Who Are The Best Forex Brokers In Nigeria?

To help Nigerian forex traders choose a broker, we compared the fees and forex trading platforms to find the best forex brokers in Nigeria. Only CBN-regulated forex brokers and brokers from ‘tier 1’ regions such as Europe were part of this April 2025 comparison.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Our best registered forex brokers in Nigeria for April 2025 are:

- Pepperstone - MT4 Best Forex Trading Platform

- AvaTrade - Best Fixed Spread Trading Account

- FP Markets - STP Forex Trading Account

- FXTM - Nigerian Naira (NGN) Funding

- IC Markets - Lowest Spread Nigerian Broker

- HFM - Best High Leverage Forex Broker

- OANDA - Most Regulated Broker (FCA, ASIC)

- Plus500 - Best Forex Demo Account

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.2 | 0.29 | 0.21 | $3.00 | 1.2 | 1.4 | 1.3 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

62 |

FCA, FSCA, CySEC FSCM, CMA |

0.1 | 2 | 0.5 | $4.00 | 2.1 | 2.5 | 2.1 |

|

|

|

160ms | $10 | 58 | - | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

46 |

FCA, FSCA, CYSEC DFSA, CMA, FSA-S |

- | - | - | $3.00 | 1.4 | 1.6 | 1.6 |

|

|

|

$0 | 38+ | 19+ |

|

|||

Read review ›

Read review ›

|

91 |

MAS, CIRO, ASIC FCA, NFA/CFTC |

- | 0.2 | 0.2 | - | 0.92 | 0.9 | 1.1 |

|

|

|

- | $0 | 68 | 4 |

|

||

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

1. Pepperstone - MT4 Best Forex Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We recommend Pepperstone as the best forex broker in Nigeria. Our tests found the brokers average just 0.36 pips for the benchmark EUR/USD with Razor account which uses ECN or RAW spreads.

Our tests also found Pepperstone to have top execution speeds these being 77 ms for limit orders and 100 for market orders.

We liked that you can trade using 4 platforms – MT4, MT5, cTrader and TradingView and even use copy trading tools like Myfxbook and DupliTrade.

All these features make Pepperstone a compelling all-round broker.

Pros & Cons

- Low trading costs.

- Fast execution speeds

- No minimum deposit for opening a Raw account.

- All major trading platforms are available.

- Their educational materials are below average.

- They charge a $100 minimum deposit for a Standard account.

- They don’t offer a fixed spread account.

Broker Details

The Best Forex Trading Platform

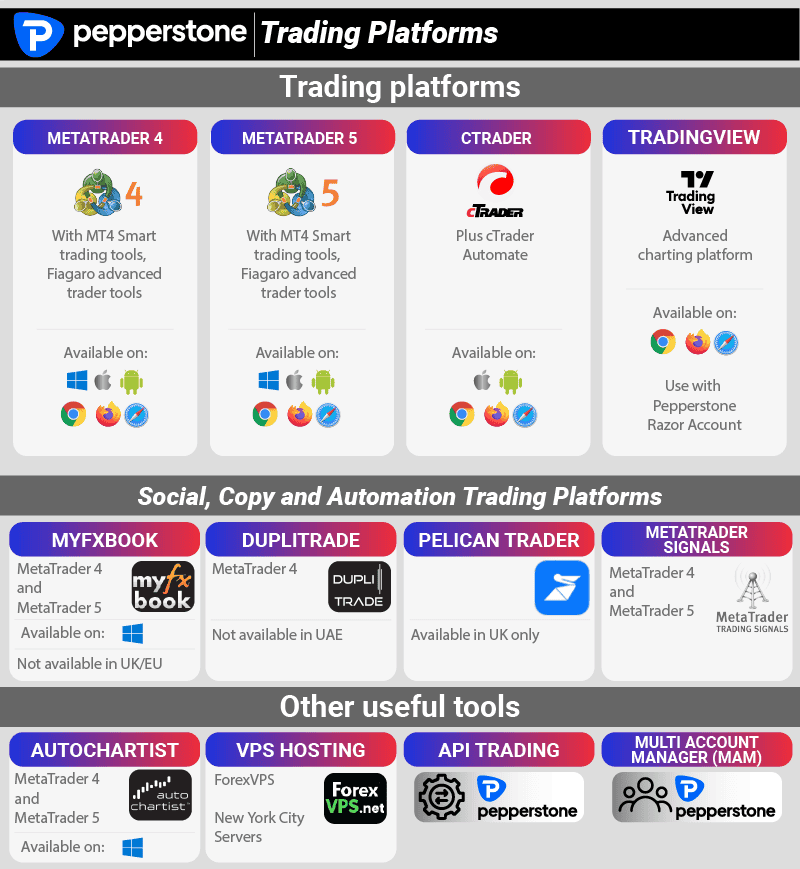

Pepperstone has the four top forex trading platforms based on popularity:

