Pepperstone Minimum Deposit UK

Pepperstone’s minimum deposit in the UK is $0 to open a Standard Account or Razor Account, but we do recommend £500 to start with. All deposit methods have no fees and include PayPal, credit cards and debit cards.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

What Is The Pepperstone Minimum Deposit Requirement In The UK?

One of the most common questions we get from novice forex trading UK is the Pepperstone minimum deposit requirements for traders based in Great Britain. To learn more, keep reading. We’ve got the answers you need.

One of the most common questions we get from novice online traders keen to choose the best possible forex broker is about the Pepperstone minimum deposit requirements for UK and Europe. To learn more, keep reading. We’ve got the answers you need.

What’s the minimum deposit requirement for a live Pepperstone UK account?

Pepperstone has a £0 balance requirement but recommends traders start with £500.

Pepperstone offers clients two core accounts – Standard and Razor (as well as specialised accounts for swap-free trading and active traders). Pepperstone recommends 500 GBP/EUR, so you have enough funds in your account to cover the initial (minimum) margin requirements when using leverage to open a trading position. Simply put, the more leverage you use, the more funds you need in your account because this means a higher minimum margin.

With the recommended minimum of 500 GBP/EUR in your new Pepperstone account, your funds are ready for when you want to trade.

Learn more about the differences between Pepperstone Razor vs Standard accounts to understand which is best suited for your CFD trading needs.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

What amount of funds should I trade CFDs with?

Pepperstone’s demo account is a great way to test the water before committing your own funds. A free 30-day trial, with $50,000 virtual currency, is available across all the Pepperstone trading platforms – MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

Once you feel confident, Pepperstone’s zero-minimum balance requirement makes live trading easy.

Pepperstone’s flexible minimum deposit approach means you can explore the brokerage and available forex trading platforms without being locked into a big financial commitment – even if you only have access to a modest amount of capital.

When it comes to the funds you should start trading CFDs with, the most honest answer is a question for you: what amount are you prepared to lose?

Remember that some losses are inevitable – especially in your early days of trading CFDs.

To help protect your financial situation, boost your knowledge on risk-return and market volatility and use those insights to help you achieve greater trading success.

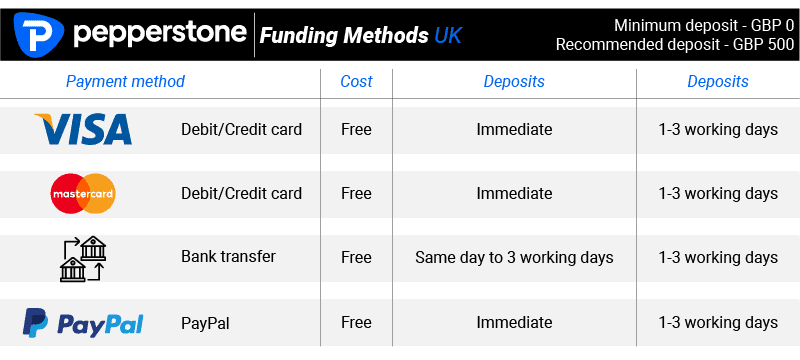

Pepperstone Funding Methods

Before you open a new account with a brokerage, it helps to know what funding methods are available with Pepperstone. Fortunately, regardless of which method you choose, Pepperstone doesn’t impose any transaction deposit or withdrawal fees from their end.

Pepperstone deposit methods

The account opening process is fully digital, user-friendly, and requires no minimum deposit for the Standard or Razor accounts. A range of deposit methods adds even more flexibility. (Remember that some funding options are country-specific depending on where you live.)

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

How can I make deposits with Pepperstone UK?

- Debit card or credit (Visa/Mastercard)

- Bank transfer/wire transfer (domestic and international)

- PayPal

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

How can I make deposits with Pepperstone Europe?

Interestingly, deposit options in Europe for strong>Pepperstone are more limited compared to its subsidiaries in other countries. While Visa and Mastercard are accepted, both as debit and credit cards, and bank transfers are an option, e-wallets or digital wallets like Skrill, NETELLER, or Union Pay are not available with Pepperstone Europe.

- Debit card or credit card (Visa/Mastercard)

- Bank transfer/wire transfer (domestic and international)

How easy is it to deposit funds with Pepperstone UK?

Whether you’re looking to set up a live account in the UK or Europe, a standout advantage of trading with this top-tier forex broker is their diverse deposit options. With no deposit fees, you can save more. Your funds could reflect in your account instantly, depending on your chosen payment method. Continue reading to grasp the deposit process and understand how processing times affect your access to various trading platforms.

How easy is it to deposit funds with Pepperstone Europe?

Very easy! Pepperstone offers a diverse range of deposit methods without charging any fees. According to their website, you can access a personal, secure client area, where they promise safe access to all your funding and withdrawal needs.

For added protection, you can easily access their award-winning customer support team by phone, email, or live chat if you need help.

How long does it take to deposit funds with Pepperstone UK and Pepperstone Europe?

Deposit processing times depend on the funding method used.

Here’s an estimate for different funding methods:

- Debit card or credit card – Immediate

- Bank transfer – Same day or up to 3 working days

- PayPal – Immediate (UK only)

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

Are there any fees for making deposits with Pepperstone UK?

No. This forex broker makes funding your forex trading account easy, with various available funding methods and no additional deposit costs or fees.

