MetaTrader 4 vs ProRealTime Comparison [Updated 2025]

MetaTrader 4 is one of the most popular trading platforms in the world, but how does it compare against an advanced trading platform like ProRealTime? I’ve tested both, and in this article, I’ll highlight the pros and cons of both platforms.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

How Does MetaTrader 4 vs ProRealTime Differ?

MetaTrader 4 vs ProRealTime differ primarily in the interface designs, but ProRealTime also offers advanced ProRealTrend tools and access to multiple markets, including Share CFDs, which MT4 lacks. I’ve found MT4 is better suited for new traders, while ProRealTime’s advanced features make it an ideal choice for professional traders.

| Feature | MetaTrader 4 | ProRealTime |

|---|---|---|

| Basic Information | ||

| Launch Year | 2005 | 2000 (initial version) |

| Developer | MetaQuotes Software | IT Finance |

| Primary Focus | Forex | Multi-asset (Stocks, Futures, Forex, CFDs) |

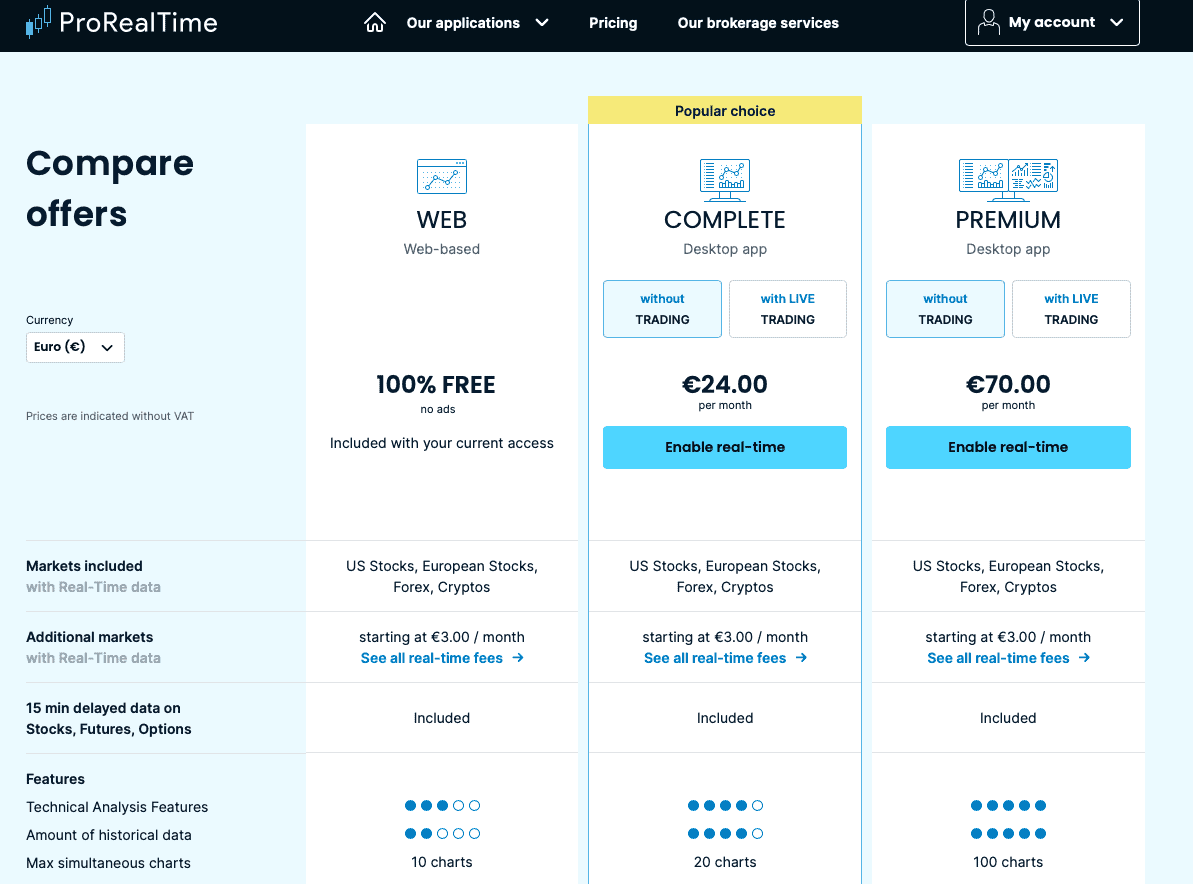

| Cost | ||

| Platform Fee | Free (provided by brokers) | Subscription-based ($30-$100/month, free with some brokers with sufficient trading volume) |

