Best Offshore Forex Brokers For US Traders [Updated 2025]

The best offshore forex brokers for US traders allow you to trade forex CFDs instead of spot trading. They also have leverage of up to 1:500, or even more in some cases. Most brokers offer the MetaTrader 4 trading platform and crypto markets like Bitcoin.

While the brokers in my list accept traders in the US, they are not regulated by the CFTC or NFA. I created this page based on a demand for offshore brokers and their unique features, but I personally recommend considering locally-regulated brokers first.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

List of offshore forex brokers for US clients is:

- Hugo's Way - Best Offshore Forex Broker In the USA

- Plexytrade - Top Range of Account Types

- MidasFX - Top Offshore Broker With MetaTrader 4

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

31 | none | - | - | - | $5 | 0.9 | 1.7 | 1.3 |

|

|

|

104ms | $10 | 55+ | 37 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

35 | none | - | - | - | $3.00 | 0.7 | 1.3 | - |

|

|

||||||||

Read review ›

Read review ›

|

91 | NFA/CFTC | - | - | - | 1.4 | 2 | 1.4 |

|

|

|

120ms | $0 | 68+ (Spot) | - | 50:1 | 100:1 |

|

|

Read review ›

Read review ›

|

84 |

NFA/CFTC FCA,CIRO |

0.0 | 0.2 | - | $7.00 | 1.50 | 1.5 | 1.4 |

|

|

|

30 ms (May 2023) | $100 | 80+ (Spot) | - | 50:1 |

|

Who Are The Best Unregulated And Offshore-Regulated Forex Brokers For US Clients?

Not many brokers outside the US accept US clients, so I did my research and found ones that do. Then, I tested the offshore brokers to find which ones offer the best and most secure trading conditions. I ranked the brokers based on their spreads, safety of funds, range of markets, trading platforms, and access to customer service.

1. Hugo’s Way - The Best Offshore Broker Overall

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.7

AUD/USD = 1.3

Trading Platforms

MT4

Minimum Deposit

$10

Why We Recommend Hugo's Way

I chose Hugo’s Way because you get offshore broker privileges that are on par with onshore-regulated brokers. I found they deliver the best trading environment with fast execution speeds of around 100ms.

There are also solid spreads starting from 0.20 pips on EUR/USD. Plus, the broker offers 1:500 leverage – this is ten times the amount US brokers can offer.

You get the PRO4 (MetaTrader 4) platform, where you can use the broker’s services and access all their 150+ CFD markets. The platform also offers custom indicators and automation tools. Meanwhile, the broker provides solid 24/7 support through live chat, so you can get help over weekends, which is a bonus.

