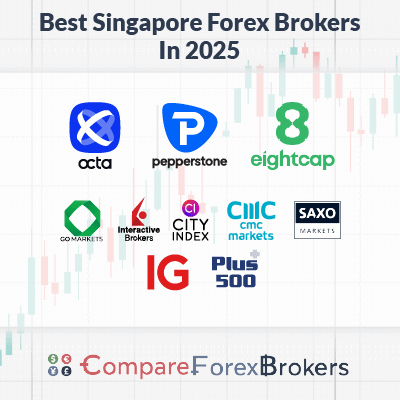

Best Forex Brokers In Singapore

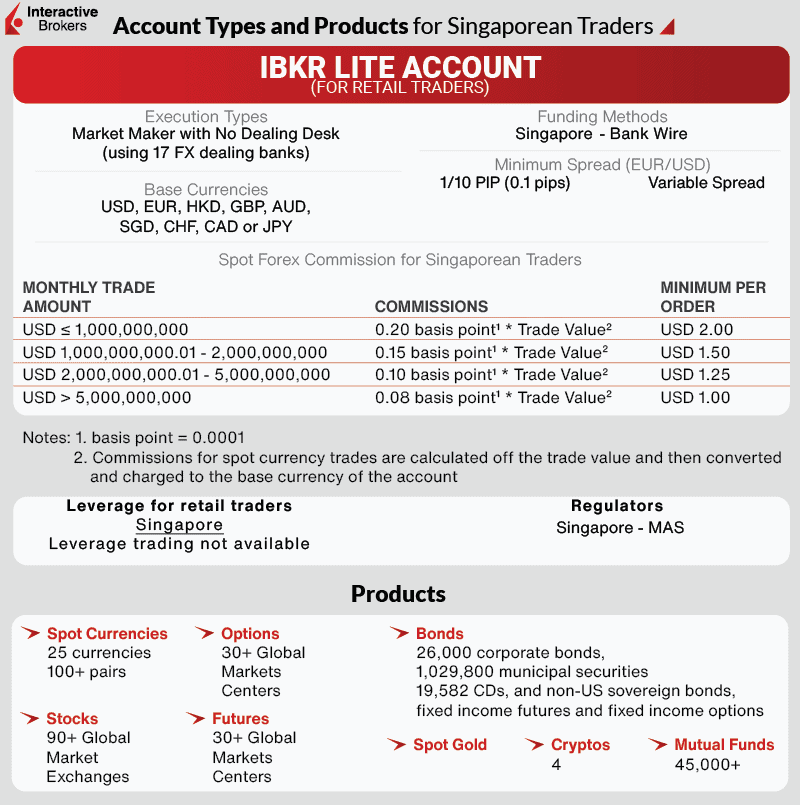

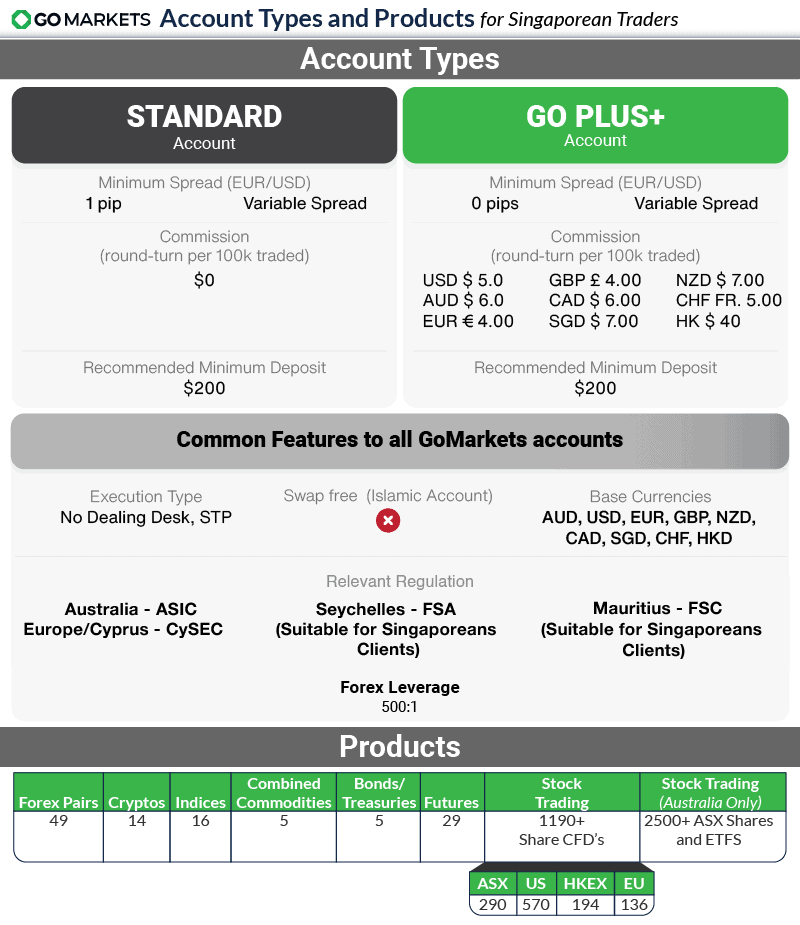

To determine the best forex brokers in Singapore, I compared more than 30 candidates. My aim was to discover who provides the lowest trading costs with the best trading conditions.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Ask an Expert

Is forex trading illegal in Singapore?

N0, forex trading is legal in Singapore however it is highly recommended to use a broker