| Availability | ||

| Desktop | Windows native (Mac via emulation) | Windows and Mac native |

| Web Platform | Yes | Yes |

| Mobile App | Comprehensive apps for iOS and Android | Limited mobile functionality |

| Trading Features | ||

| Automated Trading Systems | Yes (Expert Advisors) | Yes (ProOrder scripts) |

| Programming Language | MQL4 | ProOrder |

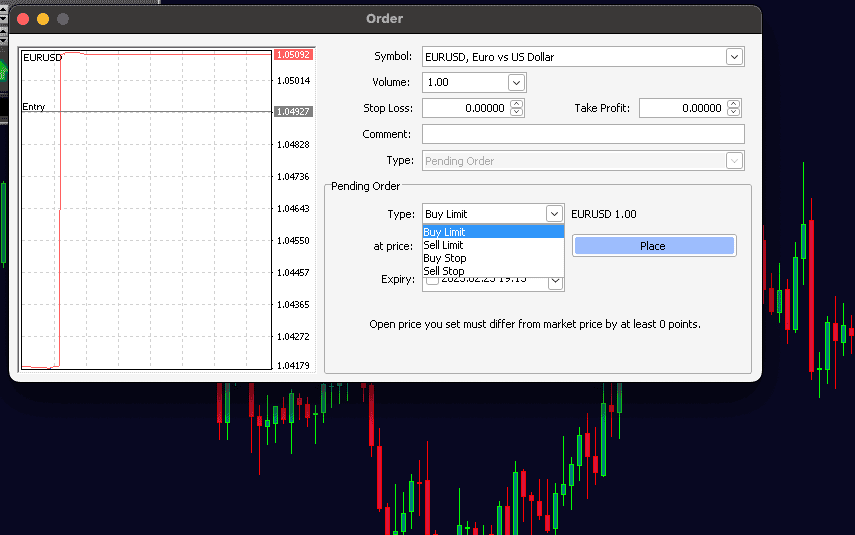

| Order Types | Market, limit, stop, trailing stop | Market, limit, stop, trailing stop, OCO (One-Cancels-Other) |

| Charting Capabilities | ||

| Built-in Indicators | 30+ | 100+ |

| Create Custom Indicators | Yes, via MQL4 | Yes, via ProOrder |

| Timeframes | 9 standard timeframes | 16+ timeframes, including custom |

| Drawing Tools | Comprehensive basic set | Advanced with more customization options |

| Chart Types | Bar, candlestick, line | Bar, candlestick, line, renko, point & figure, kagi |

| Analysis Tools | ||

| Backtesting | Basic | Advanced with detailed reporting |

| Market Depth | Requires addons | Natively built into the platform |

| Volume Profile | Requires custom indicators | Yes |

| Pattern Recognition | Requires custom EAs | Yes |

| Broker Availability | ||

| Number of Brokers | 1000+ globally | Only IG Markets (tastyfx), Interactive Brokers, Saxo Bank. |

What Is MetaTrader 4?

Launched in 2005 by MetaQuotes Software, MT4 is one of the oldest forex trading platforms and also one of the most commonly offered by brokers. MT4 was one of the first retail trading platforms to provide advanced charting tools without a hefty license fee.

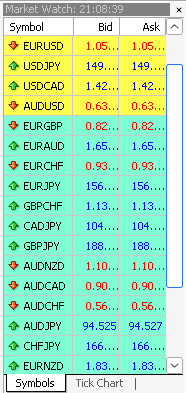

With MetaTrader 4, any retail trader could use the broker’s 30+ indicators (such as moving averages and Bollinger Bands) and develop their trading strategies at home.