Pros & Cons

- Wide variety of funding methods

- Excellent selection of cryptos

- Scalping and hedging permitted

- Unregulated broker

- Limited selection of currency pairs

- Only one trading platform

Broker Details

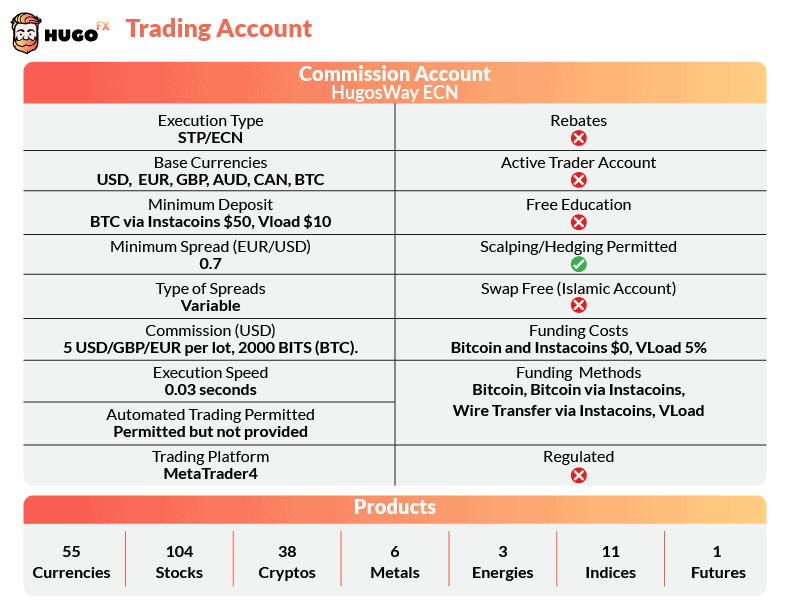

Competitive Spreads With High Leverage

Hugo’s Way only offers its PRO4 trading account only, so you don’t get the choice most other brokers offer. It’s not a bad option though – while using the account, I found EUR/USD spreads from 0.20 pips. However, it can also reach 0.90 pips, which is expensive.

In addition to spreads, you’ll pay $5 per lot traded in commission, equalling $10 roundturn. This is slightly more expensive than other offshore brokers, who average $3.50 per lot.

However, not many offshore brokers can compete with Hugo’s Way for leverage. You can get 1:500 leverage on forex majors and 1:100 on cryptocurrencies, much better than the 1:50 leverage cap for US-regulated forex brokers.

Fast Execution Speeds

Hugo’s Way is a straight-through processing/electronic communication network (STP/ECN) style broker. This means the broker passes your order directly to the liquidity provider to be matched with a buyer or seller.

I generally prefer ECN brokers as they provide faster execution speeds than other broker types. Based on my analyst’s findings, Hugo’s Way performs solidly in this area.

My analyst (Ross Collins) tested Hugo’s Way and 49 other brokers using the ExTest_ForExpat EA for limit orders and Broker Latency Tester EA for market orders. This helped him record their average execution speeds.

As you can see from the table below, Hugo’s Way achieved fast speeds with 94ms on market orders, and 104ms on limit order. I find fast execution speeds have a major impact on your trading, as they reduce the chances of requotes and slippage.

| Execution Speed Testing | ||

|---|---|---|

| Broker | Limit Order Speed (ms) | Market Order Speed (ms) |

| OANDA | 86 | 84 |

| FOREX.com | 98 | 88 |

| IG Group | 174 | 141 |

| Trading.com | 114 | 138 |

Decent Range of Markets

The range of markets with Hugo’s Way is better than what you’ll find from US brokers. The broker offers 55 forex pairs, 73 stocks, six commodities, ten indices, and 38 cryptos.

2. Plexytrade - Top Range of Account Types

Forex Panel Score

Average Spread

Trading Platforms

Minimum Deposit

Why We Recommend Plexytrade

Plexytrade is my second pick, for its range of account types that allows you to choose your pricing structure. The broker offers both spread-only pricing with no commissions, and Raw pricing with $2 commissions. You can access 120+ markets, from forex to commodities with no swap fees, making them ideal for multi-day trading.

The broker supports MetaTrader 4 and MT5, allowing for advanced technical analysis. These platforms also give you access to virtual private server (VPS) services, which are very useful for automated trading. Trading signals are provided through Trading Central.

Pros & Cons

- Multiple account types

- Negative balance protection

- Solid selection of forex pairs

- Unregulated broker

- Wider-than-average spreads

- Only offers MT4 trading platform

Broker Details

Solid Selection Of Trading Accounts

After Plexytrade recently merged with LQDFX, I found the broker’s selection of trading accounts gives you great options to optimize your trading costs. The broker has 4 trading accounts – two standard account types and two commission-based accounts.

- Micro Account: This account requires the lowest minimum deposit at $50, with 1:2000 leverage for its smaller trade sizes, and no commissions. Instead, it’s a spread-only account with spreads from 0.70 pips. This account type has swaps (overnight fees on open positions).

- Silver Account: This account lets you trade larger positions, but lowers the leverage to 1:500 to compensate for this. You get the same tight spreads and zero commission on trades, but also 7-day swap-free trading. This allows you to hold positions up to a week for free, which is great for swing traders.