- MetaTrader 4 – Most Popular For Forex Trading

- MetaTrader 5 – Most Popular CFDs Trading Platform

- cTrader – Best Automated Trading Platform

- TradingView – Top Charting Platform

All FX trading platforms are available as desktop, webtrader, and mobile app platforms. Each option comes with a free demo account that allows Nigerian traders to test out forex brokers and platforms for 30 days. A maximum of AU$50k in virtual funds can be traded over this duration on CFDs and forex markets. There are also platform enhancements available for Pepperstone traders, including MetaTrader 4 smart trader tools, cTrader Automate, Autochartist, and API trading. These third-party tools give traders the edge on the most popular forex trading platforms with their superior technical analysis and trading conditions.

Other Key Features Of Pepperstone

1) Spreads And Commissions

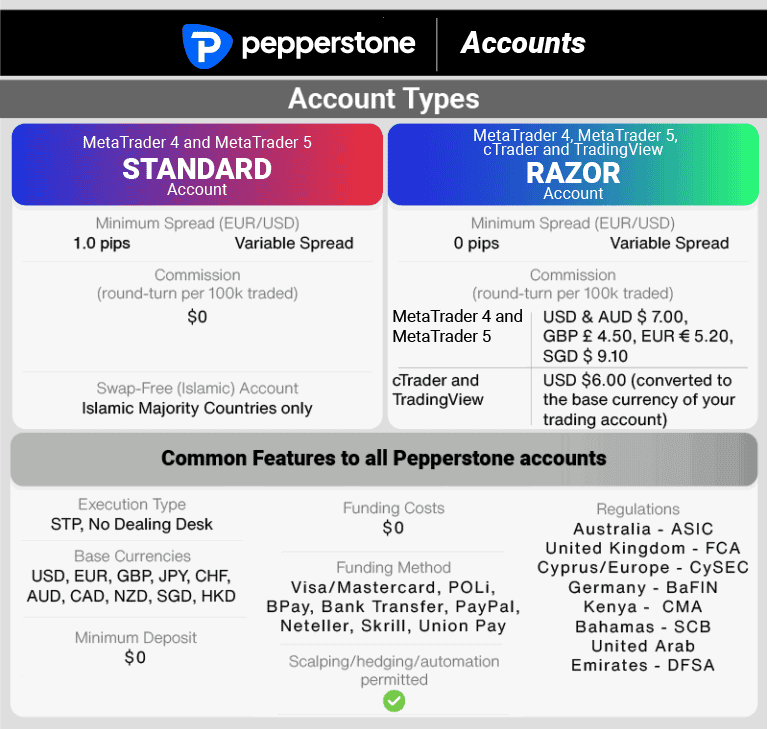

Pepperstone is the best forex broker in Nigeria and Lagos, not just for their platforms but also their fees. There are two forex accounts available. The first is the standard account, which has no commissions but slightly higher spreads, which is how the forex broker makes its money. The second is the Razor account (often called an ECN forex account) where the spreads are primarily determined by the market (not the Fx broker). Instead, the forex broker makes its money from commissions. Overall, the Razor account has some of the tightest spreads of any forex broker worldwide while having a low minimum deposit of $0.

Standard Account

Pepperstone’s standard account is available with MetaTrader 4 and MetaTrader 5 and offers some of the tightest no-commission spreads available to Nigerian forex traders.

Pepperstone’s commission-free spreads are significantly more competitive than other top brokers. If you are new to trading forex and want a no-commission account type to keep things simple, Pepperstone is a great option with tight spreads.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 04/01/2025

Razor Account

The Razor Account was designed with scalpers and algorithmic traders in mind, offering tight ECN-style spreads plus low commission fees. With straight-through processing and no dealing desk execution, Pepperstone provides an institutional-grade trading environment for experienced traders.

As you can see from the spread comparison below, Pepperstone is ultra-competitive across most major forex pairs.

Please note that all average spreads are sourced directly from the broker’s website and are updated monthly for increased accuracy.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 04/01/2025

With ECN-style accounts, forex brokers make money from commissions that apply to the Razor account. Below shows how the Razor account commission is very low at US$3.50 for MetaTrader 4 and 5.

If you select cTrader the commission is 7 unit charges per lot based on the base currency. This means that if you are trading 100,000 units of EUR/USD, you will pay a commission fee equal to 0.0035% of the base currency, in this case, €3.50 per side. All commissions can be reduced for high-volume traders through Pepperstone’s Active Trader’s program.

