Pepperstone Leverage For UK Traders 2025

Pepperstone Limited is the FCA-regulated subsidiary for UK residents with a maximum leverage requirement of 30:1 for retail traders. Only those who qualify as professional traders can get the higher 500:1 leverage that Pepperstone can offer.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

What Is Pepperstone UK Leverage?

Pepperstone has been recognized as the FCA Regulated Brokers. However, this ranking didn’t consider leverage, which we’ll delve into on this page. It’s important to highlight that the leverage available varies based on whether FCA recognizes you as a retail or professional trader. While professionals can access higher leverage, it comes with higher trading risks.

Pepperstone UK Leverage Levels By Instrument

Pepperstone offers flexible leverage on over +150 tradable instruments. The forex broker is ideal for UK traders, as it is regulated by the Financial Conduct Authority (FCA) and viewed as a trusted UK broker. The wide range of instruments offered by Pepperstone UK includes FX currencies, CFDs, and commodities. Cryptocurrencies were previously available to UK clients, but recent changes to FCA regulation have banned retail traders from accessing crypto markets.

Under the ESMA regulation, the available leverage for UK retail traders is 30:1. However, if you qualify as a professional trader, you can enjoy maximum leverage of 500:1.

View the Pepperstone UK leverage levels by each market below.

| Instrument Traded | Retail Client Leverage | Professional Client Leverage |

|---|---|---|

| Forex | 30:1 | 500:1 |

| Index CFDs | 20:1 | 200:1 |

| Gold | 20:1 | 500:1 |

| Commodities | 10:1 | 50:1 |

| Crypto | 2:1 | 20:1 |

Your leverage will be fixed per asset traded above due to ESMA rules.

You can qualify as a Professional Pepperstone UK Client if you have adequate experience and knowledge in CFDs and you meet 2 out of the 3 FCA criteria listed below:

- You have carried out at least 10 transactions of significant size ($50k notional) per quarter on average for the last year.

- Your investment portfolio exceeds 500k EUR.

- You have worked as a professional in the financial sector for at least one year.

Note: You may also qualify if you trade under an investment firm or company of adequate size. Speak to your Pepperstone Account Manager if you think this applies to you.

The overall rating is based on review by our experts

Forex Trading Leverage

The Forex market is by far the number one choice of traded product by retail traders. The UK retail traders prefer the foreign exchange market to the stock market due to the superior leverage the UK FX brokers offer. Pepperstone UK offers over 92 currency pairs, including:

- All the major currency pairs

- Minors currency pairs

- And some exotic currency pairs

You can execute your trading orders with deep liquidity from multiple tier-one providers. They make it possible to get spreads as low as 0.0 pips on the Razor account. Suppose you open a UK Pepperstone trading account. In that case, you can choose between two types of trading accounts, and both offer up to 500:1 leverage on currency trading if you qualify as a professional trader. Pepperstone doesn’t enforce a Minimum Deposit but recommends an initial deposit of £500 when opening an account.

The two Pepperstone accounts with their particular features are outlined below:

It should be noted that Pepperstone offers both CFD trading and the best UK spread betting trading platform. The latter has several advantages, which is why many UK forex traders prefer this type of trading.

Index Trading Leverage

UK Pepperstone offers two Index instruments that open the door to a whole new range of markets that are not accessible to other retail forex brokers. Index CFD trading has different levels of leverage for both retail traders and professional traders.

| Instrument | Retail Client Leverage | Professional Client Leverage |

|---|---|---|

| Index CFDs | 20:1 (Majors) 10:1 (Minors) | 200:1 |

| Currency index CFDs | 5:1 | 100:1 |

Index CFDs

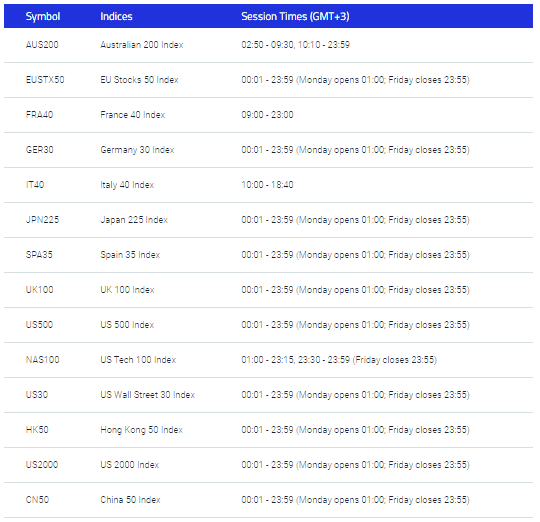

UK Pepperstone allows you to speculate on the price movement of 14 global stock market indices. You can take advantage of index CFDs in a commission-free environment. If you’re a professional trader, you can trade index CFDs with a 200:1 leverage. You have the following available indices on the UK Pepperstone trading platform:

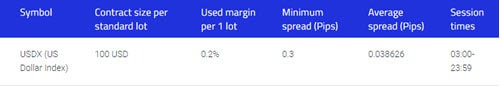

Currency Index CFDs

With Pepperstone UK, you can trade CFD on the US dollar index. It gauges the value of the US dollar against a basket of other major currencies (EUR, GBP, JPY, CAD, SEK, and CHF). You can trade the USDX CFD contract with UK Pepperstone with a leverage of up to 5:1 for retail traders and up to 100:1 for professional traders.