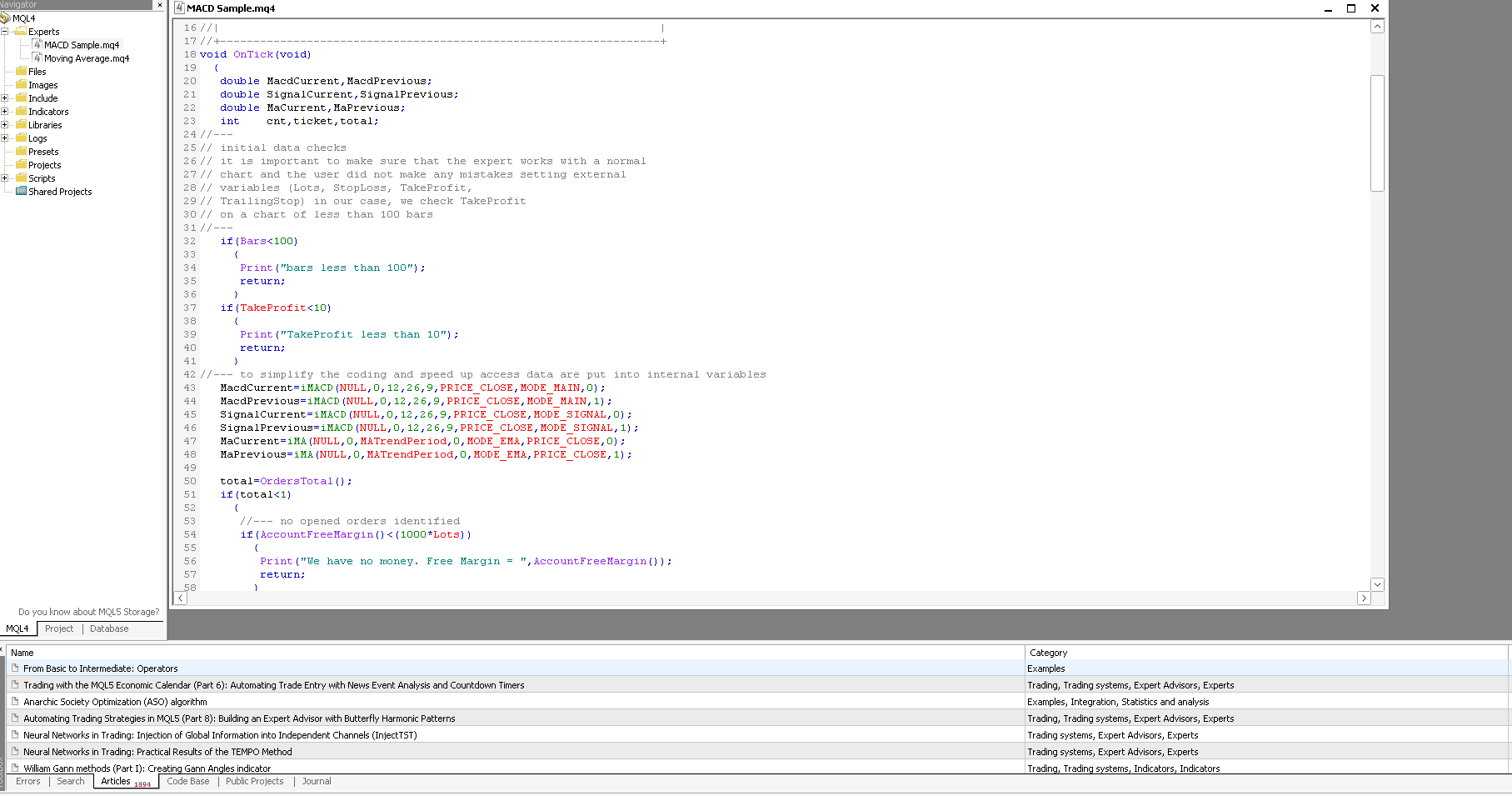

MT4 is one of the most advanced platforms because it allows custom indicators and automations (Expert Advisors) through their MQL4 programming language. These features let you transform your manual trades into automated strategies that can run 24/5, which is helpful if you want to trade the Asian, London, and New York trading sessions.

What Is ProRealTime?