that is regulated by Singapore’s financial regulator known as the the Monetary Authority Singapore (MAS).

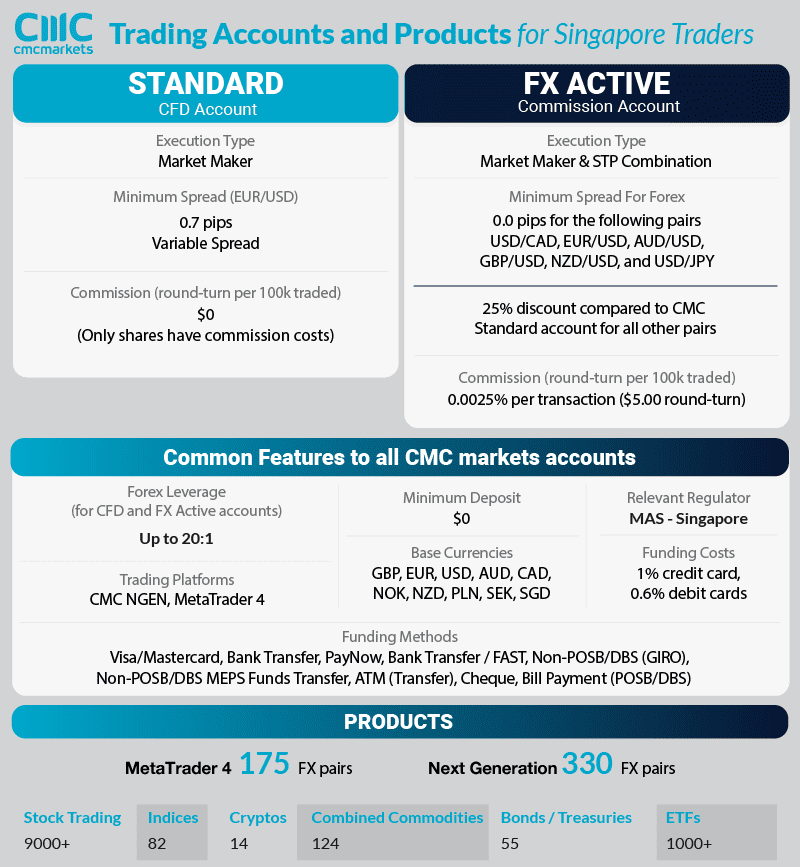

Brokers regulated by this authority include Oanda, CMC Markets, Swissquote, Plus500

What is the most popular commodity traded through Singapore CFD brokers? What leverage can I get trading it?

Gold is the most popular commodity to trade with Singapore CFD brokers. The leverage available is 5:1 (20% initial margin). Other commodities such as Silver, Oil also have the same leverage.