Best ECN Brokers USA List

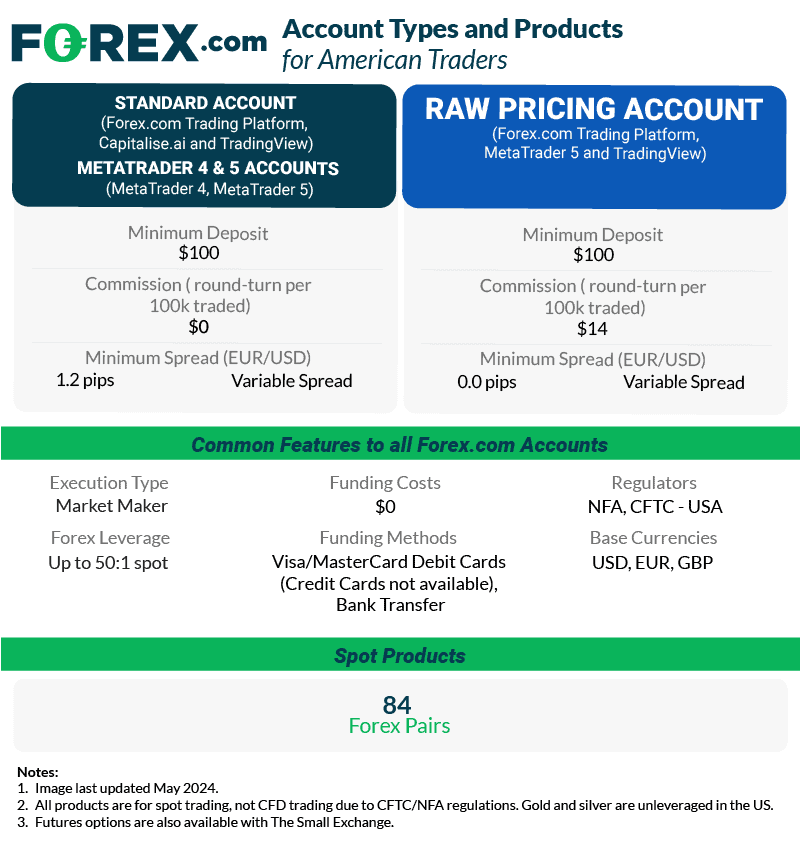

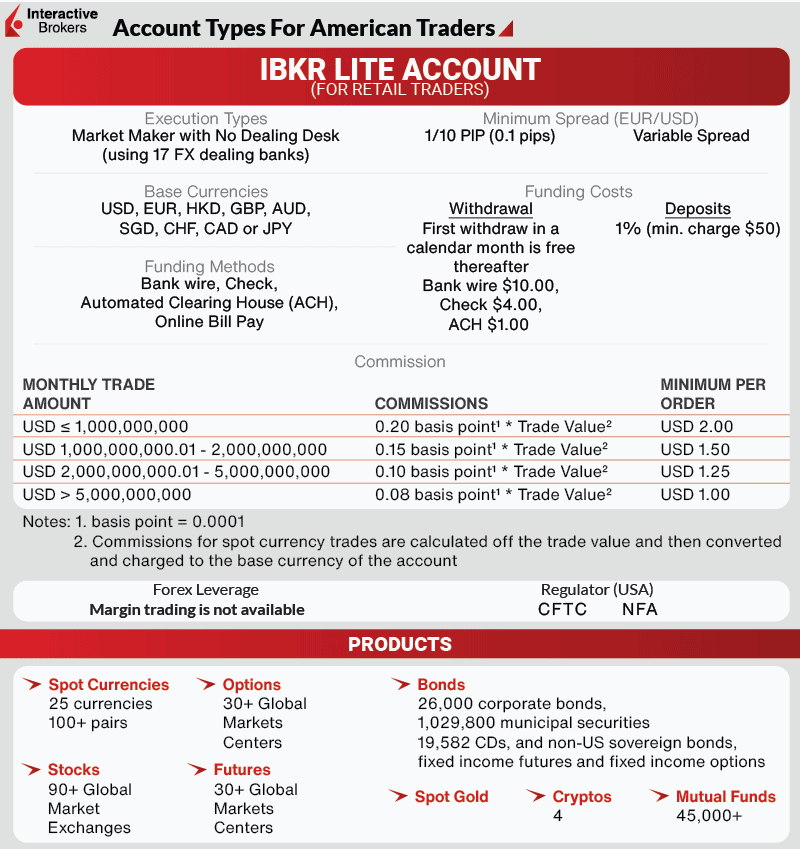

While ECN Forex trading accounts are not common in the U.S., they do have the benefit of 0 pip raw spreads even if they have commission costs. We found the best ECN Forex brokers In the USA for low-spread trading.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.