ECN vs Standard Account Comparison [Updated 2025]

If you’re new to trading, you may wonder which account suits you: ECN or Standard. I detail each account’s benefits and the trading styles they best fit. The main difference is the fees, which will affect your trading costs.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

What Is The Difference Between The Standard Vs ECN Account?

The main difference between each account type is:

Standard account has no commissions as the broker’s costs are part of the spread. For this reason, spreads are wider than those of an ECN account.

ECN accounts charge a fixed commission for each lot traded in addition to the spread. Since the commission is not part of the spread, some currency pairs can be as little as 0 pips.

Experienced traders tend to benefit most from ECN accounts’ benefits as their costs are lower, even with the commission costs accounted for.

| Feature | ECN Account | Standard Account |

|---|---|---|

| Execution Model | Direct Market Access (DMA) to interbank liquidity providers. | Dealing Desk (Market Maker) model where the broker acts as the counterparty. |

| Spreads | Typically lower and variable spreads, often starting from 0 pips. | Generally higher and fixed spreads, often starting from 1-2 pips. |

| Commissions | Usually charges a commission per trade, in addition to the spread. | Typically no additional commission; broker profits from the spread. |

| Liquidity | Higher liquidity due to direct access to multiple liquidity providers. | Lower liquidity as trades are executed against the broker's own liquidity pool. |

| Requotes | Less likely to experience requotes due to direct market access. | More likely to experience requotes, especially during high volatility. |

| Order Types | Supports a wider range of order types, including market orders for matching at the best available price. | May have limitations on order types and execution policies. |

| Cost Structure | Total trading cost includes spread + commission, which can be lower overall. | Total trading cost is primarily the spread, which can be higher overall. |

| Market Depth | Access to market depth (Level II data) showing order book and liquidity. | Limited or no access to market depth; trades are executed against broker's quotes. |

| Recommend For | Suitable for scalpers and high-frequency traders due to lower spreads. | Better for beginners or traders who prefer fixed spreads and simpler cost structure. |

What Is An ECN Trading Account?

An Electronic Communications Network (ECN) trading account connects you directly to the liquidity providers (like banks, traders, and other market participants) without needing your broker to process it. Of the trading accounts available, I consider the ECN account to be the “professional-grade” option.

I find ECN trading accounts offer the lowest spreads as you’re seeing the real market prices directly from the interbank markets, with most majors available at 0 pips.

If you trade high volumes or day trade, an ECN account is the best option.

Top brokers offering ECN trading accounts:

Pepperstone

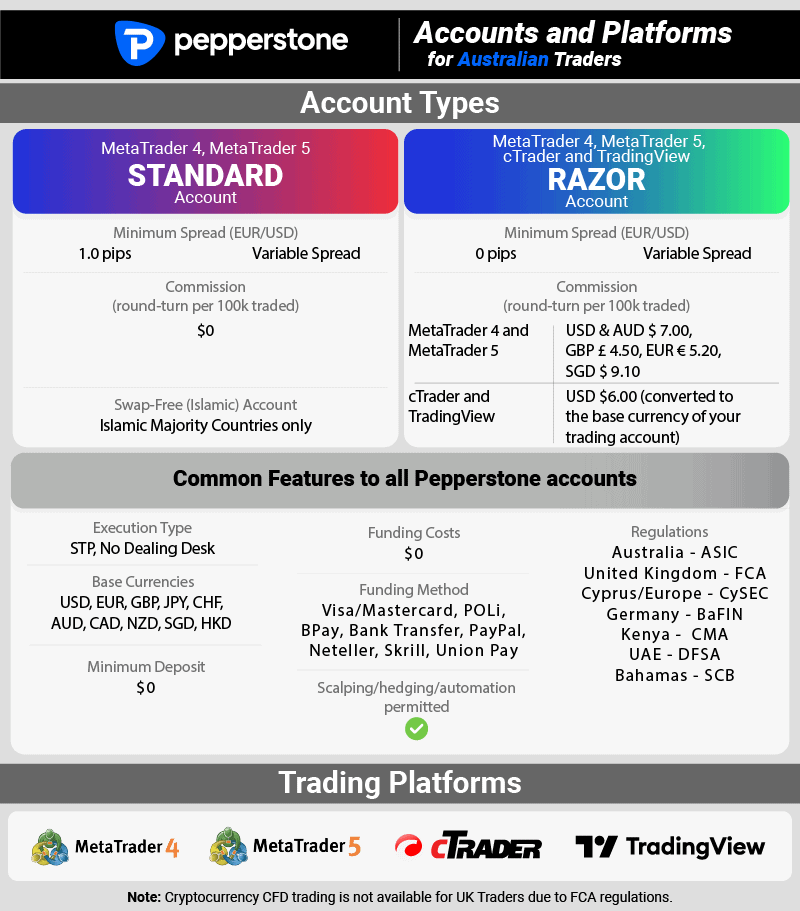

My go-to broker for its Razor account (which is their ECN account’s name) that offers 0 pips for certain currency pairs and 93 Forex pairs in total. You can trade using TradingView, MT4, MT5, and cTrader.

Pepperstone also has a Standard account. You can find out the differences between the two Pepperstone accounts in our Razor vs Standard review.

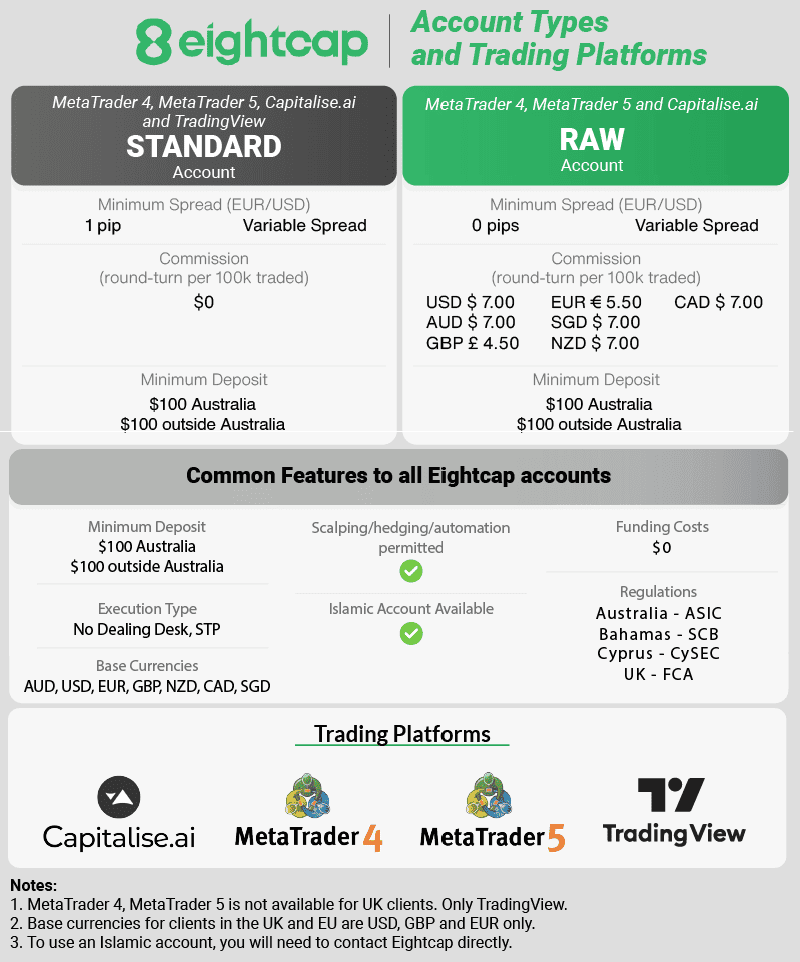

Eightcap

If you want to trade crypto along with forex, Eightcap provides a solid ECN account that gives you tight spreads from 0 pips and 95+ cryptocurrency and altcoin markets including Bitcoin and DOGE.