The final way forex brokers make money is through deposit and withdrawal fees. There are no such fees for Pepperstone. The minimum deposit of Pepperstone is $200, although the forex broker is open that they will accept a lower initial deposit from traders. Below are the overall costs for different brokers with our exclusive forex brokerage calculator.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

2) Customer Support

Pepperstone is the most awarded CFD provider in customer service. This includes investment trends that survey actual forex traders to gauge their performance. Pepperstone customer support ranges from global call centres, live chat, and e-mail.

3) Regulation

To avoid forex scams, it’s important to choose a broker that is regulated. Pepperstone is regulated by the two most credible regulators:

- FCA – The British Financial Conduct Authority

- ASIC – The Australian Securities and Investments Commission

- CySEC – Cyprus Securities and Exchange Commission

- BaFin – Federal Financial Supervisory Authority of Germany

- DFSA – Dubai Financial Services Authority

- CMA – Capital Markets Authority of Kenya

- SCB – Securities Commission Of The Bahamas

Pepperstone is also receiving regulatory approval from the Financial Services Conduct Authority of South Africa and Seychelles.

Apart from the forex foreign exchange and their low trading fees, on Pepperstone you can also trade with ETFs, bonds, various asset classes and other financial instruments. The good thing about Pepperstone is that they do not charge any inactivity fees as well and have a minimum deposit requirement of $0.

2. AvaTrade - Best Fixed Spread Trading Account

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

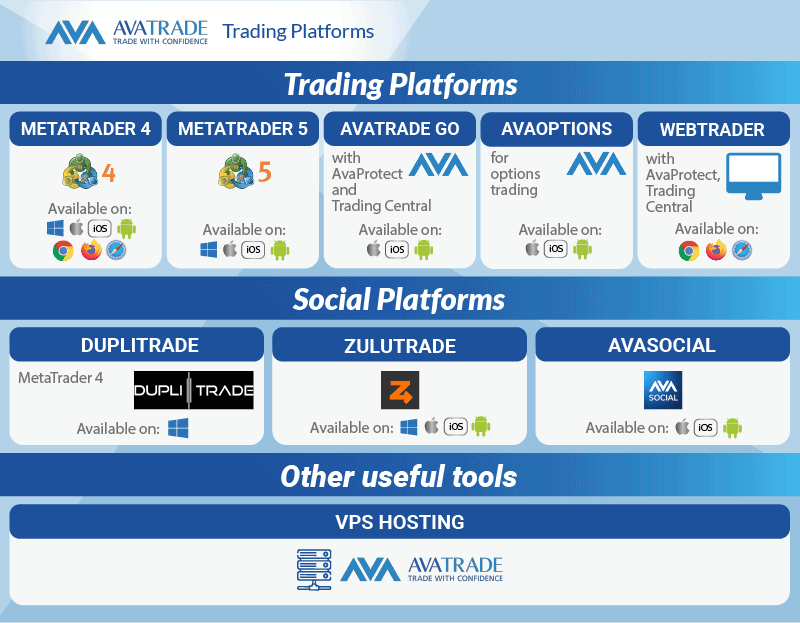

We recommend AvaTrade because it is a multi-regulated broker that offers tight fixed spreads on a range of currency pairs and CFDs including options (which few brokers have).

We like its fixed pricing model, the broker’s fixed spreads are commission-free and do not fluctuate with changes in market conditions as variable spreads do. Spread are 0.9 pips for EUR/USD most of the time according to our tests.

AvaTrade’s commission-free fixed spreads are offered across all the broker’s CFD trading platforms – MetaTrader 4, MetaTrader 5 and the broker’s proprietary trading platforms, AvaTradeGO and AvaOptions.

Pros & Cons

- Low fixed spreads.

- Licensed by reputed regulators.

- Wide range of trading platforms.

- Offers a dedicated account manager.

- Minimum deposit of $100.

- No commission-based account.

- No customer support on weekends.

Broker Details

AvaTrade is a broker that only offers fixed spreads. This can make AvaTrade a good choice for scalpers, as spreads are predictable and for traders wanting a level of protection in a volatile market.

Fixed Spreads

AvaTrade is a multi-regulated broker that offers tight fixed spreads on a range of currency pairs and CFDs. As a market maker broker, AvaTrade uses internal liquidity pools and a dealing desk to execute orders. Following a fixed pricing model, the broker’s fixed spreads are commission-free and do not fluctuate with changes in market conditions as variable spreads do.

Examples of AvaTrade’s average fixed spreads:

- EUR/USD 0.9 pips

- USD/CHF 1.6 pips

- AUD/USD 1.1 pips

- NZD/USD 1.8 pips

- EUR/CAD 3.3

Trading Platforms

AvaTrade’s commission-free fixed spreads are offered across all the broker’s CFD trading platforms – MetaTrader 4, MetaTrader 5 and the broker’s proprietary trading platform, AvaTradeGO. While AvaTrade charges no commission fees, there are general trading and account costs that customers may incur. For instance, if you hold a forex and CFD position open for longer than one day you will pay (or receive) overnight financing fees, also known as swap rates.