- Gold Account: Trade with 0 pip spreads and low commissions at $2 per lot trade. This is much cheaper than the $3.50 typical commission. Like the Silver account, you get seven days of swap-free trading, and 1:500 leverage.

- Platinum Account: Has the highest deposit requirement at $10,000, but you get cheaper commissions of just $1 per lot traded. This will save you 50% on the Gold account. The 0 pip spreads make this a good account for high-volume traders.

Large Choice of Forex Pairs

Plexytrade provides 41 currency pairs, covering all the major and minor pairs, plus some exotics. You can use high leverage on all forex pairs. The broker also offers 15 indices, 11 commodities, 48 stocks, and 8 crypto markets – including Bitcoin, Ethereum, and Ripple – on all accounts.

3. MidasFX - Top Offshore Broker With MetaTrader 4

Forex Panel Score

Average Spread

Trading Platforms

MT4, MT5

Minimum Deposit

Why We Recommend MidasFX

I rated MidasFX as the best option for MetaTrader 4 thanks to its ECN-style execution services that pair well with the platform – especially if you scalp or automate trades.

The broker’s ECN account offers low spreads from 0.70 pips on EUR/USD with up to 1:1000 leverage, making it ideal if you’re an experienced trader looking to scale up your positions.

Pros & Cons

- Choice of MT4 and MT5 platforms

- Competitive trading fees

- Offers high leverage 1:1000

- Low level of regulation (Saint Lucia FSRA)

- Limited deposit methods

- Can only withdraw funds once per day

Broker Details

MidasFX has MetaTrader 4 and 5

In testing, MidasFX offers two popular trading platforms: MetaTrader 4 and MetaTrader 5, which I think are excellent platforms that work with any trading style.

Unlike broker-owned proprietary platforms, MT4 and MT5 let you customize your trading experience. You can change the look of the platform, use custom indicators, or set up your own Expert Advisors (EAs) for automated trading.

With MetaTrader 4, you can use 30+ indicators out of the box, buidling trading strategies with Bollinger Bands or moving averages without third-party indicators. If you do require bespoke indicators, you can develop them through MQL4, which requires coding knowledge.

Alternatively, you can search the MetaQuotes Marketplace, where you’ll find tens of thousands of EAs and indicators.

I also find MT4 good for scalping, as you can activate one-click trading and set your lot size. This is a faster way to open trades, as you don’t have to go through the order ticket.

No-Dealing Desk Broker With Tight Spreads

MidasFX is a no-dealing desk broker, so all your trades are matched directly with other market participants through their Electronic Communications Network (ECN). I prefer these execution styles as they get the best price, making order filling near-instant and reducing the chance of requotes/slippage.

For their Standard account, MidasFX applies a competitive spread of 0.7 pips on the EUR/USD. There are also no commissions on this account. The MidasFX ECN account has tighter spreads from 0.0 pips, but you pay a $5 commission per lot traded. This commission is average for non-US-regulated brokers, according to my findings.

24/5 Customer Support

The broker offers solid customer support through their live chat, giving you instant access to a human agent who can help resolve your issue. Support is available 24/5, meaning they’ll be available during all market trading hours.