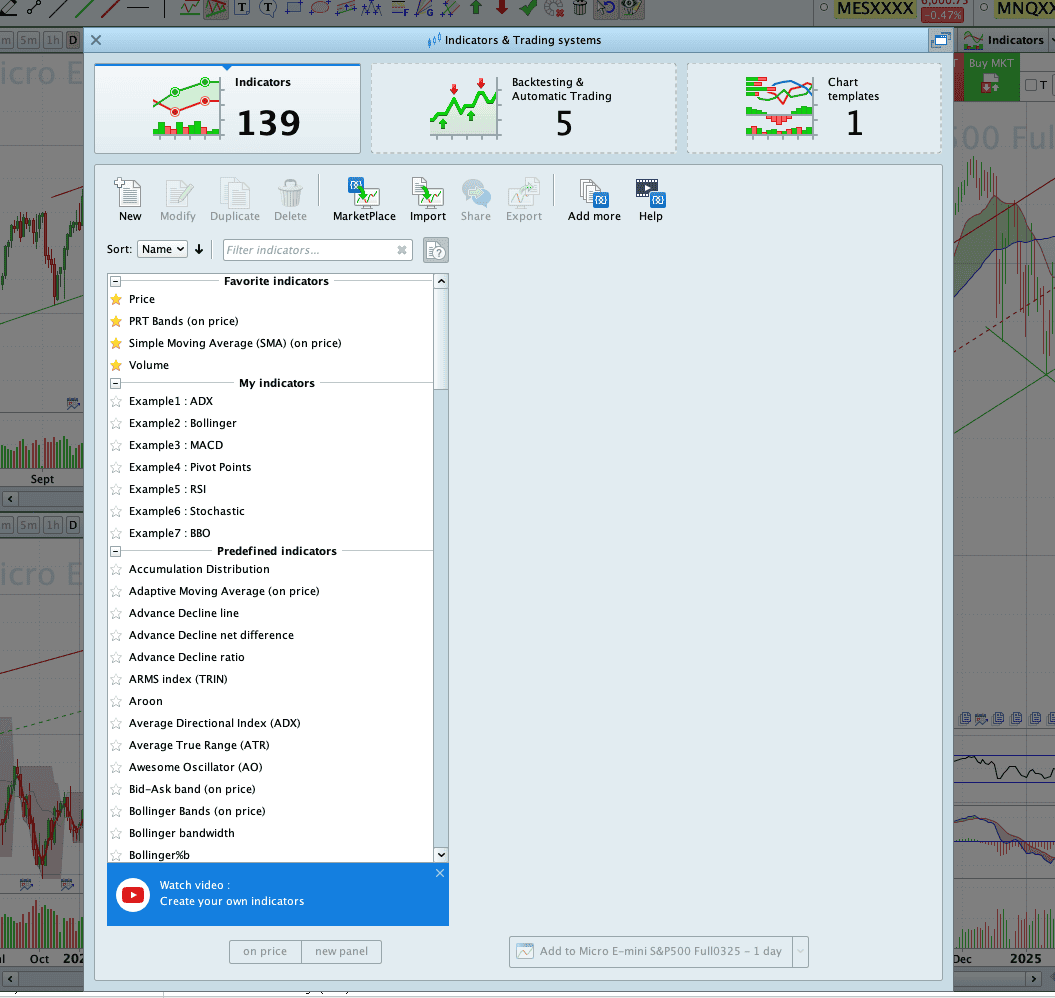

Developed by IT-Finance, ProRealTime is a multi-asset trading platform with 100+ technical indicators and real-time trading on its advanced charts.

ProRealTime also allows you to develop custom indicators and automated strategies using ProBuilder. A graphical interface is also available if you don’t know how to code (which you will need to do to use ProBuilder). This interface lets you choose your trading rules, and the wizard will build your automation.

ProRealTime has advanced tools, such as its market screener, which lets you set up automated searches to find markets that meet your trading criteria. I also find one of ProRealTime’s top features is its ProReal Trends tool that automates support and resistance levels and market trend lines.

What is the Difference Between MT4 and ProRealTime

There’s quite a difference between the ProRealTime and MT4 platforms due to their approaches to providing an advanced platform. Below, I’ve noted all the differences between the two forex trading pairs.

Range of Markets

One of the initial differences you’ll find is that ProRealTime provides access to every market, from forex to share CFDs – making it a true multi-asset platform. Due to MT4’s age, its infrastructure only supported forex price feeds (later upgraded for indices and commodities) and doesn’t support share CFDs, one of the reasons why MT5 was developed.