Be aware that your own bank may charge a fee, though – especially if you trade using a base currency different from your home bank’s. Any conversion fees from your bank (or their bank) will be passed on to you. International Telegraphic Transfer (TT) Fees charged by banking institutions are also passed on to you.

Top tip: To minimise unwanted conversion fees, carefully consider what currency you will trade in when setting up your account. Consider opening a multi-currency account at a digital bank.

Reach out to Pepperstone’s customer support team if you have extra questions. Keep reading to learn more about Pepperstone’s fee-free deposits, how to withdraw, and the 10 major currencies you can trade with. You can also compare the broker on our compare forex brokers page.

Are there any fees for making deposits with Pepperstone Europe?

No matter where you live, they do not charge any fees to make deposits into your own live account.

Available funding methods depend on your country. Funding your forex trading account is affordable and easy with no additional deposit charges. It sets it apart from many other brokerage platforms.

It’s important to realise that your bank may charge a fee. It may happen, especially if you trade using a base currency different from your home bank’s. International Telegraphic Transfer (TT) Fees charged by banking institutions are also passed on to you.

When selecting what currency you trade in when you set up your account, choose wisely to minimise any unwanted currency conversion fees your bank may charge. To help reduce the potentially high cost of conversion fees, opening a multi-currency account at a digital bank may be wise.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

How to make deposits to a Pepperstone live account

Adding funds to your live Pepperstone account is easy. Simply log in to the secure client area via your account, then go to the ‘Funds’ tab and select ‘Add Funds’.

Whether in the UK or Europe, you can choose from different funding options, including bank/wire transfer, debit/credit card, and PayPal in the UK.

Read our step-by-step process for making deposits into your Pepperstone live account:

Log in and head to your ‘Secure Client Area’.

- Select ‘Funds’ on the left-hand side.

- Decide which trading account you want to deposit into and take note of the currency.

- Choose your preferred payment method and enter your relevant details.

- Consider how much you want to put into your account (remember there’s no minimum deposit requirement with Pepperstone UK or Pepperstone Europe).

- If all details are correct (remember to double-check currency!), select the ‘Fund Now’ button to process your deposit.

Remember that their customer support team is there to help.

What major currencies can you use?

A Pepperstone live account lets you use 10 major currencies, including AUD, CAD, CHF, EUR, GBP, HKD, NZD, JPY, SGD, and USD.

When you sign up, you’ll be asked to choose a single base currency. It’s important to note that this can’t be changed. You can open additional accounts if you want to use another base currency.

Base currency matters because once it’s set, all transactions – including commissions – will convert to this currency. Depending on the bank, international transfers and exchanges between currencies can cost you extra. This is different for their UK spread betting trading account.

Understanding Pepperstone withdrawals

Knowing your selected forex broker’s withdrawal process and policies is crucial for effective financial management.

- Fees – None. They are withdrawal fee-free. Watch out for some electronic wallet platforms charging their own withdrawal fees.

- Admin – Withdrawal forms received after 21:00 (GMT) are processed the following day. Forms received before 07:00 (AEST) will be processed on the same day.

- Time – Withdrawal times can depend on your method, but it’s usually 1-3 working days (there’s no option to pay a withdrawal fee for a faster turnaround).

- Withdrawals to 3rd parties – Funds can only be withdrawn to an account in the same (or joint) name used for your forex trading account.

- Status – Check the status of your withdrawal in the ‘Funds’ tab. Simply select ‘History’ and then ‘Withdrawals’ to access a complete overview.

- Bank charges – Be aware that any International Telegraphic Transfer (TT) fees are passed on. Most international TTs cost approximately AUD 20 (depending on the exchange rate, that’s equivalent to around 17.51 GBP, or 12.83 Euros).

If you live in the UK, you can also request that funds are transferred from another FCA-regulated provider to your Pepperstone brokerage account.

Does Pepperstone charge inactivity fees for CFD trading?

No. Unlike some forex trading brokerages, they don’t charge inactivity fees.

This money-saving benefit lets you explore forex trading at your own pace without worrying about unwanted charges chipping away at your account balance.

With no inactivity fees, you can see what they offer and see how they compare to other forex traders. You can then start using your live account again without the hassle and expense of penalties.

It’s another reason why the broker is a friendly choice for forex trading novices while still offering all the benefits and high-quality CFD trading platforms that highly experienced forex traders love too.

Understanding margin requirements for CFDs

The minimum balance terms offered set Pepperstone apart from other top brokerage providers. But although that means you can deposit as little as $1 if you want, the reality is that you will need to deposit more to meet margin requirements.

Understanding margin requirements related to CFDs is an essential part of forex trading.

The key factor to remind yourself is that more leverage = more initial margin requirements. This is restricted in the UK based on FCA regulation as discussed on our leverage section.

Certain trading positions may only be open to you with sufficient funds in your account. The importance of being familiar with this part of forex trading is another positive reason to try the Pepperstone demo account today.

What makes Pepperstone unique?

Pepperstone was on a short list of the Best Forex Brokers In UK with no minimum deposit, no withdrawal fee, and zero inactivity fees. This positive point of difference attracts the attention of both novices and more experienced forex traders.

With plenty of funding options available, it offers a top-tier platform that’s secure and safe.

Because they have ten base currencies available, setting up your account correctly (depending on your home country) can help you save money by avoiding unwanted currency conversion fees.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.