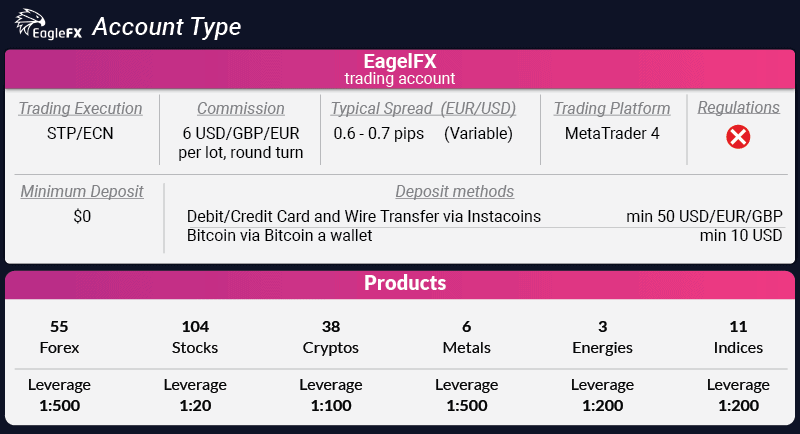

4. Eagle FX - Great CFD Brokers For Low Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.3

Trading Platforms

MT4

Minimum Deposit

$10

Why We Recommend Eagle FX

I picked EagleFX as it has the lowest spreads among the forex brokers tested, starting from 0.10 pips on its Raw account. The commissions on the account are also cheap, at $3.00 per lot traded. The broker charges no deposit or withdrawal fees, making the account one of the most cost-effective I’ve seen.

EagleFX grants you access to 1:500 leverage across its 100+ CFD market range, and allows for 24/7 trading on its crypto markets.

Pros & Cons

- Demo account option

- Competitive trading costs

- Client funds in cold storage for added security

- Unregulated broker

- No educational materials – at all

- Minimum deposit

Broker Details

Tight Spreads On CFD Markets

While using the EagleFX Raw account, I found it averaged 0.70 pips on EUR/USD. However, at some points of the day, this dropped to 0.10 pips, providing great value and lower trading costs. The spreads on the Raw account from EagleFX are lower than the other unregulated brokers tested, beating Hugo’s Way and Plexytrade.

The other benefit is that the broker charges $3.00 per lot traded, which is cheaper than its competitors. The average is around $5, so EagleFX beats this by 40%. This will make a large difference in your trading costs, especially if you scalp or day trade.

24/7 Trading

As the broker is unregulated, EagleFX supports a range of CFD markets for US traders, which includes 32 cryptocurrencies, 54 forex pairs, 5 commodities, 10 indices, and 64 share CFDs.

I found the broker lets you trade its crypto CFDs 24/7, allowing you to take action on any crypto market news immediately, even over the weekend. This makes EagleFX a solid pick if you trade crypto.

US Traders Can Access 1:500 Leverage

The broker also lets you use up to 1:500 leverage on forex majors – around the same as what most good unregulated forex brokers will offer. Some brokers may offer higher leverage, like Plexytrade for example, but only on limited trade sizes. With EagleFX, there are no such limits.

Leverage varies across different assets. Here’s what I found when I looked at EagleFX.

| Asset Class | Leverage Ratio |

|---|---|

| Stocks | 1:20 |

| Forex Market | 1:500 |

| Metals | 1:500 |

| Indices | 1:200 |

| Energies | 1:100 |

| Cryptocurrencies | 1:100 |

5. OANDA - Most Trusted US Broker

Forex Panel Score

Average Spread

EUR/USD = 1.4 GBP/USD = 2 AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

I awarded OANDA 91/100 in my broker reviews, as it’s one of the most trusted brokers with regulation from 10 authorities. It also offers low spreads for US traders.

Its Standard account has no commissions, with a 1.40 pip spread – better than the other Standard spreads I’ve seen while creating this list. Low spreads can save you money, and with OANDA you’ll still get the benefit of trading with a broadly regulated forex broker.

You also get access to trading platforms like TradingView, MetaTrader 4, and OANDA Trade – a good selection that should suit most trading needs. Customer service is excellent, and there is a large range of 68 forex pairs and plenty of crypto markets.