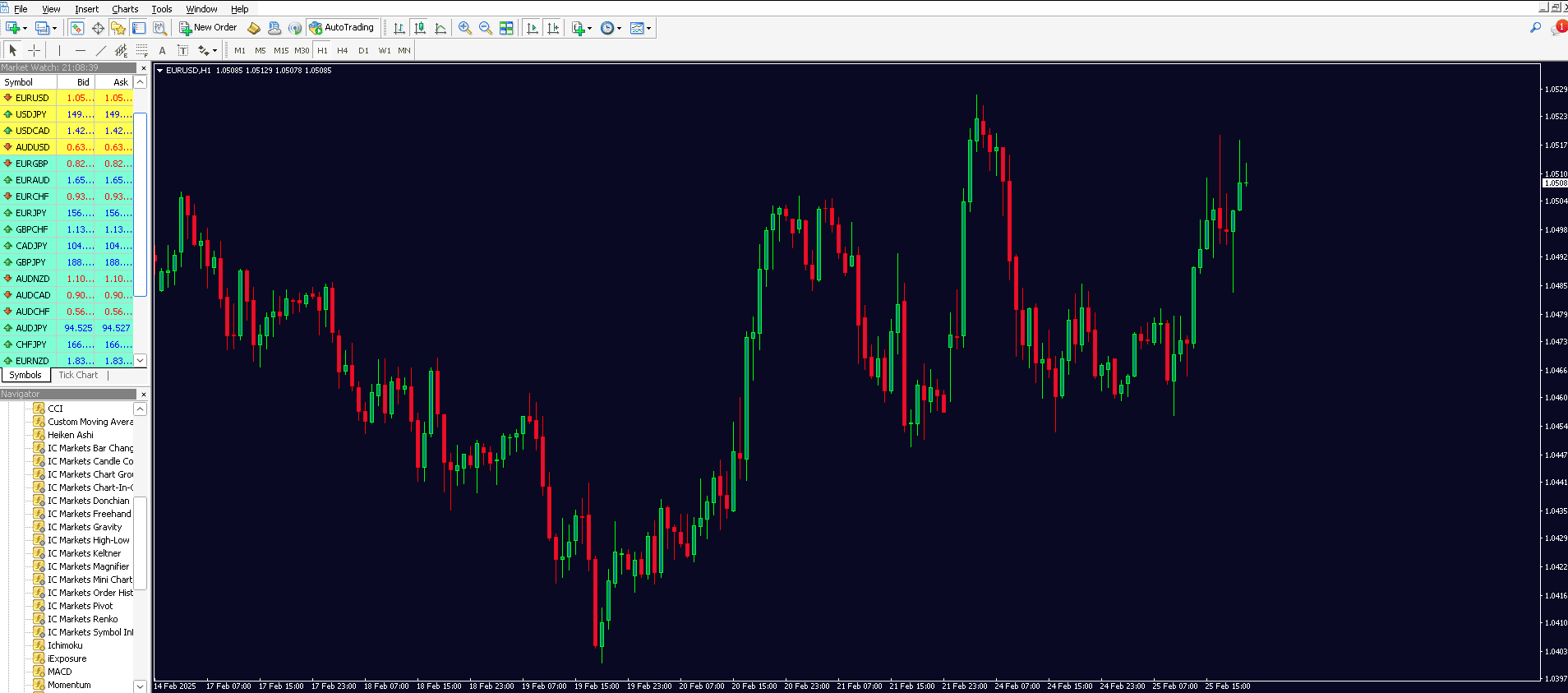

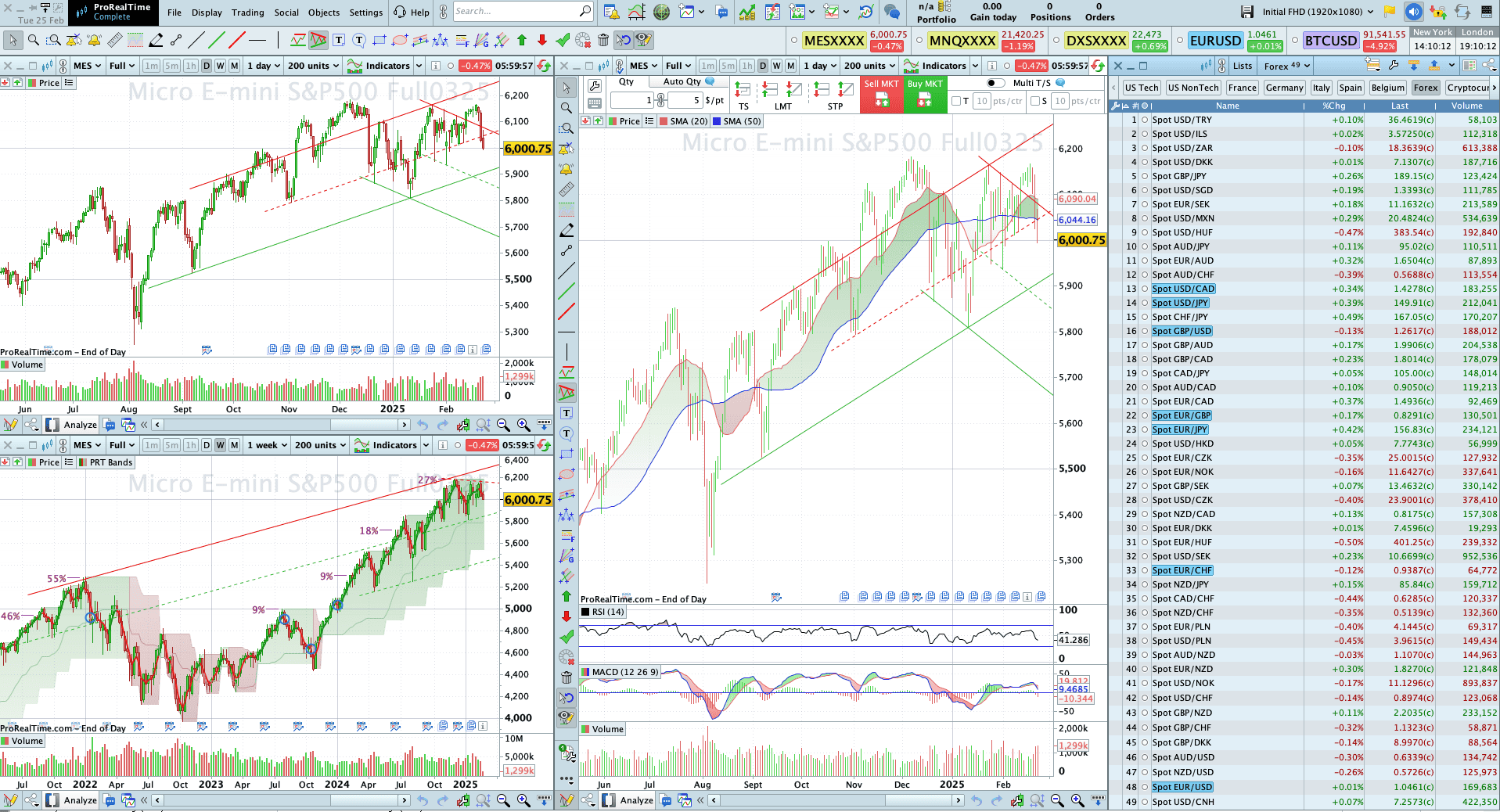

User Interface

Although it’s fair to say they have the same chart-focused layout, I have to be honest and say MT4’s interface is dated compared to ProRealTime’s modern interface.

MT4’s core focus is on functionality over aesthetics, but is also modelled on the original trading terminals. ProRealTime offers a visually pleasing experience and still packs many advanced features and tools.

Charting Tools

One of the largest differences is that ProRealTime has 3 times the amount of trading indicators (100+) compared to MT4’s 30+.

ProRealTime also has built-in market screeners to find assets that meet your preferences to help find new trading ideas during the day. It also has direct market access and advanced volume-based indicators such as market and volume profiles, making it ideal for scalping.

Programming Languages

MT4 uses its MLQ4 programming language, which is the most popular trading language, and thousands of experienced traders use it to develop their custom indicators or EAs. ProRealTime uses ProBuilder to create their custom indicators and automated trading strategies.

Platform Device Availability

ProRealTime can run on any device; with native options for Windows, Mac, Web platforms, iOS, and Android mobile devices. All versions of the ProRealTime are fully functional and work with each other, letting you trade across any platform and enjoy the same trading experience.

MetaTrader 4 has a native option for Windows but not for Mac (which requires a workaround). You have access to the web platform and MT4 mobile trading app for iOS and Android devices; these platforms miss many of the top features from the desktop versions.

Platform Cost

I think this is where MetaTrader 4 stands out the most: its platform cost. MetaTrader 4 is free with any broker that supports the platform; you can even download a “non-broker” version from the website for free.