View our UK compare forex brokers page to find the brokers offering this instrument and then view their fees and features.

CFD Share Trading Leverage

UK Pepperstone’s range of share CFDs includes top US companies like Facebook, Alphabet, Amazon, Apple, etc. There are +60 share CFDs available for UK traders with leverage of up to 5:1 for retail traders and up to 20:1 for professional traders.

Pepperstone UK is one of the best share CFD brokers. Not only do they offer a good selection of stocks, but they also offer after-market trading hours. It minimises the risk of overnight positions. To gain access to equity CFDs, you must open a Pepperstone MetaTrader 5 account.

Commodity CFD Trading Leverage

Pepperstone UK lets you trade commodities with CFDs offering maximum leverage of 500:1 for professional traders and 20:1 for retail traders. You can trade commodity CFDs with an investment as low as £200. There are three types of commodity CFDs available on the Pepperstone UK platform:

1) Precious Metals

Pepperstone UK offers you the world’s most popular precious metals. These include:

- Gold

- Silver

- Platinum

- Palladium

Trading gold and silver through Pepperstone comes with another advantage. Besides being paired against the US dollar, Pepperstone UK offers its customer the opportunity to trade gold and silver against the Australian dollar and EUR. You have access to a range of six metal pairs with leverage up to 500:1 for professional traders and up to 20:1 for retail traders.

2) Energy

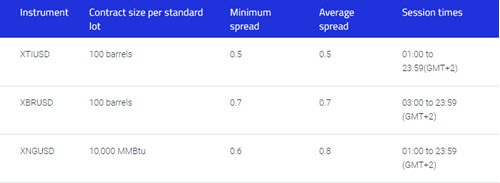

Energy assets are available as CFDs across all Pepperstone UK trading platforms. Pepperstone UK offers the most traded energy contracts around the world:

- XTIUSD – Commodity based on West Texas Intermediate crude oil

- XBRUSD – Brent Crude Oil, also referred as to UK Oil

- XNGUSD – Natural Gas

Like precious metals, energy in the form of oil and gas can be traded with 500:1 leverage if you qualify as a professional trader or with 20:1 if you’re a retail trader.

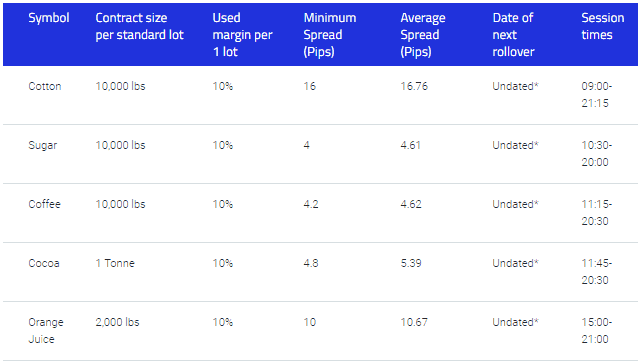

3) Soft Commodities

Another asset class that Pepperstone UK offers lower leverage is soft commodities:

- 10:1 leverage applied to retail traders

- 500:1 leverage applied to professional traders

Pepperstone UK can offer through its state-of-the-art trading platform CFDs on 5 soft commodities, including the most popular cotton, sugar, and coffee.

Cryptocurrencies CFD Trading Leverage

Investing in cryptocurrency CFDs is no longer possible through Pepperstone UK as the FCA banned crypto CFD trading. This includes trading cryptocurrency CFDs of Bitcoin, Bitcoin Cash, Ethereum, Dash, and Litecoin.

Summary Of Pepperstone UK Leverage

The maximum leverage for Pepperstone is 30:1 for retail traders as set by ESMA rules. This is the same as other Best Forex Brokers In UK.

The exact retail trader leverage levels are:

- Forex = 30:1

- Indices = 20:1

- Gold = 20:1

- Other Commodities = 10:1

- Equities = 5:1

Generally, an active trader needs to have placed significant sizes of trades periodically over the past year, have substantial cash deposits and financial instrument portfolios, and/or have worked in a professional position in the financial sector. For more specific requirements, visit the Pepperstone website.