Choosing the AvaTradeGO app for Android and iOS mobile means you will get access to AvaTrade’s exclusive risk management tool known as AvaProtect. With this feature, you can buy time to decide if you wish to reverse your trade. This feature can be handy in the event price movement goes against you for a set amount of time after your trade. Besides AvaProtect, all AvaTrade clients will get negative balance protection.

AvaTrade also offers a mobile app specifically designed for options trading. Options trading can be complicated and many standard CFD trading platforms lack design features that allow you to truly make the most of the potential with options trading.

AvaTrade Islamic Trading Accounts

Although the broker only offers one main forex and CFD trading account as all spreads are fixed and commission-free, AvaTrade caters to Islamic traders by offering a swap-free account type. Islamic Accounts are designed for traders that follow Sharia law where you cannot earn or receive interest. Rather than interest rate-based payments, Islamic traders pay a flat-rate daily administration fee for forex positions held open overnight. There are certain CFD products Islamic Account holders cannot trade, including cryptocurrencies and forex pairs that include the ZAR, RUB, MXN or TRY.

3. FP Markets - STP Forex Trading Account

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

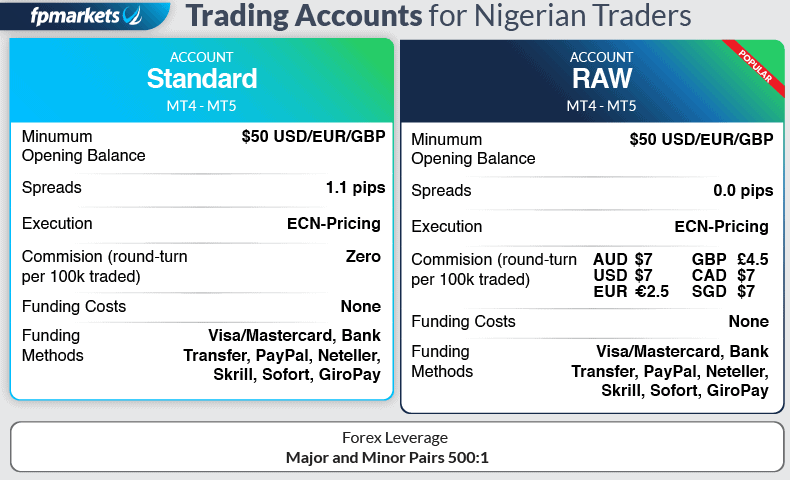

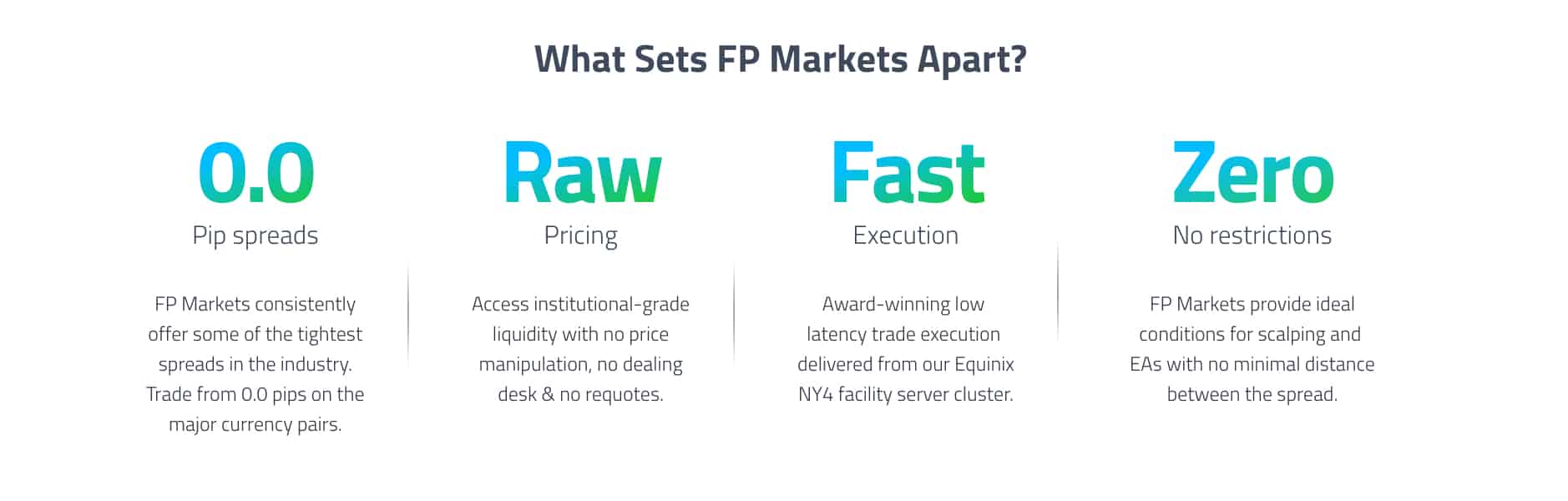

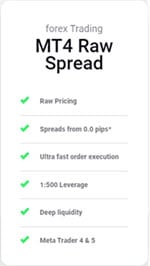

We recommend FP Markets because it offers STP trading with tight spreads and great customer support. To access the broker’s competitive trading conditions, you can pick between two account types that offer different pricing structures – the spread-only account and the commission-based account.

Spreads with the RAW spread account have an average of 0.1 pips for EUR/USD according to the broker and in tests done by our colleague Ross Collins, we found they averaged a low of 0.41 pips.

With deep liquidity sourced from 50+ major financial institutions, FP Markets can offer some of the tightest raw spreads available to retail investor accounts according to our tests.

Pros & Cons

- Tight standard and raw spreads.

- Excellent customer support with a dedicated account manager.

- Above-average educational material.

- No minimum deposit for the Raw account.

- FP Markets Social need more advanced features.

Broker Details

FP Markets is a top ECN broker offering STP trading with tight spreads and fast execution speeds. To access the broker’s competitive trading conditions, you can pick between two account types that offer different pricing structures. Both account types require a minimum deposit of AU$100 and are available on MetaTrader 4, MetaTrader 5, cTrader and TradingView.

- Standard Account: Forex spreads from 1.0 pips + no commission fees.