ProRealTime, on the other hand, has subscription costs ranging from $30 – $100 monthly depending on the data fees required. Although it is also free with some brokers like IG Markets, you must meet the minimum requirements, which can be five lots traded in a month.

Similar Features Between MetaTrader 4 and ProRealTime

Despite the platforms’ differences, they share common features which are:

Automated Trading Features

The most obvious similarity is that both platforms have automated trading features.

With MetaTrader 4, you have the ability to program through its MQL4 language to develop Expert Advisors that will follow your instructions. EAs can automatically find signals, enter trades, manage the risk, and exit the position based on the rules you program.

ProRealTime offers the same capabilities through its ProBuilder, but also provides a no-code solution through its ProBuilder Wizard. The Wizard gives you a user-friendly interface and step-by-step instructions to follow to build your own strategy, without programming knowledge.

Custom Indicators

Similar to automation, you can create custom technical indicators to fine-tune your trading strategies. This allows you to expand from the pre-set technical indicators found on both platforms, where you can combine different indicators to produce unique tools for technical analysis.

Allow Backtesting

Both platforms allow you to backtest through your trading platform on their desktop versions. Both use historical data provided by the platform or your broker with different timeframes from 1 minute to monthly.

Advanced Order Tickets

You can implement different orders like buy stops and sell limits, allowing you to control how you wish to enter the market. Additionally, you can add trailing stop loss orders to your positions, helping you lock in profit.

Which Brokers Use ProRealTime?

