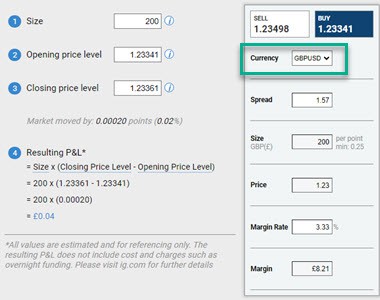

We created a UK spread betting calculator to understand the profit or loss or a single spread bet based on a number of variables. These include the size of the bet, price movement and the broker’s spread when making the trade.

Our spread betting calculator utilises industry average spreads for over 40 brokers and end-of-day market prices to offer the most accurate scenario possible. When using the calculator, you can choose from six major currency pairs, or if you prefer, opt for the ‘other’ category to simulate making a spread bet on another market such as the FTSE 100.

Our spread betting calculator

You can take some of the guesswork out of spread betting. Use our example below to explore how margin requirements, as well as profit and loss, are calculated on spread bets.

Market moved by: points (%)

= Size x (Opening Price Level - Closing Price Level)

= x ( - )

= x ()

=

*All values are estimated and for referencing only. The resulting P&L does not include cost and charges such as overnight funding.

SELL

BUY

GBP(£)

min: 0.25

The spread bet calculator uses real market data offering a unique experience where you can calculate the profit/loss of a spread betting strategy without a trading account or platform. Over time we will continue to enhance our spread betting calculator with new financial markets and trading instruments.

How to use our Spread Betting Calculator?

- Choose your market

- Decide on your spread betting strategy

- Choose your position size

- Update the opening price

- Update the closing price

- See your profit or loss, and margin requirements

1. Choose your Market

Firstly, decide on the financial market that interests you from the forex pair dropdown in the deal ticket.

Our calculator is preloaded with data for six major currency pairs to help you simulate an accurate spread betting scenario. However, if you are looking to trade a different asset, or are still unsure on the financial market you want to focus on, simply choose the ‘other’ option from the deal ticket dropdown.

To provide a real life trading environment, the buy and sell prices for these six forex pairs are generated based on industry average spreads and end-of-day market prices. These average spreads are continuously updated and sourced from over 40 of the best brokers worldwide.

To eliminate commission fees from your profit and loss calculations, we use standard account spreads where the brokers charge no commission on top of the spread.

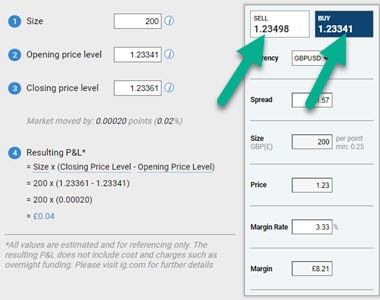

2. Decide on Your Spread Betting Strategy

The next step is deciding whether you believe prices will move in an upward or downward trajectory.

If you think the market price is going to decrease, you would select ‘SELL’. Conversely, if you predict the market price is going to increase, you would select ‘BUY’.

- Long: betting the market will rise – profit from an upwards price movement

- Short: betting the market will decrease – profit from a downward price movement

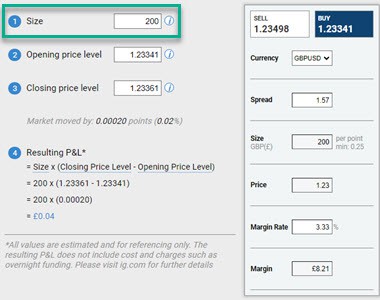

3. Choose your Position Size

In the size field of the calculator, enter the amount per point you want to trade.

When you choose your bet, you’re specifying how much you stand to gain or lose with each point the market moves. For instance, if you would like to bet £1000 per point, you would enter 1000 in the size field.

If you chose a bet size of £1000 per point and the market moved 2 points in your favour, you would make £2,000. If the market moved 10 points against your position, you would incur a £2,000 loss.

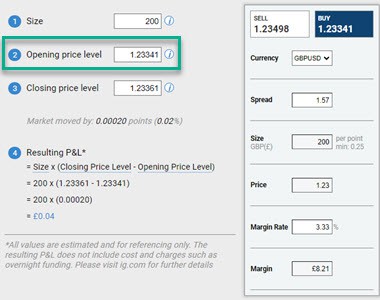

4. Update the Opening Price

The next step is to update the opening price. This is the initial price of the market you are interested in.

The default opening price is the industry average for the currency pair selected. This is designed to give you an idea of current market conditions, yet you can change the initial opening price to whatever you please to help you test trading strategies.

For instance, if you are looking at trading strategies for the Euro vs US Dollar and the current rate is EUR/USD is 1.20, you would enter 1.20 in the opening price level field.

Alternatively, you can enter a more favourable opening price than the current market price. For instance, if you are developing a spread betting strategy where you anticipate the market price to drop to EUR/USD 1.10, you can change the price to 1.10 in the opening price field.