Pros & Cons

- Most trusted US broker

- Low spread-only trading fees

- Offers TradingView for US traders

- No Raw pricing

- Customer service is limited on weekends

- No MetaTrader 5 platform is available

Broker Details

Regulated By 10 Authorities

OANDA is the most trusted forex broker I’ve tested, with licenses from 10 regulators across multiple jurisdictions. The broker also has more than 30 years of industry experience.

| Tier | Regulator |

|---|---|

| Tier-1 | NFA/CFTC MAS CIRO FCA ASIC |

| Tier-2 | JFSA KNF MFSA |

| Tier-3 | FSC-BVI |

As a US trader, you benefit from Commodity Futures Trading Commission (CFTC) regulation. OANDA is also a National Futures Association (NFA) member, offering further protection to traders in the USA.

The broker must adhere to the CFTC’s strict framework. I think this is important, as it gives you a transparent and secure trading environment.

If given the choice, I always choose a US-regulated forex broker over a broker without US regulation. This is because you gain protection and support if anything goes wrong.

Low Spreads With No Commissions

OANDA provides a Standard account, which offers spread-only pricing with no commissions. In other words, you’ve got a pricing model that simplifies your trading costs.

In tests, I was able to get EUR/USD between 1.40 and 1.50 pips during the London and New York sessions, which is cheap when compared to the offshore brokers. By choosing OANDA, not only will you be regulated under CFTC/NFA, but you’ll also have cheaper trading costs.

Even though offshore brokers have higher leverage, OANDA still offers 1:50 which I think is high enough for most traders. I believe only experienced traders with a market-proven trading strategy should use higher leverage.

Access to Plenty of Trading Platforms

OANDA supports multiple trading platforms, like TradingView, MT4, and even its own proprietary platform.

Each of these platforms will allow you to perform excellent technical analysis. TradingView is particularly strong here, with 110+ trading indicators – including Pivot Points and automated trend lines – and 50+ drawing tools.

6. FOREX.com - Top US Regulated Broker With Raw Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 0.8 AUD/USD = 1.7

Trading Platforms

MT4, MT5, TradingView, FOREX.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

I chose FOREX.com for the tight spreads on its Raw account. These start from 0.0 pips on the major forex pairs, the lowest available across onshore and offshore brokers. If you trade high volumes, you can receive cash rebates, further reducing your trading costs. You’ll also have access to a diverse range of 2,500+ markets.

With a wide range of trading platforms – like MT4, MT5, and TradingView – I find FOREX.com does a good job of supporting you with top trading tools. You can access tools like Trading Central for intraday signals and Performance Analytics to improve your trading skills.

Pros & Cons

- US-regulated broker

- Tight Raw spreads

- Wide range of currency markets

- Demo account expires

- No copy or social trading

- Requires a $100 minimum deposit

Broke Details

Spreads From 0.0 Pips On Raw Account

FOREX.com’s Raw account started from 0.0 pips in our testing, making the broker an ideal option for scalping. Tighter spreads reduce your trading costs, as you won’t have to cover a wide spread to turn a profit.

This can translate to a huge saving compared to other offshore brokers like Hugo’s Way, who charge 0.90 pips for the same markets.

All Raw accounts are commission-based – the only way to receive the tightest spreads. With FOREX.com, you pay $7.00 per lot. I like that FOREX.com provides its VIP program, giving you cash rebates. These can reduce your commissions by up to 15%, depending on your trading volume.

Largest Choice of Financial Markets

I found FOREX.com offers almost twenty times the number of financial markets offered by other brokers on this list. Altogether, you can trade 2,500+ markets. For commodities and indices, you’ll need to trade the futures and futures options products. Here, you’ll find crypto, soft and metal commodities, interest rates, and stock indices.

Excellent Trading Tools

FOREX.com’s range of trading tools is extensive, covering professional trading signals through Trading Central – which is helpful for day trading. You also get Capitalise.ai for no-code automated trading tools.

Unique to FOREX.com, you have Performance Analytics, which uses your trading history and performance to improve your trading skills based on behavioral science.

For example, with me, it identified which trading instruments and time of day I was most successful with. It also gave me more insight by highlighting my weaknesses. This gives you useful knowledge of how you can improve your own strategy.