- Raw Account: ECN spreads starting from 0.0 pips + US$3 commission fee per side, per 100k traded.

Trading Conditions

Regardless of the account type or trading platform you decide on, you can enjoy excellent trading conditions with low spreads and fast trade execution.

The no-dealing desk broker executes your orders using straight-through processing (STP) and multiple liquidity providers. With deep liquidity sourced from 50+ major financial institutions, FP Markets can offer some of the tightest spreads available to retail investor accounts.

As well as low spreads, the NDD broker offers:

As well as low spreads, the NDD broker offers:

- A low likelihood of re-quotes and slippage.

- Low latency order execution.

- Over 60 major, minor and exotic currency pairs.

- Besides forex, commodities, shares, and indices are available to trade as CFDs.

- Algorithmic trading with Expert Advisors on MT4 and MT5.

- An Islamic trading account for traders of the Muslim faith, with no interest-based swap rates.

- MT4 and MT5 demo accounts.

Financial Regulation

The broker is popular among the Nigerian forex trading community as it is overseen by multiple top-tier financial authorities.

- Australia: Regulated by the Australian Securities and Investments Commission (ASIC).

- Europe: Regulated by Cyprus’ Securities and Exchange Commission (CySEC)

- Global: Regulated by the Financial Services Authority in St. Vincent and the Grenadines (FSA).

Overall, FP Markets is a great option for Nigerian traders wanting a trusted STP broker. With STP order execution, the broker can offer ultra-tight ECN spreads via its raw account, or low no-commission spreads through its standard account.

Both account types enjoy excellent trading conditions with fast execution speeds on MetaTrader 4, MetaTrader 5, cTrader or TradingView. To test FP Markets’ ECN features, you can sign up for a demo account to practise trading.

4. FXTM - Nigerian Naira (NGN) Funding

Forex Panel Score

Average Spread

EUR/USD = 0

GBP/USD = 0

AUD/USD = 0.5

Trading Platforms

MT4, MT5

Minimum Deposit

$10

Why We Recommend FXTM

We recommend FXTM because it is ideal if you are new to CFD trading. With the highest leverage of any Nigerian forex broker of 1,000:1, good training material, and social trading options FXTM caters for a wide range of clients.

FXTM proves to us that it is a reliable broker because of the amount of global regulatory licenses that they hold including the FCA (Financial Conduct Authority) of the United Kingdom, CySEC (Cyprus Securities and Exchange Commission) of Cyprus, and the FSC (Financial Services Commission) of Mauritius.

Pros & Cons

- Offers social trading.

- Offers high leverage.

- Tight Raw spreads.

- Higher than average commission.

- Does not offer cTrader, TradingView, or any proprietary platform.