Professional Trader Pepperstone Leverage Comparison

| Instrument Traded | Pepperstone Leverage | IG Markets Leverage | CMC Markets Leverage | Plus500 Leverage |

|---|---|---|---|---|

| Forex | 500:1 | 200:1 | 500:1 | 300:1 |

| Index CFDs | 200:1 | 200:1 | 500:1 | 300:1 |

| Share CFDs | 20:1 | 20:1 | 20:1 | 20:1 |

| Commodities | 500:1 | 25:1 to 200:1 | 150:1 | 150:1 |

| Cyptocurrency | 5:1 | 10:1 | 20:1 | 20:1 |

| Bonds | ✘ | ✘ | ✘ | ✘ |

| Futures | ✘ | ✘ | ✘ | ✘ |

| ETF | ✘ | 20:1 | ✘ | 100:1 |

| Treasuries | ✘ | ✘ | 400:1 | ✘ |

Open a demo accountVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

Are You Outside The UK?

This page is tailored for UK residents. If you’re outside the UK, consider visiting our high leverage forex broker section. For international users, we recommend our Pepperstone leverage page, brought to you by Pepperstone Group Limited. Additionally, to gain insight into how forex brokers, including Pepperstone, operate, check out our article on how brokers make money.

Pepperstone Review: Account Types and Customer Support

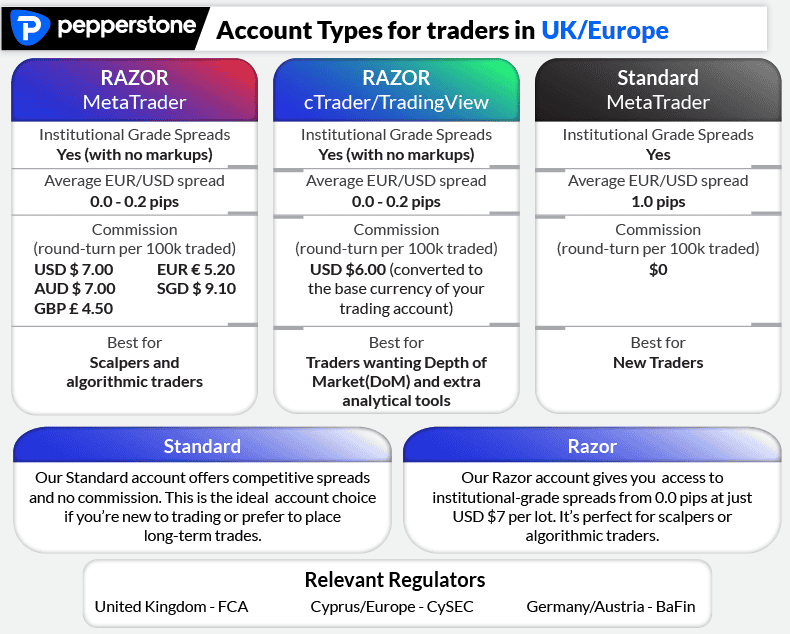

To start trading with Pepperstone in the United Kingdom, you will need to choose from one of two retail investor account types that offer different pricing structures with tight average spreads. The same maximum leverage is available with both account types.

- Standard Account: Commission-free trading with forex spreads from 1.0 pip

- Razor Account: ECN trading with spreads from 0.0 pips + round turn commission fees

If you are using a Standard Account, MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are available as trading platform options, while Razor Accounts can choose from MT4, MT5, or cTrader. For a more diverse selection of trading tools, MT4 or MT5 are recommended as they provide free access to add-on features such as Autochartist and Smart Trader Tools. If you want to start social trading, MetaTrader Signals can be used, but UK traders cannot access popular account mirroring services such as ZuluTrade.

Certain features are the same across both account types, such as:

- Trading Platform Functionality: MT4, MT5, and cTrader are available as desktop trading platforms, web trader platforms, and mobile apps for Android and iOS devices.

- Customer Support: 24/5 customer support via live chat, phone, and email

- Execution: No dealing desk

- Base Currencies: GBP, EUR, CHF, and USD (Pepperstone AU offers a greater range of base currencies, including the AUD, JPY, SGD, and NZD).

- Funding Methods: Credit Cards (Visa and Mastercard) and bank transfers can be used to deposit and withdraw funds via Pepperstone’s Secure Client Area. No e-wallet options like NETELLER, PayPal, or Skrill are available.

- Education: Trading platform tutorials, webinars, articles, and an intro to forex trading course.

- Risk Management: Order types to help manage the high risk of trading complex instruments such as forex and CFDs.

- Regulators: Pepperstone is located in Melbourne, Australia, but is overseen by multiple financial authorities worldwide. The Financial Conduct Authority (FCA, UK), the Australian Securities and Investments Commission (ASIC, Australia), the Cyprus Securities and Exchange Commission (CySEC), the Dubai Financial Services Authority (DFSA), the Federal Financial Supervisory Authority of Germany (BaFin), the Securities Commission of the Bahamas (SCB) and the Capital Markets Authority (CMA).

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Ask an Expert