5. Update the Closing Price

In the next field, you can enter your desired closing price.

The closing price point is where you aim to either secure a profit or minimise a loss depending on how the market moves. For example, if the EUR/USD is trading at 1.20 and you are aiming for a profit that corresponds to the market price dropping by 0.18 points, you would enter 1.02 in the closing price field.

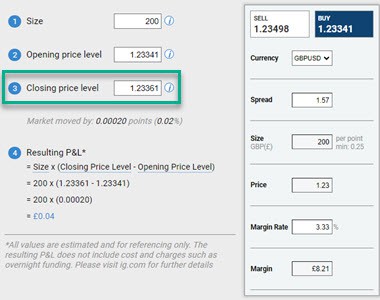

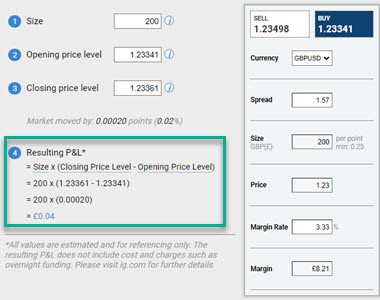

6. See your Profit/Loss and Margin

Once you’ve entered your position size, opening price, and closing price, the spread betting calculator will automatically calculate your potential profit and loss. This is shown in the ‘Resulting P&L’ field.

To determine your margin requirements for the bet, enter the assets margin rate in the deal ticket. For example, if the margin rate is 3.33% for EUR/USD, you would enter 3.33 in the margin field. If the bet size is 1000, the opening price is 1.20, and margin rate 3.33%, a £39.96 margin will be required.

Margin Rate = Bet Size x Opening Price x Margin Rate

Margin Rate= 1000 x 1.20 x 3.33% = £39.96

If your prediction was correct and the market price decreased to 1.02, the result of your spread betting strategy would be £180 profit. Alternatively, if the market moved 0.18 points in the opposite direction, and increased to 1.38, you would experience a £180 loss.

How Can You Calculate The Outcome Of A Spread Bet?

Spread betting allows you to speculate on the price movements of assets such as stocks, currencies, commodities, and indices. Instead of owning the asset, you place a bet on whether the price will go up (buy/long) or down (sell/short). You can check out our full guide on spread betting with forex section.

Factor In The Spread When Trading

The spread is the difference between an assets buy and sell prices.

For example take the GBP/USD currency pair. If the buy price is 1.1152 and the sell price is 1.1150, the spread is 0.0002, often referred to as 2 pips.

In forex trading, a pip stands for ‘percentage in point’ and is the smallest price movement a given exchange rate can make. If the GBP/USD decreases from 1.1150 to 1.1149, that equates to 1 pip.

How To Get Started Spread Betting

To get started with spread betting, let’s take a look at what’s required:

- Learn the fundamentals of spread betting

- Discover how to spread bet

- Develop a spread betting trading strategy

- Research what brokers offer spread betting

- Pick a broker and choose what markets you want to spread bet

- Open a demo account to practice spread betting

- Open a live spread betting account

If you’re interested in spread betting, the last thing to note, is that spread betting is only available in limited countries such as the UK and Ireland.

What Are The Best Trading Platforms For Spread Betting?

The best platforms for spread betting really come down to the trading style of the individual and the software you want to use. We found four key types of traders, all listed below.

1. Best Spread Betting Broker Overall

If you’re looking for a balanced broker that has low fees, advanced software and an easy-to-use platform then Pepperstone was judged the best in the UK for 2024. The full writeup can be viewed on our UK best spread betting platform section.

2. Best Demo Account

Practice makes perfect, as they say. The good news is, most brokers offer demo accounts where you can practice trading before you open a live account. Once again, Pepperstone had the best demo account for spread betting, with the easiest account opening experience, fast execution speeds and a wide range of spread betting markets. You can read our spread betting demo account page, for a full list.

3. Best MT4 Broker

When it comes to trading platforms, MetaTrader 4 (MT4) is the most popular financial spread betting platform on the market. Pepperstone came up as our best UK MT4 spread betting broker due to its quick execution speeds, competitive spreads, and wide range of platforms. You can check out our full guide for the best MT4 Spread Betting Brokers In the UK.

Do note that there are other platforms you can use that are also very good. Other popular platforms include MetaTrader 5 (MT5), TradingView and cTrader. Some brokers have their own proprietary platforms such as IG Group with IG Trading Platform, City Index with Web Trader and FxPro Platform.

4. Best For Stocks

Stocks are some of the most popular financial markets you can spread bet, with thousands of markets to choose from. Pepperstone was once again the best spread betting broker in the UK for stocks, based on execution speeds, a wide range of stocks to spread bet with and a diverse range of trading platforms. You can see our full list of the UK’s Best Spread Betting Brokers for Stocks

Spread Betting Benefits

The United Kingdom has the highest popularity of financial spread betting due to the unique benefits permanent residents can derive. A few of the key benefits including:

- No tax on profits

- The ability to trade with leverage

- A wide range of markets to trade

- The ability to go long or short

Below is a more in-depth analysis of core benefits that have led to the increased adoption of spread betting.