- No customer support on weekends

Broker Details

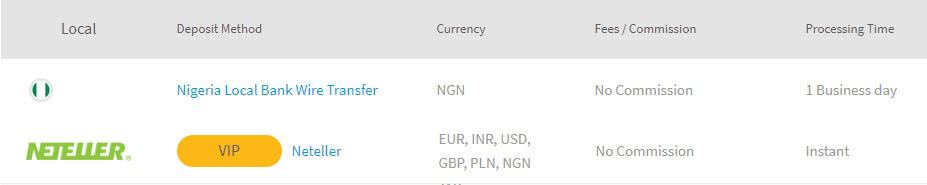

Most online brokers don’t offer local Nigerian Naira ₦ (NGN) funding increasing the exchange costs of currency trading. ForexTime offers two NGN account funding methods these being bank wire transfer and Neteller. The minimum deposit is $100 for a standard Forex account for ForexTime. This allows individuals to start trading a range of currency markets while lowering the exchange costs when moving NGN currency to a standard base currency like the GBP, USD or EUR.

Other Key Features Of FXTM (ForexTime)

ForexTimeoffersr social trading (copy trading) which means a trader: Selects a Strategy Manager

- Makes a deposit (minimum deposit of $100)

- Mirror the Strategy Manager’s trade

- Watch as you share a percentage of wins/lossesCash-out or add deposits when required

ForexTime also offers local seminars in Nigerian locations such as Port Harcourt. This is run by industry experts and complements the forex trading (e.g. webinars) offered on the website.

Why Choose ForexTime (FXTM)?

ForexTime is ideal for Nigerian traders new to CFDs with a higher risk profile. With the highest leverage of any Nigeria fx broker of 1,000:1, detailed training and social trading options, they are ideal for time-poor traders who want to test CFD financial markets.

FXTM proves itself to be a reliable broker because of the amount of global regulatory licences it holds:

- FCA (Financial Conduct Authority) – United Kingdom

- CySEC (Cyprus Securities and Exchange Commission) – Cyprus

- FSC (Financial Services Commission) – Mauritius

5. IC Markets - Lowest Spread Nigerian Broker

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

We are long-time fans of IC Markets due to their exceptionally low spreads, when using their RAW spread account spread average is 0.02 pips for the EUR/USD pair which is very good. Even their standard account has low spreads, with just 0.062 pips for the same EUR/USD pair.

Trading is available with MT4, MT5, cTrader and TradingView and we appreciate the availability of cTrader Copy, Myfxbook and ZuluTrader for copy trading.

Pros & Cons

- Winner for lowest spreads in our tests

- Largest broker in the world by daily volume traded

- MT4, MT5, cTrader, TradingView

- Good for high-volume traders

- Education tools need a refresh

- Live chat is very slow to respond

Broker Details

IC Markets is based in Australia (ASIC regulated) and offers the lowest brokerage fees, including:

- Low spreads on major currency pairs and exotic pairings

- Low commissions for MT4, MT5, cTrader or TradingView forex traders

- No Deposit Or Withdrawal Fees

Spreads Offered By IC Markets

Spreads Offered By IC Markets

The table below compares IC Markets to other major forex brokers in Nigeria for average spreads. Across many currency pairs, IC Markets has the lowest spreads.

| Average Spreads (21/02/2019) | EUR/USD | USD/JPY | AUD/USD | GBP/USD |

|---|---|---|---|---|

| Pepperstone | 0.13* | 0.25* | 0.14* | 0.44* |

| Oanda | 0.2* | 0.2* | 0.2* | 0.2* |

| IC Markets | 0.1* | 0.2* | 0.2* | 0.4* |

| IG Markets | 0.263* | 0.293* | 0.512* | 0.992* |

| CMC Markets | 0.805 | 0.879 | 0.751 | 2.793 |

| AxiTrader | 0.44* | 0.62* | 0.42* | 0.85* |

Commissions Offered By IC Markets

Forex traders in Nigeria can receive some of the lowest commissions from IC Markets including:

- US$3.5 (per lot per side) for MetaTrader 4

- US$3.5 (per lot per side) for MetaTrader 5

- US$3.0 (per USD 100k) for cTrader

There is no commission for the standard account (commission-free account) but this isn’t recommended for this CFD provider as the overall fees are higher. They also were awarded in 2020 with the Swap Free Islamic Accounts.

Deposit/Withdrawal Fees

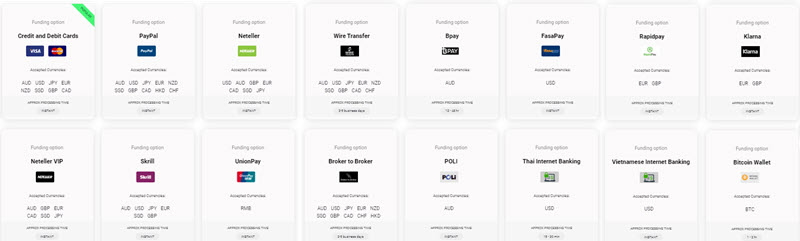

IC Markets has no charges on any account deposits or withdrawals to any forex account. Any fees that may be charged will be from the local bank if an international bank transfer is chosen. Below are the funding methods available with IC Markets.