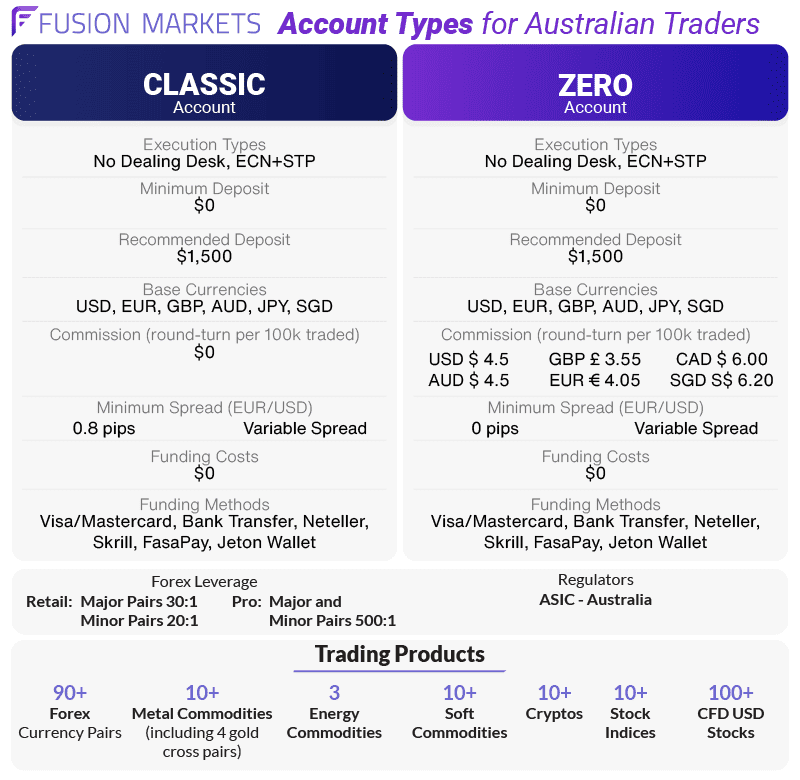

Fusion Markets

FP Markets is a decent pick if you want excellent trading conditions with some of the tightest spreads on its ECN account and low commissions ($2.25). The broker also has the second fastest execution speeds at sub 80ms from our testing.

How Do ECN Accounts Work?

One advantage I’ve seen from ECN accounts is that they have fewer requotes compared to Standard accounts, and this is due to how they work. Instead of being placed as an “Instant Order” (fill or kill method), ECN accounts use Market Order that matches your order with the same price (or best available) – providing no requotes.

Here’s a quick breakdown of the process:

- Your order gets transmitted straight to the ECN network (other traders and liquidity providers).

- The ECN matches your order with the best available quotes from the liquidity provider; this sometimes can be more (or less) expensive.

- You pay 0 to 0.5 pips (depending on your broker’s charges and markets) in addition to a small commission which varies from $2 to $4.50 depending on platform and broker.

The ECN account has a commission structure instead of a spread-only model, which typically ranges from $4.50-$7.00 per lot (round-trip). A round trip is the total cost of opening and closing a trade, so when brokers offer commissions at “$3.50” they mean it’s $3.50 per open plus close (I.E. $3.50 on each side).

How Do ECN Brokers Deliver Tighter Spreads?

ECN brokers can deliver spreads from 0 pips because the broker shows you the direct price feed from its liquidity providers. Since the spreads are rock low, it means spreads are unlikely to be marked up by the broker (which is why Standard account spreads are much wider).

ECN brokers can afford to do this as you pay a fixed fee (commission) for each trade instead of collecting the markup from the spread like Market Maker brokers do. By doing this, you get tighter spreads directly from the market, and the broker gets a commission for providing access.

What Is A Standard Trading Account?

A Standard account (sometimes called a Classic account) is the traditional approach to forex trading fees. You pay no commissions, but instead pay wider spreads than the ECN account, which can vary from 0.6 pips+.

I find the Standard account a beginner-friendly option as commission cost consideration doesn’t need to be factored when you open your position. This cost approach is more straightforward as you won’t have to ensure you’ve earned enough to cover the closing commission.