ProRealTime is a subscription-based platform, meaning you can use it alongside any broker. However, if you want to execute trades directly through the platform, there are only a handful of brokers to offer ProRealTime; these are:

IG Markets / tastyfx

IG Markets (tasty fx in the USA) lets you trade its 17,000+ markets on ProRealTime with tight spreads from 1.13 pips on EUR/USD. I found IG Markets pays for your ProRealTime subscription if you trade 4+ standard lots per month; otherwise, it’s a $30 per month fee.

Interactive Brokers

Interactive Brokers is one of the largest forex brokers with 50,000+ markets and low commissions at $2.00 per lot traded. The broker also offers a way of reducing your subscription based on your trading activity, but you need a minimum deposit of $3,000 to get started.

I think using ProRealTime is a solid alternative to their IBKR trading platforms as I find that they can be too technical for many traders.

Saxo Bank

Saxo Bank is in the middle of both IG and Interactive Brokers which offers a solid trading experience with competitive spreads and the ability to trade CFDs, Futures, and options.

If you trade 15 standard lots per month, you can access ProRealTime for free.

As you can see, the selection of ProRealTime brokers is very limited, but the brokers available are some of the best.

Personally, I’d use IG Markets if you want to trade with ProRealTime as their account opening process is excellent with knowledgeable and helpful customer support. The spreads are better than what you’d get with Saxo Bank, and there are no commissions like Interactive Brokers while still hosting an extensive range of markets.

Which Brokers Use MetaTrader 4?

MetaTrader 4 is the most popular forex trading platform and is adopted by virtually every forex broker. Below are my favourite MT4 forex brokers:

Pepperstone

Pepperstone is my favourite overall broker (scoring 98/100 in my tests) thanks to its zero pip spreads on the Razor account and fast execution speeds. The broker also has additional trading tools for the MT4, such as Capitalise.ai (no-code tool for automating strategies) and Autochartist plugin, which provide trading signals.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY | Grand Total |

|---|---|---|---|---|---|---|---|

| Pepperstone | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

OANDA

OANDA is an excellent broker with low minimum deposits, competitive spreads on its Standard account, and a decent range of 68 forex pairs. With its MT4 platform, OANDA provides 28 excellent trading tools that enhance the platform’s trading experience with new indicators like Pivot Points and High-Low lines, both excellent for breakout trading.

IC Markets

IC Markets has the lowest Standard account spreads averaging 1.03 pips on the major pairs in our tests, with a standout performance on EUR/USD averaging 0.73 pips. These low spreads make IC Markets perfect if you don’t want to pay commissions for tighter spreads.

| Tested Standard Spreads | |

|---|---|

| Broker | Combined for major pairs AUDUSD, EUR/USD, GBPUSD, USD/CAD, USDCHF) |

| IC Markets | 1.03 |

| CMC Markets | 1.11 |

| Fusion Markets | 1.19 |

| TMGM | 1.21 |

| Admirals | 1.31 |

| Pepperstone | 1.46 |

| FP Markets | 1.47 |

| FXCM | 1.47 |

| Go Markets | 1.49 |

| Eightcap | 1.51 |

| OANDA | 1.54 |

| Axi | 1.71 |

| City Index | 1.79 |

| Blackbull Markets | 1.82 |

| FxPro | 2.22 |

| Tested Average | 1.49 |

With MT4 available, you can use their VPS services to automate your trades 24/5 or use their copy trading services like Signal Start and ZuluTrade, which plug into your MT4 platform.

Fusion Markets

Fusion Markets outperformed most brokers in our testing with low trading commissions ($2.25) and tight spreads (averaging 0.16 pips EUR/USD), making it a low-cost broker. With its MT4 platform, you can benefit from the broker’s fast execution speeds, which are sub-80 ms (second fastest broker I’ve tested).

| Broker | Overall Speed Ranking | Limit Order Rank | Limit Order Speed (ms) | Market Order Rank | Market Order Speed (ms) | Broker Type |

|---|---|---|---|---|---|---|

| Blackbull Markets | 1 | 1 | 72 | 5 | 90 | ECN |

| Fusion Markets | 2 | 3 | 79 | 1 | 77 | ECN |

| Pepperstone | 3 | 2 | 77 | 10 | 100 | ECN |

| Octa | 4 | 4 | 81 | 6 | 91 | ECN |

| OANDA | 5 | 5 | 86 | 2 | 84 | Market Maker |

| Exness | 6 | 10 | 92 | 3 | 88 | Market Maker |

| Blueberry Markets | 7 | 6 | 88 | 7 | 94 | ECN |

| Forex.com | 8 | 13 | 98 | 4 | 88 | Market Maker |

| Global Prime | 9 | 7 | 88 | 9 | 98 | ECN |

| Tickmill | 10 | 9 | 91 | 11 | 112 | ECN |

Having these trading conditions, Fusion Markets is a solid pick if you’re an algorithmic trader or scalper.