The minimum amount needed to fund an account (minimum deposit) is US$200 or the equivalent in another base currency.

6. HFM - Best High Leverage Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 0.7

AUD/USD = 0.1

Trading Platforms

MT4, MT5, HFM App

Minimum Deposit

$0

Why We Recommend HFM

We recommend HFM to traders who are looking for a broker that offers high leverage as they offer leverage of 1:1000 which is higher than most other brokers will permit. Other key features of HotForex include a good choice of trading accounts and several bonus offers.

We love that HFM offers two unique types of accounts. These are designed for traders who wish to use trading automation or copy trading.

- Auto – This account allows you to subscribe to free and paid trading signals in the MQL5 community when using HFM MT4

- HFcopy- This account allows you to follow the trades of strategy providers who have joined HFcopy

Pros & Cons

- Better than average raw spreads.

- Decent commission of $3 per side.

- High number of bonus offers and discounts.

- Offers a dedicated social trading account.

- Below average standard spreads.

- Does not offer cTrader or TradingView.

- Does not accept PayPal.

Broker Details

HFM is a good choice if you are looking for a broker that offers High Leverage Forex Brokers as they offer leverage of 1:1000, which is higher than most other brokers will permit. The key features of HotForex include:

- High Leverage of 1:1000

- Choice of trading accounts

- Bonus offers

High Leverage Of 1:1000

While most brokers offer a maximum of 1:500 and in Europe 1:30 leverage when trading, HotForex allows trading with 1:1000 with their Micro account. While leveraged trading (sometimes called margin trading) carries high risk when movements don’t go in your favour, leverage can be a useful tool to amplify your profits with little capital when successful.

Choice Of HotForex Trading Accounts

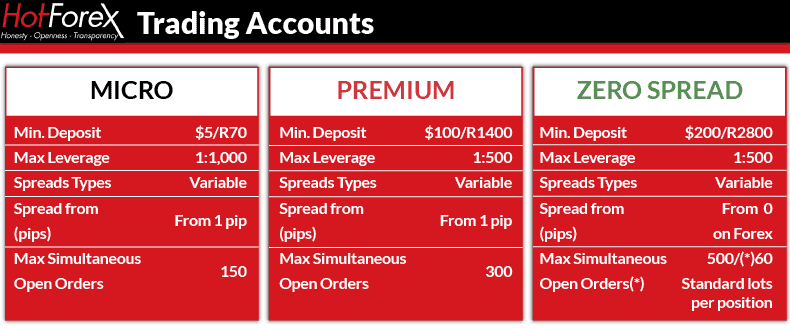

HFM offers a choice of 5 trading accounts. Most retail traders will want the Micro, Premium or Zero Spread account, as these are built for traders who plan to manage their trading activities. Each of these accounts can be summarised as:

- Micro – Good for traders with low trading experience. This account has low deposits, commission-free trading, and a leverage of 1:1000.

- Premium – Similar to the Micro account, but with a higher minimum deposit and lower leverage. Spreads are tighter than the Micro.

- Zero Spread – This account offers ECN pricing. Commission with major pairs is $6 round turn and $4 round turn for minor pairs.

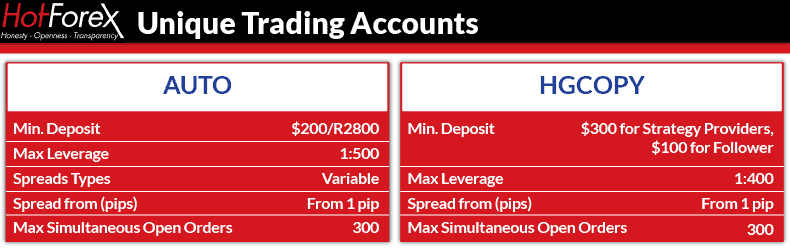

HFM also offers two unique accounts. These are designed for a trader who wishes to use trading automation or copy trading.

- Auto – This account allows you to subscribe to free and paid trading signals in the MQL5 community when using HotForex MT4

- HFcopy- This account allows you to follow the trades of strategy providers who have joined HFcopy

Bonus Offers

HF Forex has a large range of bonus offers, which means extra cash to trade with. HFM bonus offers include:

- 100% supercharged deposit bonus – Earn $2 cash rebates per lot each time you deposit $250 or more into your account

- 30% rescue bonus – earn up to $7,5000 for every deposit over 50%

- 100% credit bonus – Increases your account leverage provided you meet trading volume requirements

7. OANDA - Most Regulated Broker (FCA, ASIC)

Forex Panel Score

Average Spread

EUR/USD = 1.4

GBP/USD = 2

AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

With average spreads of 0.6 pips for EUR/USD and no commissions with OANDA, we think the broker deserves a spot as one of the best brokers if you are in Nigeria.