Calculating Tax When Spread Betting

While there are many taxes you can incur while trading, spread betting is exempt from capital gains tax and stamp duty, one of its major advantages. To find out more about spread betting taxes, including how to calculate your tax and report your earnings, you can check out our spread betting tax page.

Financial Spread Betting Examples

Below are two examples that show a profit and a loss scenario to help understand how a spread bet outcome occurs.

Example 1: Spread betting profit

Imagine you are developing a spread betting strategy for the EUR/USD forex pair.

Your online broker’s pricing is 1.1150 to sell EUR/USD, and 1.1152 to buy EUR/USD.

You believe the Euro will strengthen against the dollar, so you buy at 1.1152 with a bet size of £10 per point. The market moves in your favour, and when the sell price reaches 1.1172 and buy price 1.1174, you decide to close out your position.

- Opening price level: 1.1152

- Closing price level: 1.1172

As the market moved 20 points in your favour from 1.1152 to 1.1172, your result is £200 profit.

Points the market moved = (1.1172 – 1.1152) = 0.0020 = 20 points

Profit = 20 points x £10 = £200

Example 2: Spread betting loss

Pretend the sell price of Apple shares was $150.50 and the buy price was $150.52. Apple is due to release their quarterly results and you believe they will be positive. So, with a bet size of £5 a point, you buy at $150.52.

The results are not as positive as you’d hope, and Apple’s stock price drops. You decide to cut your losses when the spread reaches $149 to sell and $149.02 to buy.

- Opening price level: $150.52

- Closing price level: $149

The market moved 152 points against you, resulting in a loss of £760.

Points the market moved = $150.52 – $149 = -$1.52 = -152 points

Loss = -152 points x £5 = -£760

Learn more on our what is Spread Betting guide.

How To Calculate The Outcome Of Sports Spread Betting?

While with financial spread betting you are betting on the direction prices are moving in a market such as forex or commodities, sports spread betting involves betting on the outcome of a match. Unlike traditional sports betting where you bet on a single outcome at fixed odds, sports spread betting allows you to bet against a spread or range of outcomes established by the spread betting broker.

Popular sports include football (soccer), basketball, golf, tennis, American football, cricket, rugby, darts, and snooker.

Sports Spread Betting Example

Say the spread for total goals in a football match is set at 2-3.

If you feel optimistic that it will be a high-scoring game, so you decide to buy at 3 for £10 a point.

The game finishes with 5 goals being scored in total. To calculate your winnings you would take the actual number of goals scored, being 5 in this example, and subtract the point at which you bought the spread, being 3, which equals 2.

5 – 3 = 2

You then multiply this by your stake of £10, resulting in winnings of £20

Profit = 2 x £10 = £20

Spread Betting FAQs

What is the Difference Between Spread Betting and Forex Trading?

The key differences between spread betting and forex trading are tax implications, legislation and the breadth of markets you can trade. Spread betting is free from capital gains tax and stamp duty, offered in fewer countries due to legal jurisdictions and has a wider range of markets you can trade than forex. To view the full list of differences in more detail, you can read our forex trading vs spread betting guide.

What is the Difference Between Spread Betting vs CFD Trading?

The key difference between spread betting and CFD trading is taxation and availability. Spread betting is free from capital gains tax while CFD trading is not (for the most part). Spread betting is also only available in the UK or Ireland, while CFDs are available globally. You can read the full list of differences in our spread betting vs CFD trading guide.

What are the Different Types of Spread Betting?

Spread betting is not restricted to financial markets, sports spread betting is popular amongst UK traders as well. There are three main areas of spread betting:

- Financial spread betting is where you bet on how many points the current market price of an asset will move. You can learn more about professional spread bets taken by experts.

- Sports spread betting is where you are betting on the result of a competition such as Football or Golf. You can read more about sports spread betting here.

- More obscure areas such as political events, weather conditions, and special events like the Oscars or BBC Sports Person of the Year.

Is Spread Betting More Risky than CFD Trading?

Both spread betting and CFD trading are considered high-risk activities, yet neither is more inherently risky than the other. However, the level of risk involved can vary based on factors such as leverage, market volatility, and your trading strategy. You can learn more on our spread bet risk page.

To learn more facts about the spread betting industry and market, click here to read our Spread Betting Statistics.

How To Calculate Margin In A Spread Bet

The margin calculation when spread betting is: Margin = total exposure x margin factor. As a practical example, if the margin offered by a broker was 5% (know as 20:1 leverage) for exposure of £100,000 a trader would need to put down £5,000 (5% x £100,000) to open the trade. Learn more about the role of leverage in our margin spread bet page.