The above brokers are all solid options, but my top choice is Pepperstone as it delivers in every area when it comes to forex trading. It has zero pip spreads on its Razor account, reducing your trading costs while having sub-100 ms execution speeds – giving you solid trading conditions.

You can trade over 1,300+ markets (including 93 forex pairs), while it has the most trading tools to improve the MT4 trading experience.

Alternatively, you can read my analysis for the best MT4 brokers where I have picked out the best eight forex brokers suited for MetaTrader 4.

How to Start Trading With MT4 and ProRealTime

For MT4

- Choose a regulated forex broker that offers MetaTrader 4

- Open a demo or live account with the broker

- Download the MetaTrader 4 platform from the broker’s account portal

- Install MT4 on your desktop and log in with your MT4 account details

- After MT4 initialises, you’ll receive live price feeds allowing you to start trading with MT4.

For ProRealTime

- Find a regulated forex broker with ProRealTime such as IG Markets

- Open your trading account

- Download ProRealTime for your desktop for the most advanced features

- Install ProRealTime on your desktop and login when prompted

- Once logged in, you’ll be able to access the broker’s markets directly through ProRealTime.

Which Is The Best Trading Platform: MT4 vs ProRealTime

Choosing between MT4 and ProRealTime is subjective, as there are many reasons to choose either.

MetaTrader 4 is a solid pick, providing decent charting capabilities, custom indicators, and automation through Expert Advisors, without the flashy features other platforms provide.

If you want to expand MetaTrader 4’s features, you can find Expert Advisors, which are like custom indicators and bots. Examples of EAs include trade management tools and trading signals alerts.

That said, MT4’s main advantage over ProRealTime is that it’s also widely adopted across thousands of brokers, while ProRealTime is limited to 3 major brokers. This reach makes MT4 a better option, as you can find a broker with the best trading conditions and low costs, which have a larger impact on your profits.

ProRealTime provides similar features to MT4 in a user-friendly way, but also extra features like market screeners, and it’s ProRealTrend tool automates trend lines, channels, and support/resistance levels.

I think ProRealTime is a better choice if you trade multiple assets like share CFDs (which is unavailable on MT4), and perform advanced technical analysis through its advanced tools. Some of these advanced tools include market profile and volume profiles, which are appealing options if you day trade.

If you are willing to join one of the brokers that provides it for free, ProRealTime is a solid pick. Otherwise, you’ll have to pay a monthly subscription, which may not be ideal for most traders.

FAQs

Is MT4 Free?

Yes, MT4 is a free trading platform available with most forex brokers. To access it, you need an account, which can be demo or live, and you get access to all of its features. MT4 uses all the data feeds provided directly from your broker, so there are no additional charges.

Is ProRealTime Free?

No, ProRealTime is not free as it has a monthly subscription ranging from $30+ depending on which data feeds you want to access. Some brokers like IG Markets provide ProRealTime for free for active retail traders, but this still costs you through the spreads it charges.

Is MT4 Good For Beginners?

Yes, MT4 is suitable for beginners as the interface is relatively simple and doesn’t clutter with distracting tools. Most brokers provide forex traders with unlimited demo accounts on the MT4, allowing you to practice trading on the platform without the account expiring.

Is ProRealTime Good For Beginners?

ProRealTime is good for beginners as they provide automated trading tools like ProRealTrend, which displays support and resistance levels, channels, and trend lines, making technical analysis easier. The platform is also good for advanced traders too.

Will MT4 be phased out?

MetaTrader 4 is slowly being phased out and replaced with its upgraded version, MetaTrader 5. There are no immediate signs of MT4 being removed completely as most brokers still provide the option for MT4 and MT5.

Do professional traders use MetaTrader 4?

Yes, professional traders use MetaTrader 4 as it’s a secure and fast trading platform with customisable trading indicators and Expert Advisors that provide advanced features for trade management.

What's better than MT4?

This depends on your trading style and needs, but there are alternative platforms available which include:

- MetaTrader 5 (more asset classes, improved backtesting)

- cTrader (modern interface, depth of market visualisation)

- TradingView (superior charting with social features)

- ProRealTime (excellent advanced technical analysis tools)

Is MetaTrader 4 outdated?

From a technological and interface design perspective, MetaTrader 4 is outdated. Due to its original implementation in the early 2000s, MT4 can’t provide price feeds for share CFD trading and some other markets, which MT5 solves.

This doesn’t make it outdated per se, but it does limit your trading options if you require a platform offering multi-asset trading.

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.