We like the OANDA Trade platform as it comes with TradingView charts (the best in the industry), an order book overlay and a guaranteed stop-loss order. Other platforms include MT4 and TradingView.

With customer support, we appreciate that OANDA has won several customer service awards. It’s offered via live chat, emails and Twitter along with a dedicated account manager.

Customer satisfaction is also enhanced through periodic trading news, instructor-led online trading education material, and a plethora of free tools and resources.

Pros & Cons

- Very tight standard spreads for major currency pairs.

- Does not charge a minimum deposit.

- Highly regulated broker.

- Offers a dedicated account manager.

- No MT5 or cTrader.

- Very limited funding options.

- No swap-free account and no fixed spread account.

Broker Details

OANDA operates across the six most credible authorities, including:

OANDA operates across the six most credible authorities, including:

- Australia ASIC (Australian Securities and Investments Commission)

- United States CFTD (Commodity Futures Trading Commission)

- Europe and UK FCA – (Financial Conduct Authority)

- Japan IFFA (Institute Financial Futures Association)

- Singapore MAS (Monetary Authority of Singapore)

- Canada IIROC (Investment Industry Regulatory Organization of Canada)

OANDA Focuses On Transparency

Along with regulation, OANDA has focused on pricing transparency and customer satisfaction. With pricing, they offer real-time data from liquidity providers and find mid-points across instruments. This is communicated to traders to be transparent about spreads. With customer support, OANDA has won several customer service awards for 24 hours/6 days week support. It’s offered via live chat, emails and phone support. Customer satisfaction is also enhanced through periodic trading news, instructor-led online trading education material, and a plethora of free tools and resources.

Why Choose OANDA?

If regulation, transparency and satisfaction are your priority, OANDA is the best forex broker for your trading needs. The downside is the CFD provider offers low leverage, spreads are not as competitive as Pepperstone and IC Markets and trading markets such as cryptocurrencies are not available.

8. Plus500 - Best Forex Demo Account

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why We Recommend Plus500

We recommend CFD providers Plus500 for their excellent WebTrader platform and mobile app. The webtrader comes with 100 indicators, 20 drawing tools, 13 chart types and risk management tools such as a Stop Limit, Trailing Stop, and Guaranteed Stop-Loss Order (GSLO).

To trade with Plus500, you will find there is no minimum deposit, and spreads are commission-free with an average of 1.7 pips for the EUR/USD pair. A large range of trading products are available including Forex, cryptos and indices.

Pros & Cons

- Minimum deposit of $100.

- Several funding options.

- 24/7 customer support.

- No raw spread account.

- Does not offer MT5, cTrader, or TradingView.

- Charges high spreads.

Broker Details

Plus500 is a CFD broker with its forex trading platform offering:

- A free unlimited demo account

- Various trading options from Stop Limit and trailing Stops to Guaranteed Stops

- Web trading, Mobile trading and a desktop trading platform

They offer the best range of Cryptocurrency trading with instruments6, including Bitcoin, Ethereum, Litecoin, NEO, Ripple XRP, IOTA, Stellar, EOS, Cardano, Tron and Monero. This can be traded on their real money or demo account to get a feel for these markets.

Plus500 is listed on the London Stock Exchange and all Nigerian traders’ client money is segregated for their protection.

Why Choose Plus500

Overall, Plus500 is recommended for those looking for the best forex demo accounts that works on their desktop or mobile devices and offers an extensive list of tradable instruments from currency to crypto.

Ask an Expert

Does Nigeria have a regulator?

Nigeria had two financial regulators – The Central Bank of Nigeria (CBN) and the Securities and exchange commission (SEC) who have the authorisation to make laws and regulations regarding the trading of financial derivative products in Nigeria. While these bodies have the powers, at this time there is no process for brokers to obtain official regulation to operate in Nigeria.

Is octafx good forex broker

We have never reviewed Octafx so cannot give a fair assessment but we plan to review them sometime this year

what broker woud you recommend for a Nigerian trader

All of the brokers we have analysed above are great recommendations. Just make sure you choose a broker than has appropriate regulation.

please kindly review SerengetiFx i am using the platform and i want to know my funds are safe

Hi bossmedia – while we have no plans to do a review about SerengetiFX, a look at this website doesn’t show any indication they are formally regulated in Nigeria and while they do appear regulated by ASIC in Australia they don’t appear to be regulator by any other relevant regulated. We only recommend using a broker using a relevant regulator, that not to suggest SerengetiFX is unsafe but you can be more sure they are safe if they are regulated.