Top brokers offering Standard trading accounts:

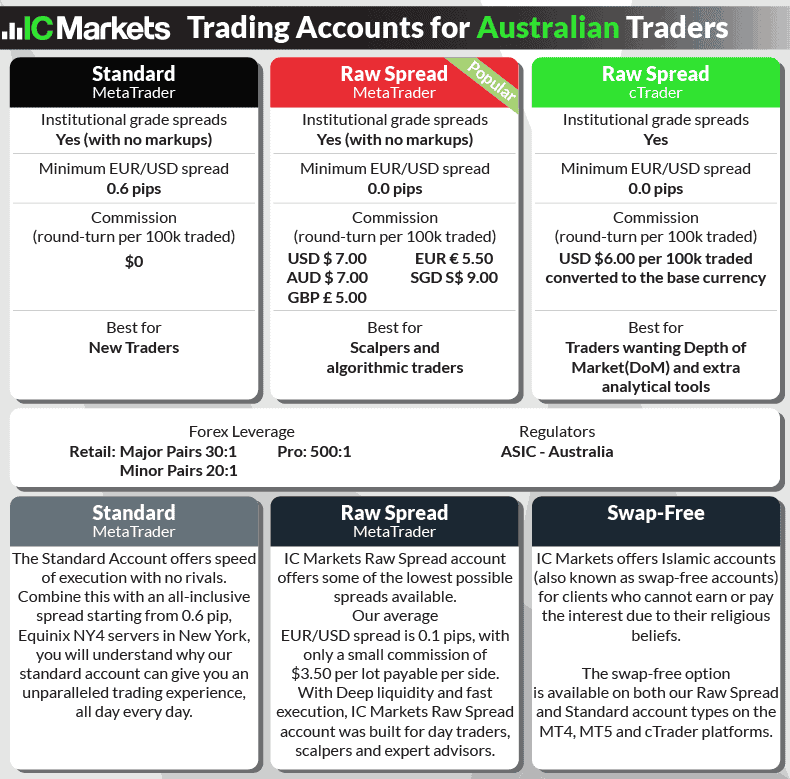

IC Markets

In my tests, IC Markets is the lowest spread broker providing EUR/USD spreads averaging 0.73 pips. You can benefit from the Standard account with ECN-style trading conditions across its 2,250+ markets.

IC Markets also has a RAW account, you can find out more about the difference between IC Markets RAW vs Standard.

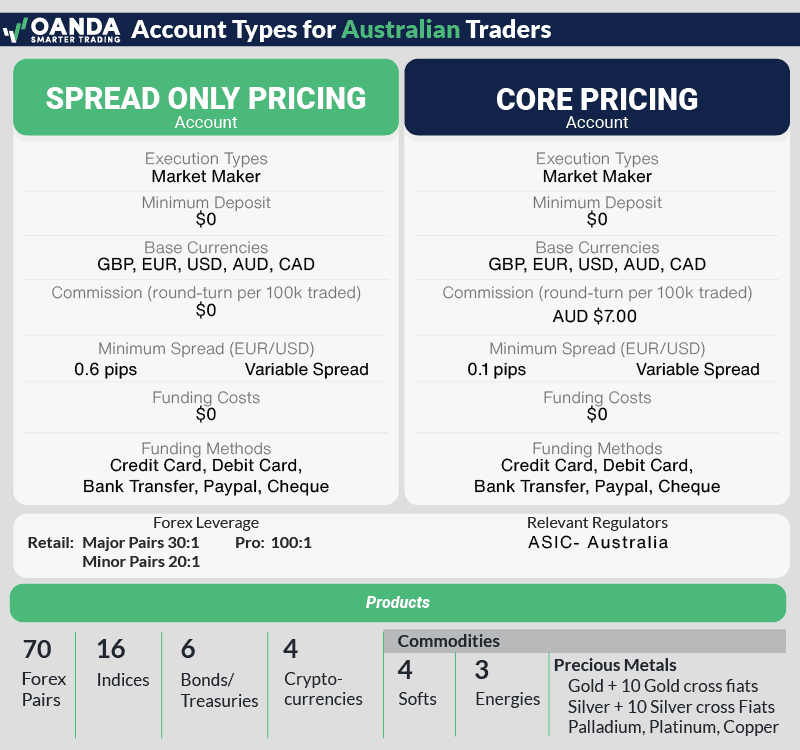

OANDA

I think OANDA is the best for beginners as it has low spreads on its Standard account and no minimum deposit. With its OANDA Trade platform, it comes with TradingView charting and beginner friendly features like lower trade sizes (down to 1 unit).

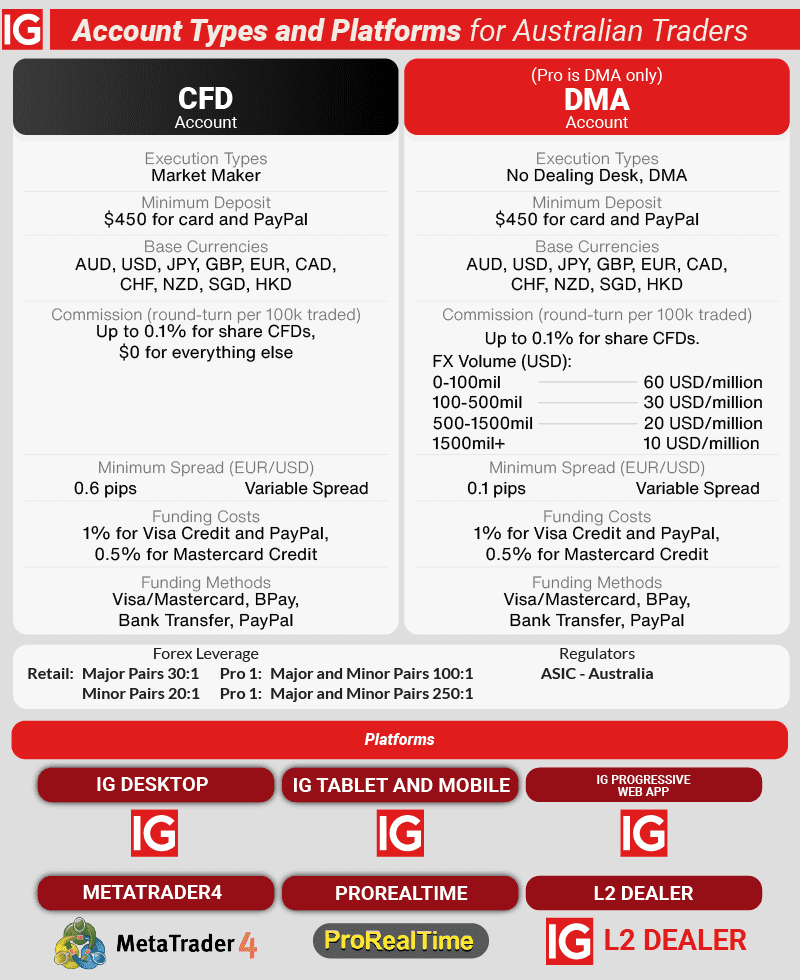

IG Markets

IG Markets offers the most trading products with over 17,000 markets including 100+ forex pairs, crypto, share CFDs, commodities, and indices. The spreads are competitive and their IG Trading platform has professional trading signals.

How Standard Accounts Work

Standard accounts are the easiest to work with as you pay the spread, which is the difference between the buy and sell price before opening a trade. What happens after opening a position is you’ll see your current PnL in the negative – this reflects the amount paid for the spread.

For example, if I were to open a 1 lot trade for EUR/USD with a 1 pip spread, I’d expect my opening PnL to be -$10. It’s perfectly natural for your trades to open in the negative with Standard accounts.

When you see $0+ in your PnL, it means you’ve covered the spread and have broken even or made a profit.

This is why I recommend Standard accounts to beginners as they’ll see their actual profit or loss, while ECN accounts have to deduct their commissions. For new traders, this could lead to mistakes by closing a profitable position before covering the commissions.

ECN Account vs. Standard Account: What’s the Difference

At its core, the fundamental difference between each account type is the pricing structure. I’ve discussed. ECN accounts have tighter spreads (from 0 pips) and commissions per lot, while Standard accounts are spread-only.

Below, I’ve crafted a table to demonstrate the differences:

| ECN Account | Standard Account | |

|---|---|---|

| Pricing Structure | Lowest spreads with fixed commissions | Wider, variable, spreads with no commissions |

| Execution Method | Direct market access/straight through processing/No dealing-desk | Dealing desk/Market maker |

| Execution Type | Market Orders (no requotes) | Instant Orders (requotes possible) |

| Trading Costs | Typically lower overall if you’re an active trader | Often cost-effective if you don’t trade frequently |

When choosing between the two options, I feel that the ECN account is an easy pick if you’re an experienced trader due to the direct market access. You get tighter spreads and faster execution type, ensuring no orders are requested, helping you execute all your trades and preventing missed opportunities.

The no commissions on the Standard account are appealing as they simplify the pricing structure, making it easier to read whether you’re making a profit or losing on your open trades.

I prefer to use ECN accounts as my strategies consist of breakout trading and scalping to benefit from the tighter spreads. However, both options are viable for all trading types.

Similar Features Between The ECN vs Standard Account

1. Straight-through processing with no dealing desk

Both trading accounts can use Straight-through Processing (STP) with no dealing desk. If your trading account is with an ECN broker like Pepperstone or IC Markets, their trading accounts are STP, which gives you fast execution speeds.

I recommend choosing a broker with this execution model, as slow execution speeds can lead to market slippage, which you would want to avoid. Slippage can wipe out your profits or double your losses if the price moves in the wrong direction, forcing your stop loss to exit at a worse price.

2. Access to all financial instruments

One to note is that even if you use an ECN trading, some financial instruments may still use spread-only trading. While Forex markets and commodities may be available with and without commissions, some products like crypto and indices only have spread-only pricing.

3. Trading Platforms

With both account types, you can use any third-party trading platforms, which include:

-

- MetaTrader 4

- MetaTrader 5

- cTrader

- TradingView

- ProRealTime

- NinjaTrader

However, I notice that some brokers limit trading accounts to different platforms – so double-check your account is available for your platform of choice.

For example, I’ve seen TradingView as an option for ECN accounts only, forcing you to open an ECN account if you want the advanced charting tools from TradingView.

4. Trading Size

Both account types let you trade the same lot sizes, including micro (0.01), mini (0.1), and standard (1.0) lot sizes, allowing you to tailor your risk management.

ECN account commissions are quoted for standard lots ($3.50), so you’ll be charged less if you trade lower lot sizes.

-

- Standard lot – $3.50

- Mini lot – $0.35

- Micro lot – $0.035.

These figures will also multiply by the number of lots traded.

5. Leverage

I’ve noticed that leverage (or margin) is not tied to the account type; instead, it’s linked to the asset and who the broker is regulated by. Australian traders fall under ASIC’s jurisdiction, so ECN and Standard accounts are limited to 1:30 on forex majors.

6. Negative Balance Protection

Retail forex traders have extra measurements in place through the Negative Balance Protection to prevent your account from falling below $0. While you don’t want to lose on your trades, Negative Balance Protection as least ensure you are not left owing the broker money which can crippling if you use high leverage.

Both accounts have this as it is a requirement for all regulated forex brokers, and it works by liquidating your positions as you get closer to a $0 balance. If the market is volatile and has a large spike, taking you below $0, regulated brokers will absorb the losses.

Just note that if you’re using a Professional account (available in Australia, the UK, Europe, and the UAE), you will lose this protection in favour of higher leverage.

7. Scalping/hedging

Both trading account types allow these strategies. For scalping, the ECN account is better thanks to its tighter spreads, which makes it faster to cover the spread and turn a profit faster.

8. Automation / Social Trading / Copy Trading

You have access to automation, social, and copy trading services on both accounts. Instead, these are trading platform features – so you are only limited to the broker’s platform selection.

Most brokers have MetaTrader 4, giving you access to automated trading through the Expert Advisors. For social trading, TradingView is my favourite platform, where you can view other people’s technical analyses and engage with others in chat rooms.

Copy trading is the least available, with some platforms offering bespoke tools like eToro’s CopyTrader, ZuluTrade, or DupliTrade.

With all of the features mentioned above, you’ll find they support both Standard and ECN accounts.

ECN Account vs. Standard Account: Trading Cost Comparison

Comparing the trading costs between the two accounts can be difficult due to external commissions and tight spreads, meaning there is no direct comparison. That is why I use the “Effective Spread Cost” to demonstrate the costs directly and clearly, showing the true trading costs for both accounts.

The Effective Spread Cost

Due to commissions being an “external” fee to your trades, they can contaminate the true cost of the account when comparing spread-only with ECN accounts. So to demonstrate this, the Effective Spread Cost follows the formula to convert it into a “spread-only” cost.

Based on a standard lot size (100,000 units), we know 1 pip is roughly $10 per pip:

ECN Effective Spread Cost (ESC) = Spread + Commission (round-trip)

So if you traded 1 lot EUR/USD with a spread of 0.10 pips and a $3.50 per lot traded ($7.00 round-trip), I can put that into my formula as:

ECN ESC = 0.1 pips + $7.00

On EUR/USD $7.00 is the same as 0.70 pips on a Standard account, and for every 0.1 pip is $1 in terms of commissions. So to translate this into a “spread-only” price, we can add the 0.70 pips to 0.10 pips, equaling 0.80 pips as the Effective Spread.

The Effective Spread = 0.80 (0.1 + 0.70)

In this example, the ESC gives a 0.80 pip spread, which is $8.00 in trading fees for trading the EUR/USD with 1 lot. If the Standard account has a 1 pip spread, that equates to $10.00 in trading fees.

Now when you compare the spreads with a Standard account, you can see how much cheaper (or expensive) the spreads are before choosing which account.

The Trading Cost Comparison

With that cleared up, it’s easy to understand the comparison between the accounts. I will use some of the lowest-spread brokers to help demonstrate the differences from our recent Raw (ECN) and Standard spread tests.

| EUR/USD Tested Spreads | ECN Account | Standard Account | Difference |

|---|---|---|---|

| Pepperstone | Spread: 0.19 pips Commission: $7.00 (Round-trip) | 1.21 | ECN account is 0.32 pips cheaper |

| IC Markets | Spread: 0.19 pips Commission: $7.00 (Round-trip) Effective Spread: 0.89 | 0.73 | Standard account is 0.16 pips cheaper |

| Fusion Markets | Spread: 0.16 pips Commission: $7.00 (Round-trip) Effective Spread: 0.89 | 1.01 | ECN account is 0.12 pips cheaper |

As you can see, Standard accounts can be cheaper than their ECN counterparts – but it is rare. Comparing the two, ECN accounts are generally more affordable even when paying the commission.

It’s important to show it this way as you can see with Pepperstone’s ECN account you’ll save 0.32 pips (or $3.20) per lot traded compared to its Standard account. This cost difference is a large saving, and will save you a fortune over time – especially if you’re an active trader.

Which Brokers Offer The Lowest ECN Account Spreads?

The Top 3 ECN Account Spread Brokers Are:

- Fusion Markets

- City Index

- IC Markets

Special Mention: Pepperstone’s Razor account offering zero pip spreads.

Our Testing and Results

At CompareForexBrokers, the team and I have opened hundreds of forex trading accounts to review. My head analyst, Ross Collins, has developed his own tests to find the lowest spreads for ECN brokers using the IceFX SpreadMonitor EA on the MT4 to capture the average spreads.

Ross found that Fusion Markets had the lowest overall ECN spreads, averaging 0.22 pips across the major pairs, beating the industry average by 55%. Other stand-out brokers include IC Markets and Pepperstone, who also generated low average spreads of 0.32 and 0.36, respectively.

| Tested Raw Spreads | |

|---|---|

| Broker | Combined for major pairs we tested |

| Fusion Markets | 0.22 |

| City Index | 0.25 |

| IC Markets | 0.32 |

| TMGM | 0.32 |

| Pepperstone | 0.36 |

| FP Markets | 0.41 |

| Blueberry Markets | 0.43 |

| GO Markets | 0.46 |

| ThinkMarkets | 0.46 |

| Tickmill | 0.47 |

| Eightcap | 0.5 |

| Axi | 0.73 |

| CMC Markets | 0.73 |

| Admirals | 0.79 |

| BlackBull Markets | 0.94 |

| Tested Average | 0.49 |

Ross also highlighted that Pepperstone is one of the few brokers to average zero pip spreads on EUR/USD, which makes it the best option for EUR/USD trading. It also managed minimum spreads across the other majors like AUD/USD and USD/JPY.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY | Grand Total |

|---|---|---|---|---|---|---|---|

| Pepperstone | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

In addition to the RAW account, Peppersonte also has a Standard account. This Pepperstone account types review looks at their differences.

Which Brokers Offer The Lowest Standard Account Spreads?

The Top 3 Standard Account Spread Brokers Are:

- IC Markets

- CMC Markets

- Fusion Markets

Our Testing and Results

Like our ECN spread tests, Ross also compared the average spreads of the Standard account across 15 brokers. To keep the results consistent, he also used the IceFX SpreadMonitor EA for the MT4 to generate the averages over a 24-hour period.

IC Markets is the clear winner, averaging 1.03 pips across the major pairs tested, beating the industry average by ~31%. A highlight for me was EUR/USD on IC Markets, where the broker averages 0.73 pips, which was cheaper than its ECN account (0.89 pips effective spread).

| Tested Standard Spreads | |

|---|---|

| Broker | Combined for major pairs AUDUSD, EUR/USD, GBPUSD, USD/CAD, USDCHF) |

| IC Markets | 1.03 |

| CMC Markets | 1.11 |

| Fusion Markets | 1.19 |

| TMGM | 1.21 |

| Admirals | 1.31 |

| Pepperstone | 1.46 |

| FP Markets | 1.47 |

| FXCM | 1.47 |

| Go Markets | 1.49 |

| Eightcap | 1.51 |

| OANDA | 1.54 |

| Axi | 1.71 |

| City Index | 1.79 |

| Blackbull Markets | 1.82 |

| FxPro | 2.22 |

| Tested Average | 1.49 |

As IC Markets is an ECN broker (but has RAW and standard Account types), it’s a clear demonstration that this execution model provides the best spreads for both ECN and standard accounts due to the broker claiming top spots for both account types.

The more expensive brokers tend to be market makers, which is something to note when choosing a forex broker.

Which Is The Best Forex Trading Account – ECN or Standard?

This will be a personal decision, as each account will reflect your trading style, experience, and preferences. However, I will shed some light on the subject based on my experience.

Choosing The ECN Account

I typically recommend ECN accounts for anyone trading several times a week, as this has a larger impact on trading costs compared to those who trade once a week (or month). However, there are other greater benefits to using an ECN account, which I’ve highlighted in this article.

ECN accounts have spreads from 0 pips, making them the tightest available for forex trading. The lower spreads make it quicker for scalpers and day traders to cover their spreads, placing you in a profitable position faster. This is a big positive if you’re in a trade for 30 seconds or so.

The fixed commissions stabilise your trading costs during volatile trading periods, allowing for consistent costs during the day and avoiding price spikes during high-impact economic news announcements. Stable trading costs make the ECN account a top contender for algorithmic trading as you can easily account for the fees, regardless of volatility.

Finally, a positive for all trading types is that ECN accounts typically have better trading conditions with faster execution speeds as the broker will provide a STP execution model.

Choosing The Standard Account

The Standard account is ideal for newer traders as your trading costs will be taken directly out of the trade you open, simplifying the process.

One of the main benefits in my eyes is that the PnL on your trading screen includes the spread, making it much easier to see if you’re profitable or not.

ECN accounts show the external commissions outside your PnL on some platforms (like MT4), meaning you have to make mental adjustments to include the commissions with your PnL. I see this as potentially leading to mistakes and new traders closing positions too early, not considering the closing commission.

Other than that, Standard accounts are subject to the same trading conditions as their ECN accounts counterparts (if you use ECN brokers). If you choose a Market Maker style broker, pricing and execution speeds will differ.

FAQs

Is ECN or Standard More Popular?

From my personal experience, the most popular trading account is the ECN account because of its reduced trading costs from zero pips and fixed commissions. ECN accounts are also a top pick for scalping and algo trading styles as the brokers that supply them have faster execution speeds with less slippage and no requotes.

Which is better ECN or Standard account?

Both have their benefits; however, I lean to the ECN being the better account as its reduced trading costs have an impact on your overall trading performance. With the commission-based pricing model, it may overwhelm newer traders, which is why I think beginners should consider the Standard account.

Which is better ECN or STP?

ECN and STP are the same thing. An Electronic Communications Network is where the orders are routed to liquidity providers to match your orders at the best available price. Straight Through Processing is where the broker passes your orders directly to the ECN (liquidity providers) without intervention, allowing for faster execution speeds.

What are the disadvantages of ECN?

The core disadvantages of ECN are that some brokers may require a higher minimum deposit to get started compared to Standard accounts to give it a higher perceived value. Also, the commissions are taken outside of your trade, which can confuse newer traders on how much their true PnL is.

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.